Anti-money laundering compliance (Fintrac)

What Home Builders Need to Know About

Anti-Money Laundering Compliance

Canada’s housing industry is vulnerable to money laundering. The housing market is attractive to criminals and potential money launderers, for many reasons including that:

- Money launderers can enjoy the property, as a residence and/or to conduct criminal activities;

- A large sum can be laundered in a single transaction;

- Additional sums can be laundered during renovations; and

- Perception of real estate as a safe investment.

Many professionals in the housing industry, including home builders and developers, are unaware that they must comply with Canada’s money laundering / terrorist financing laws and regulations. Even when aware, compliance is often a challenge. Noncompliance leaves CHBA members potentially open to substantial fines and/or criminal charges.

MNP, a leading national accounting, tax and business consulting firm in Canada and a CHBA Alliance Network member, has a deep understanding of the Real Estate & Construction industry, regulatory environment and the ever-changing complexities entailed by sustained growth. They’ve put together information below to help CHBA members navigate this topic.

What is FINTRAC?

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is Canada’s financial intelligence unit. Its mandate is to detect, prevent, and deter money laundering and terrorist financing activities. Its enabling legislation – the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) – is aimed at meeting Canada’s international obligations to fight cross-border crime and terrorism, and to help Canadian law enforcement respond to organized crime. It achieves this by placing obligations for customer identification and record keeping on businesses susceptible to money laundering.

Records of financial transactions reported to FINTRAC are used to provide intelligence to law enforcement. This intelligence is only as good as the information provided to it from those business required comply with the Act. As a result, FINTRAC can audit the compliance programs of those businesses to ensure there are effectively designed and operating to help FINTRAC meet its obligations.

Does your business need to take action?

The questions below will help you determine if you are required to comply with the PCMLTFA. If you are, you must take steps to comply with FINTRAC guidelines and avoid attracting administrative monetary penalties.

Are you a reporting entity?

- FINTRAC defines a real estate developer as anyone who, in any calendar year since 2007, has sold to the public:

- Five or more new houses or condominium units,

- One or more new commercial or industrial buildings,

- One or more new multi-unit residential buildings each of which contains five or more residential units, or

- Two or more new multi-unit residential buildings that together contains five or more residential units.

If the answer is “yes” to any of the above questions, you are considered a Real Estate Developer. Real Estate Developers are considered Reporting Entities by FINTRAC and they are obligated to comply with the PCMLTFA, including the requirement to build and implement a compliance program.

Reporting entities also include Real Estate Brokers and Sales Representatives. The PCMLTFA considers individuals or entities as real estate brokers or sales representatives when they act as agents for the purchase or sale of a real estate property1 and are provincially registered and licensed to do so. This includes the buying or selling of land, houses, commercial buildings, etc.

Do you have an exemption?

- Do you engage exclusively in property management activities such as leases and rental management transactions?

- Are you a real estate agent acting exclusively on behalf of a broker or developer?

- Do you sell properties through a real estate brokerage, which will in turn sell the units to the end buyer?

If any of these exemptions apply to you, it is recommended that you contact an AML specialist to help you make a definitive determination on your regulatory compliance obligations.

You’ve determined you do need to take action. Here are the next steps.

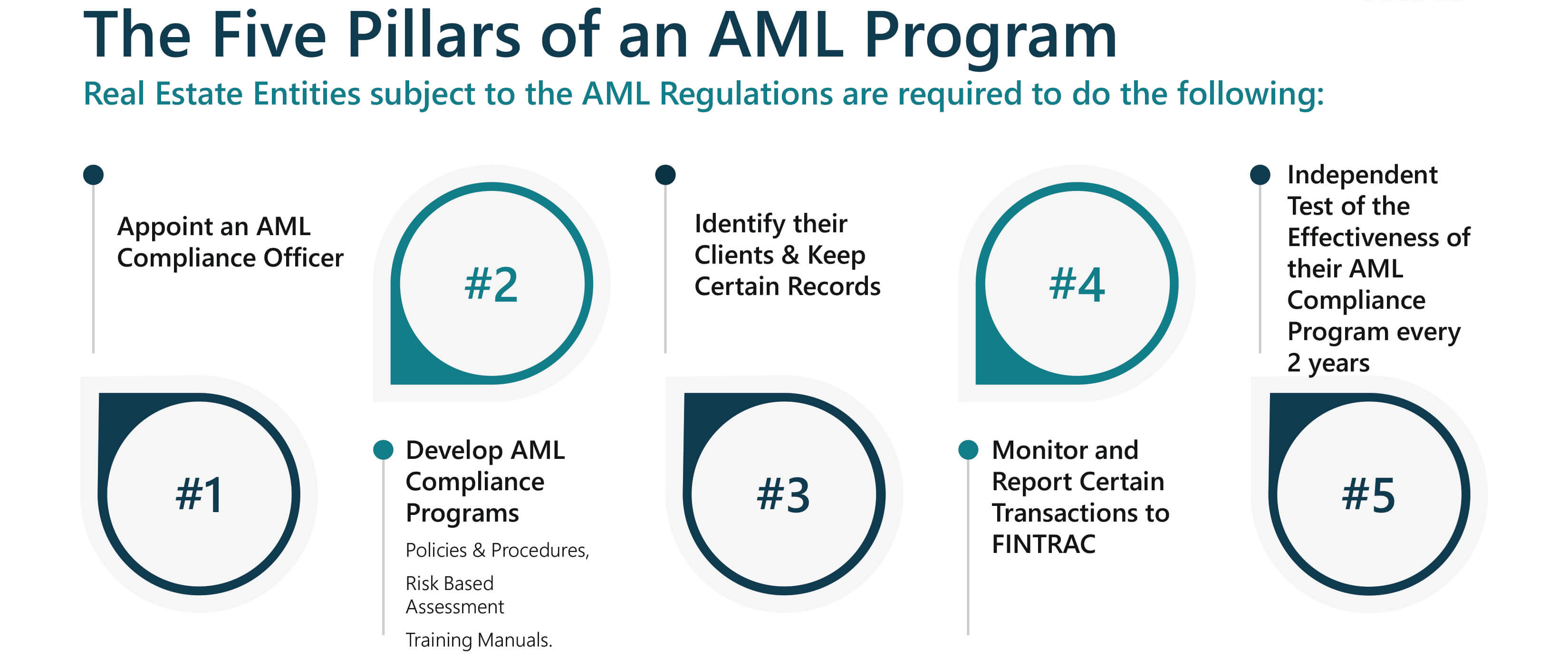

If you are a reporting entity, you are obligated by the PCMLTFA and FINTRAC guidelines to build and implement a compliance program. An Anti-Money Laundering (AML) program comprises five pillars that must be incorporated for compliance. These five pillars are:

Graphic provided by MNP

What happens if my business doesn’t comply?

Reporting entities are also liable to criminal penalties and can be reported to law enforcement where cases of extensive non-compliance are uncovered. Criminal penalties may include the following:

- Failure to report suspicious transactions: up to $2 million and/or 5 years imprisonment.

- Failure to report a large cash transaction or an electronic funds transfer: up to $500,000 for the first offence, $1 million for subsequent offences.

- Failure to meet record-keeping requirements: up to $500,000 and / or 5 years imprisonment.

- Failure to provide assistance or provide information during compliance examination: up to $500,000 and/or 5 years imprisonment.

- Disclosing a suspicious transaction report was made, or disclosing the contents of such a report, with the intent to prejudice a criminal investigation: up to two years imprisonment.

FINTRAC has the legislative authority to issue administrative monetary penalties where non-compliance is observed. The PCMLTFA was also amended on June 21, 2019, to provide FINTRAC with the mandate to publish all administrative monetary penalties imposed.

Since 2017, the housing industry has attracted the highest number of examinations conducted by sector (561 examinations to date), which is significantly higher than money service businesses (342 examinations) and securities dealers (204 examinations). As a result of this increased focus from FINTRAC, administrative monetary penalties issued to real estate practitioners totaled up to $1.5 million within a period of 24 months (2020-2022).

In October 2022 alone, FINTRAC issued administrative monetary penalties to three real estate entities for various AML violations with the total figure standing at approximately $764,000. Based on MNP’s research, some of the common deficiencies observed by FINTRAC include:

- Failure to develop an AML Program;

- Failure to report suspicious transactions to FINTRAC;

- Failure to keep prescribed records;

- Failure to develop policies and procedures and risk assessment framework; and

- Failure to keep client identification information

Other Regulatory Obligations

Know Your Customer (KYC)

Do you know your clients? As someone who sells homes (called a “real estate practitioner”), you are required to verify the identity of persons and entities for certain transactions and activities, using one of the prescribed methods by FINTRAC. You are also required to enter a business relationship when certain criteria are met and conduct ongoing monitoring. Other KYC obligations include beneficial ownership and politically exposed persons determination and third-party determination.

According to FINTRAC, real estate practitioners must obtain and take reasonable measures to confirm the accuracy of beneficial ownership information for entities. A beneficial owner is an individual who directly or indirectly owns or controls 25% or more of a corporation or an entity other than a corporation.

According to FINTRAC, real estate practitioners must obtain and take reasonable measures to make a PEP determination for certain activities and transactions. These include when real estate practitioners enter into a business relationship or when they detect a fact about the business relationship. They are also required to make a PEP determination when they conduct periodic monitoring of business relationships and when they are in receipt of $100,000 or more in cash or an amount in virtual currency equivalent or more.

FINTRAC expects real estate practitioners to take reasonable measures to ensure they are not dealing with a third party when they report a large cash transaction or keep a large cash transaction record or when they report a large virtual currency transaction or keep a large virtual currency transaction record; and when they keep an information record.

Reporting Obligations

Have you been submitting the required reports to FINTRAC? As a real estate practitioner, you are required to file certain reports to FINTRAC including Suspicious Transaction Reports (“STR”), Terrorist Property Reports, Large Cash Transaction Reports “(LCTR”), and Large Virtual Currency Transaction Reports. For example, an STR is warranted when real estate professional have reasonable grounds to suspect that an activity or an attempted activity is indicative of money laundering or terrorist financing. FINTRAC expects an STR to be filed in this instance, as soon as reasonably practicable. An LCTR is warranted when real estate professionals receive $10,000 or more in cash in the course of a single transaction or two or more cash amounts less than $10,000 each that total up to $10,000 or more within 24 hours.

Record-Keeping Obligations

Do you maintain adequate records of your clients? As a real estate practitioner, you are required to maintain large cash transaction records, large virtual currency transaction records, and records of all reports filed to FINTRAC, including Suspicious Transaction Reports, Terrorist Property Reports, Large Cash Transaction Reports, and Large Virtual Currency Transaction Reports. Other record-keeping obligations include; receipt of funds records, information records, and the Identification of unrepresented party records.

If you are not sure about any of the above points, it is time to speak with your AML specialists immediately.

Seek Assistance to Ensure You Are Compliant

Creating and maintaining a compliance program does not have to be daunting. Third-party AML professionals can help ensure your organization meets all regulatory requirements, starting with evaluating your need for a compliance program and preparing or assessing your compliance program. They also will evaluate your training regime, help you seamlessly integrate your program, and keep your program relevant, up-to-date, and efficient by conducting independent compliance effectiveness reviews.

Whether you are a large or small organization, advice and assistance may be required to successfully implement and maintain a compliance program.