Housing Market Index

Are you a builder interested in being part of the HMI panel of respondents?

Single-Family

(includes single detached homes, semi-detached homes and row (townhouse) homes)

Multi-Family

(includes stacked townhouses, duplexes, triplexes, double duplexes and row duplexes, and low and high-rise apartment buildings)

Properties of the HMI

(i.e. how to read the number)

- The HMI is on a scale of 0 to 100

- It's 0 only when everyone says conditions are "poor"

- It's 100 only when everyone says conditions are "good"

- It's 50 when the % saying "good" = the % saying "poor"

2025 Q3 HMI

This page outlines the Q3 2025 results of CHBA’s Housing Market Index (HMI). This informative research and economics product provides a much-needed leading indicator about the current and future health of the residential construction industry in Canada with respect to housing units for ownership (freehold or condominium). The HMI is a sentiment indicator, assessing current selling conditions, expectations for selling conditions over the next six months, and the level of sales office traffic (or other measures of prospective buyer interest). It is a proven indicator of housing starts that can be expected in six months and beyond.

The data for the CHBA HMI comes from a panel of CHBA homebuilders and developers from coast to coast. Every quarter, this panel – created in collaboration with our local and provincial home builders’ associations across Canada – responds to a series of questions about market conditions. CHBA then uses proprietary statistical analysis to prepare the quarterly HMI. In addition to the standard HMI questions, each quarter CHBA asks “special questions” that allow the Association to gather data and insights into current issues affecting the industry across the country.

CHBA’s HMI was modelled on the National Association of Home Builders’ (NAHB) very successful and influential US version. The NAHB version is used regularly by financial analysts, the Federal Reserve, policymakers, economic analysts, and the news media, given the importance of the health of the residential construction industry to the overall economy. Through the CHBA HMI, CHBA has done the same for Canada, where it is being used and followed by similar Canadian agencies (e.g. Bank of Canada, Statistics Canada), government policymakers, economists/analysts and media.

If you have any questions or feedback about the CHBA HMI, please contact hmi@chba.ca.

Summary for Q3 2025 HMI

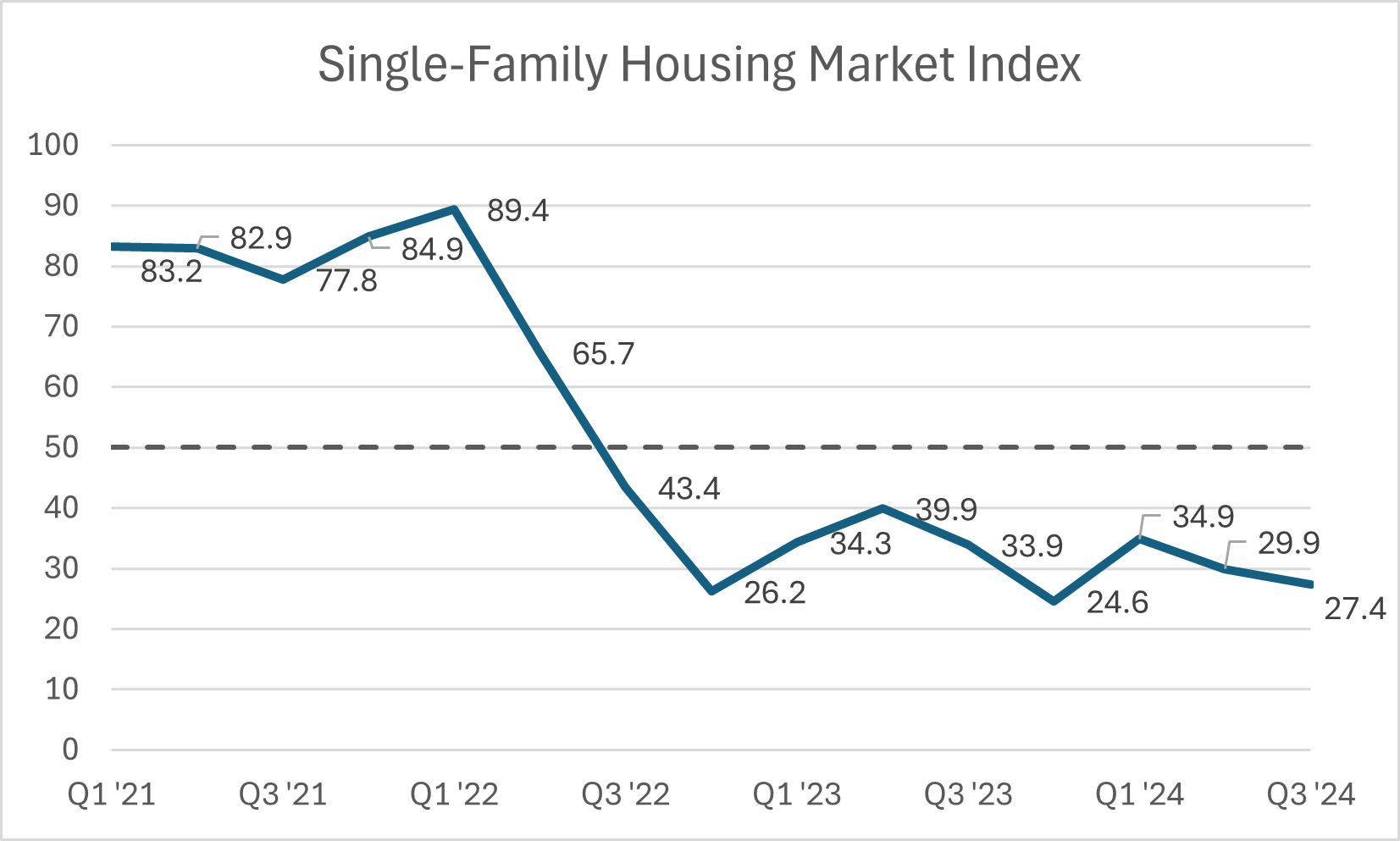

Dream of homeownership slipping as government policy falls short and industry layoffs abound

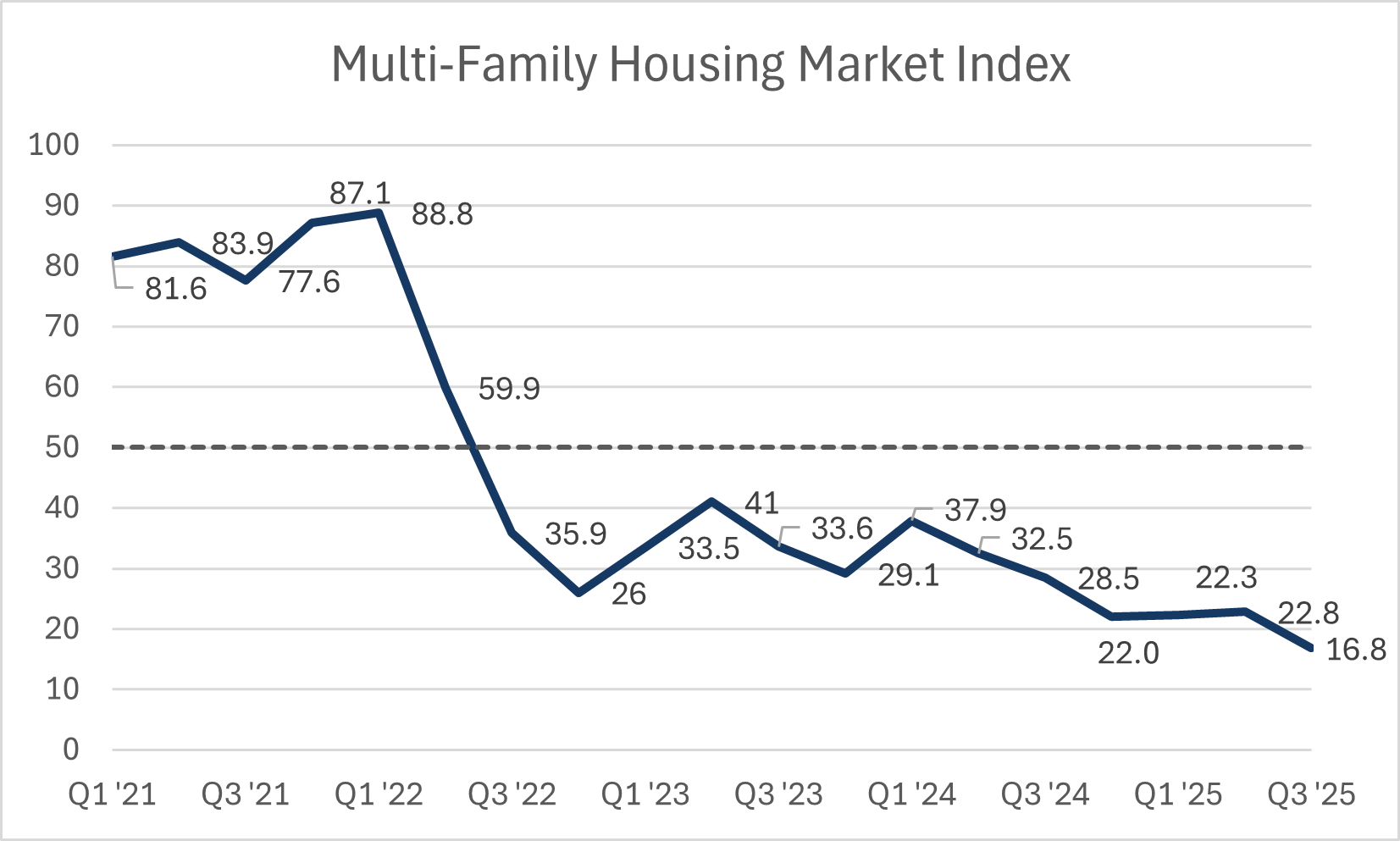

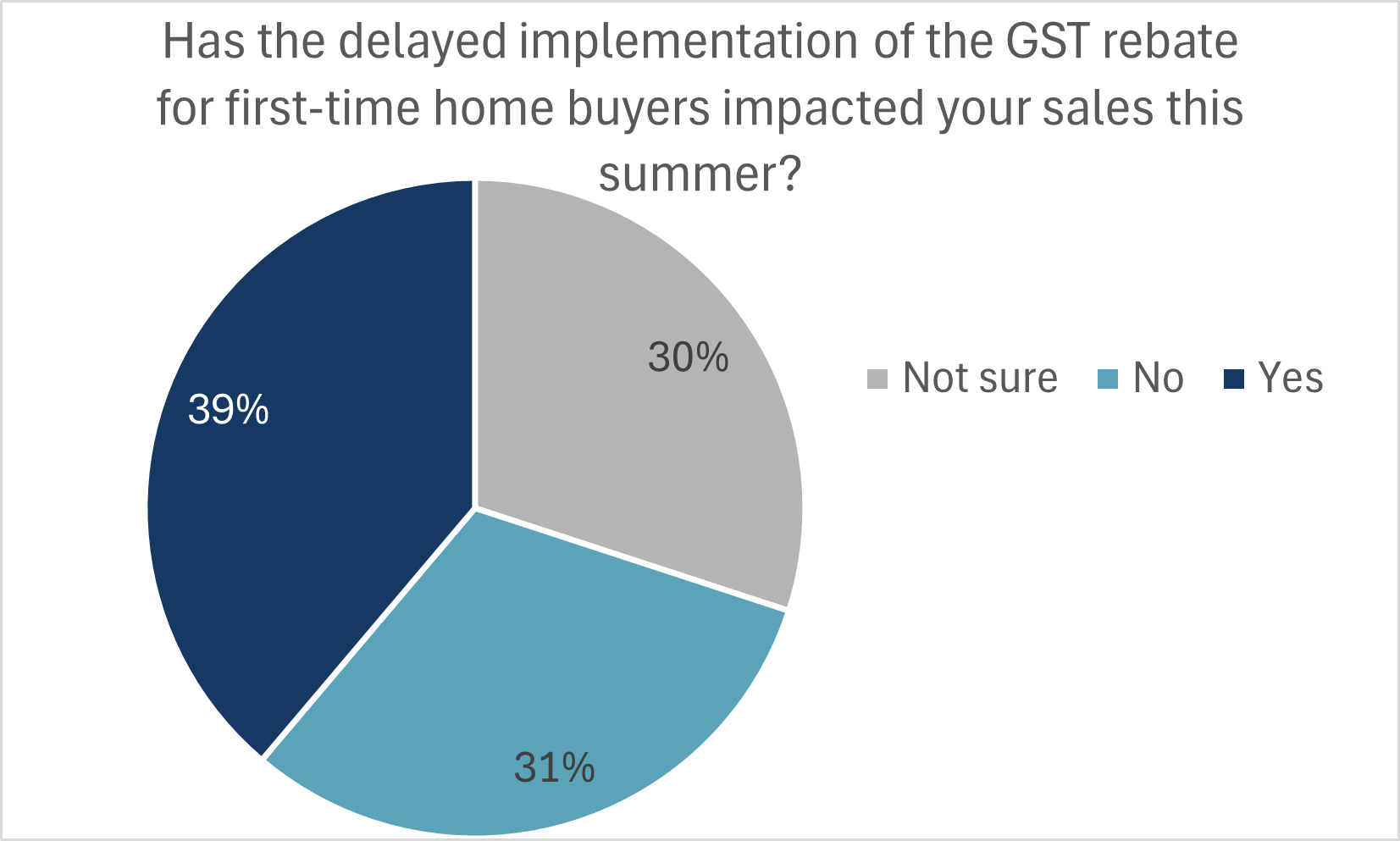

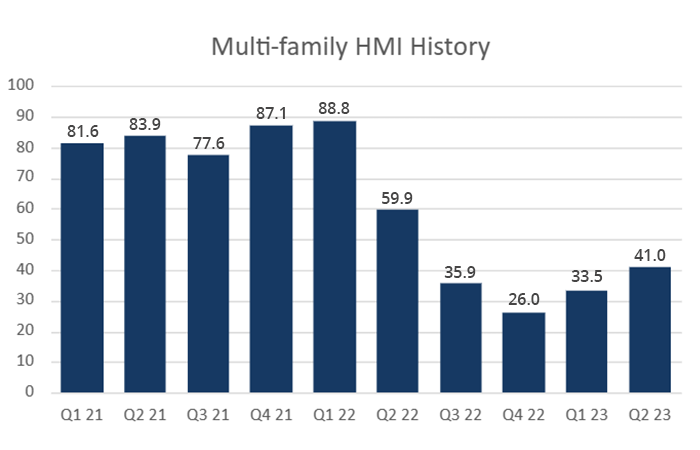

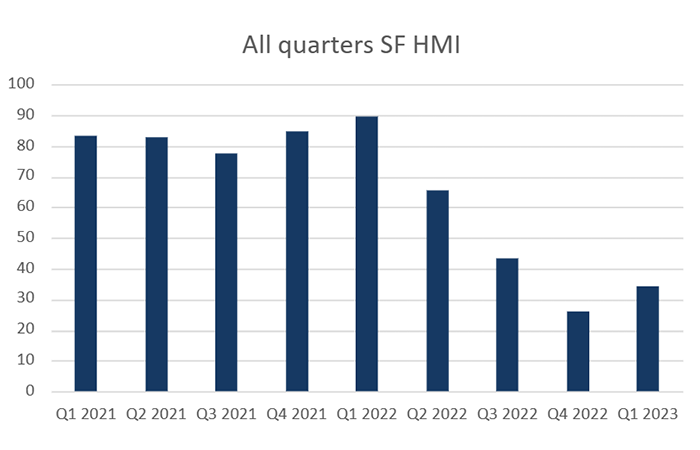

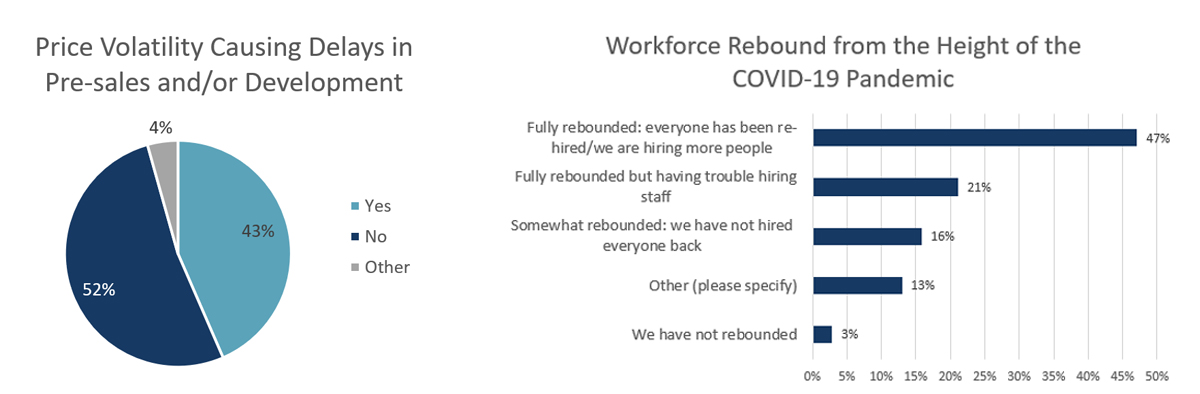

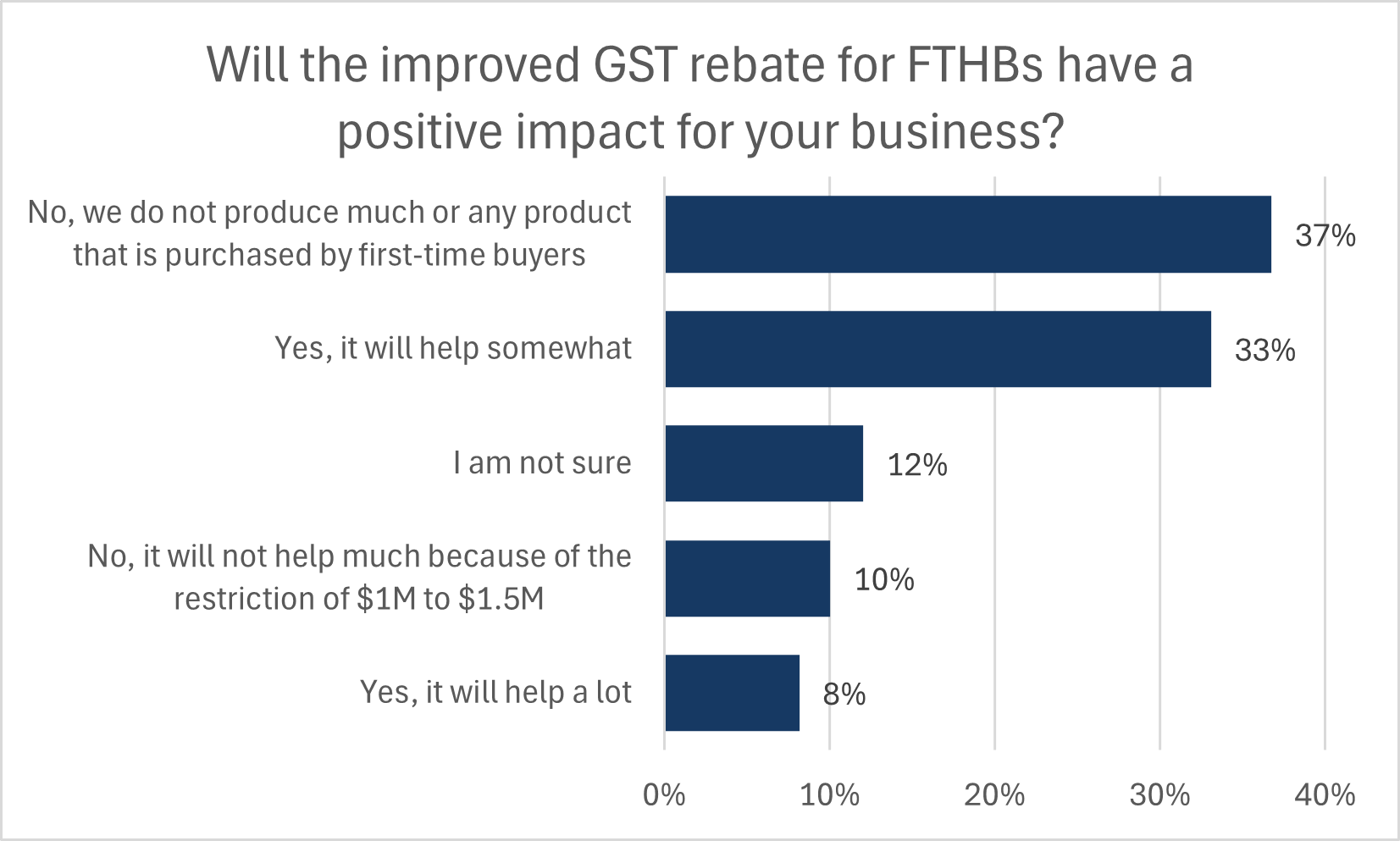

Reflecting sales conditions over the summer months, builder confidence in new home sales conditions fell to new record lows in the third quarter and widespread layoffs take hold in Ontario and British Columbia. CHBA’s single-family Housing Market Index (HMI) reached a low of 23.3 out of 100, which is a decline of 4.1 points from this quarter last year. The multi-family HMI was 16.8, a decline of 11.7 points from a year ago and the first time either HMI score has fallen below a score of 20. The continued erosion of builder confidence can be attributed to continued trade uncertainty and lack of policy implementation. The GST rebate for first-time buyers, which has not yet received royal assent and is therefore not accessible. Instead, it has caused purchase and construction delays, as those buyers wait for clarity.

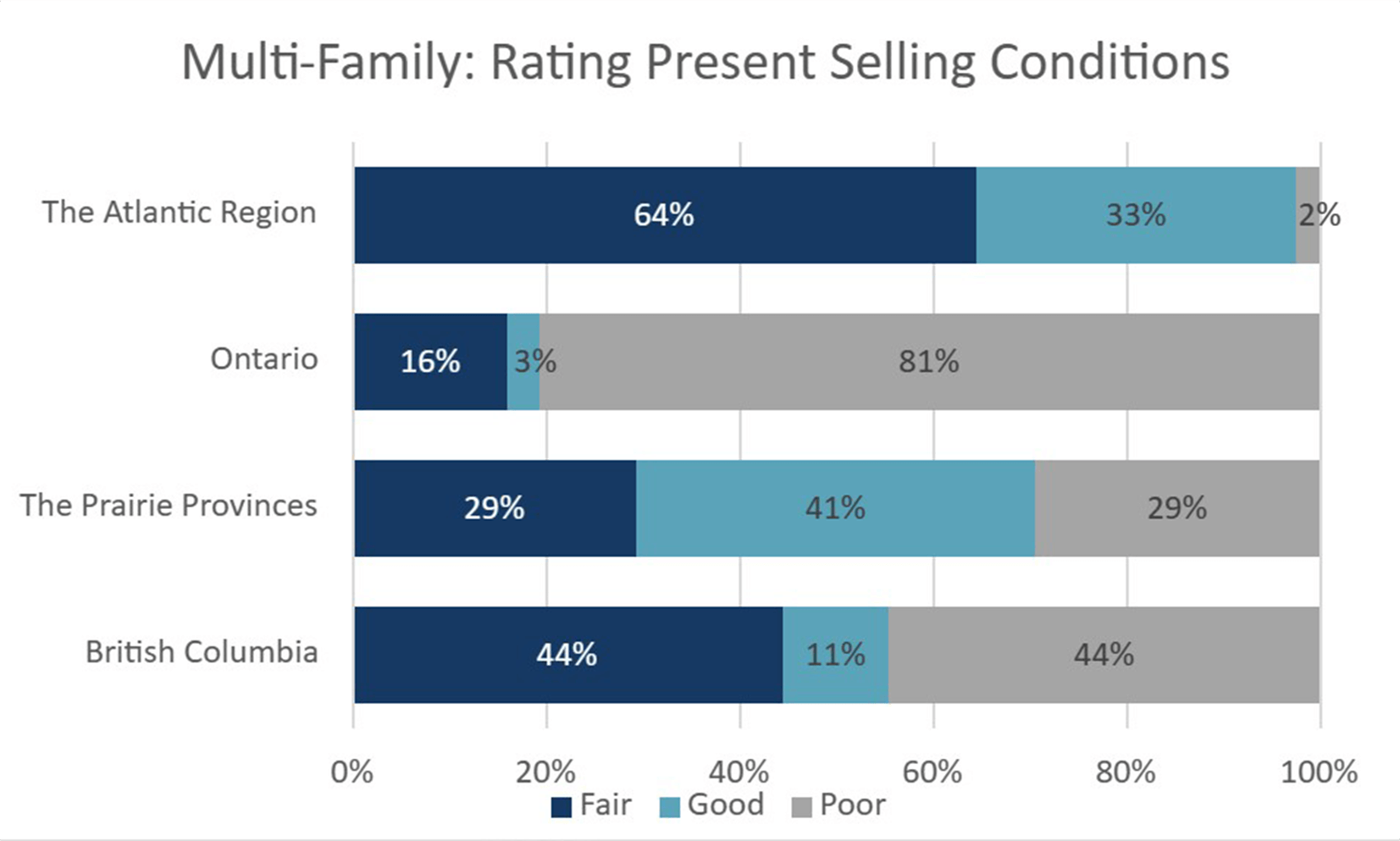

Regional differences in builder sentiment show that markets that are in dire need of large increases of housing supply continued to worsen. Pessimistic builder sentiment continues to be led by Ontario, where 64% of builders surveyed have had to layoff workers. Well-qualified demand has collapsed in the province, with a single-family HMI reading of 7.1 and a multi-family HMI of 4.4. While British Columbia’s single-family HMI of 11.7 was close to record lows, the multi-family HMI of 14.7 represented a large decline of 14.6 points from the score of 29.3 in Q3 2024—the largest decline of all regions this quarter. In the Prairie Provinces, the single-family HMI of 47.1 continues to be stable, while the multi-family HMI score this quarter of 52.9 contributed to a downtrend in sentiment that began in mid-2024. In Atlantic Canada, the single-family HMI of 47.6 was materially lower than HMI scores in the 60s in the first half of 2025.

In the first three quarters of the year, there have only been 88,908 urban starts intended for freehold or condominium ownership, which is 9,466 fewer starts for ownership seen over the same period last year. A 4,500 unit year-to-date decline in Ontario’s single-family starts for ownership have been offset by a total of 3,800 unit year-to-date increase seen across the rest of Canada—led by Alberta and Quebec. On the multi-family side, only Alberta and Saskatchewan have increased starts for condominium ownership. While sales conditions for housing units for ownership have been incredibly weak, Ontario has still grown its urban rental starts by 4,615 year-to-date to 17,614 units total. This is in line with a national surge in purpose built rental construction, rising from 67,865 units year-to-date in 2024 to 85,879 year to date in 2025. In other words, units for ownership are being replaced by units for rental, as housing policy lags for homeownership, instead focusing on rental and social housing units.

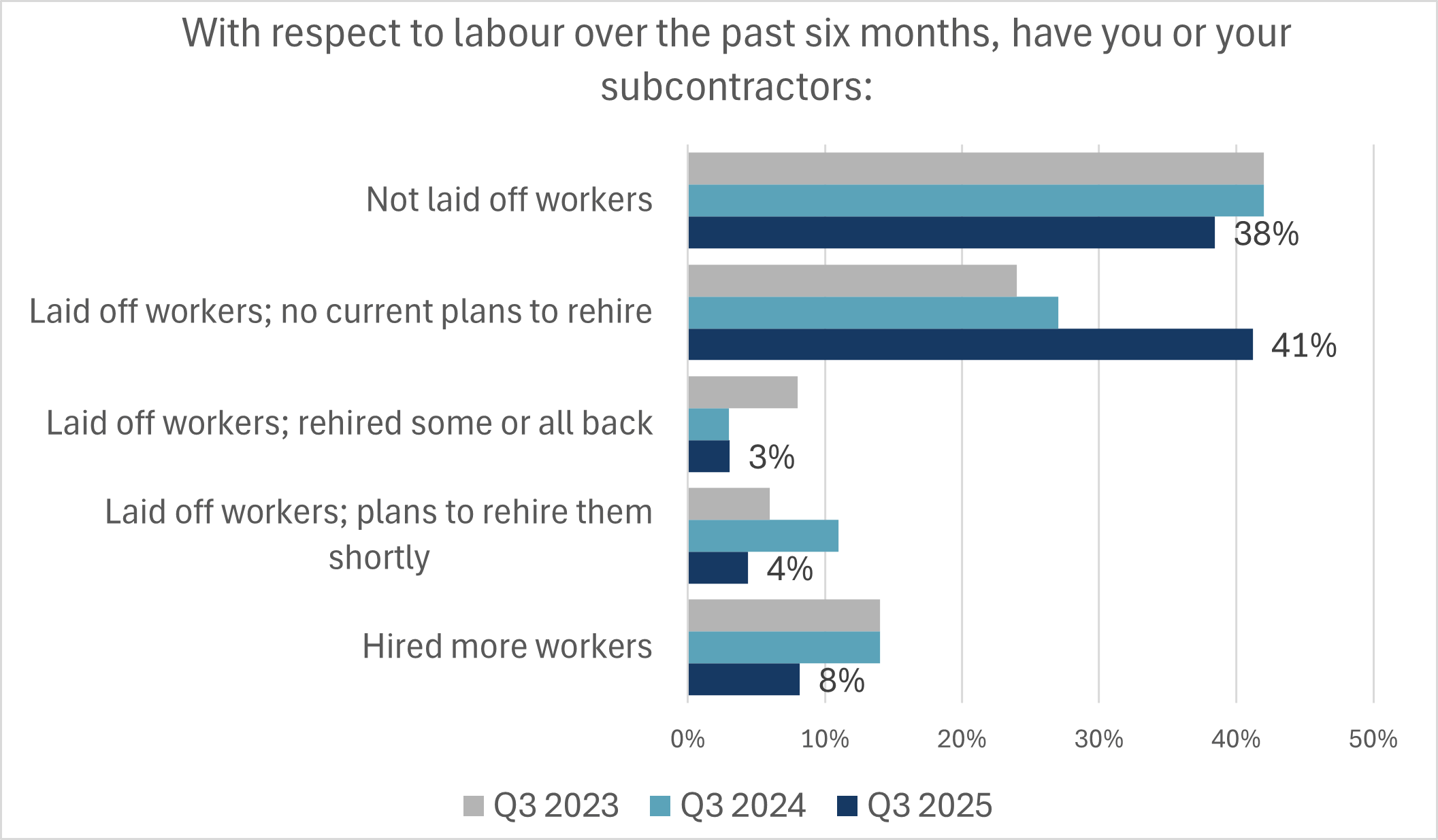

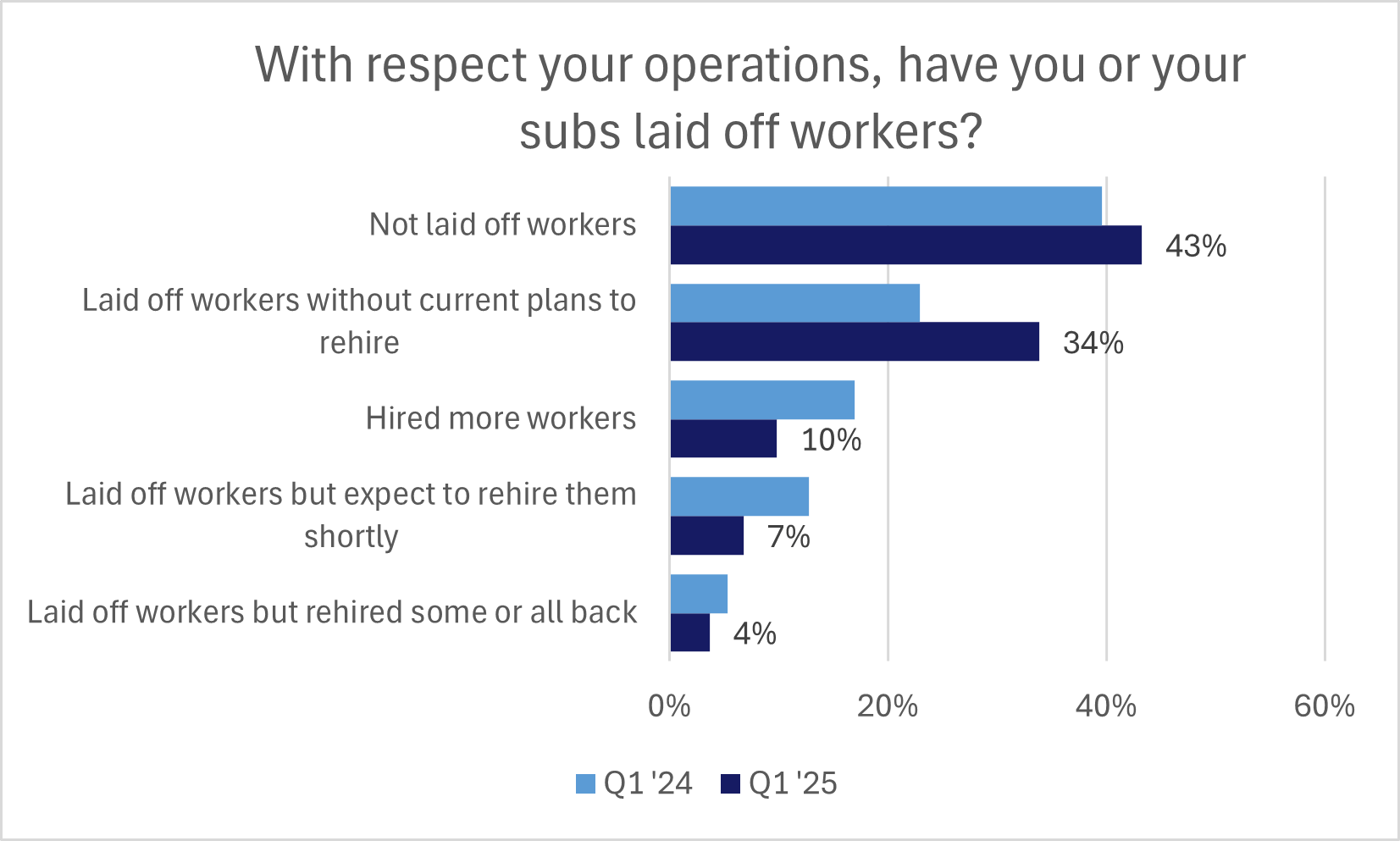

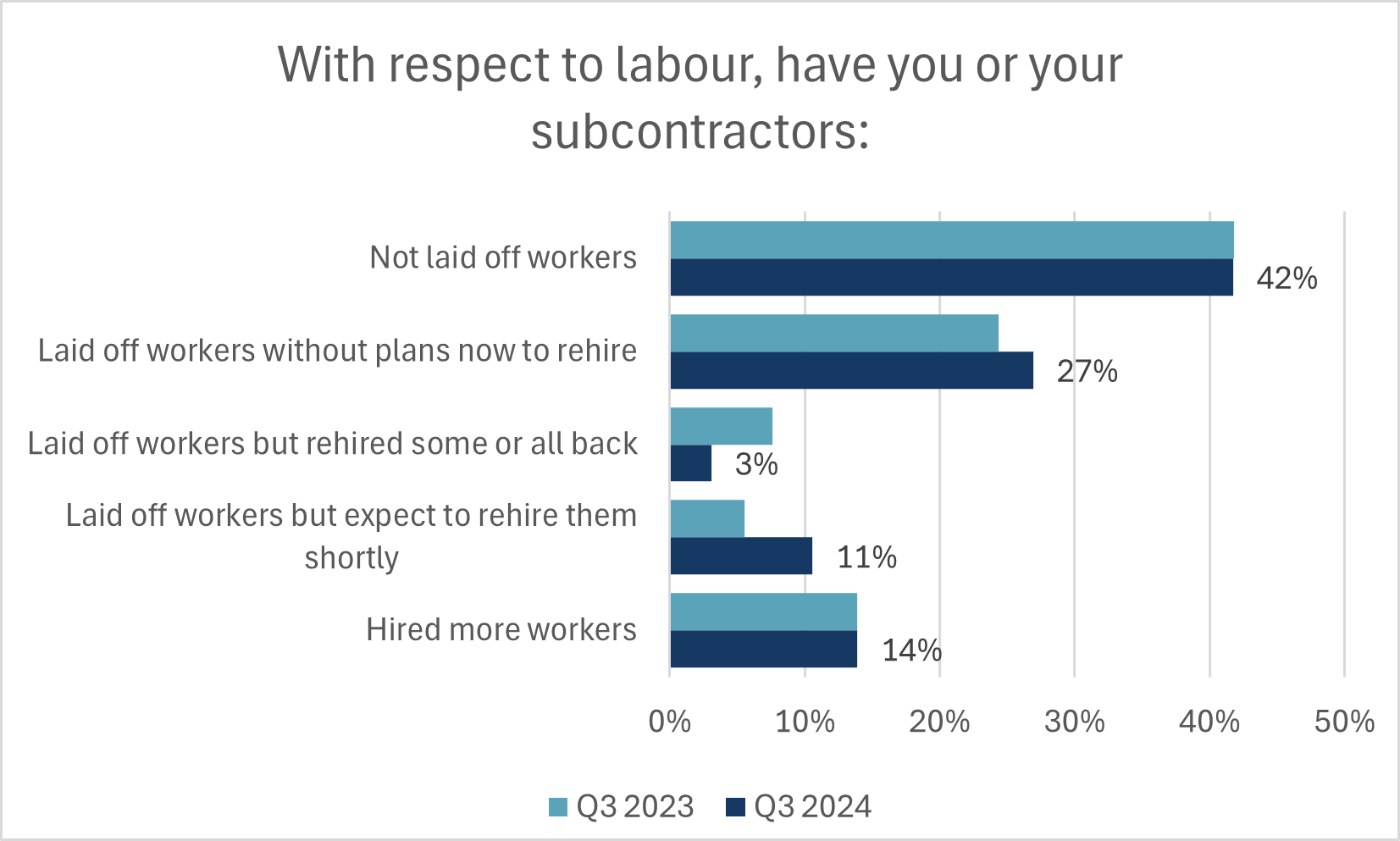

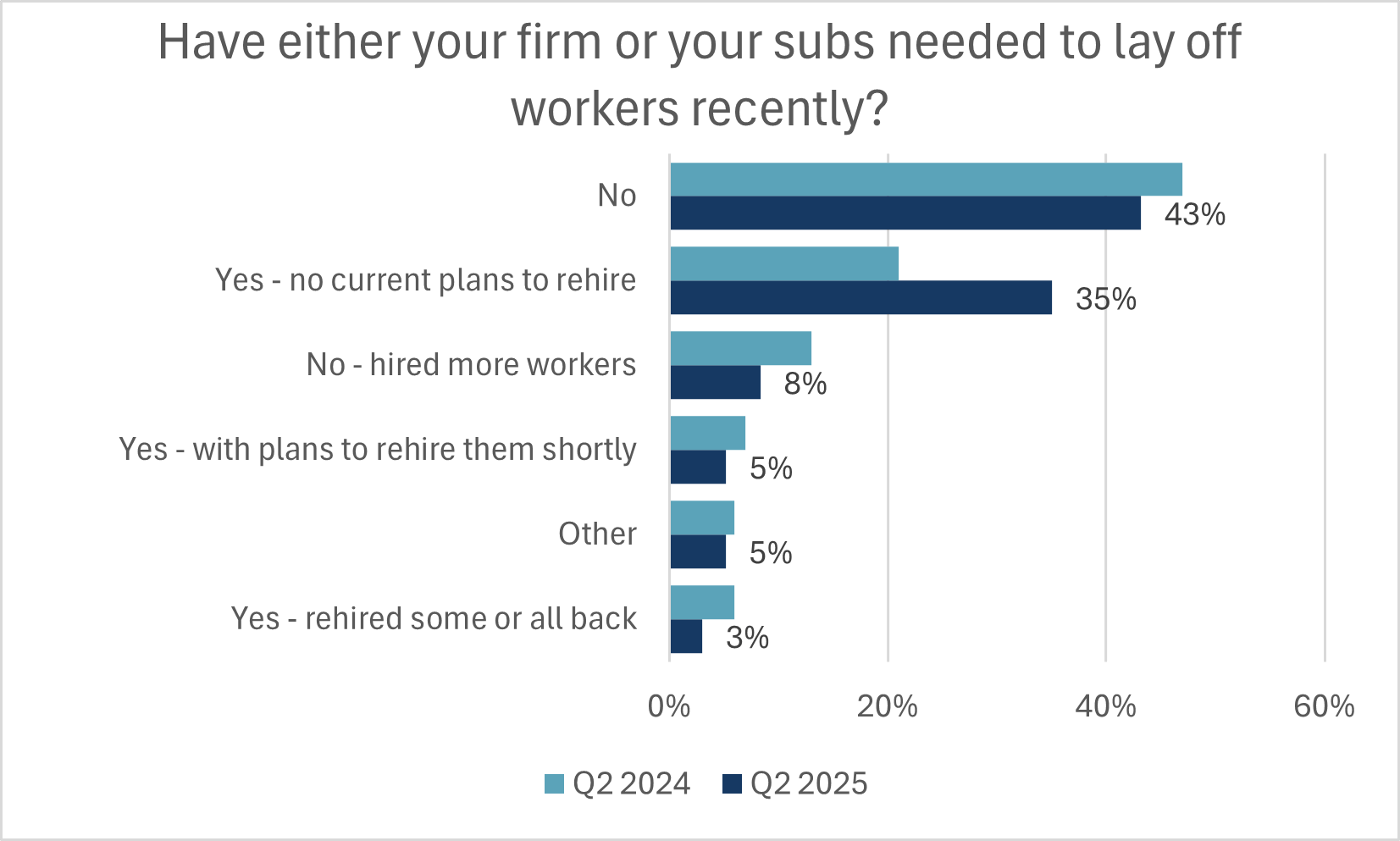

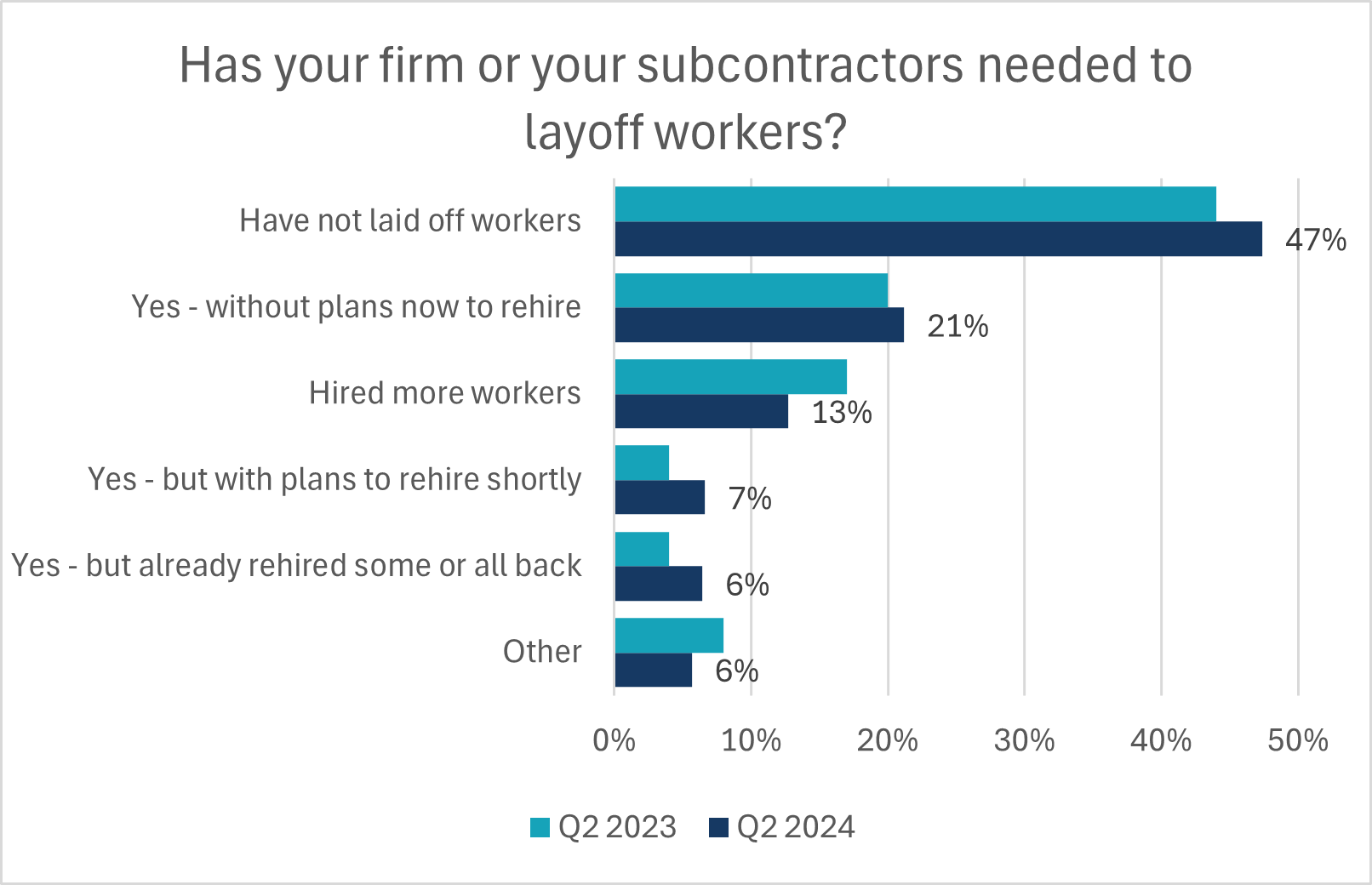

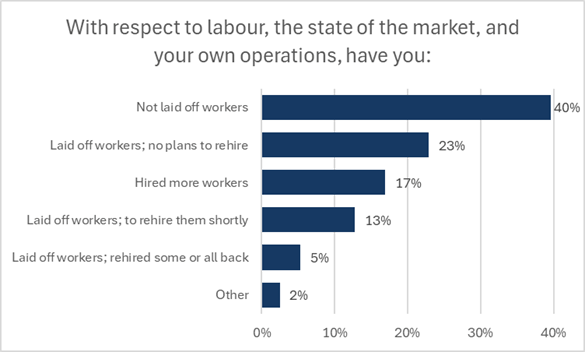

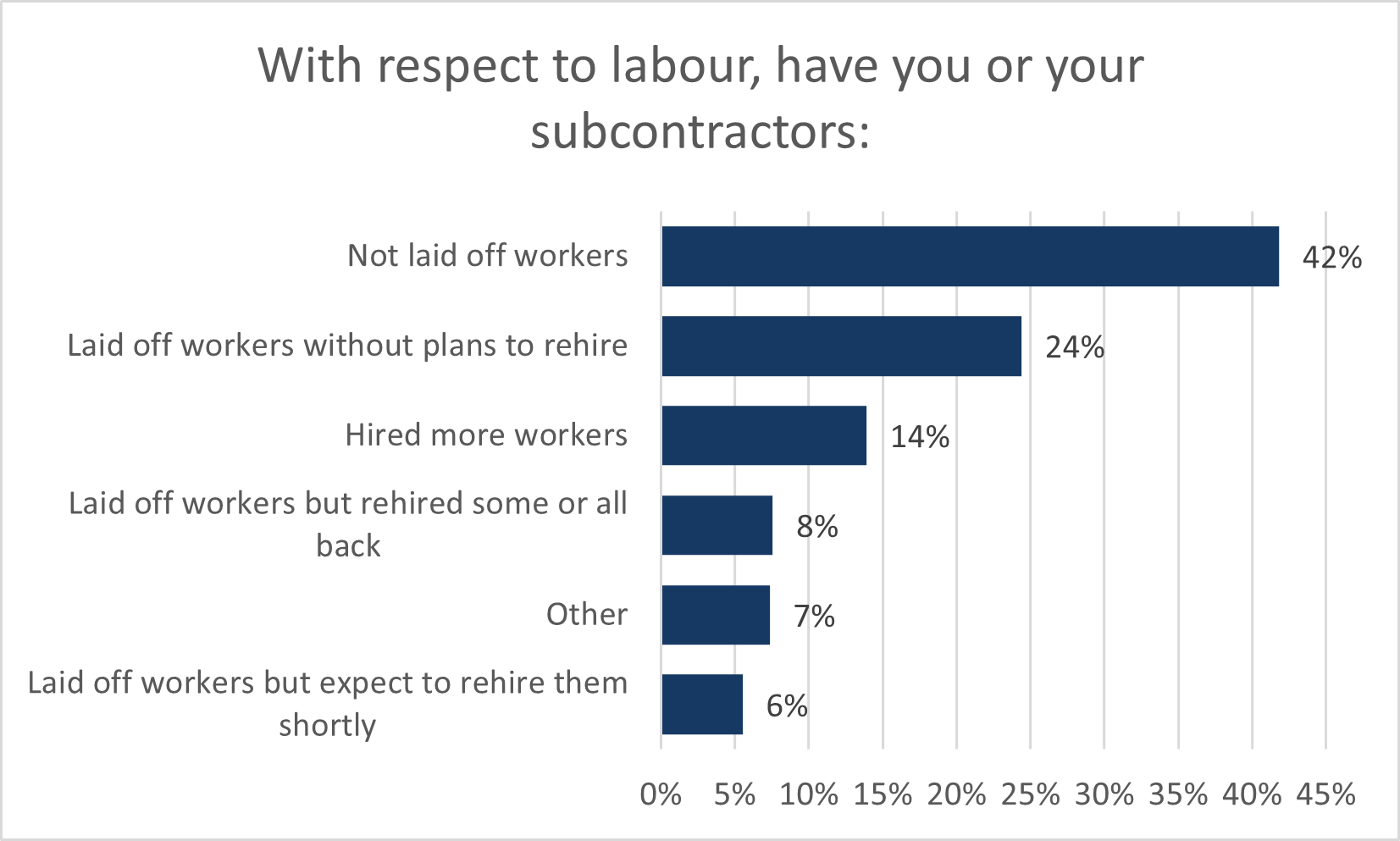

This quarter saw a large increase in the proportion of builders that reported having to lay off workers. Builders have resisted laying off employees during the past 2.5 years of weak selling conditions, given how hard it is to rehire them, and fear they may be lost to other sectors permanently. This quarter, however, conditions have reached a point where 41% of builders stated that they or their subcontractors have had to lay off workers without plans to rehire. In Ontario, 64% of respondents indicated that they have needed to lay off workers, and in British Columbia, 39% are reporting the same. Residential payroll data shows a year over year employment reduction of 3,511 jobs in July and 2,166 fewer jobs in AugustWhile not large declines, the data shows that the industry’s payroll employment historically only contracts during periods of stress. Results from the HMI indicate that these industry job losses will accelerate.

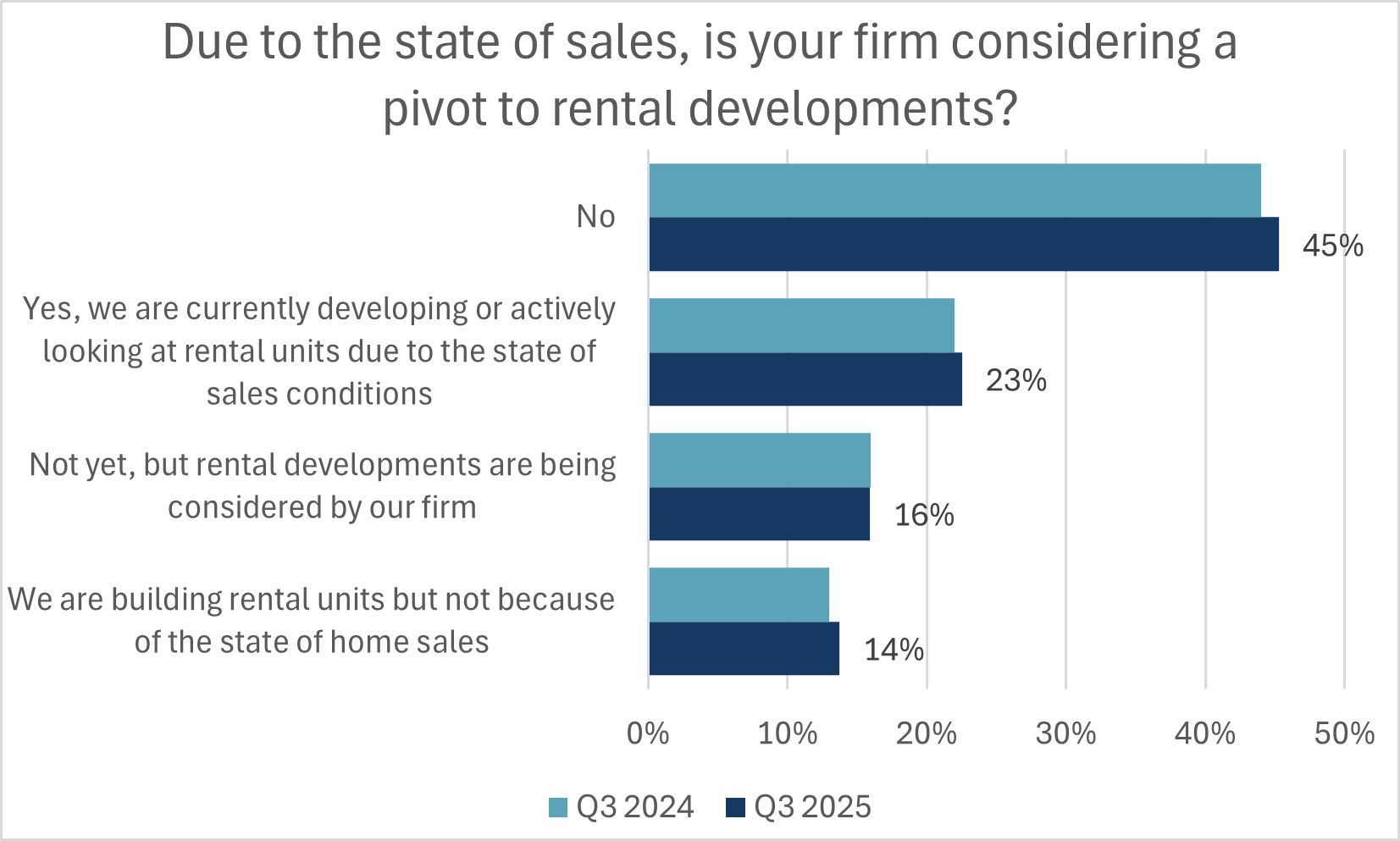

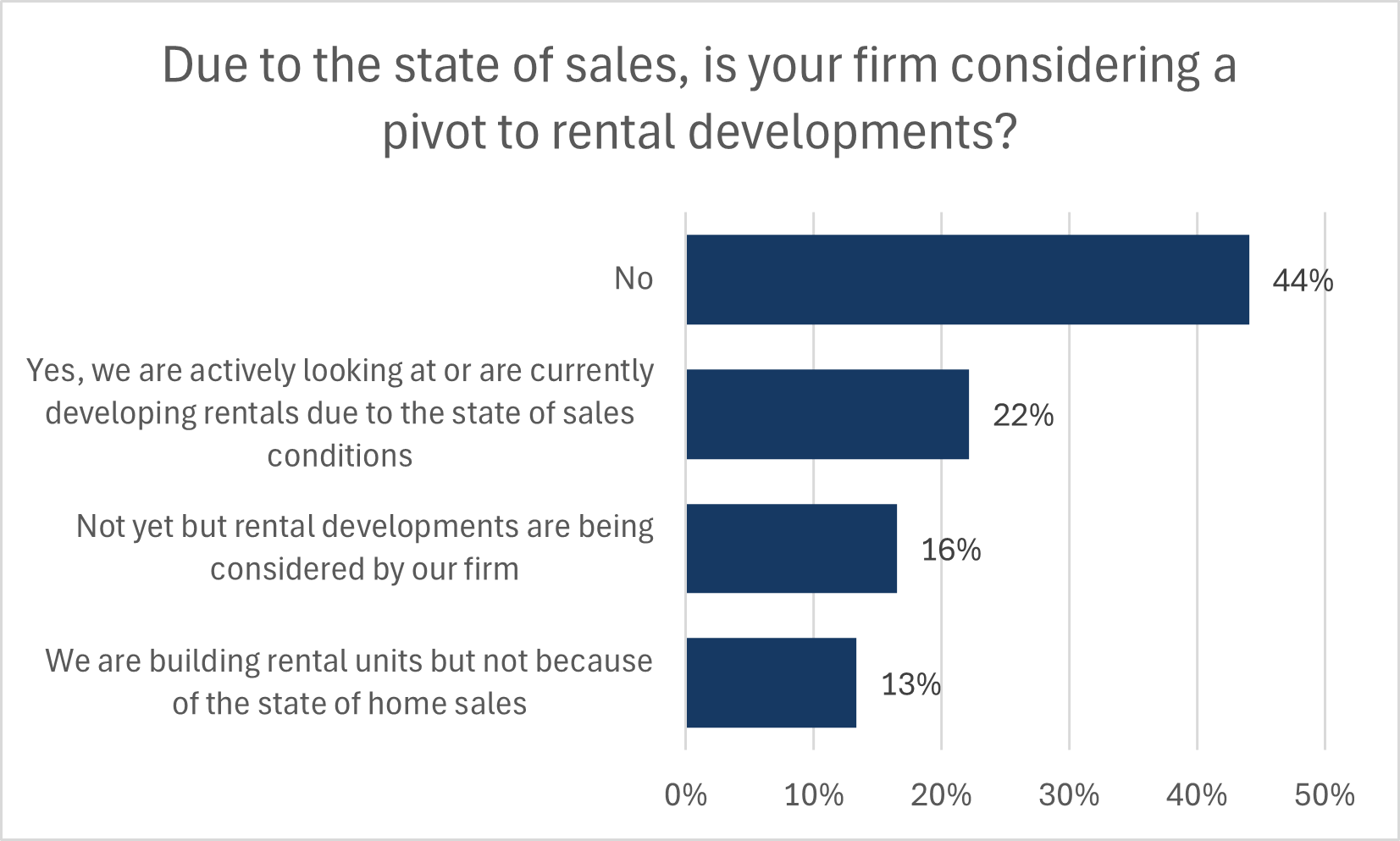

Motivated by the continued ramp up of purpose-built rental starts, builders were asked if they are considering rental market developments due to the state of sales. 39% of all builders reported that they have already shifted or are looking to pivot to rental developments. This provides some additional context that the increase of Canada’s rental stock is coming at the expense of dwellings for ownership.

If left unaddressed, Canada’s homeownership rate will continue to fall. Affordability of homes for ownership must be improved, through increased supply, additional mortgage stress test adjustments and urgent follow through with policies like the GST rebate for first-time home buyers—which should be expanded to all buyers—and reduced development taxes.

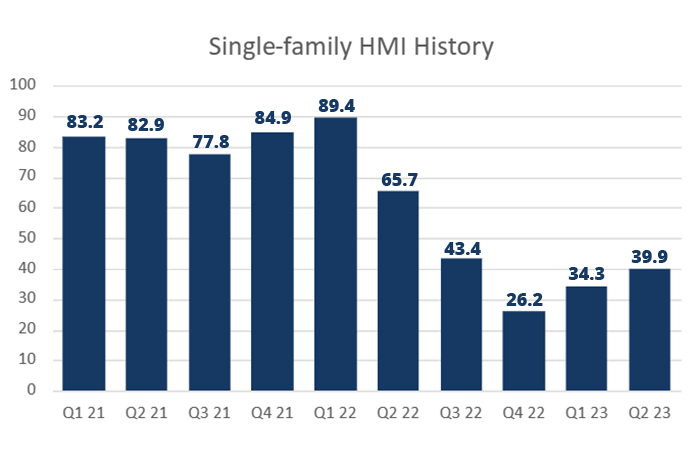

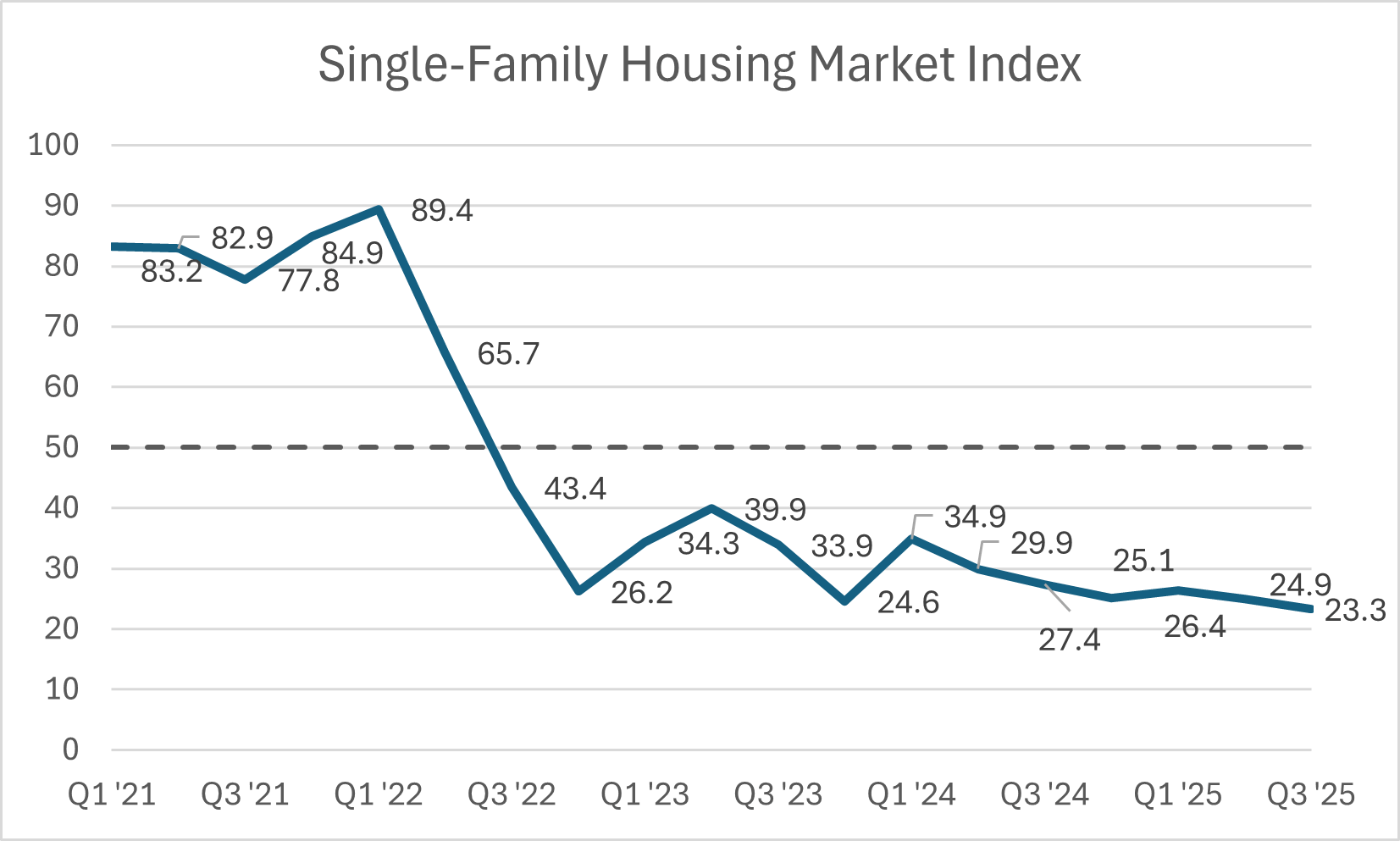

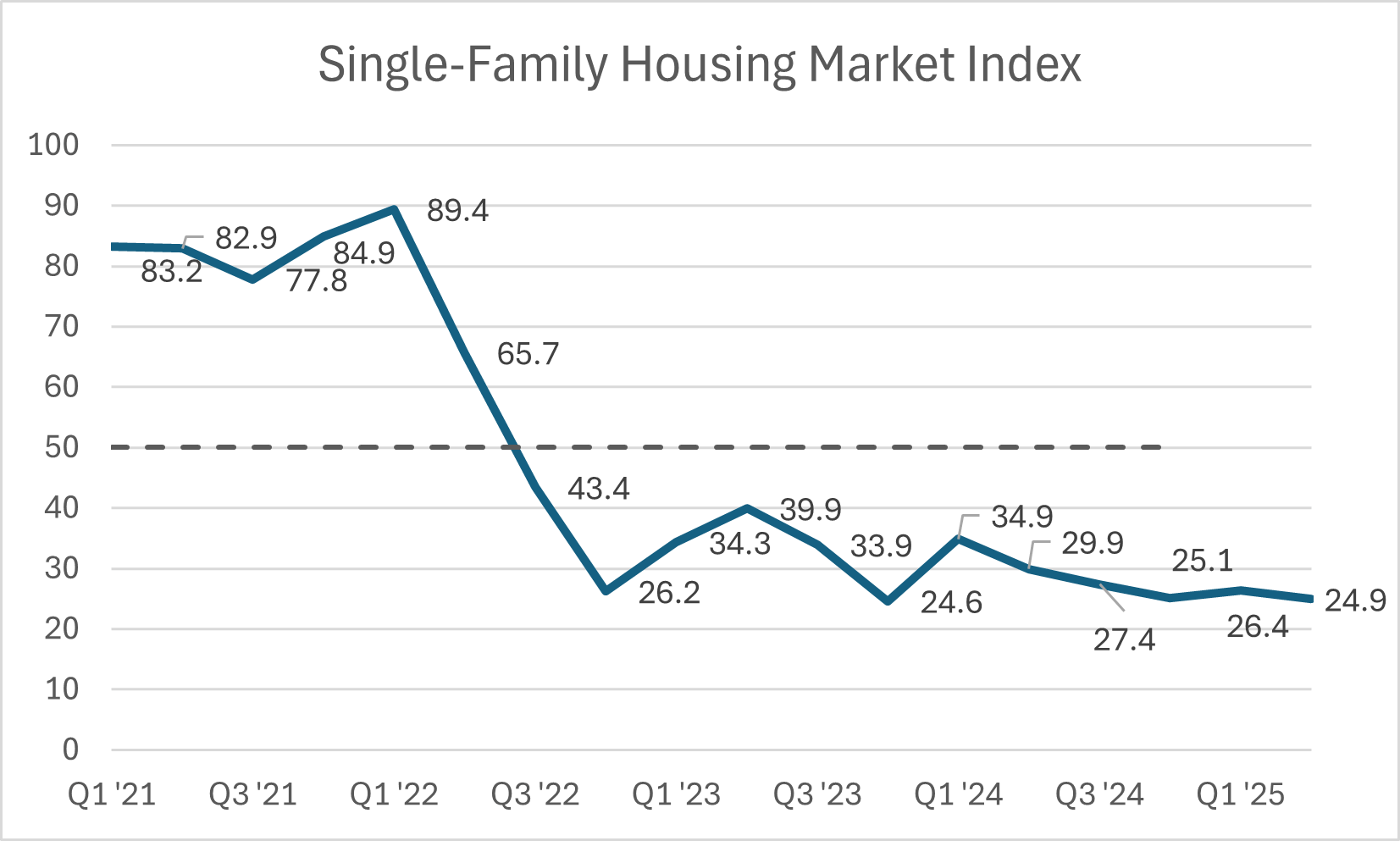

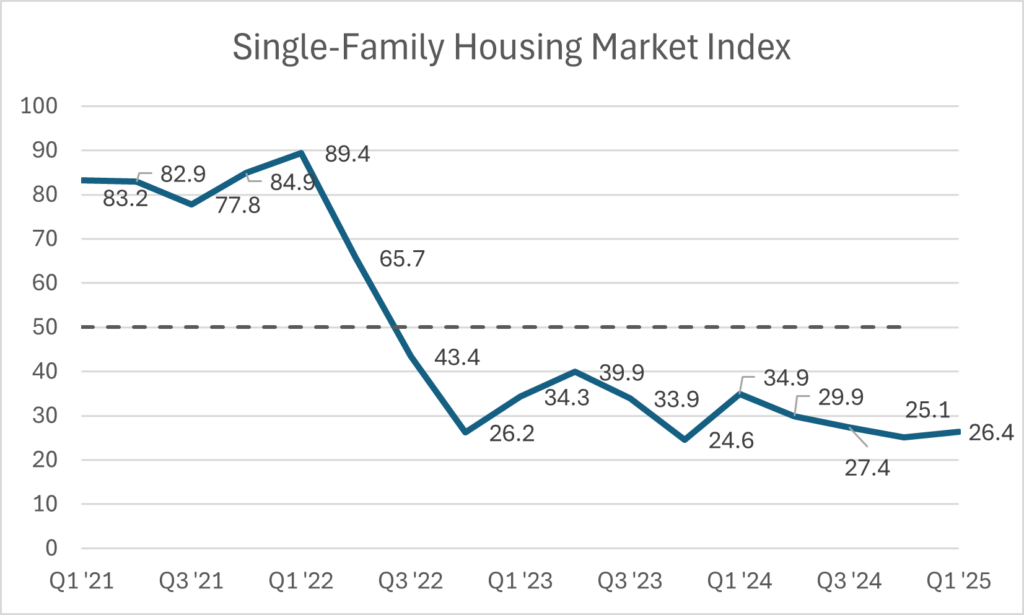

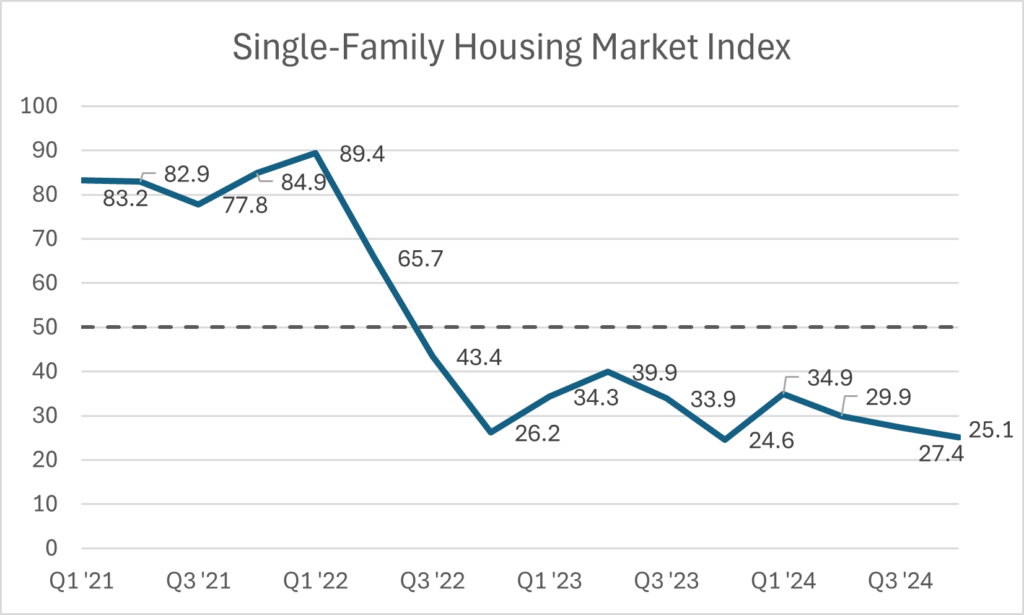

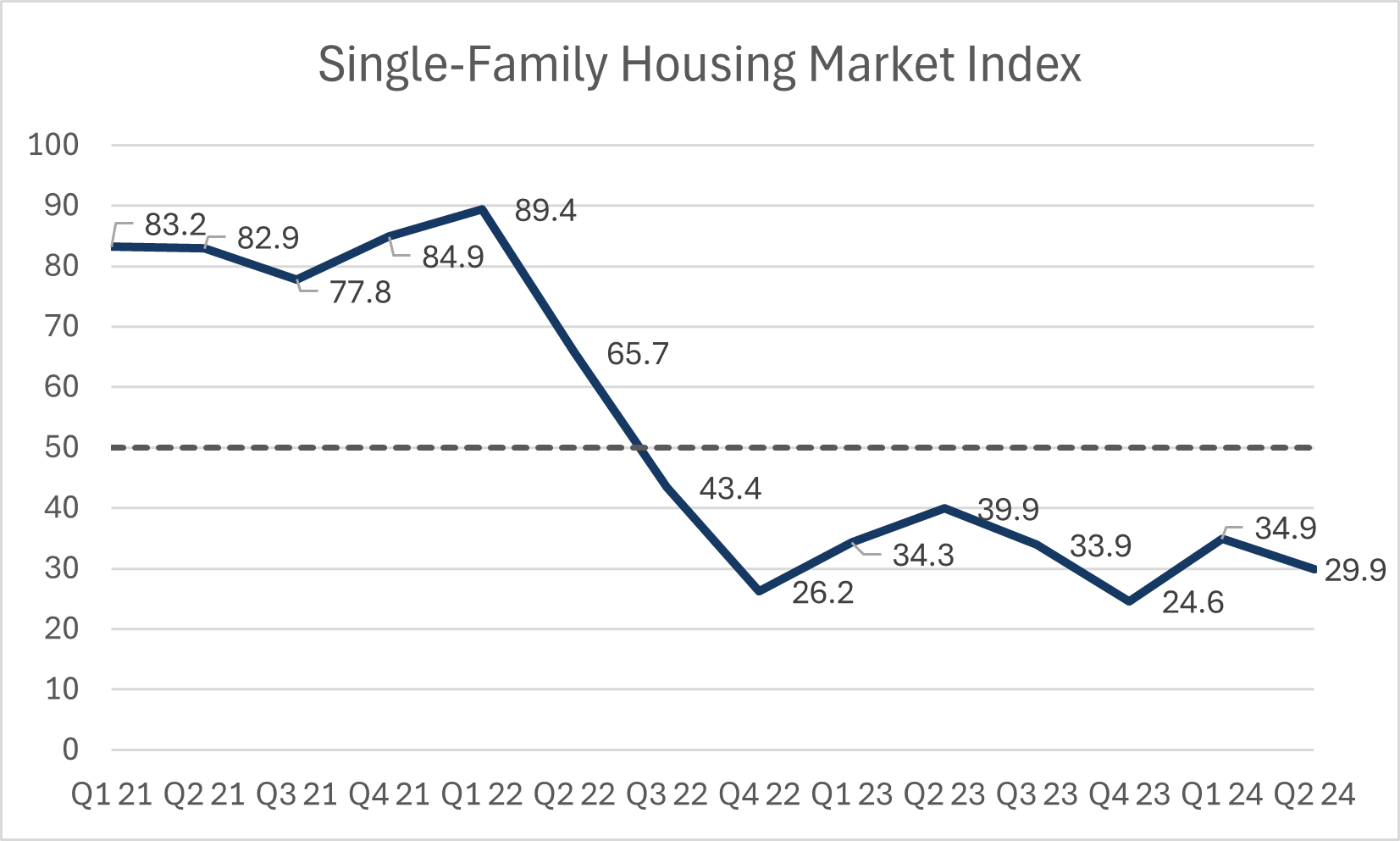

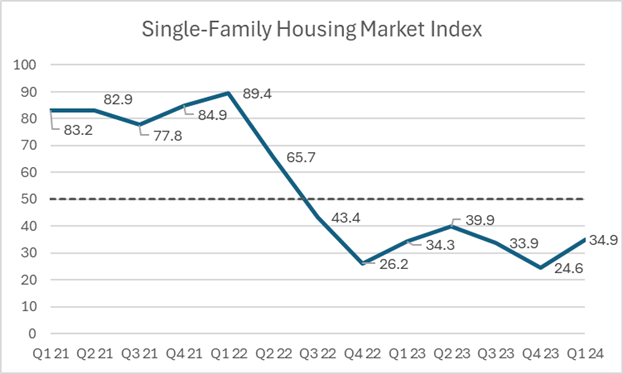

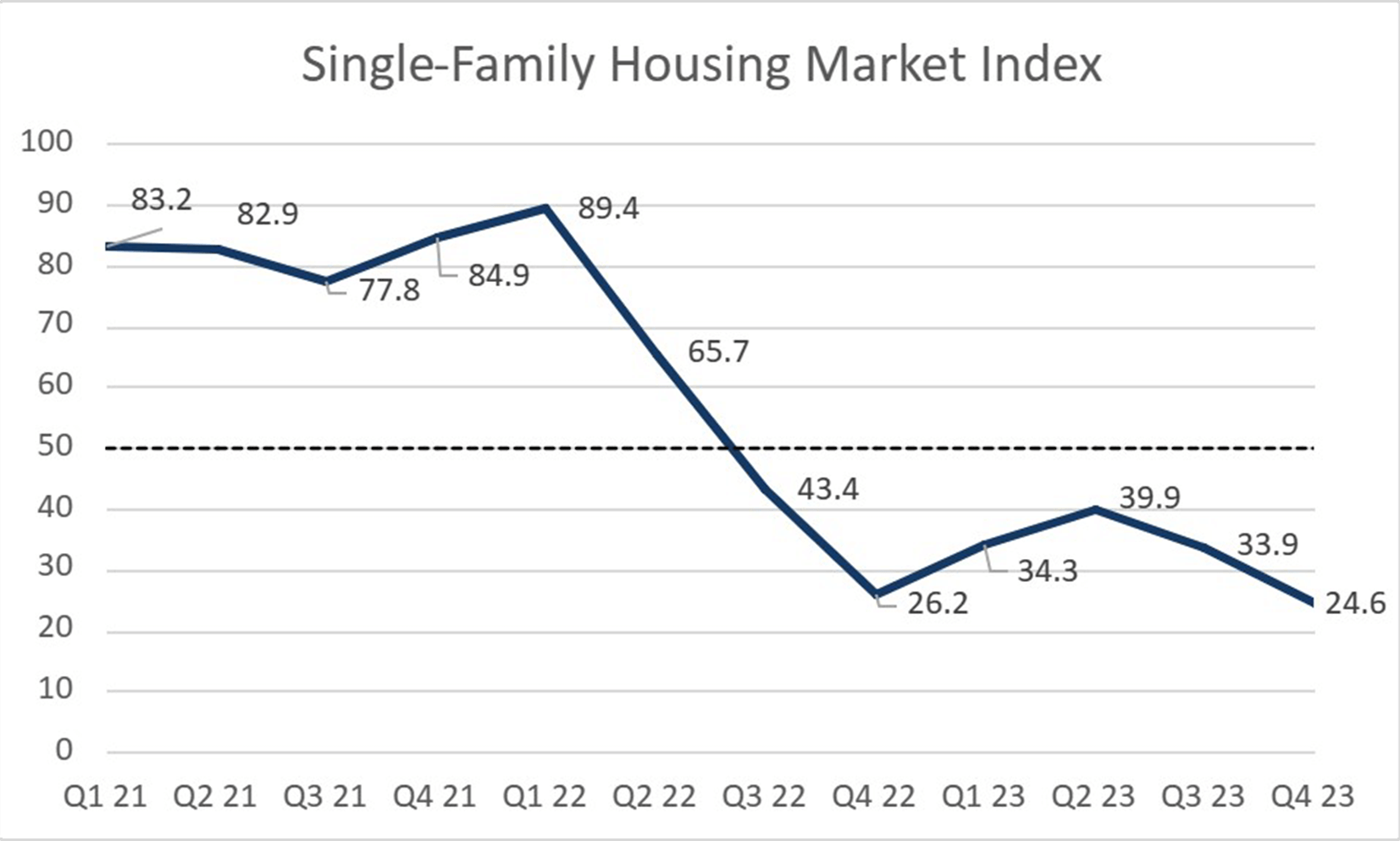

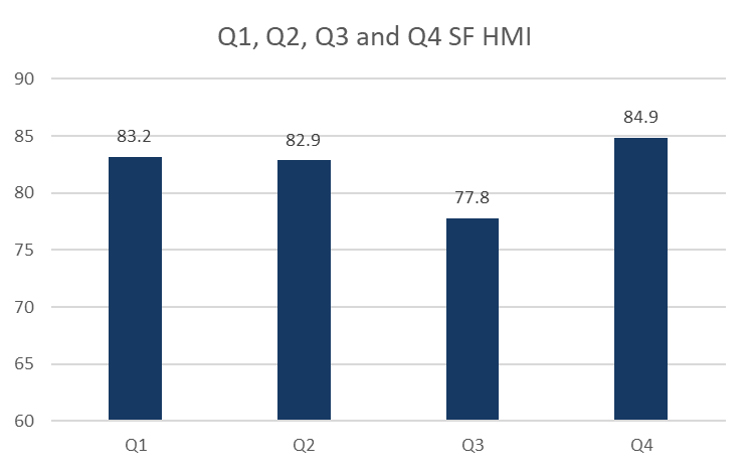

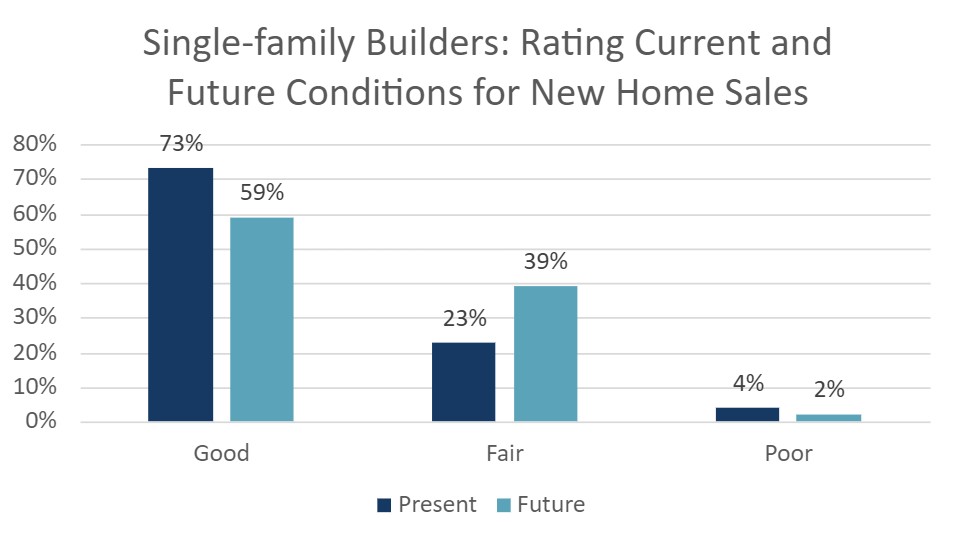

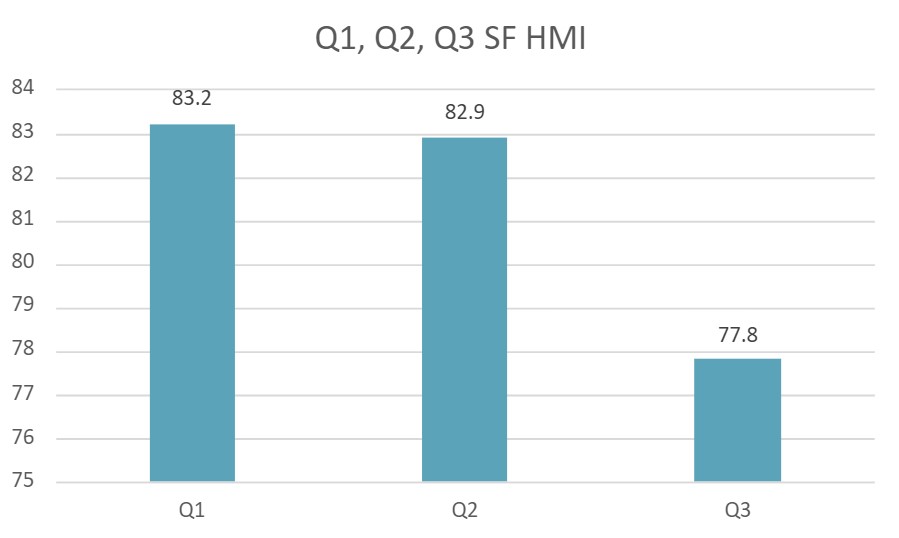

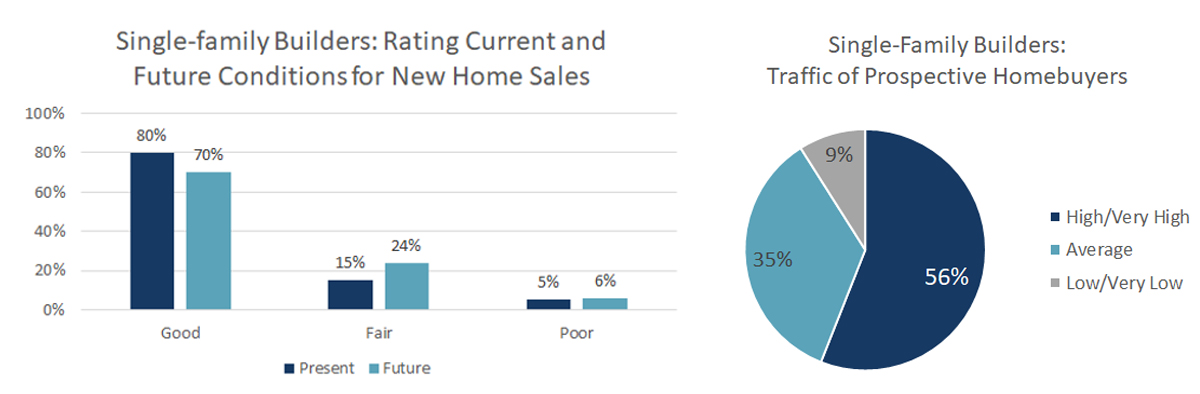

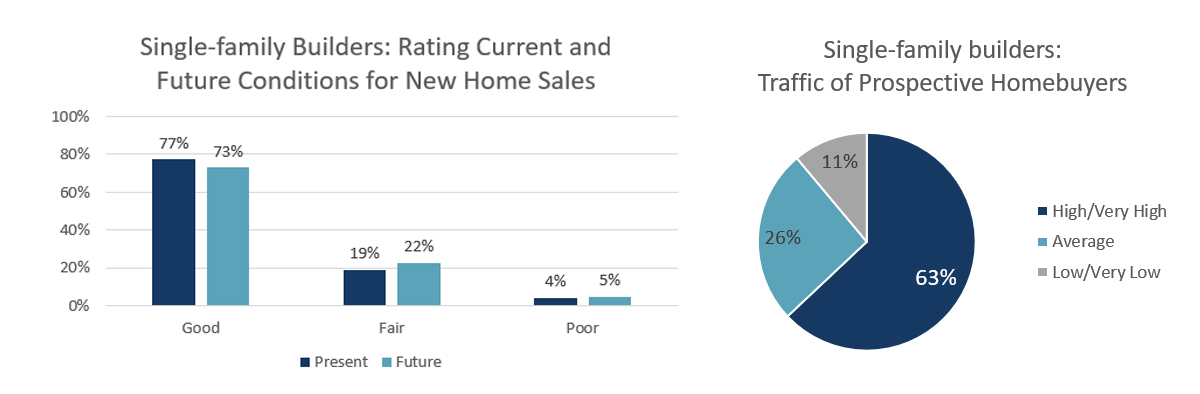

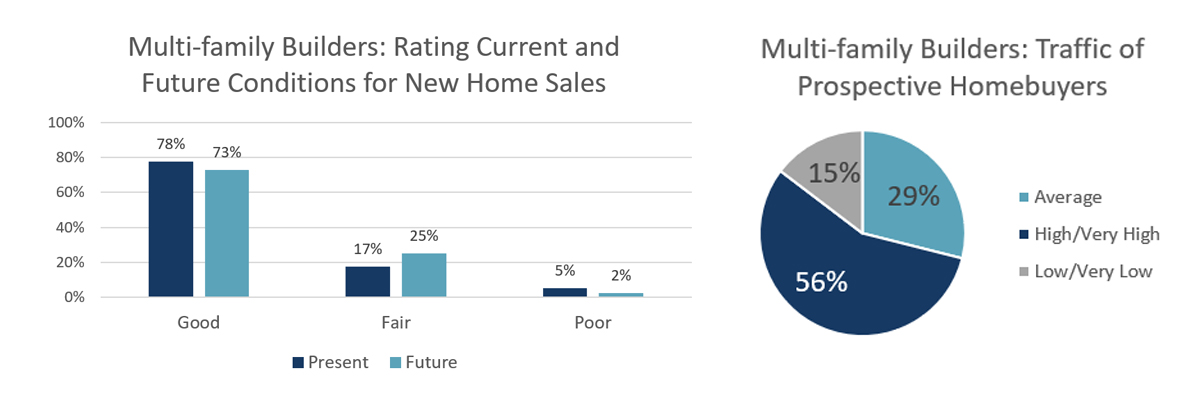

- The single-family Housing Market Index in the third quarter was 23.3, falling 1.6 points from the previous quarter and 4.1 points from a year ago. This is a new record low for the single-family HMI, surpassing the previous low of 24.6 from the fourth quarter of 2023.

- For comparison, the US’ NAHB/Wells Fargo single-family HMI was 32.3 during the third quarter.

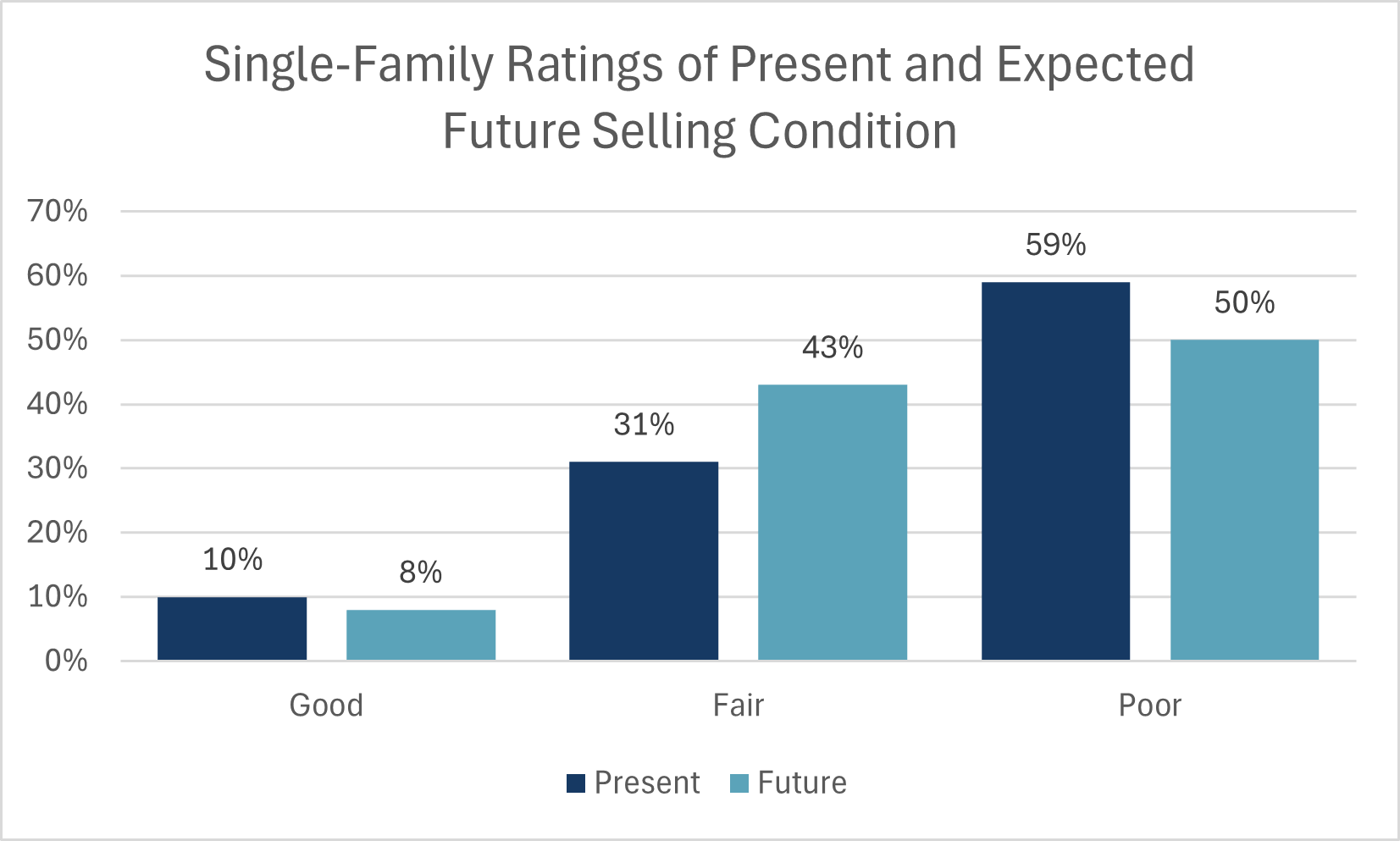

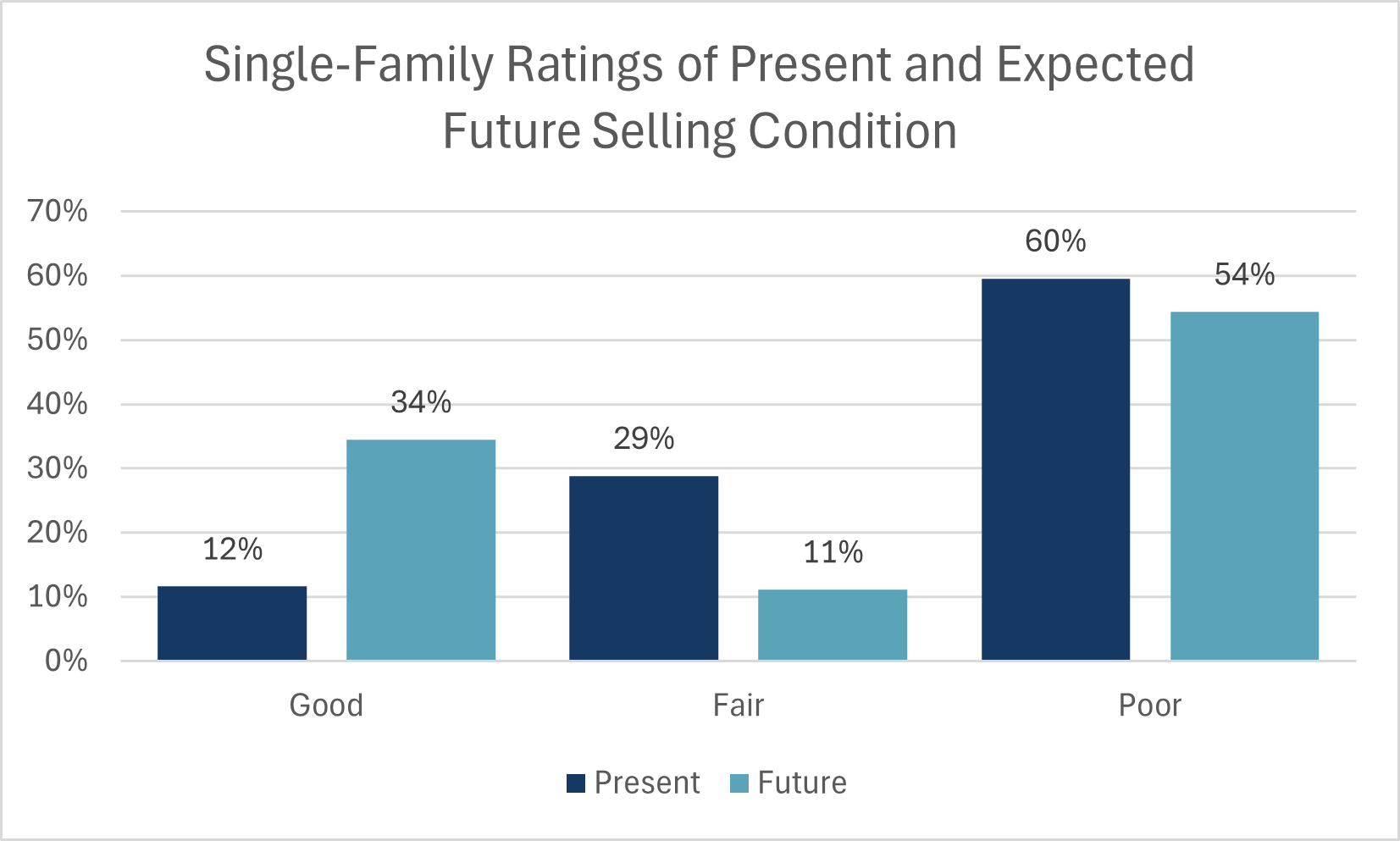

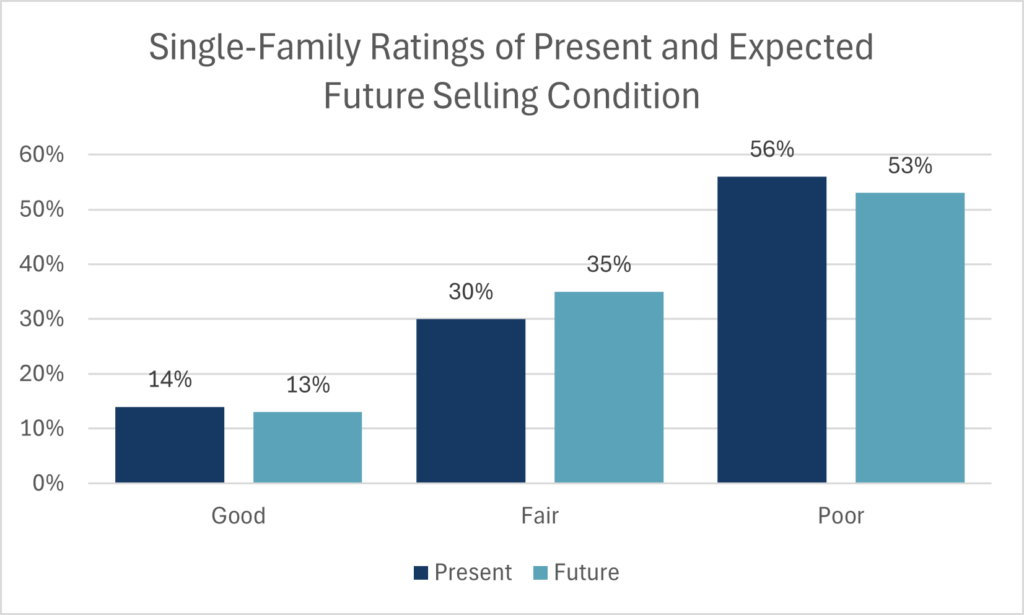

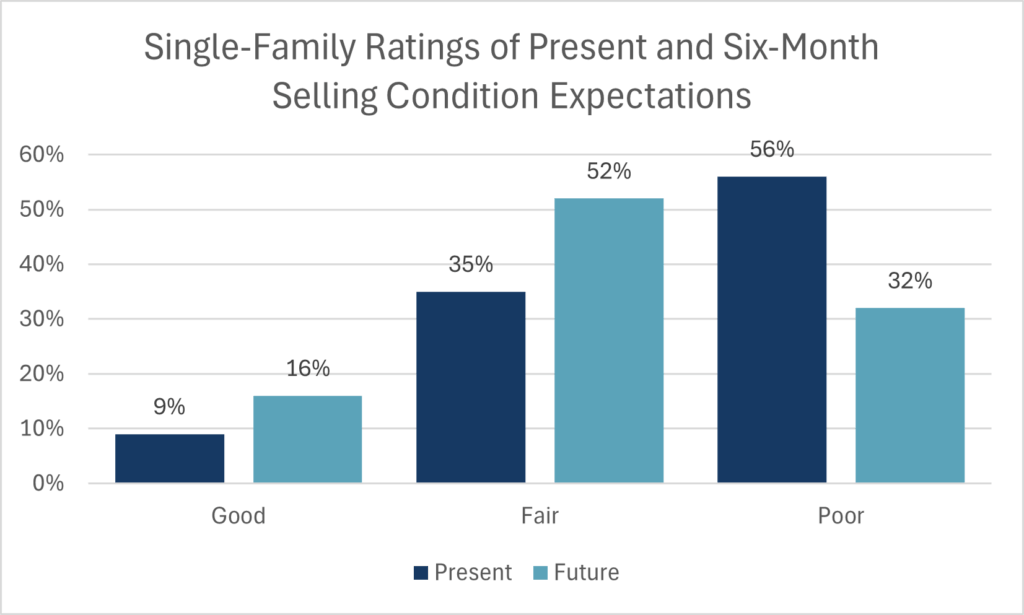

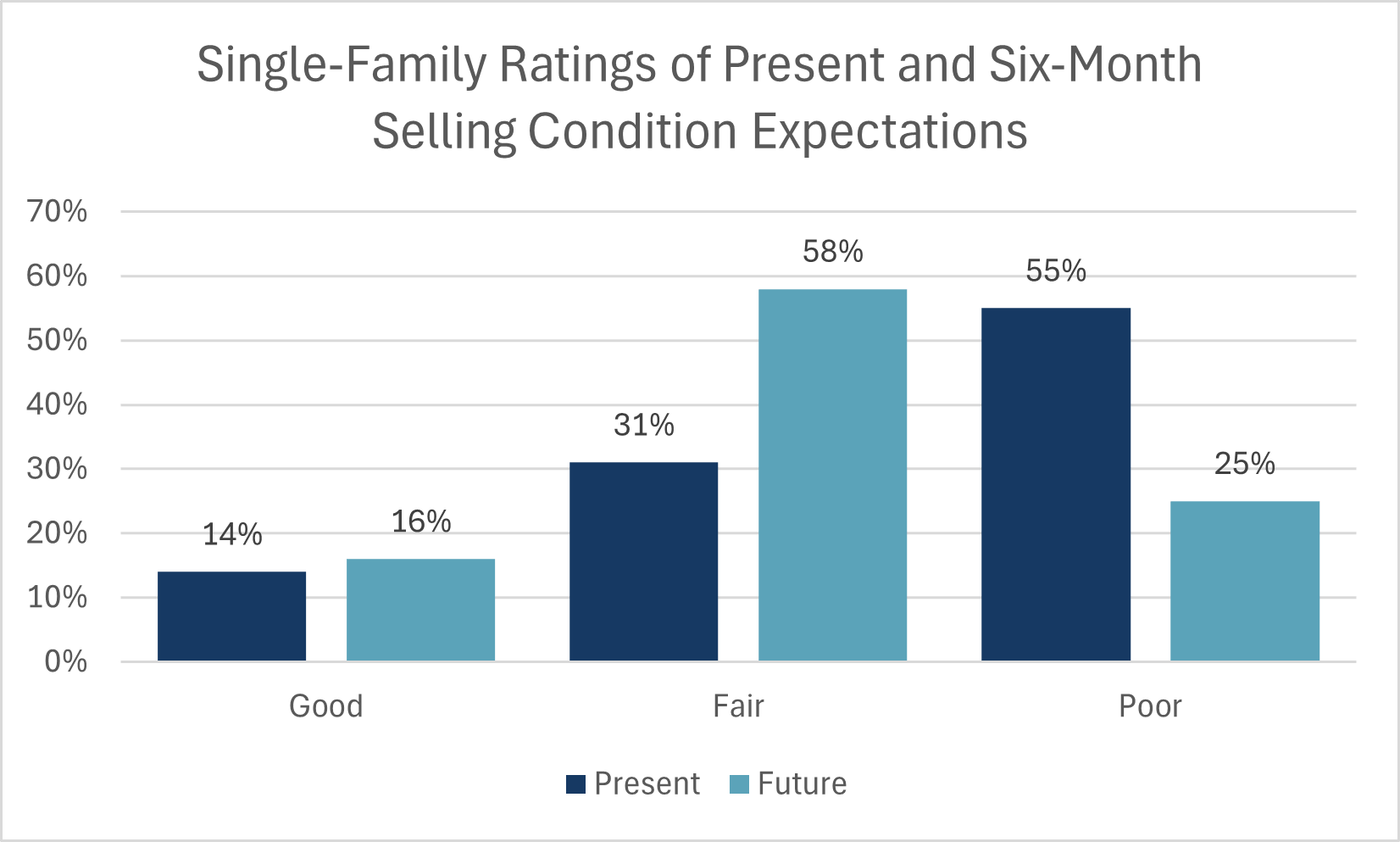

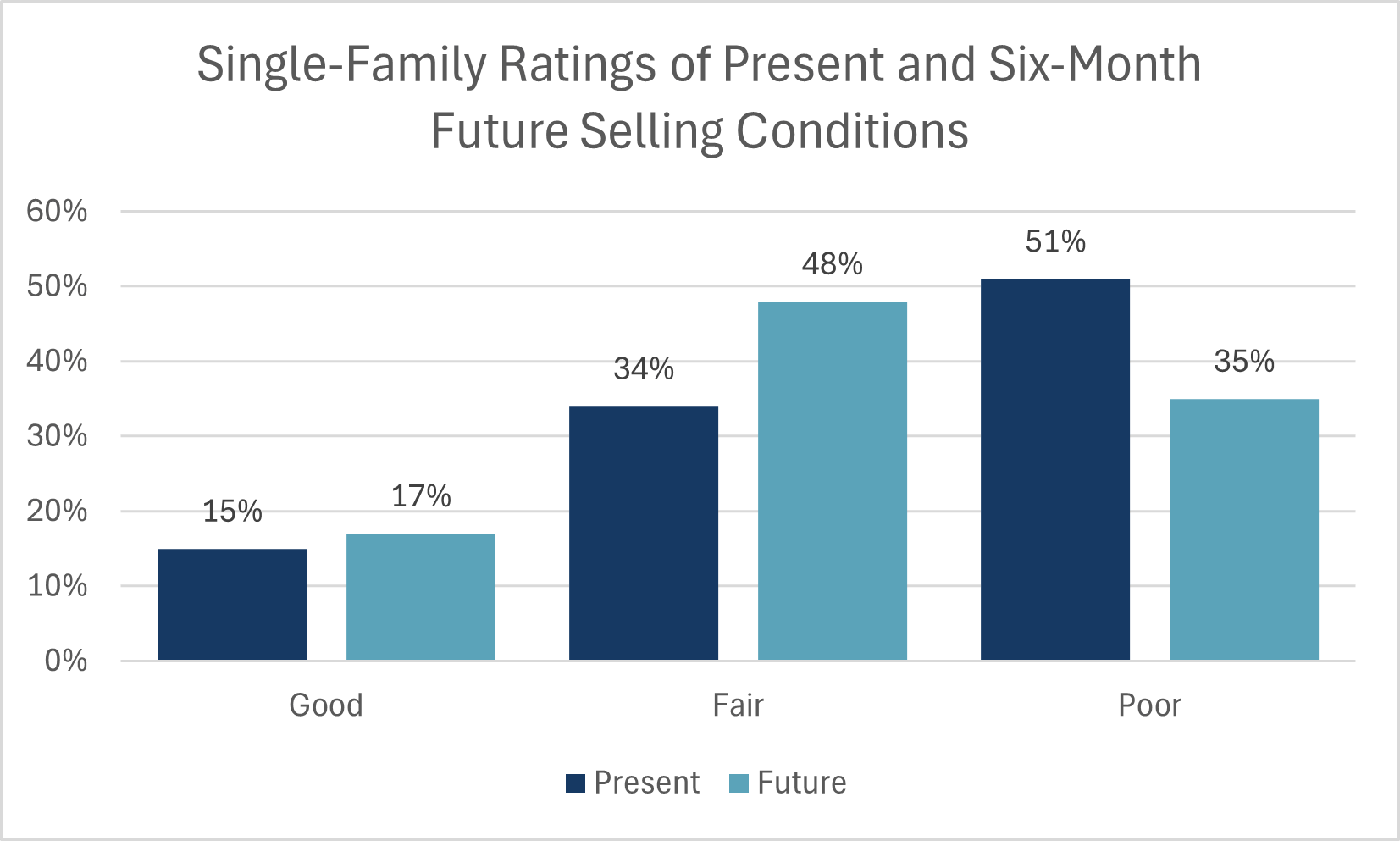

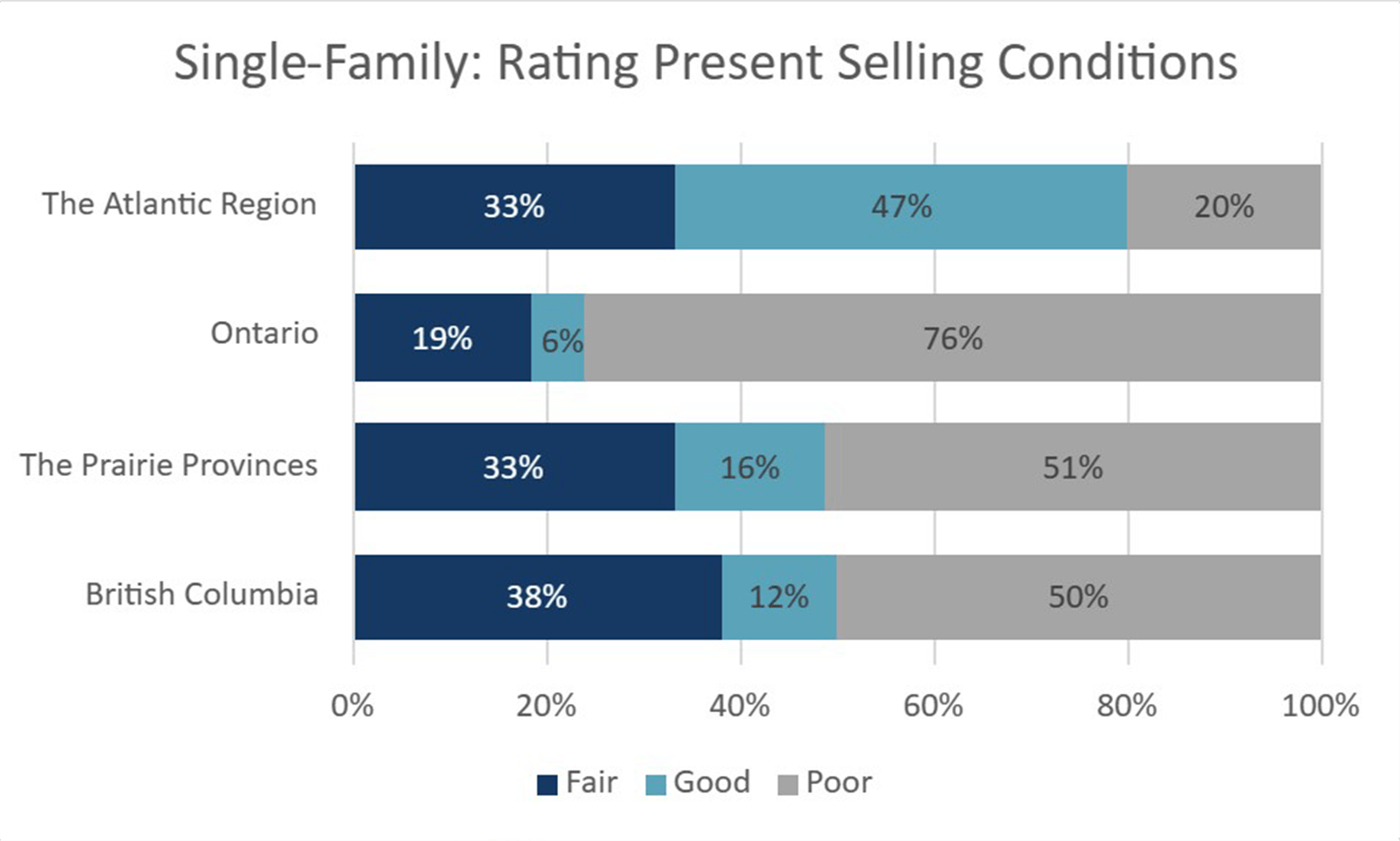

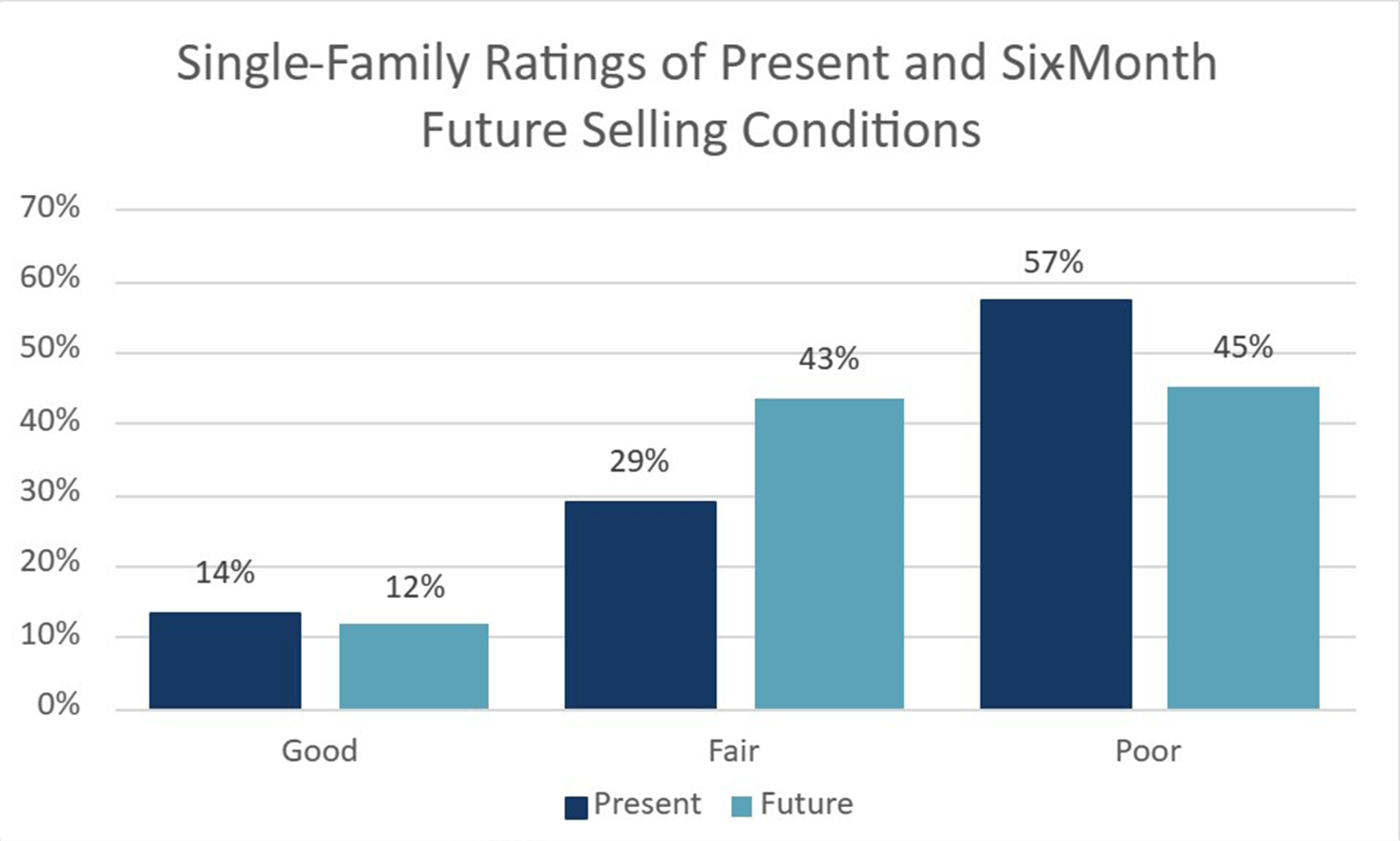

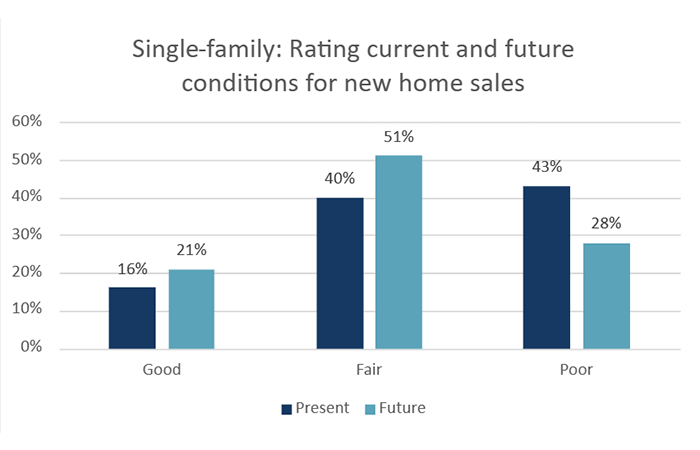

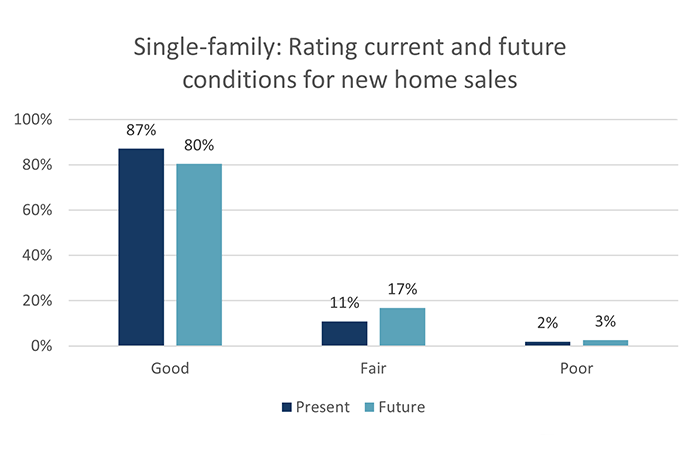

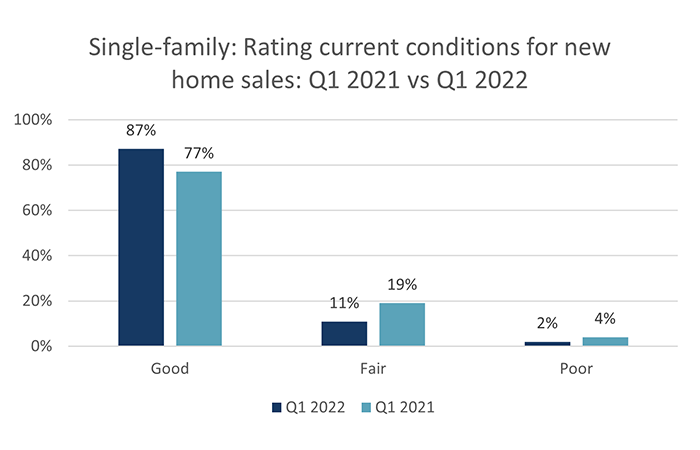

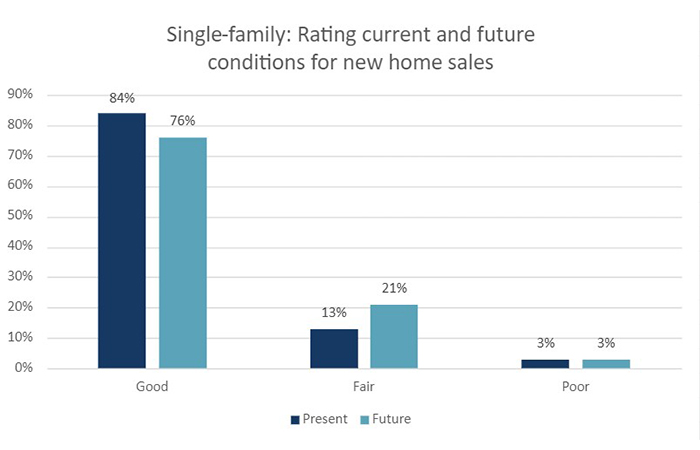

- 59% of single-family builders rated current selling conditions as Poor, equal to the proportion reported in the previous quarter.

- Just 8% of builders anticipate Good selling conditions in the next six months. Half of builders believe conditions will be Poor. 2025 surveys have shown a material decline in the optimism for a near-term turnaround for selling conditions due to the prolonged weakness of current sales conditions.

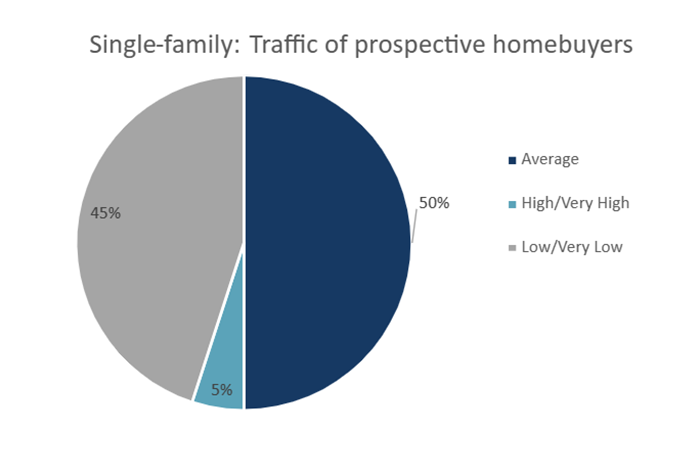

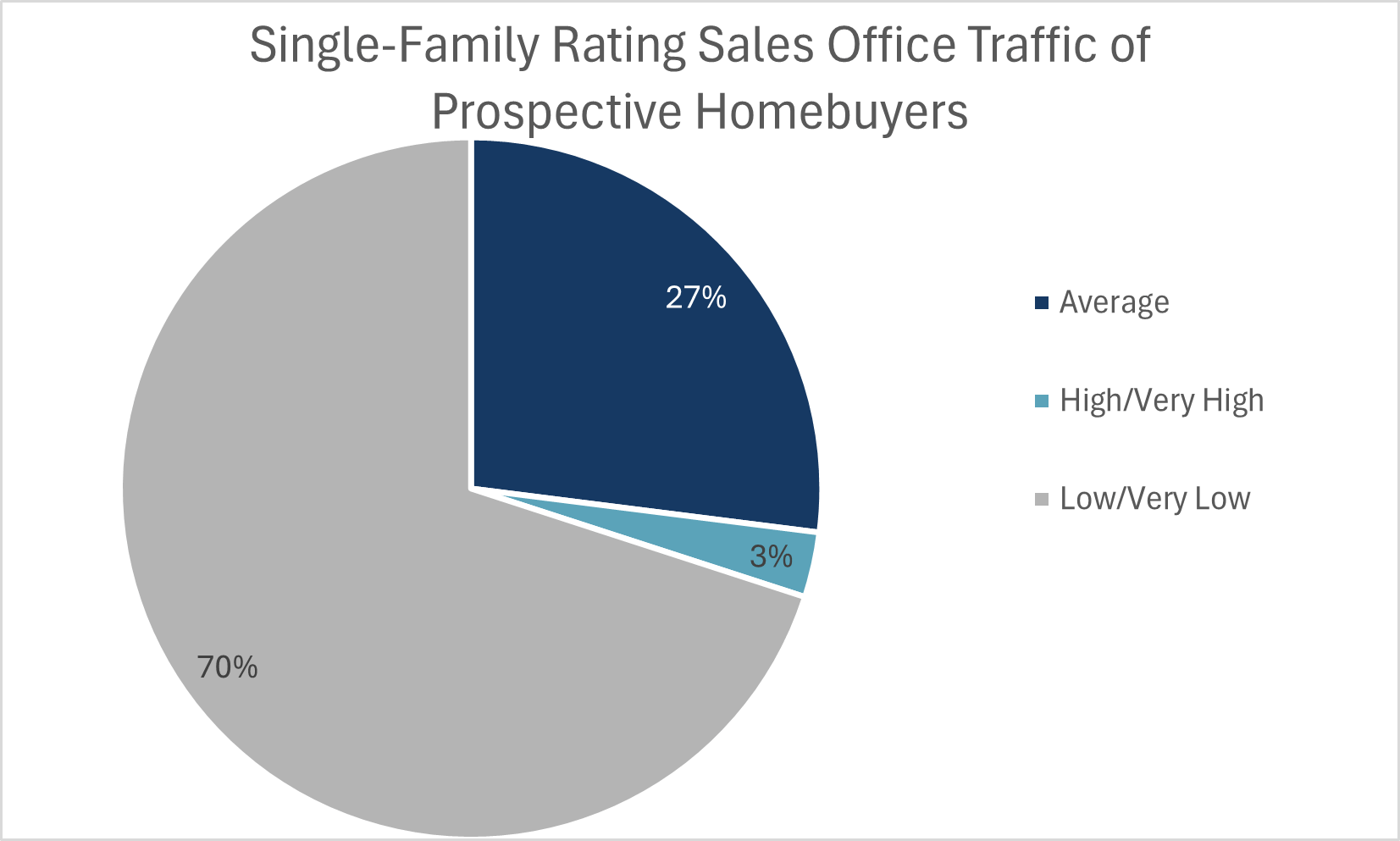

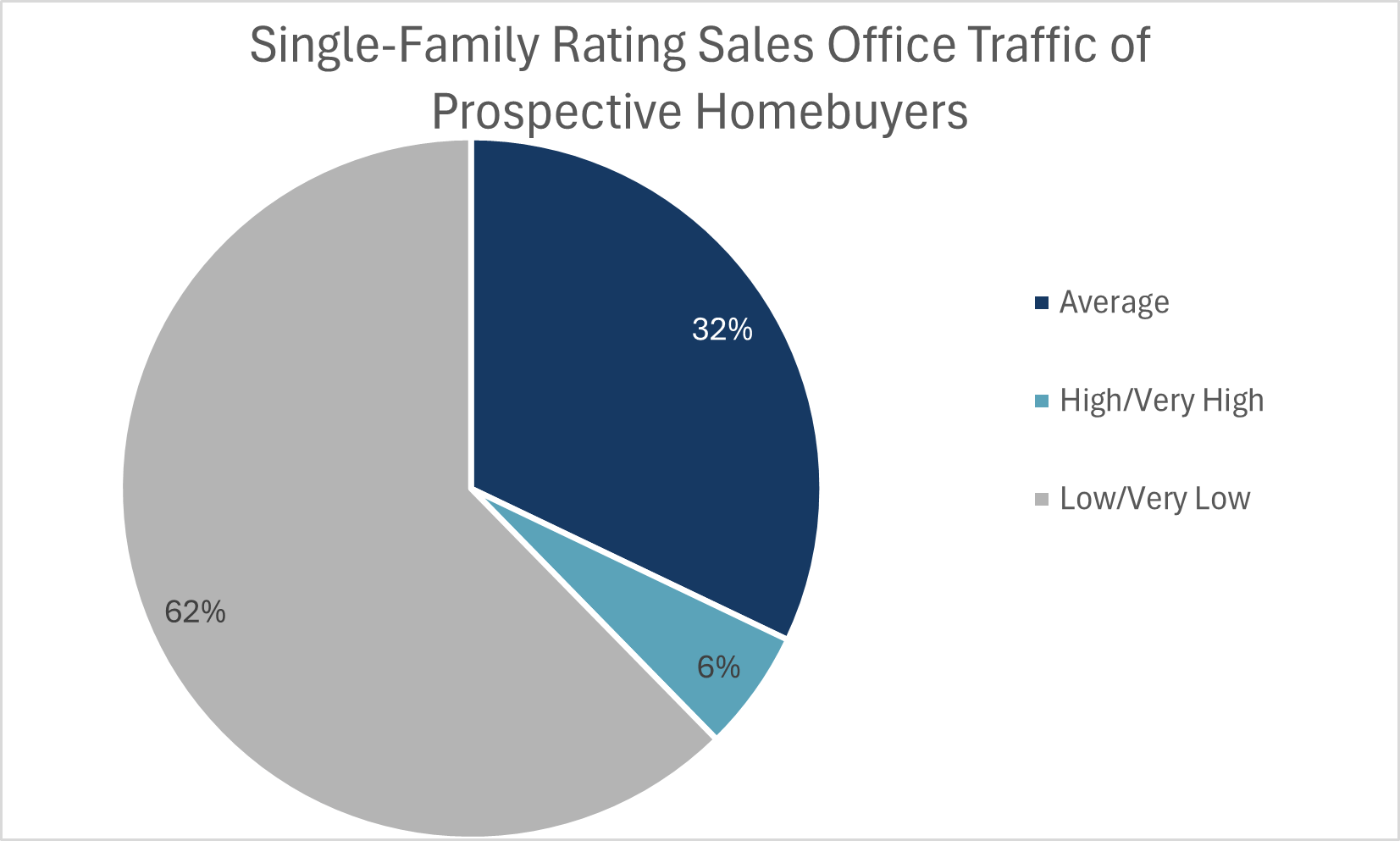

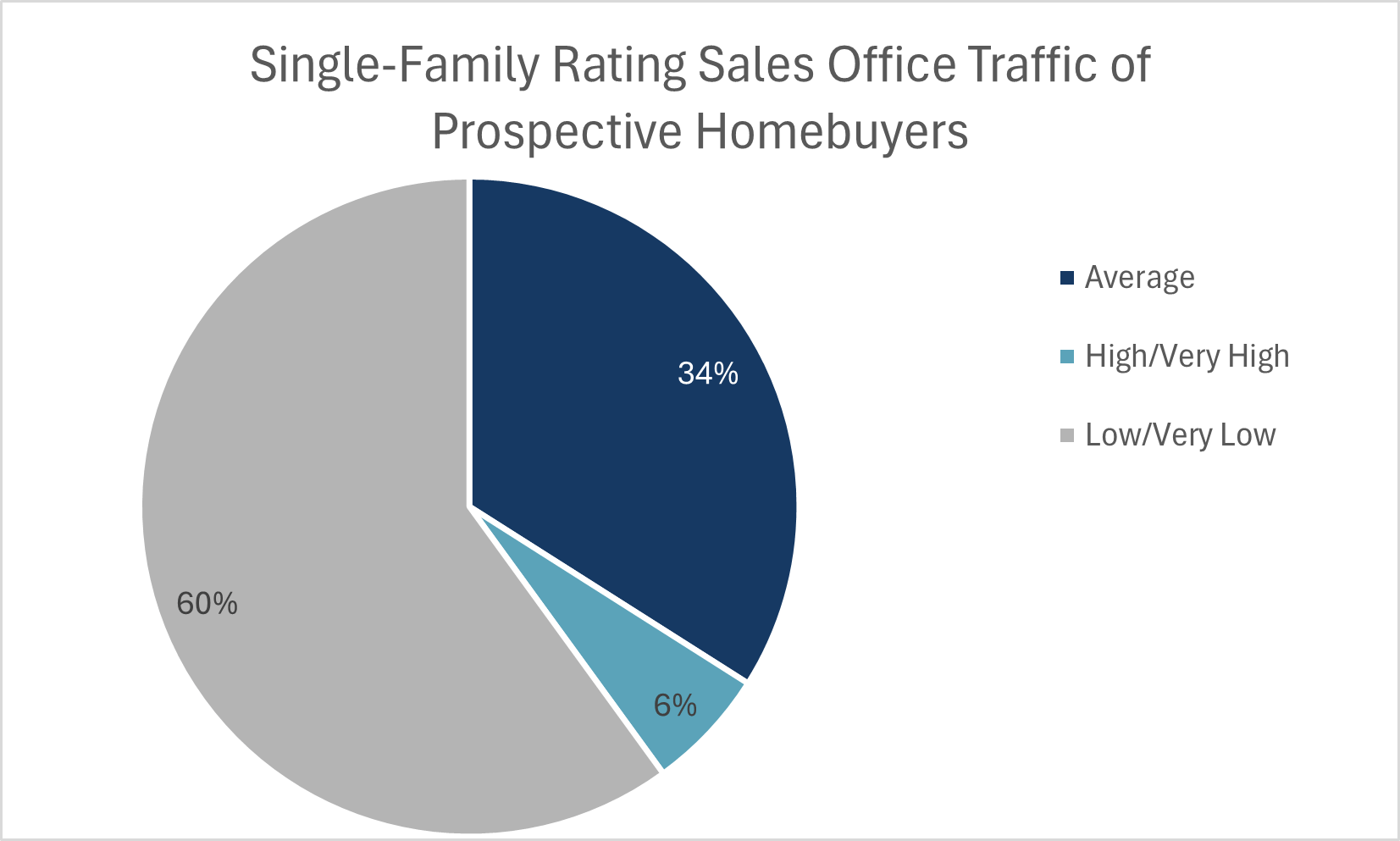

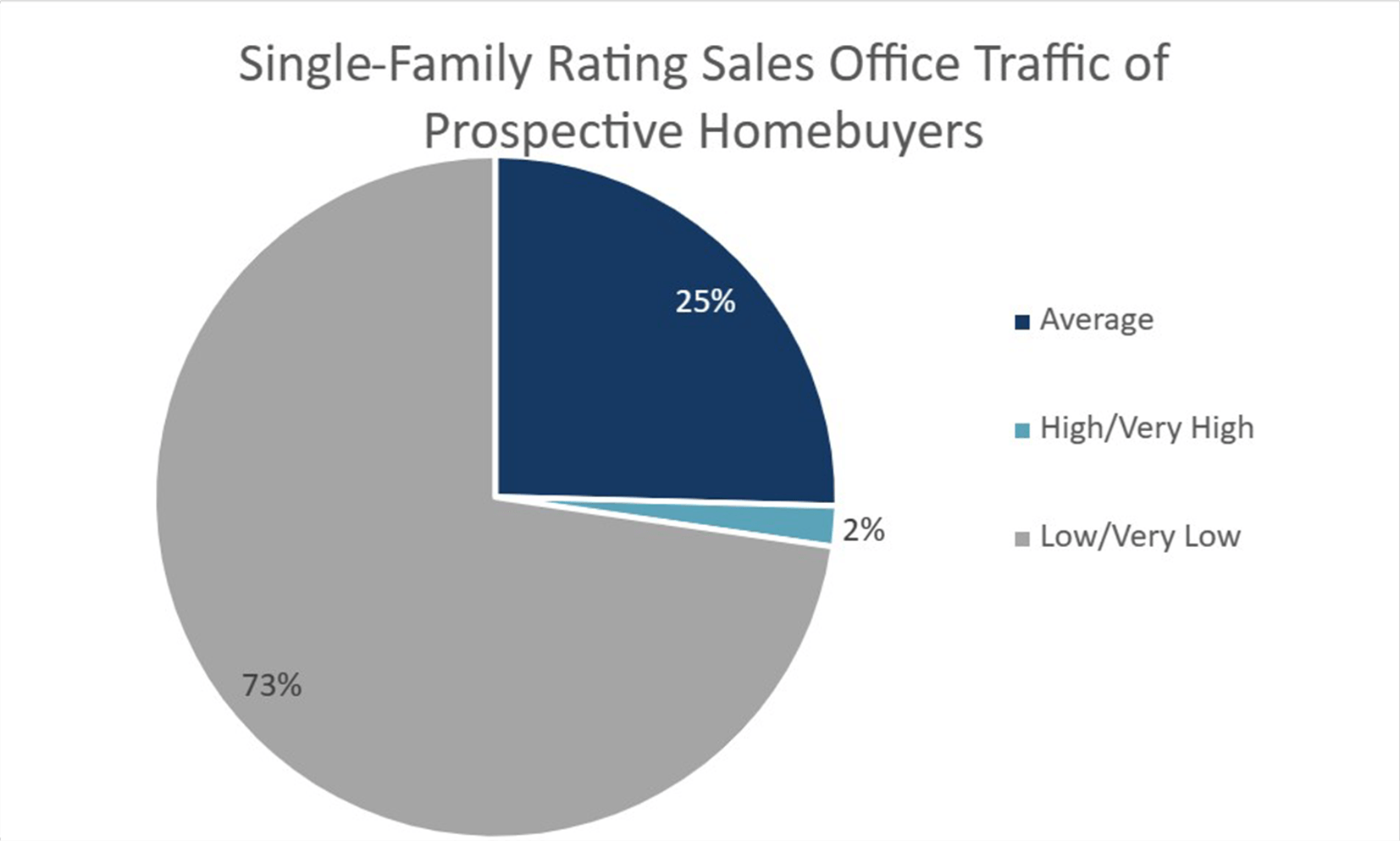

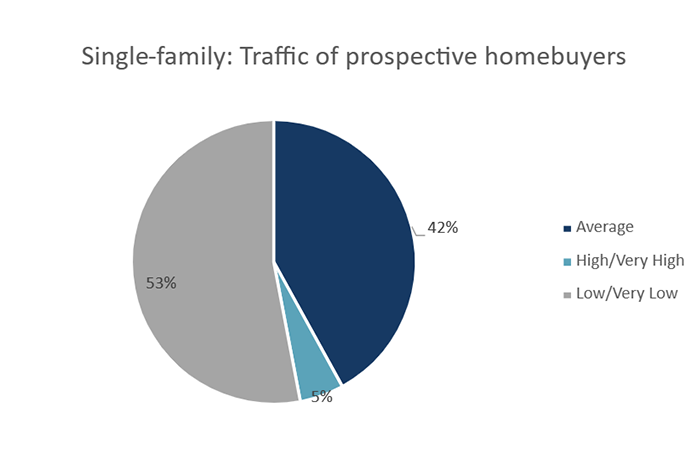

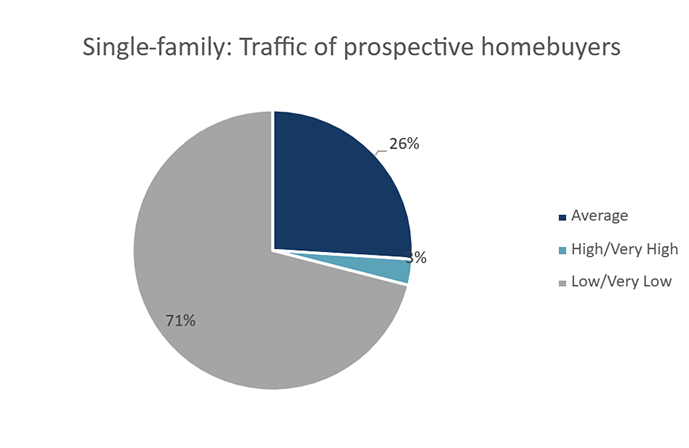

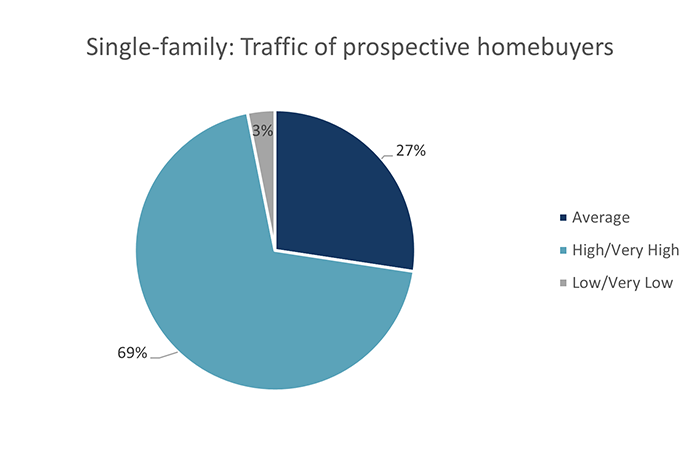

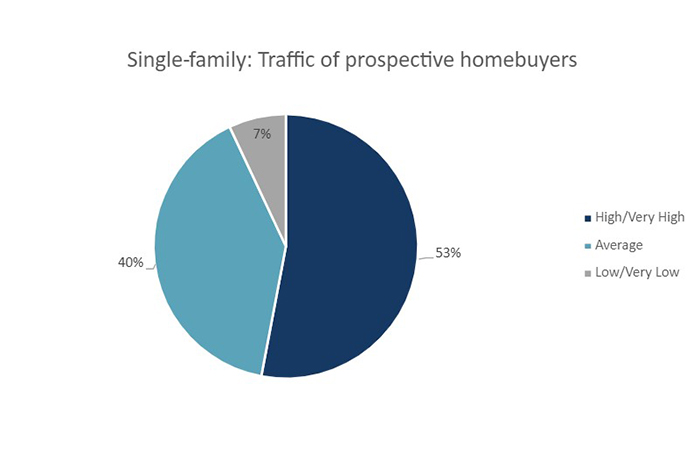

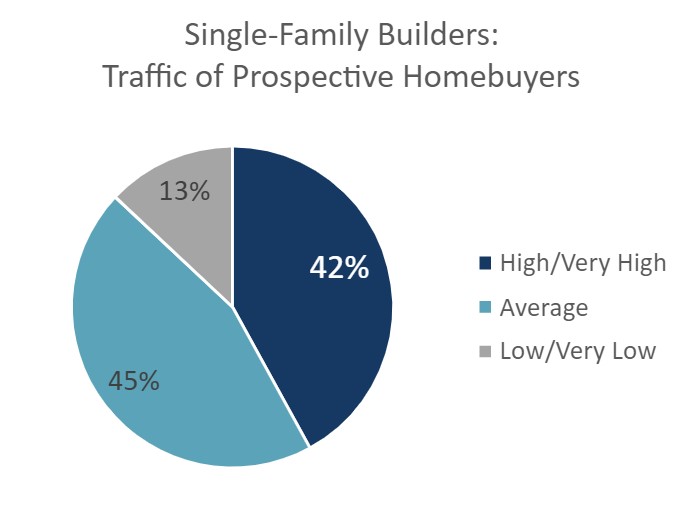

- 70% of builders rated sales office traffic and customer inquiries as Low or Very Low. Weak traffic flows have been widely and consistently reported by single-family builders since mid-2023

- Regionally, Ontario’s single-family HMI was an abysmal 7.1 and represents a 7.2-point decline from Q3 of 2024. Not far behind, British Columbia recorded a score of 11.7 and its HMI score has held in the teens since the second quarter of 2024. Alberta’s single-family HMI was 47.1, near neutral, and 1.7 points above its score from Q3 2024. While the Atlantic provinces also reported a neutral score of 47.6, it is down from scores earlier this year that were in the 60s.

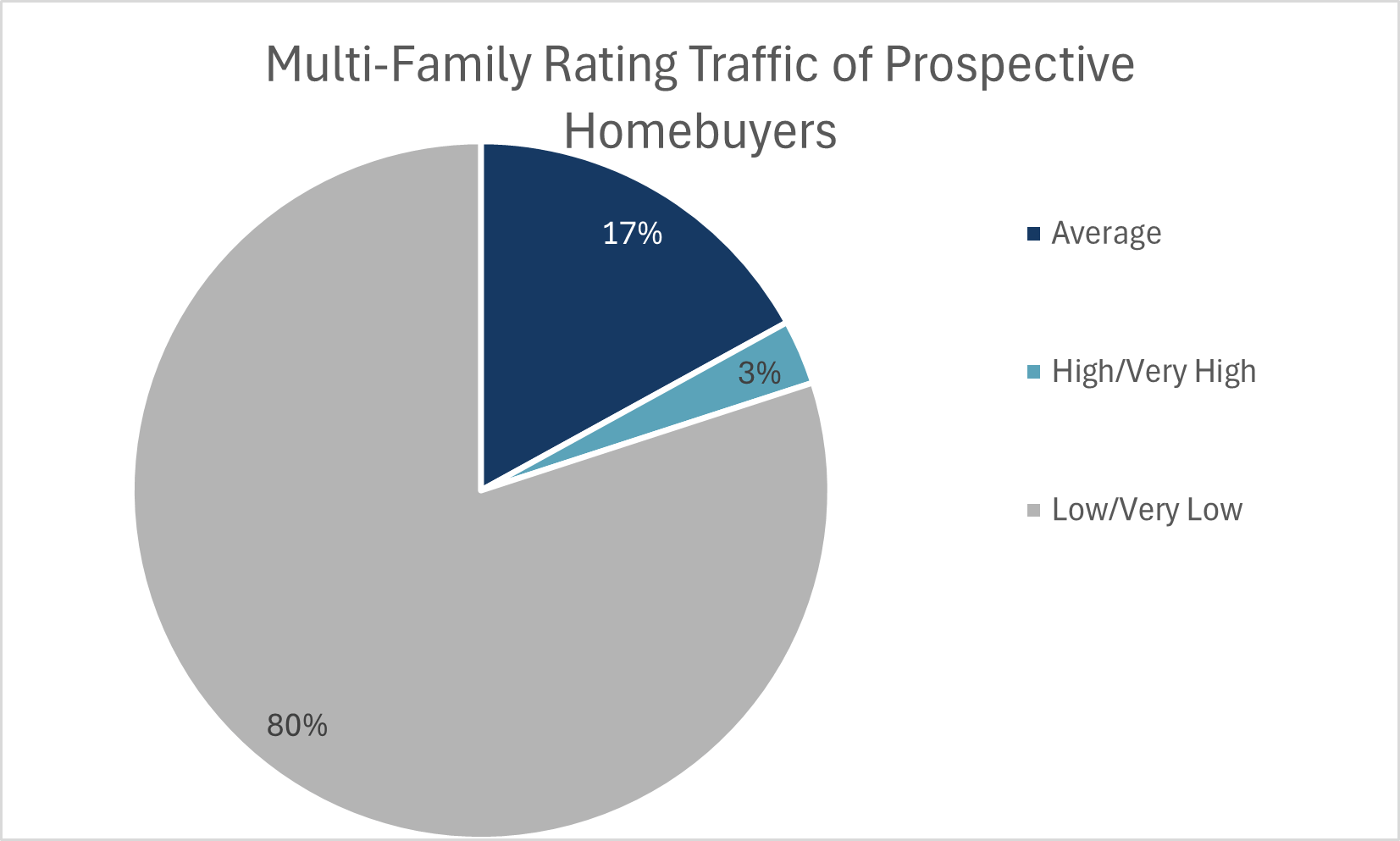

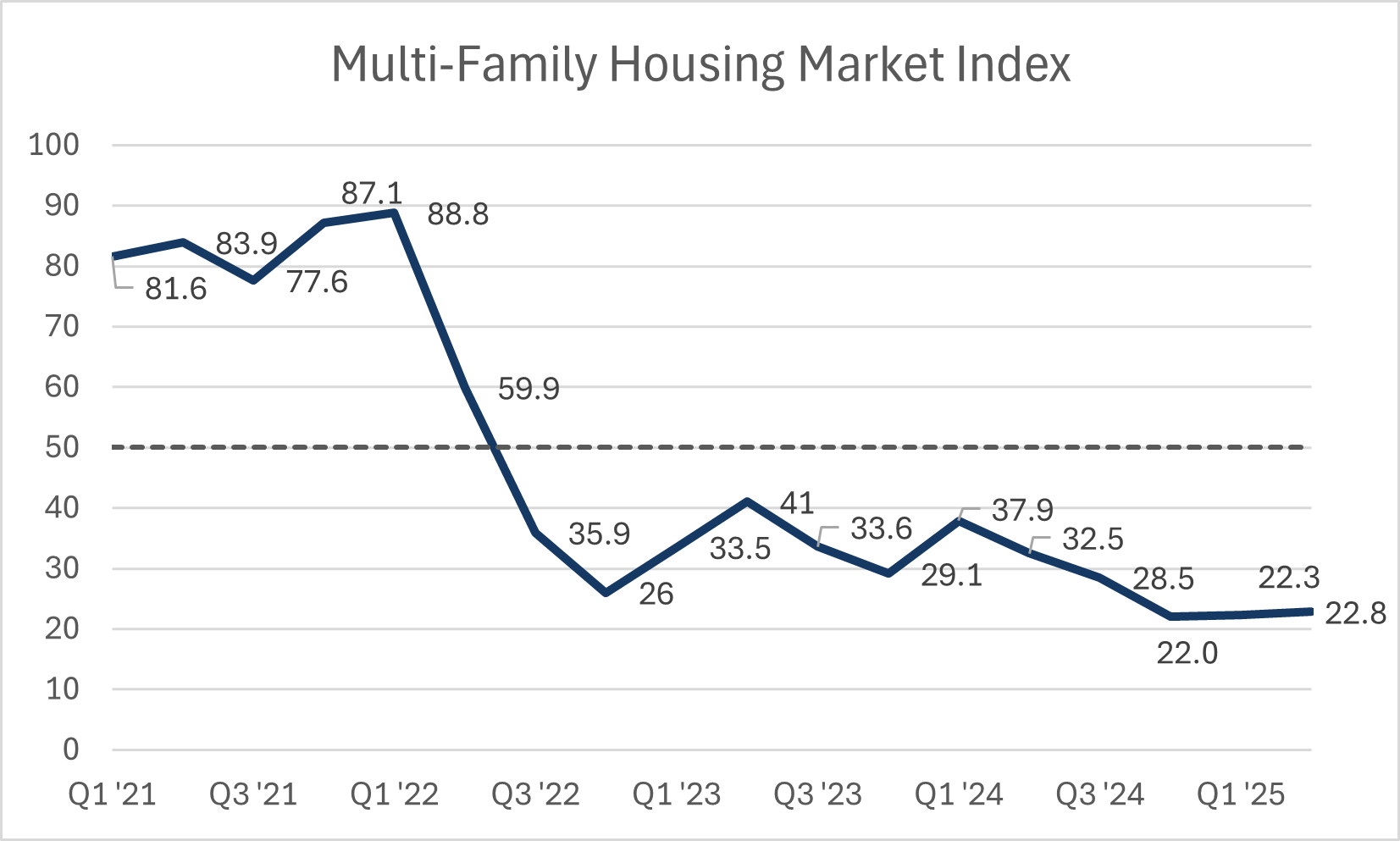

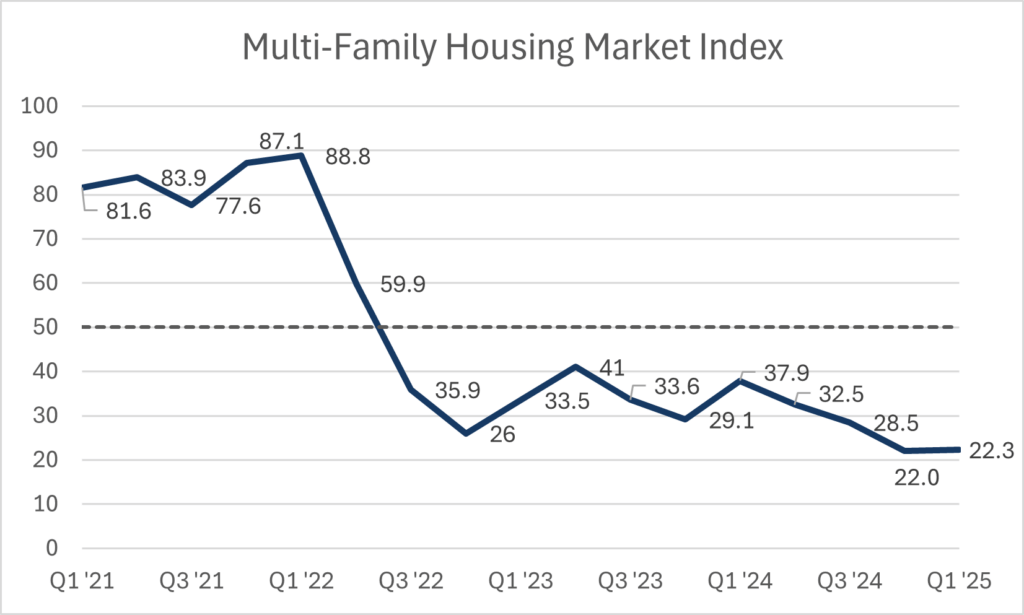

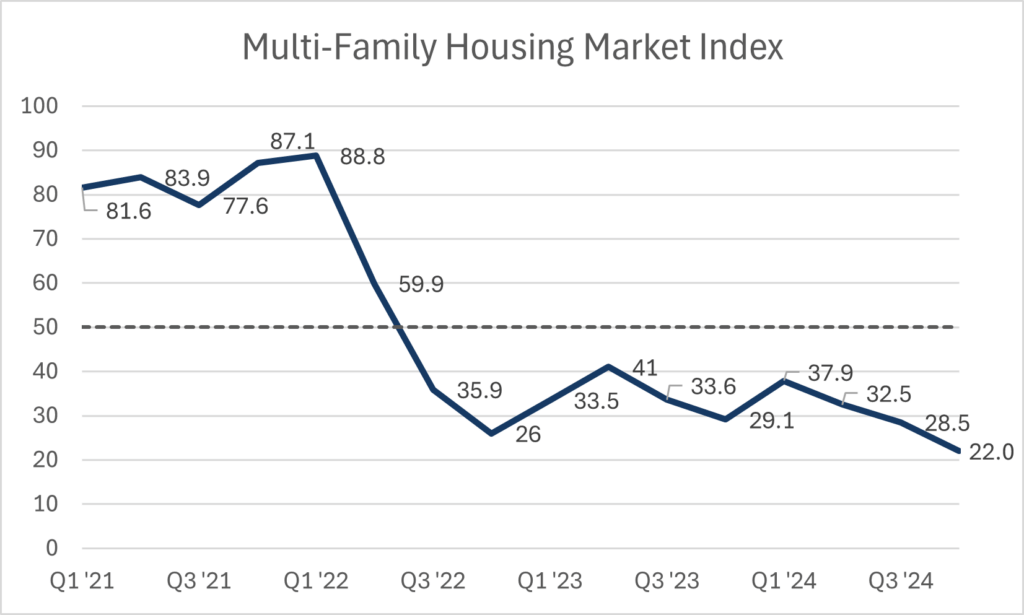

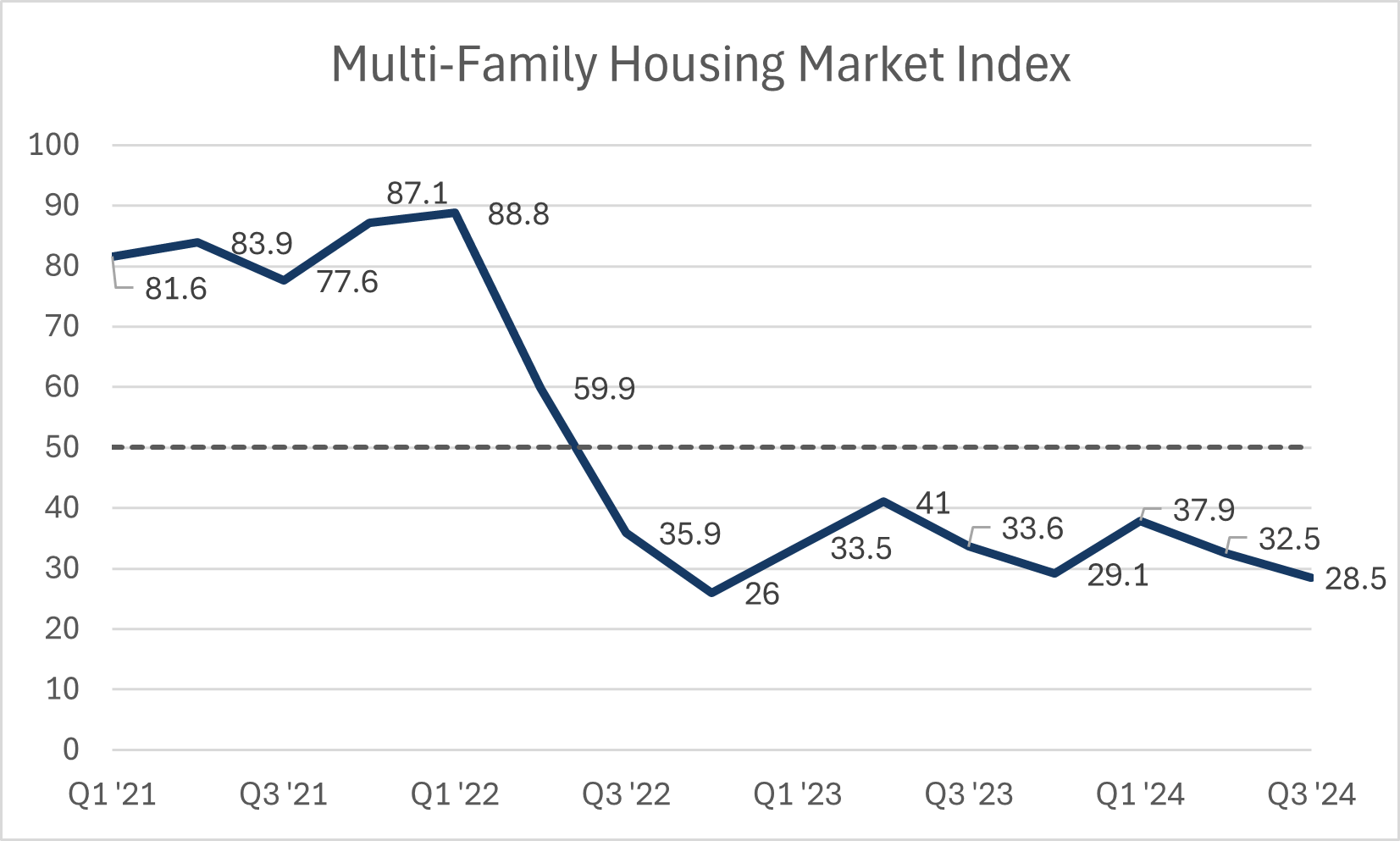

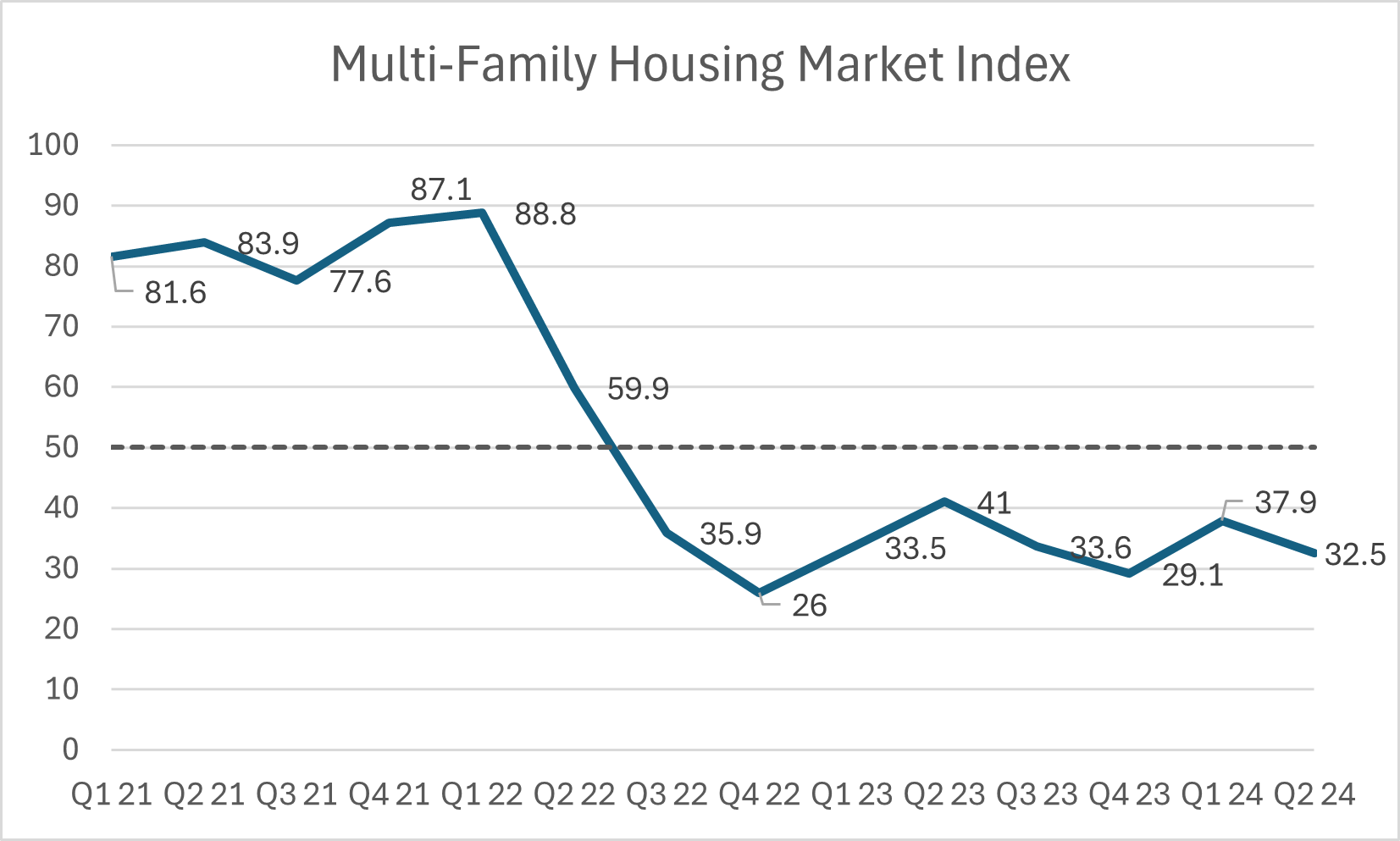

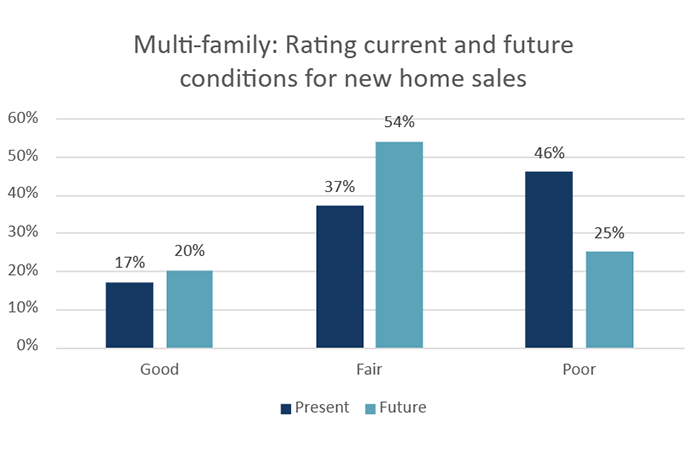

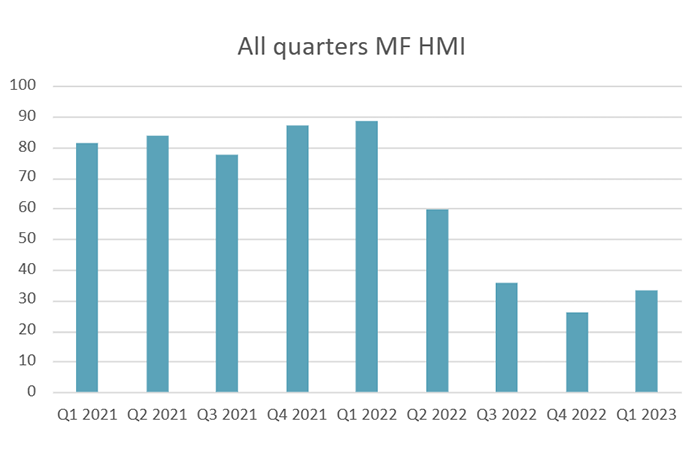

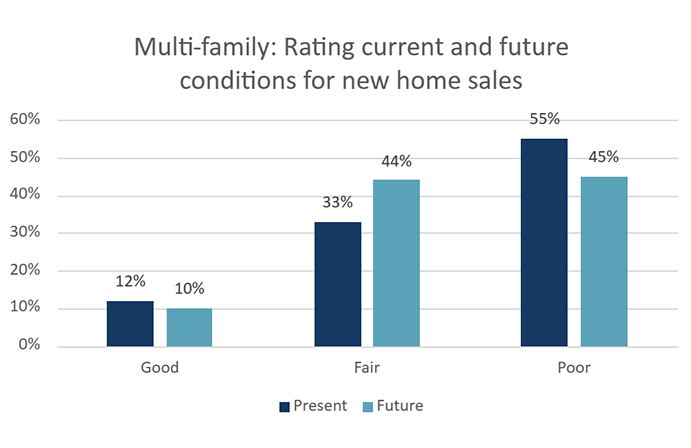

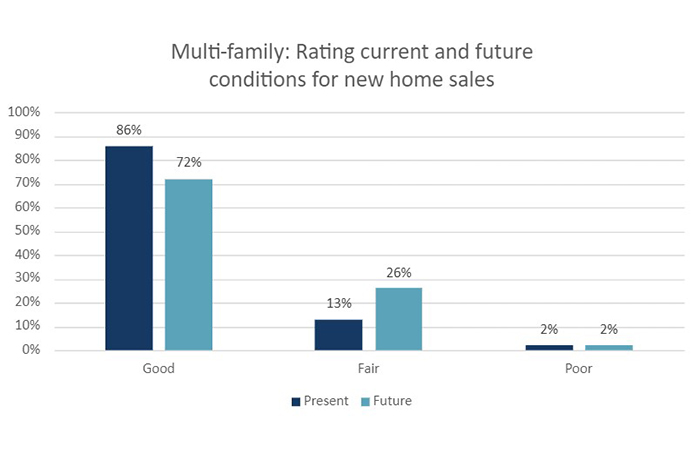

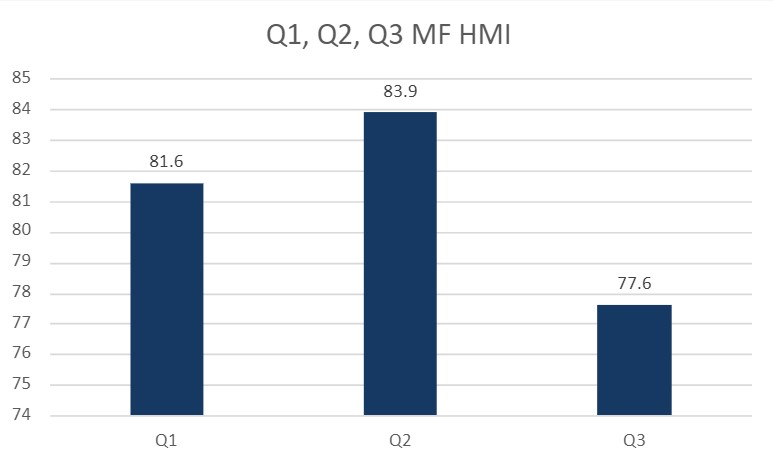

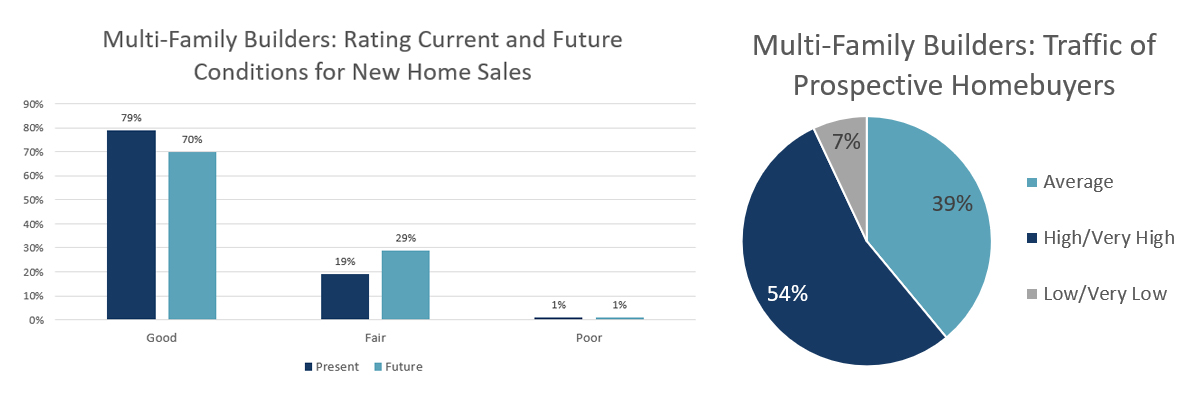

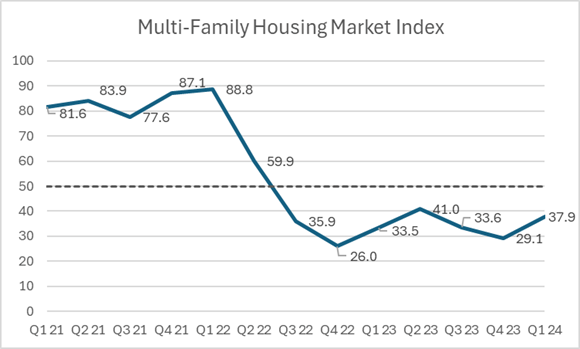

- The multi-family Housing Market Index in the third quarter was 16.8, which is an unfortunate but not unsurprising new record low. This comes after the multi-family HMI held around a score of 22 since the last quarter of 2024.

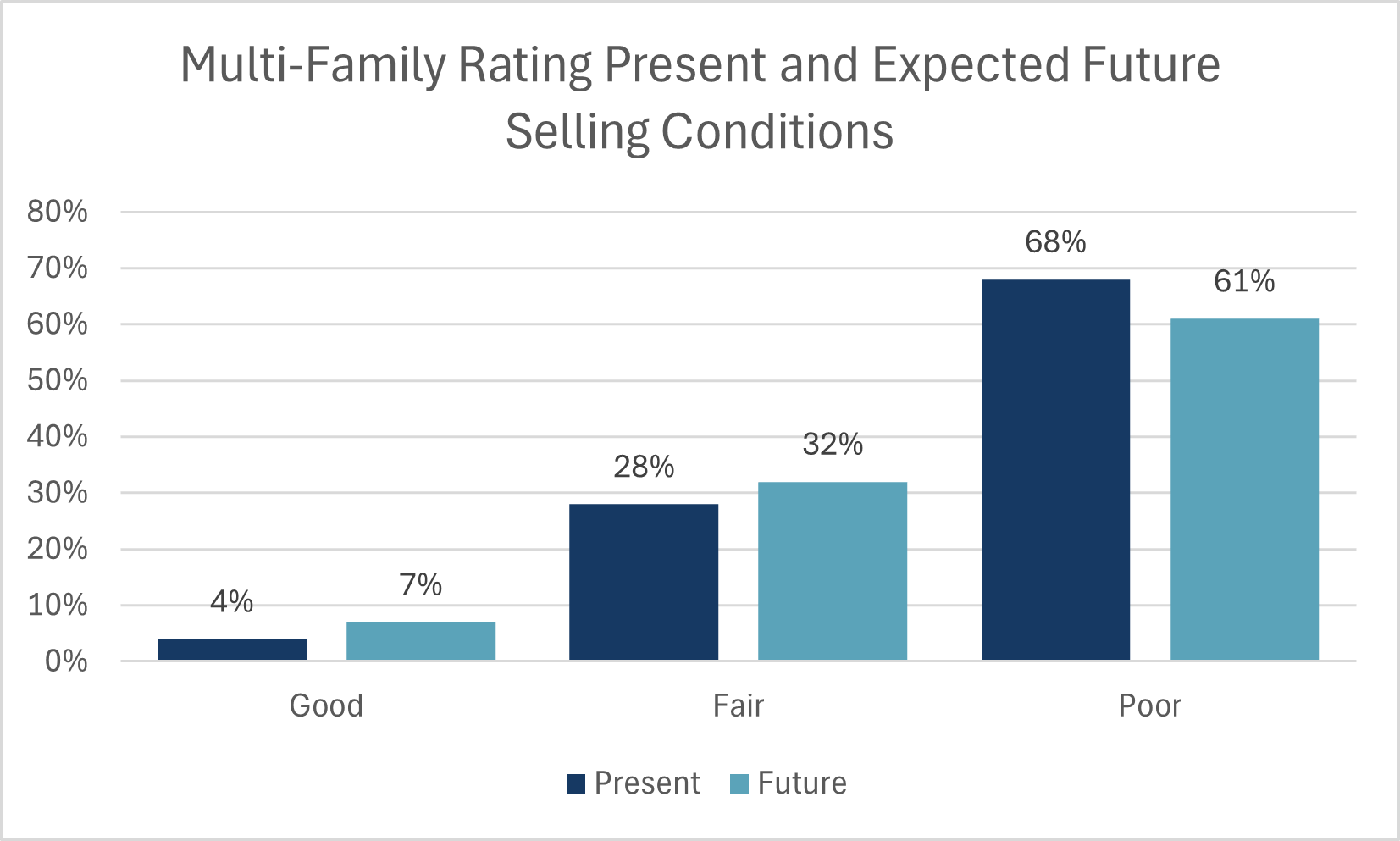

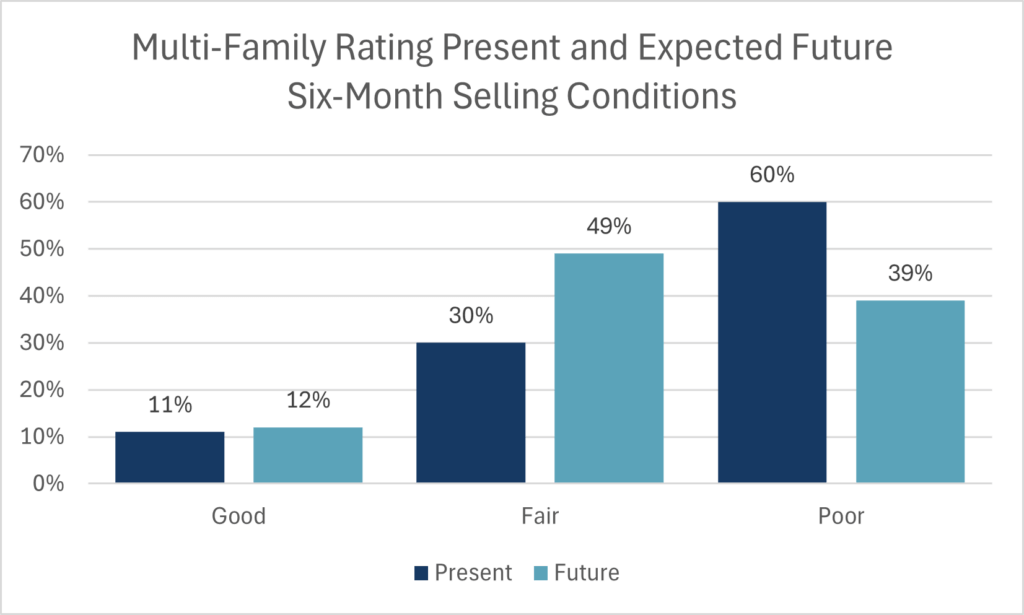

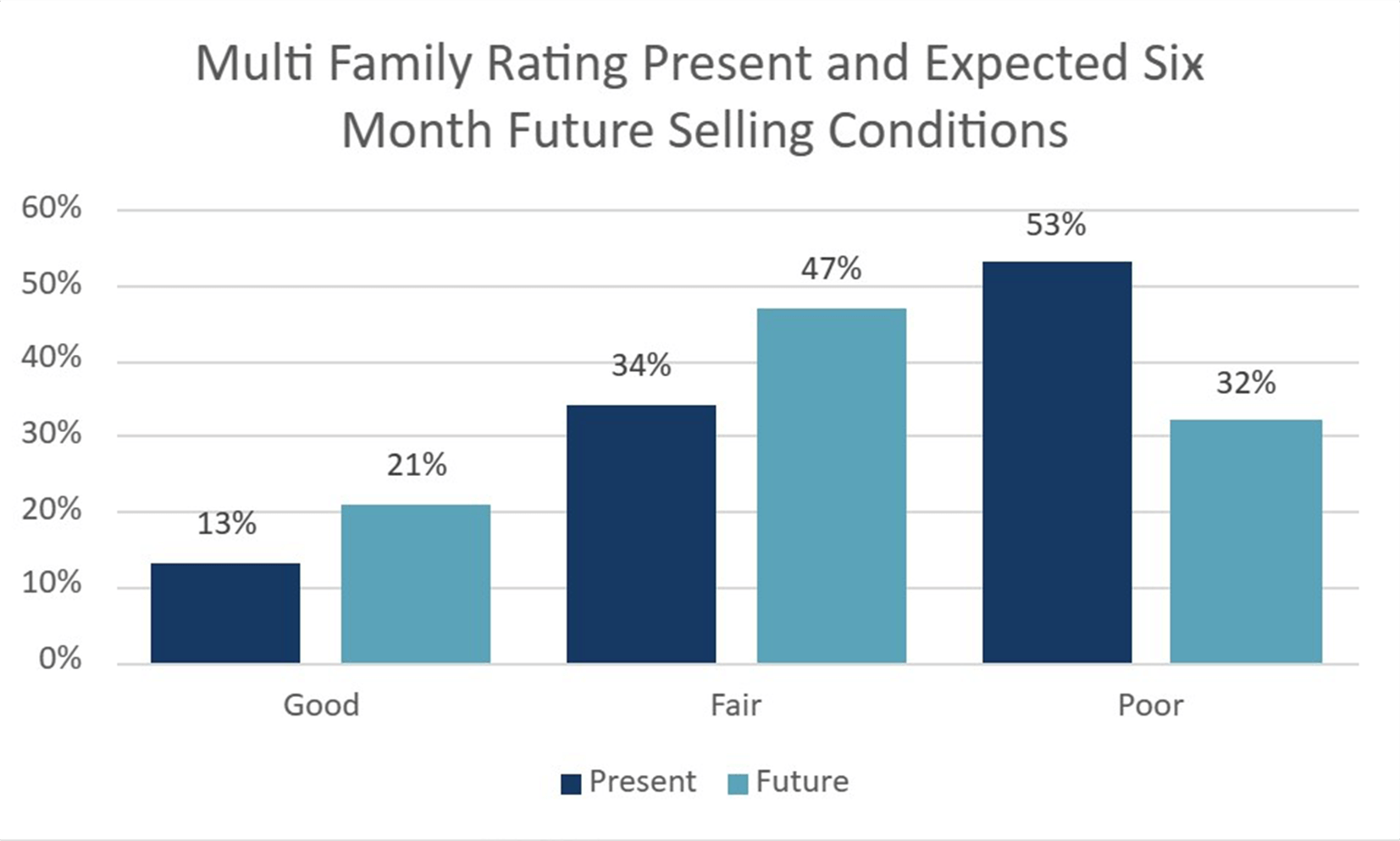

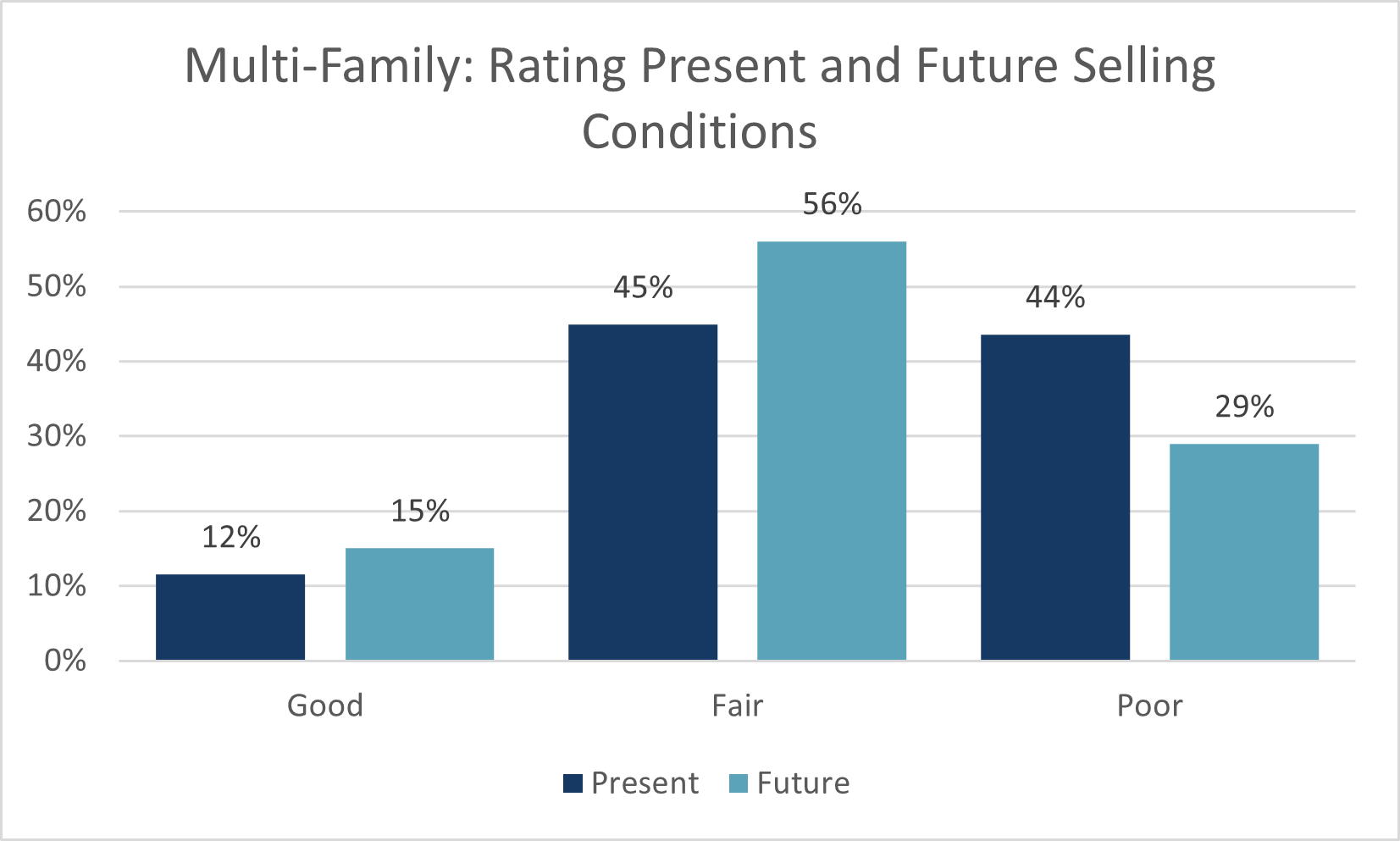

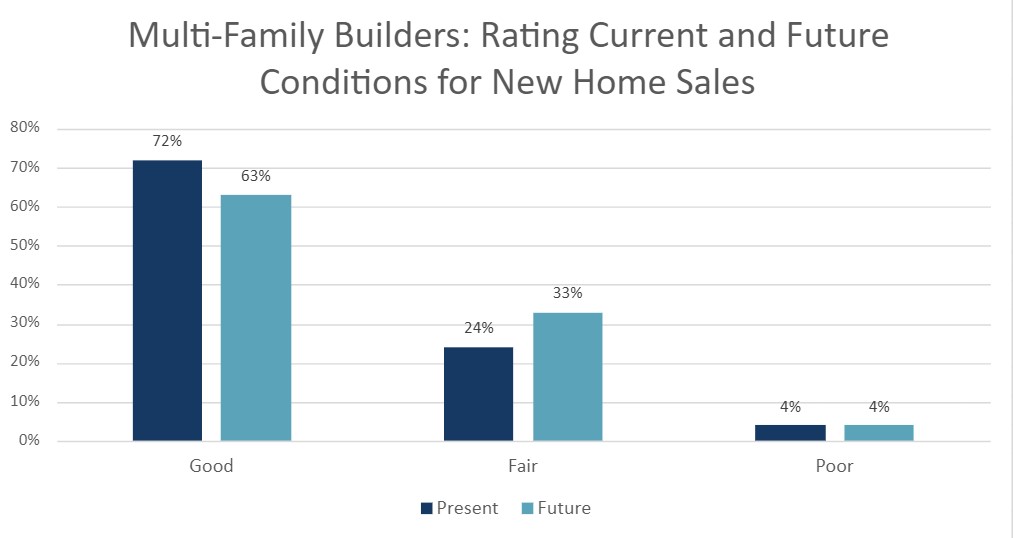

- 68% of multi-family respondents rated current selling conditions as Poor. This was the primary reason for the decline the overall multi-family HMI over the past quarter. With first time buyers more likely to purchase a multi-family unit, the delayed implementation of the GST rebate likely played a role in the further erosion of sales conditions over the summer months.

- 61% of builders also rated expected future conditions to be Poor as well. Under the prolonged weak selling conditions, builders are reducing their optimism that well qualified demand will return to the market within the next couple quarters.

- Regionally, multi-family builder confidence in Ontario remained the weakest, with a score of 4.4 and has remained in single digits for four consecutive quarters. However, the largest decline in confidence came from British Columbia, where the score of 14.7 represented a decline of 12.7 points over the previous quarter and 14.6 lower than in Q3 2024 and had a large impact on the national index. The Prairies remains around a neutral score of 52.9, however, builder sentiment has trended down since reaching a score of 73.2 in Q2 2024.

- There was a stark increase in the proportion of builders reporting permanent layoffs this quarter relative to years past. 41% of builders reported recent layoffs with no plans to rehire. This up substantially from the 27% reported in Q3 last year and even well above the 35% reported in the previous quarter.

- Payroll employment in residential construction fell by nearly 4,400 between July 2024 and 2025. While modest, this was the largest 12-month decline in residential construction employment since 2009—excluding the 2020 pandemic.

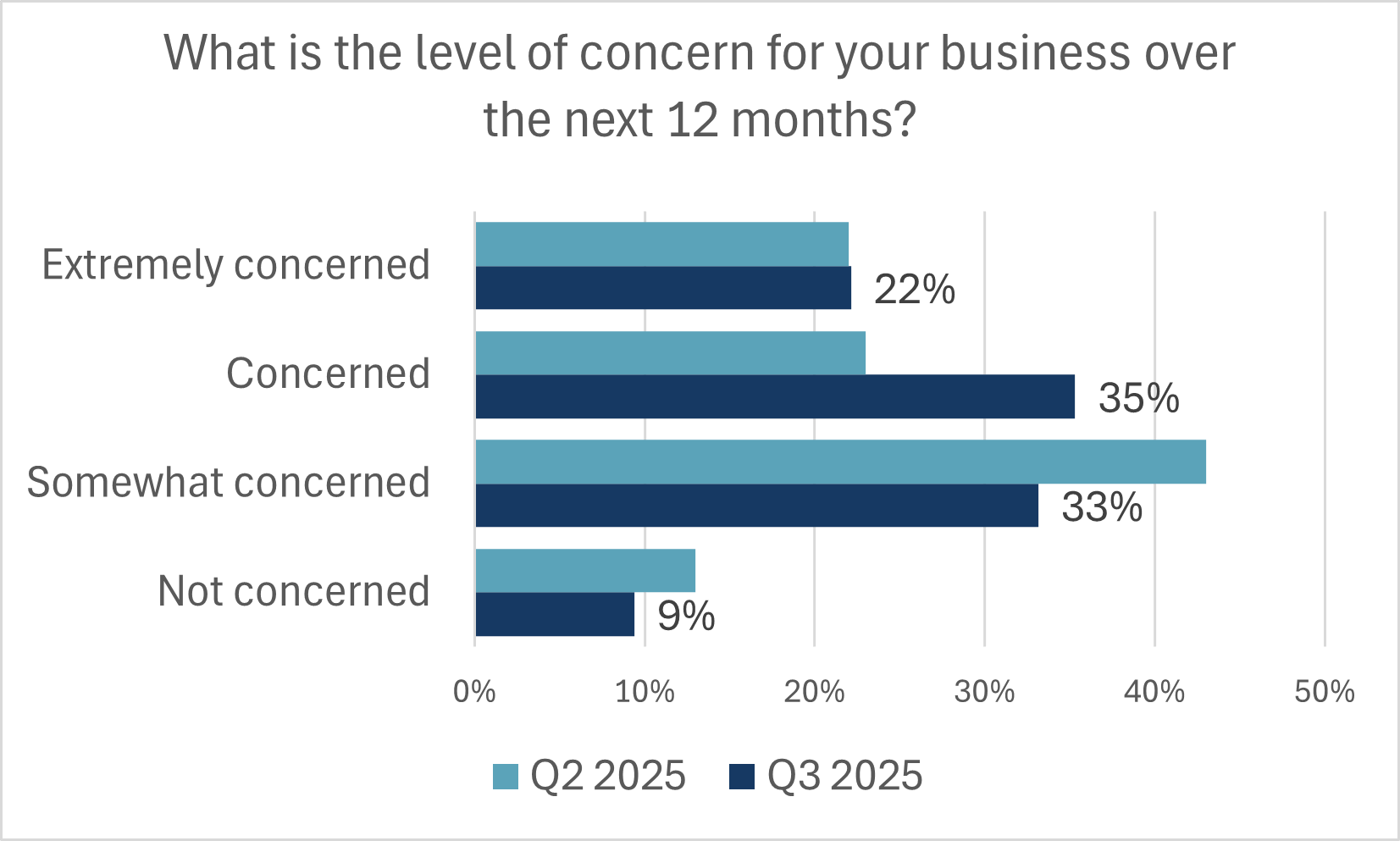

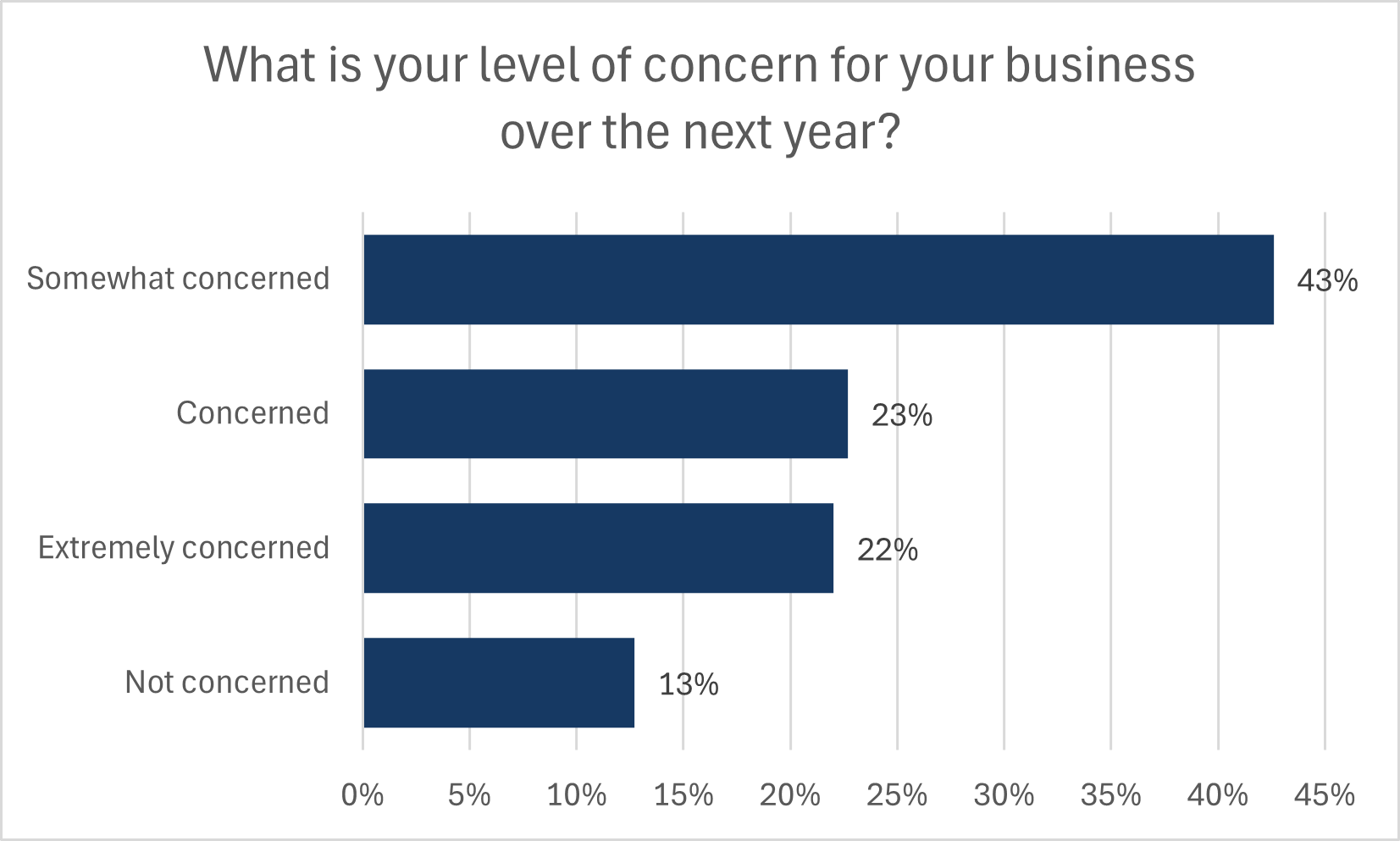

- Difficult sales conditions and the increase in permanent layoffs have also raised the overall level of concern builders have on the outlook of their business. 57% of builders are concerned or very concerned about their business over the next 12 months. This stemmed from a shrinking proportion that were just somewhat concerned.

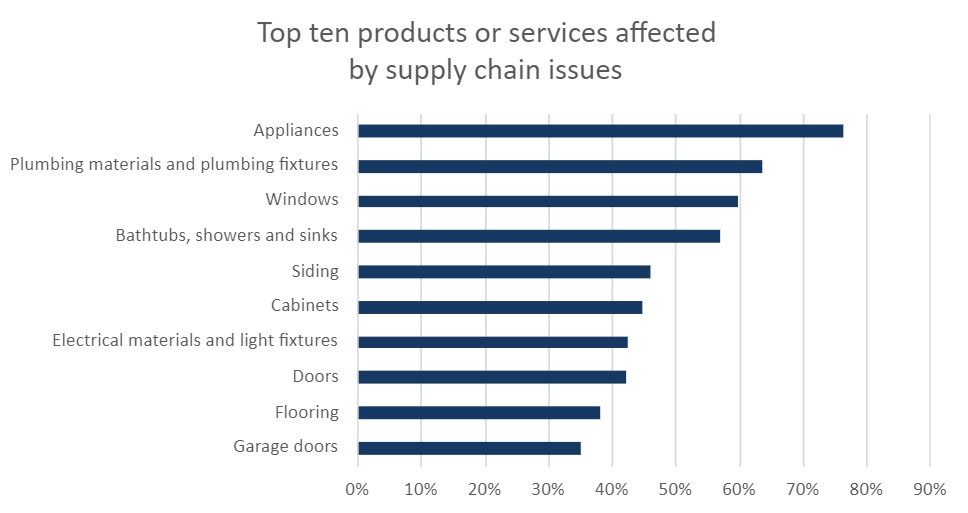

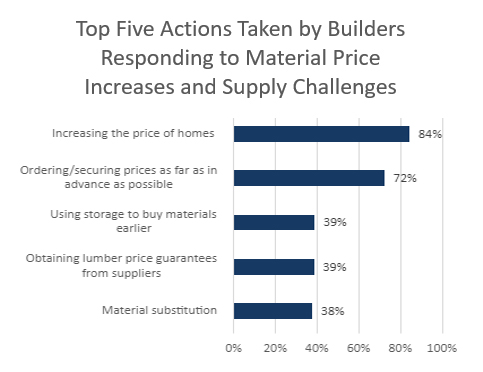

- Builders were asked to provide any concerns they still have about the tariff situation or trade negotiations. Feedback from respondents indicates that tariff-related challenges relate to the damage they have had on home buying demand, despite the removal of much of Canada’s countermeasure tariffs. Many noted that tariffs on key metal materials like doors, window casings, sinks, and furnaces are supporting building material price pressure, as Canada’s counter tariff measures on steel and aluminium products remains in place.

- The first-time buyer GST rebate remains a drag on sales due to its lack of implementation—it has yet to be given royal asset. 39% of builders stated that they their lack of a guarantee for FTHBs that they would be eligible for this rebate hurt summertime sales. This is roughly the proportion of builders that offer entry level units or units that would be within the budgets of FTHBs.

- Following up from a question posed last year, builders were asked if they are or are considering construction of rental units. The distribution across answers remains consistent with last year’s results, as 23% of respondents saying that their firm is developing or actively considering rental units. A further 16% stated that this is informally under consideration.

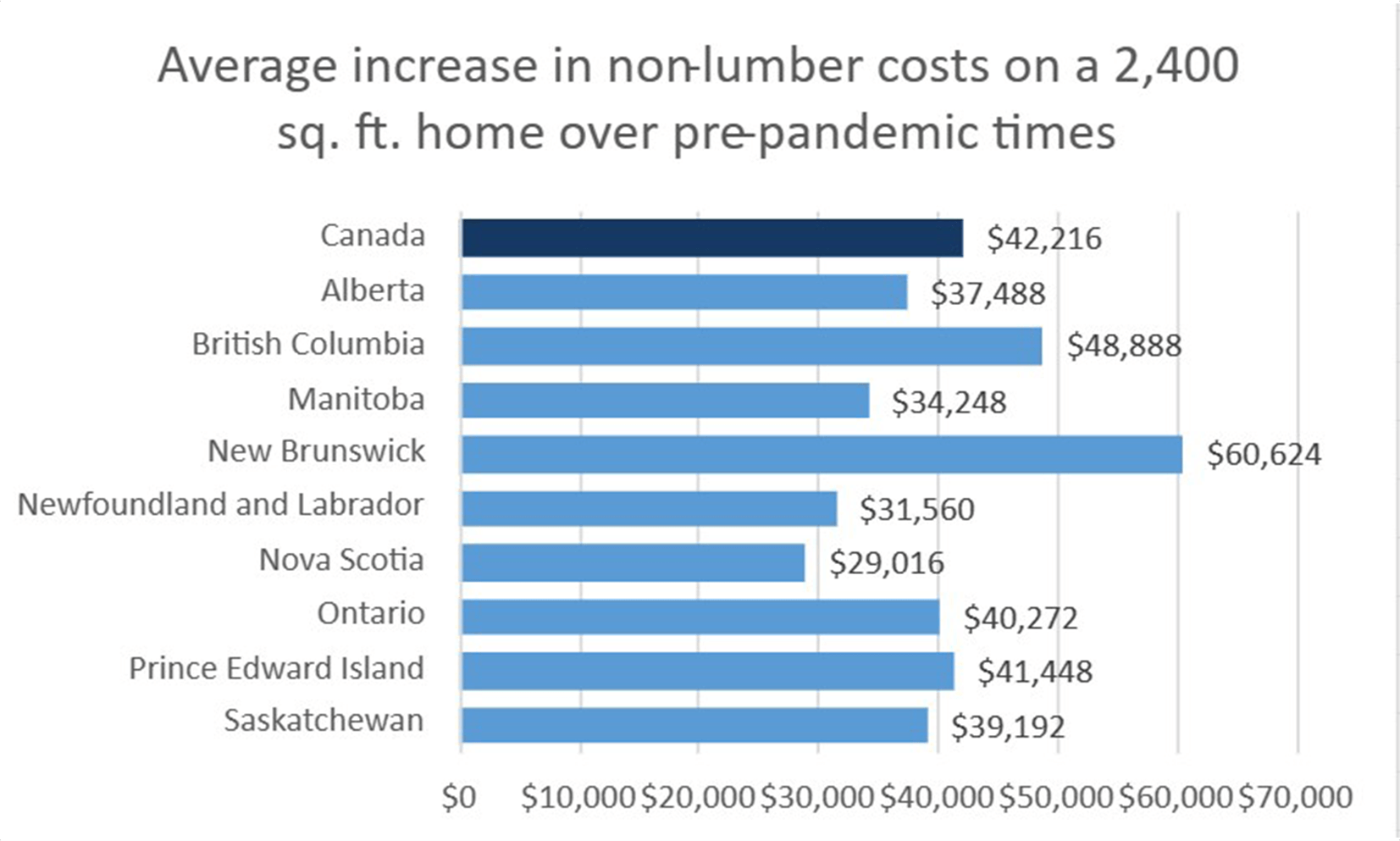

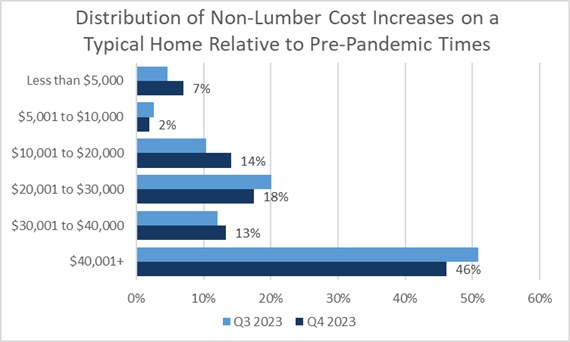

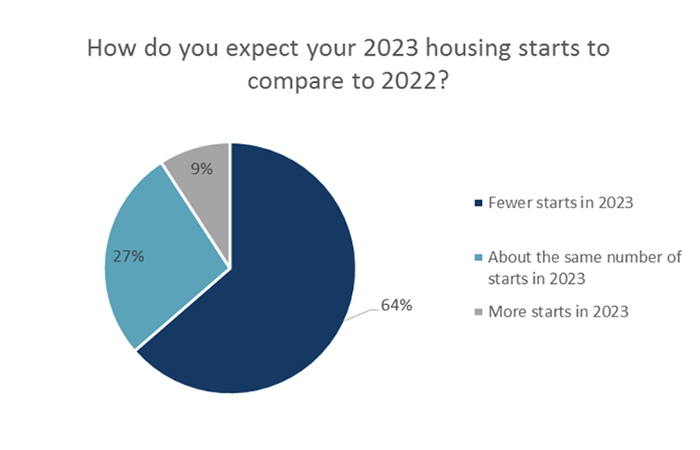

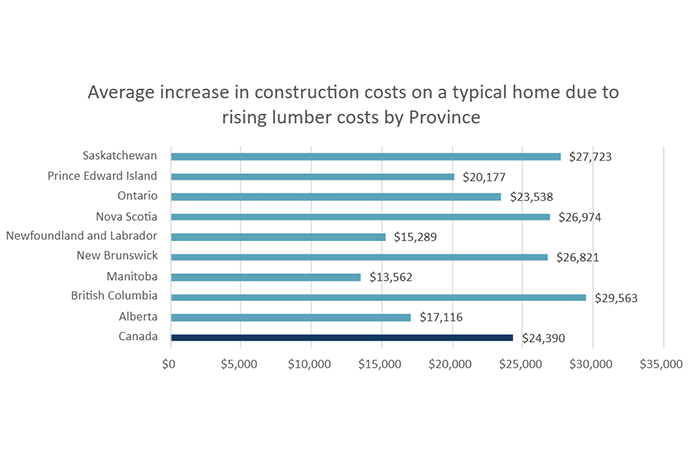

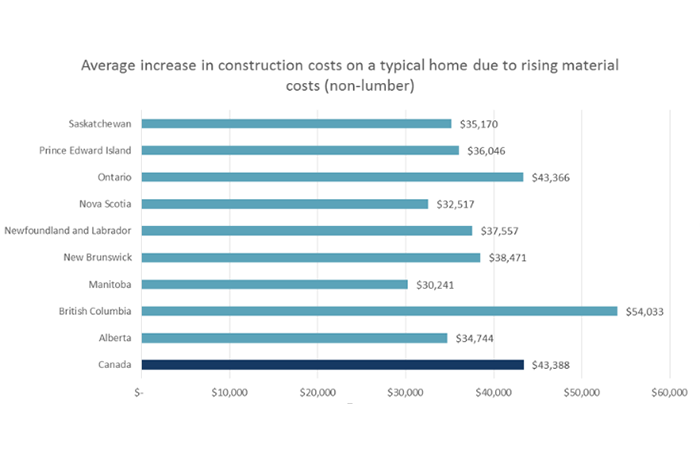

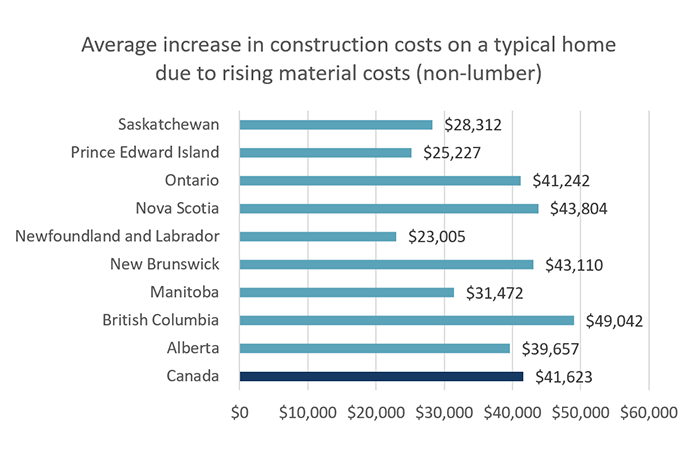

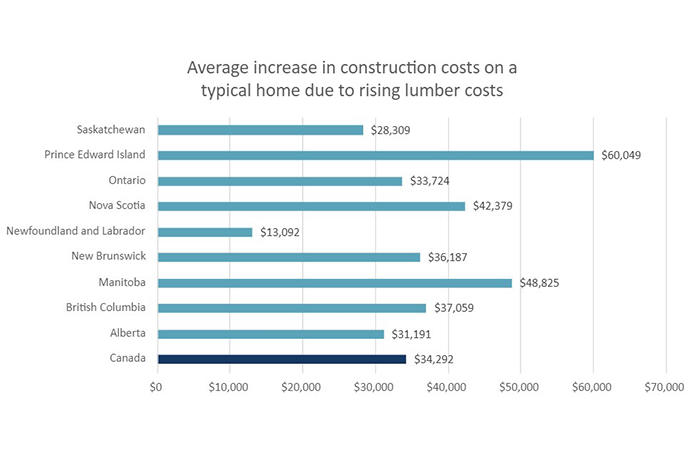

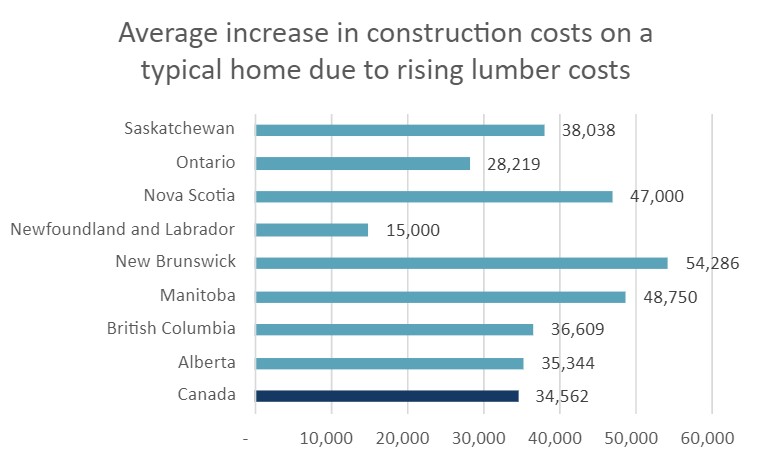

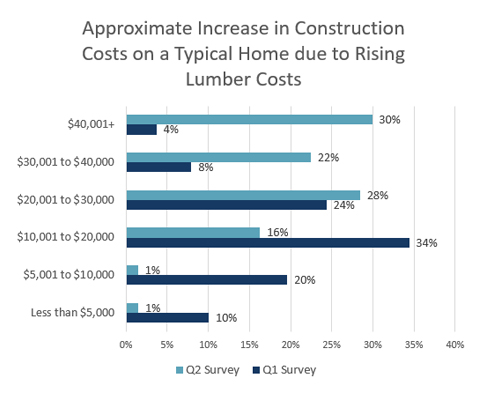

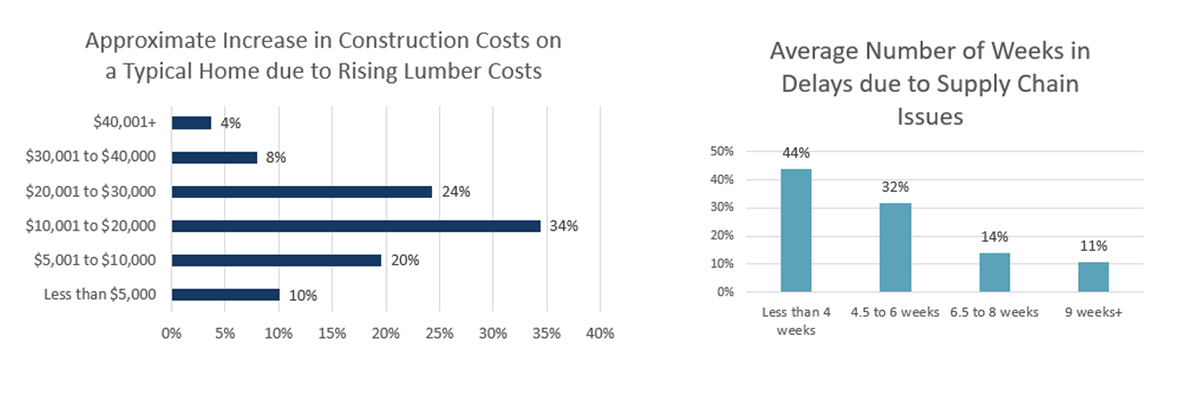

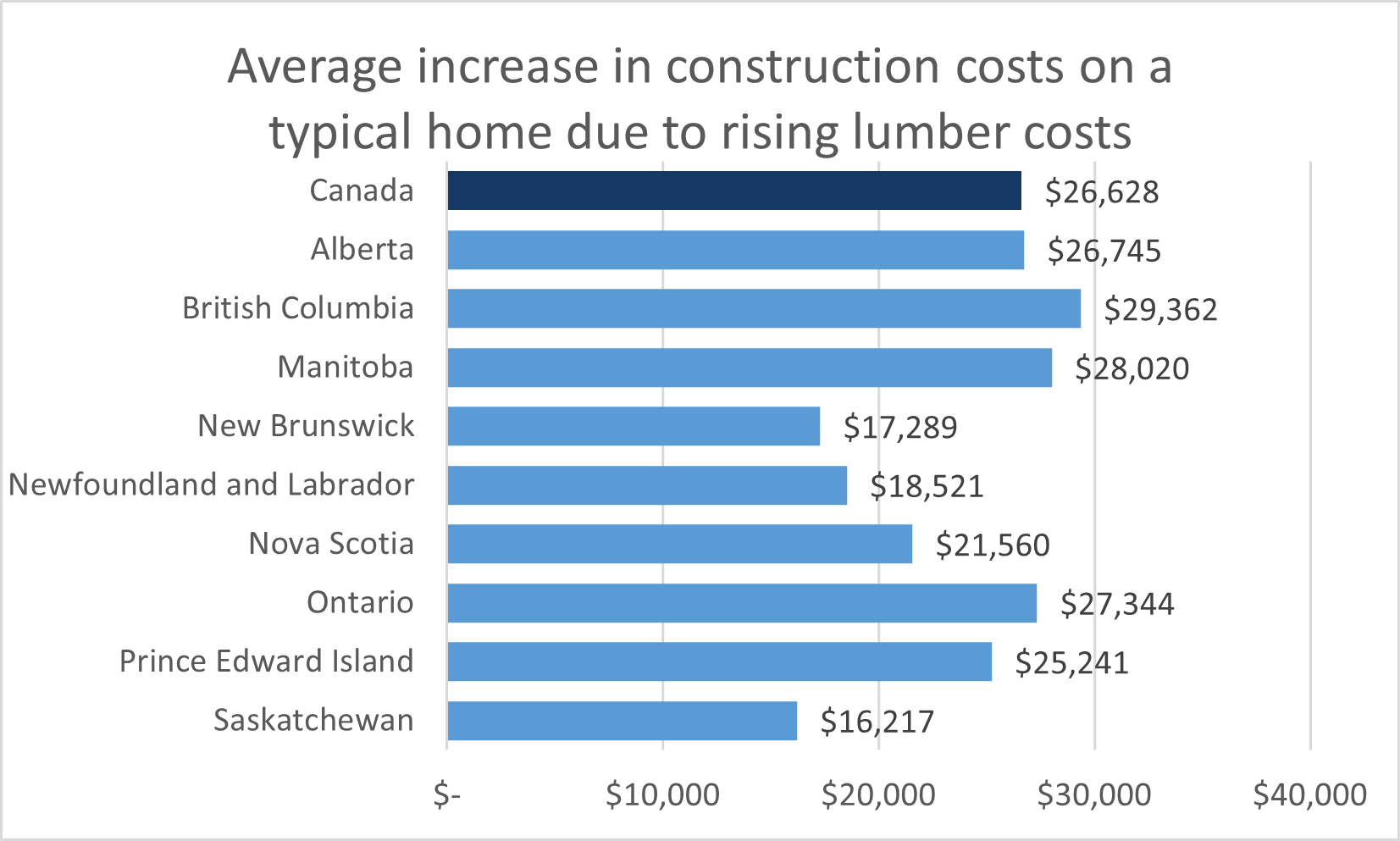

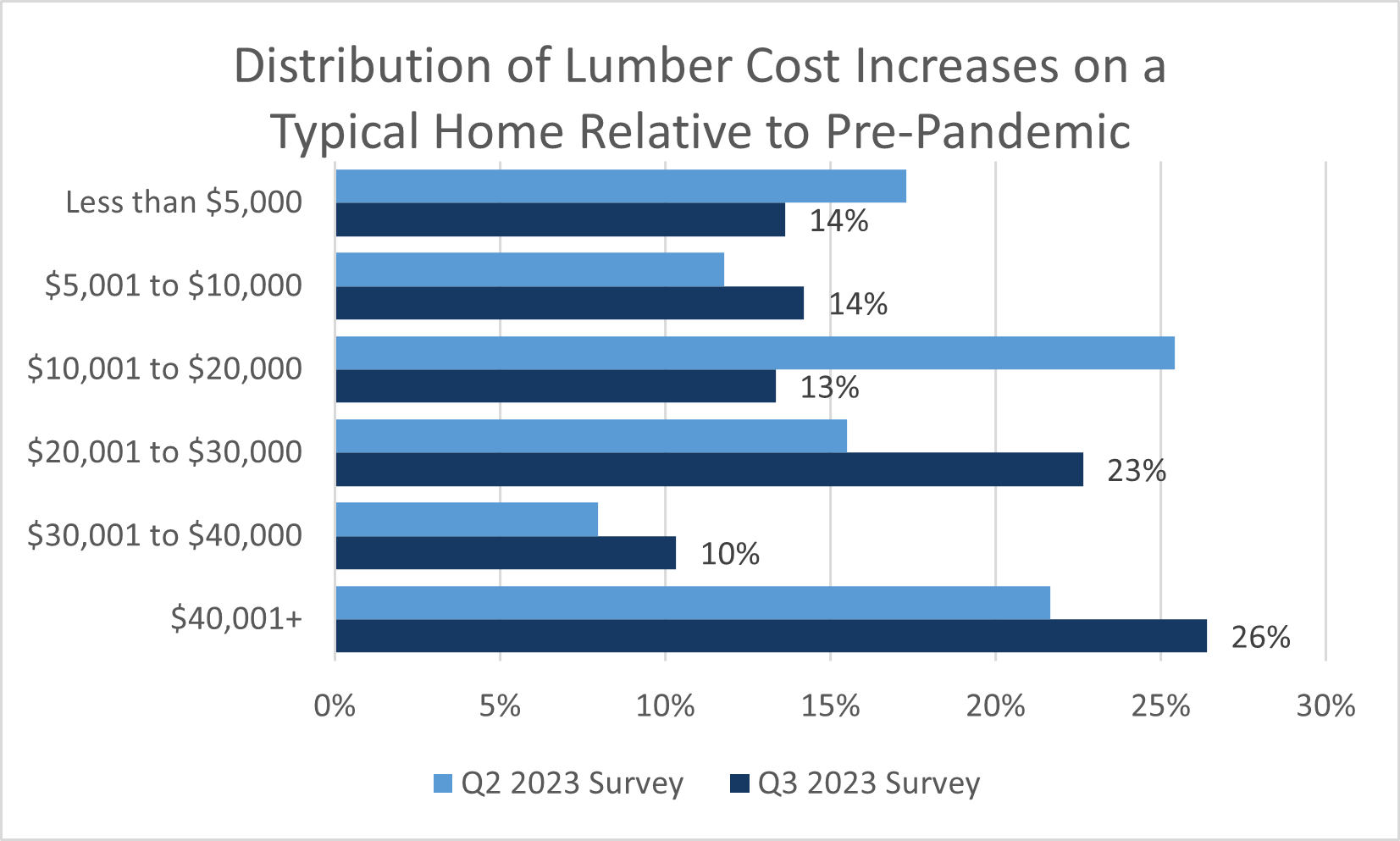

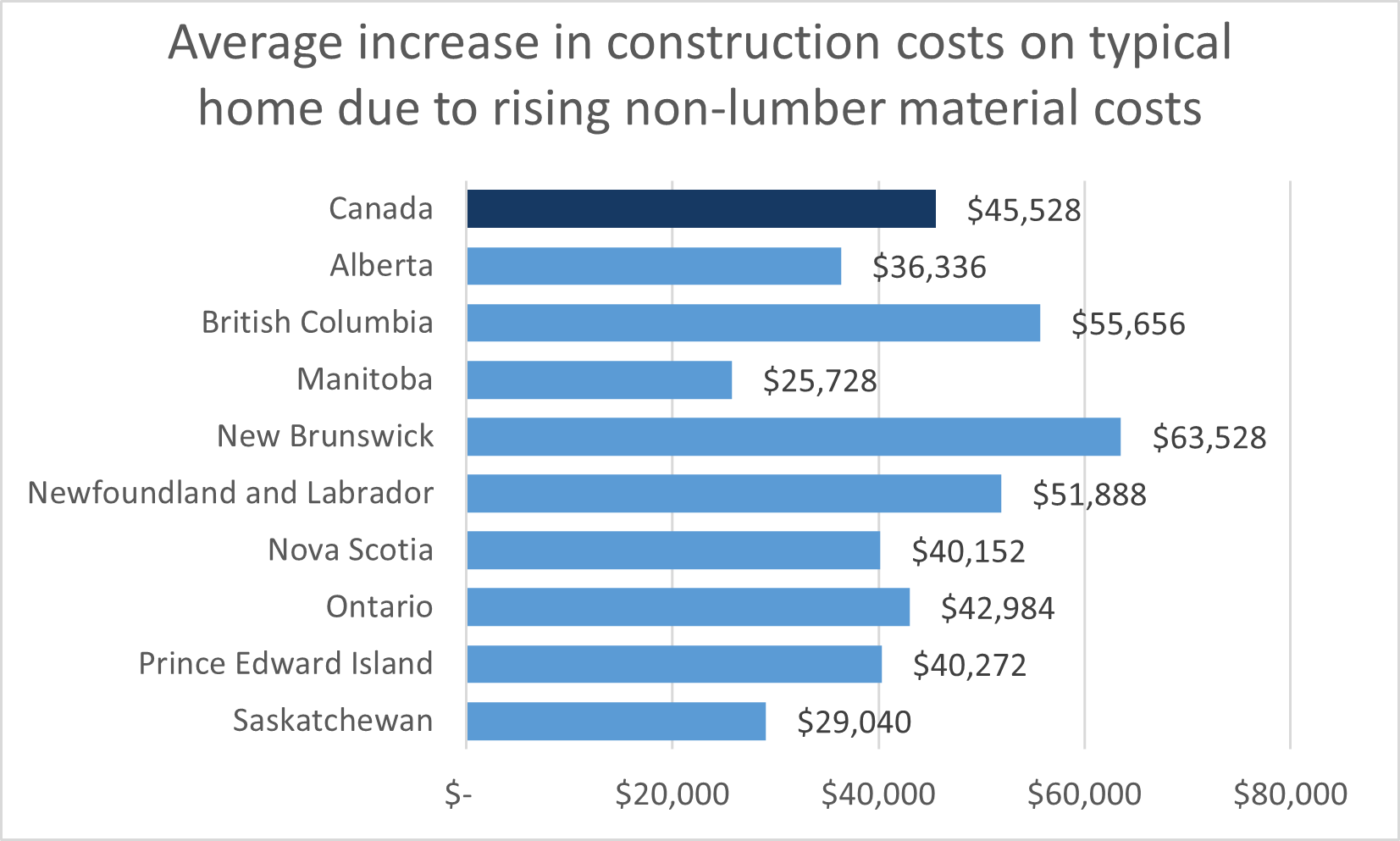

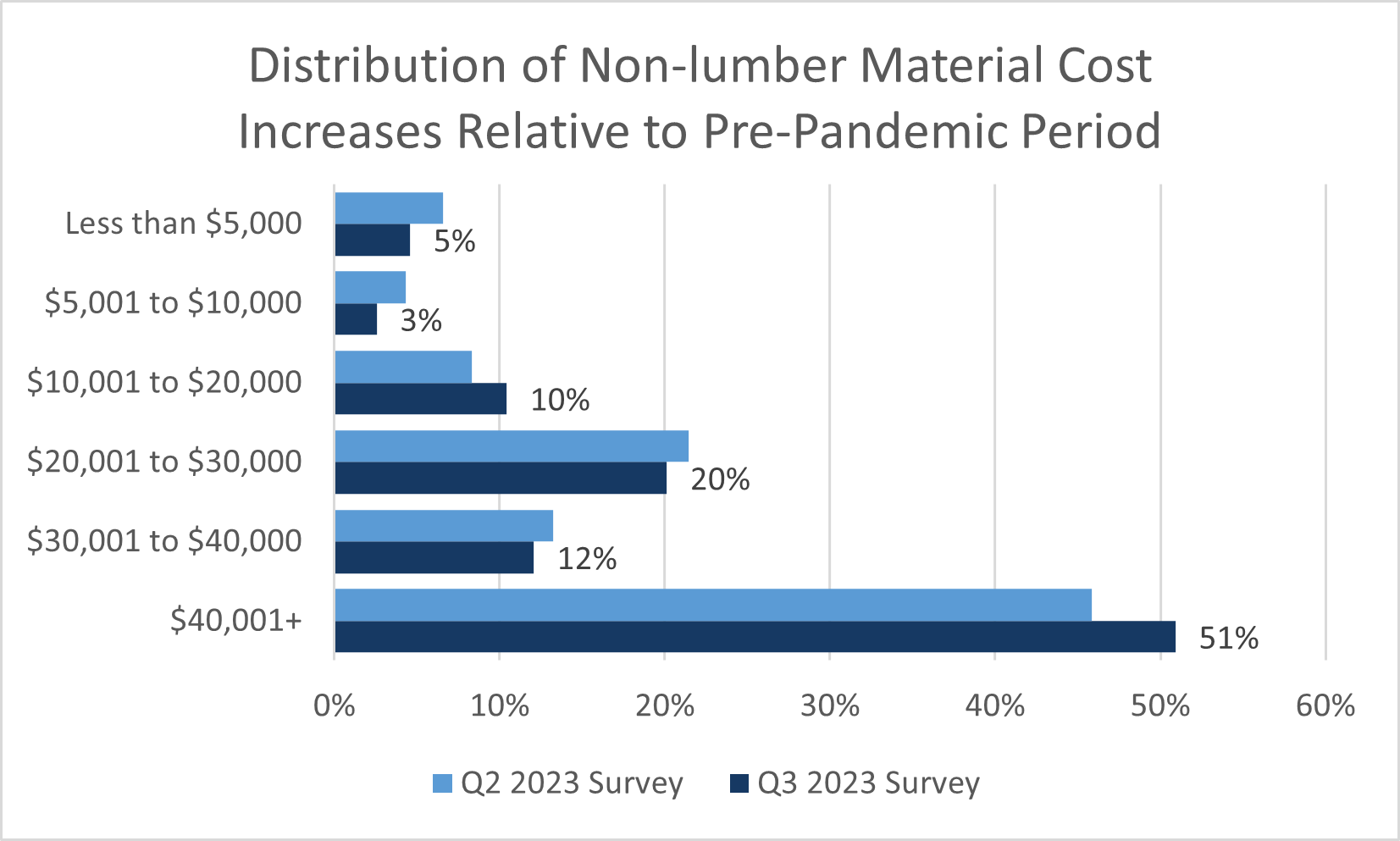

- Building costs continue to rise, as illustrated by the Building Construction Price Index. Based on respondent estimates, non-lumber material cost increases have added $72,000 on average to the cost of constructing a 2,400 square foot home since the start of 2020. When combined with cumulative lumber cost increases, the cost of materials alone adds $99,000 in additional costs on average on a 2,400 square foot home relative to 2020 material costs.

An explanation of CHBA's methodology for the HMI is below.

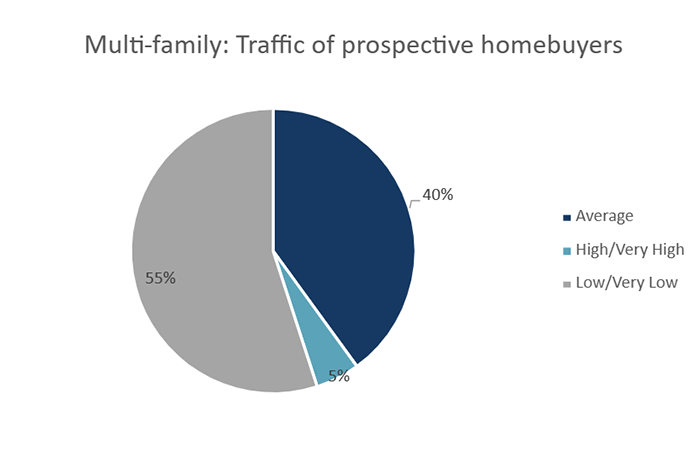

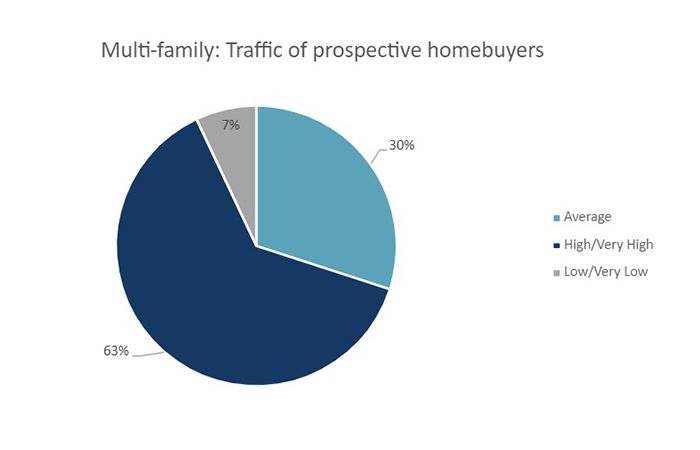

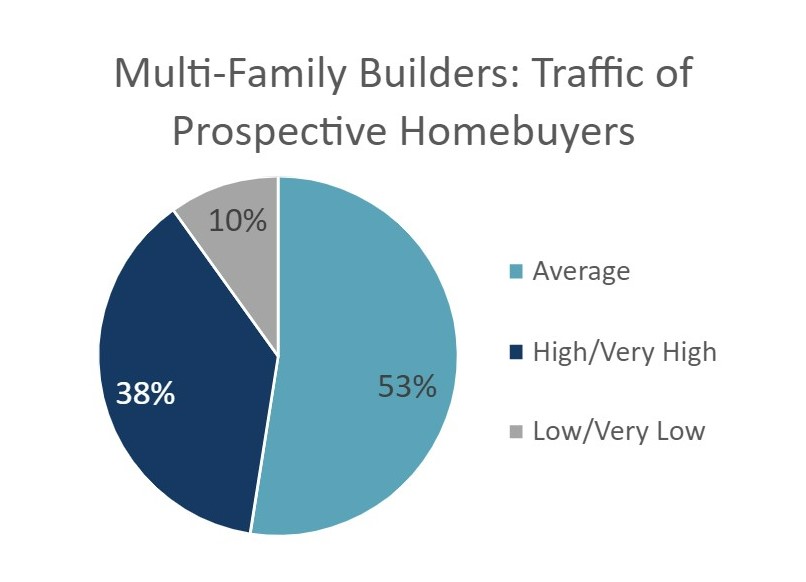

Conducted on a quarterly basis, the CHBA survey asks an expert panel to rate market conditions for the sale of new homes at the present time and in the next six months as well as the traffic of prospective buyers of new homes. Each variable allows the respondent to rate conditions as either “Good”, “Fair” or “Poor” or in the case of the traffic of prospective homebuyers “High/Very High,” “Average,” “Low/Very Low.” Each of these three variables creates a component index and the HMI is an average of the three component indices:

Component Indexᵢ = (% of Good responsesᵢ - % of Poor responsesᵢ +100)/2

HMI = 0.6xPresent + 0.1xFuture + 0.3xTraffic

The final number is weighted to ensure it is representative of CHBA’s membership by geographical location. The provincial weights leveraged 2024 Statistics Canada housing starts data for the breakdowns of single and multi-family markets to create the proportions of the single-family and multi-family markets in each province. This allows CHBA to create an accurate provincial representation while also taking into consideration that each province has very different single-family and multi-family proportions. Each local Home Builders’ Association (HBA) is also weighted to ensure proper representation by builder size (I.e., small/medium and large). In some cases, where local breakdowns for HBAs are not available, those HBAs are not weighted. The provincial weights are developed in a way to ensure the sample size is representative of the overall population of CHBA's membership of builders. The special questions presented above are only weighted at the provincial level.

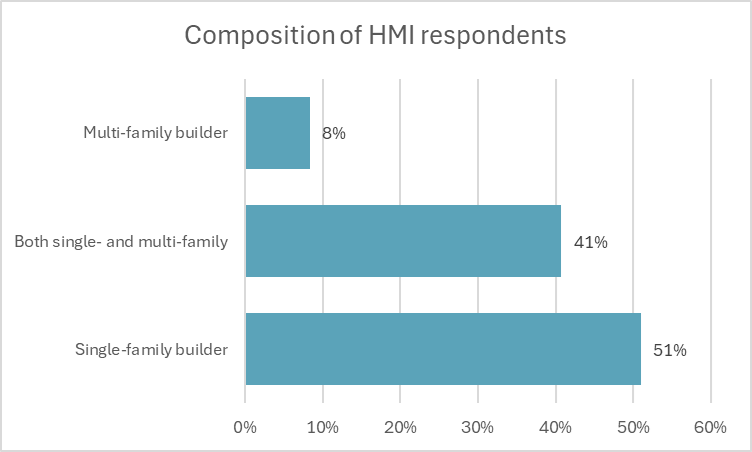

For the Q3 2025 results, an online survey was conducted by CHBA from September 16th to October 6th, 2025, using CHBA's panel of builders. Some builders elected to speak to both the single and multi-family builds, resulting in 196 unique responses. Respondents from 36 different local HBAs participated in this survey.

CHBA’s HMI is modelled on that of the National Association of Home Builders (NAHB) in the US. The NAHB-Wells Fargo Housing Market Index is based on a survey of single-family builders that the NAHB has been running every month since 1985. CHBA is leveraging the NAHB's weights as the basis for CHBA’s HMI weights (see formula above). This is to ensure that CHBA is placing more weight on the Present conditions question. As CHBA collects more data, it is planning on developing weights for each of the component indices discussed above that will allow us to maximize the correlation with Canadian housing starts six months into the future.

Panel

The panel is made up of builders from constituent associations to ensure representativeness across Canada. Working together with the association’s local and provincial Executive Officers, CHBA was able to build a panel that is reflective of membership in each region. To ensure it remains up to date, CHBA is continually refreshing the panel. The HMI is weighted to ensure the panel is representative by both geographical location (i.e., national, provincial and local) and size (i.e., small, medium and large). For some smaller home builder associations (HBAs), the sample is not weighted. In those cases, CHBA leverages the HBA’s expertise to ensure the sample is representative of the region. Single-family includes single-detached homes, semi-detached homes and row (townhouse) homes. Multi-family includes stacked townhouses, duplexes, triplexes, double duplexes and row duplexes, and low and high-rise apartment buildings.

The panel is made up of builders from constituent associations to ensure representativeness across Canada. Working together with the association’s local and provincial Executive Officers, CHBA was able to build a panel that is reflective of membership in each region. To ensure it remains up to date, CHBA is continually refreshing the panel. The HMI is weighted to ensure the panel is representative by both geographical location (i.e., national, provincial and local) and size (i.e., small, medium and large). For some smaller home builder associations (HBAs), the sample is not weighted. In those cases, CHBA leverages the HBA’s expertise to ensure the sample is representative of the region. Single-family includes single-detached homes, semi-detached homes and row (townhouse) homes. Multi-family includes stacked townhouses, duplexes, triplexes, double duplexes and row duplexes, and low and high-rise apartment buildings.

Housing starts continues to remain historically strong, but critically, starts for freehold or condominium ownership continue to contract. Urban multifamily starts for ownership have totaled 30,416 units from January to August of this year. This down from 39,550 multi family starts over the same period last year. While the HMI scores in Ontario are remarkably weak and year to date multi-family starts for ownership are down by 50% relative to 2024, the province has seen a 25% increase in multi-family rental starts over the same period. This contrasts with the latest CMHC supply targets that find 80% of Canada’s needed doubling of annual housing starts needs to be comprised of housing starts slated for the ownership market.

Archive

- The-single family builder confidence level was 24.9 in the second quarter. This is 5 points below the HMI level in the second quarter of last year and has remained at a critically low score of below 30 since the final quarter of 2023. This quarter’s score is just shy of the Q4 2023’s record low score of 24.6.

- 60% of single-family builders rated current sales conditions as Poor. This a record high proportion and led to a record low score for the present conditions sub-index. This is directly related to the consumer pullback from economic uncertainty introduced earlier this year through the trade war while the market was still recovering from high interest rates, and is compounded by first-time buyers remaining sidelined until the implementation of the enhanced GST/HST rebate.

- For a second consecutive quarter, a majority rated their expectations for future sales as Poor. Throughout 2023 and 2024, builders tended to remain optimistic and expected selling conditions to recover to an average pace of sales. This is a marked change in the first half of 2025, and does not bode well for starts moving forward.

- As a relative comparison to the United States, the NAHB HMI for single-family builder confidence averaged 35.0 in the second quarter—falling 8 points from the previous quarter, but still 10 points higher than Canada.

- The regional results continue to show that sales conditions continue to languish in Ontario and British Columbia relative to other parts of the country. The index for Ontario was 10.2 and 12.1 in British Columbia; these scores were down 1.4 points and down 5.7 points from the second quarter of last year. The index for the Prairie provinces was 45.1. While close to a neutral score, the Prairies have failed to return above a score of 50 since Q2 of last year. Atlantic provinces recorded a strong score of 60.8, the highest across the country.

- The multi-family HMI was 22.8 for the second quarter. This overtly low score has remained nearly unchanged, at a record low, for three consecutive quarters. This is due to no material improvement in sales conditions, especially in Ontario.

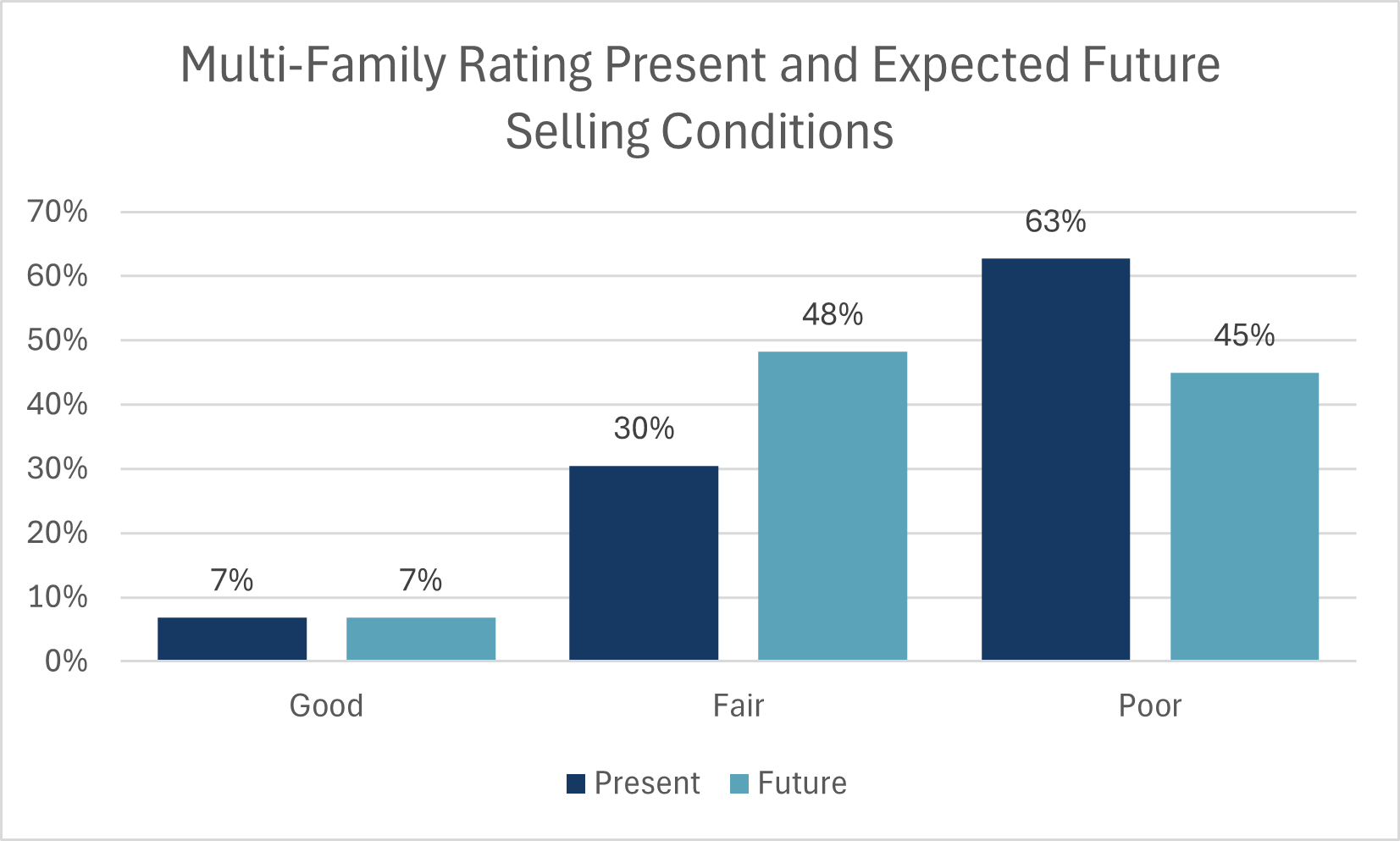

- As with last quarter, a record high 63% of builders speaking to multi-family developments rated current selling conditions as Poor. Just like the single-family HMI’s present selling conditions, this can be tied to economic uncertainty and the delayed introduction of the GST rebate for first time buyers.

- However, unlike the single-family HMI, there was some improvement in builder views on sales expectations in the next six months. 48% of builders expect conditions to be Fair, which is 12 percentage points higher than the previous quarter and 7 percentage points higher than a year ago. This is partly related to the outlook on the improved GST/HST rebate for first-time buyers—more applicable to condo and plex type dwellings.

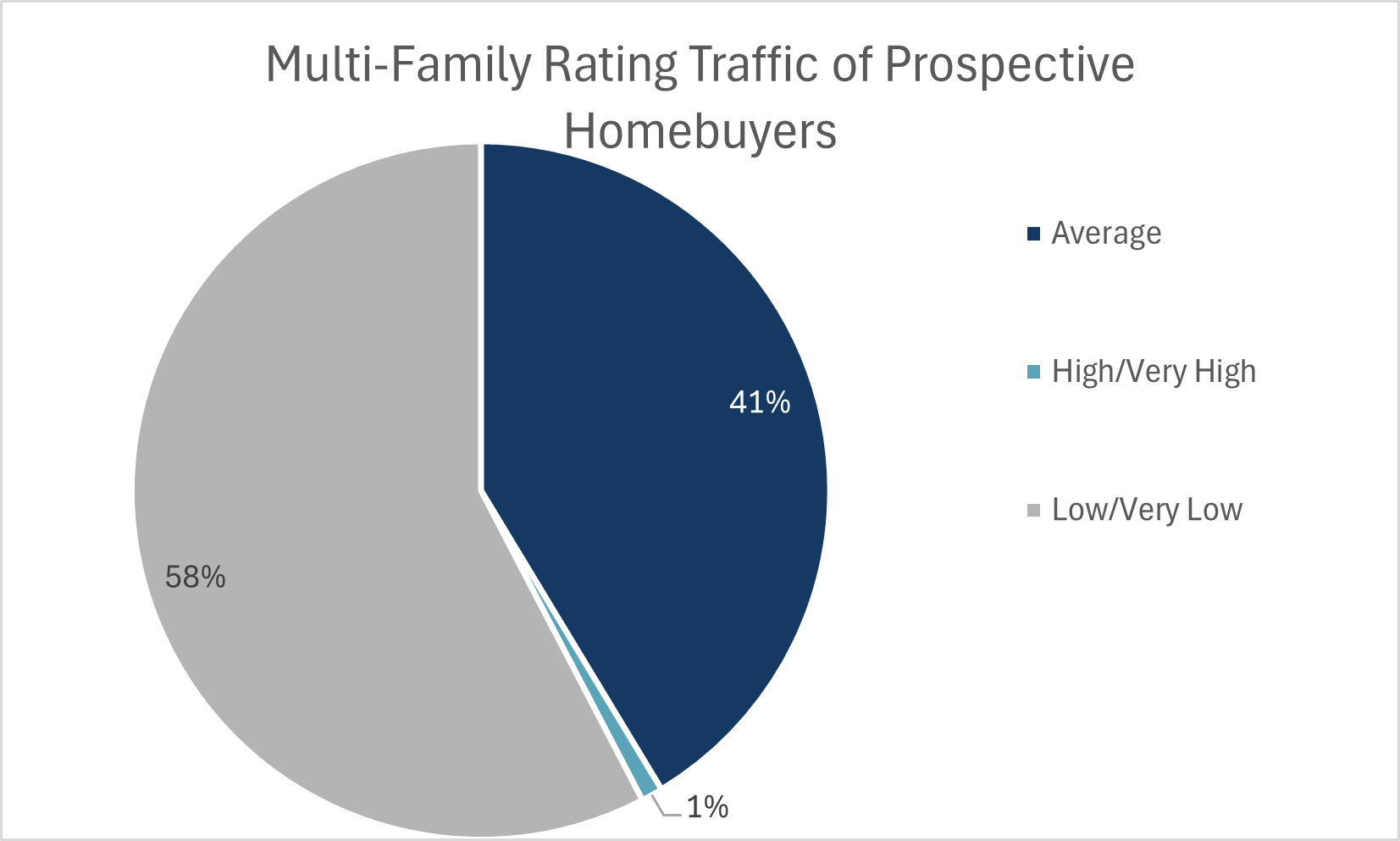

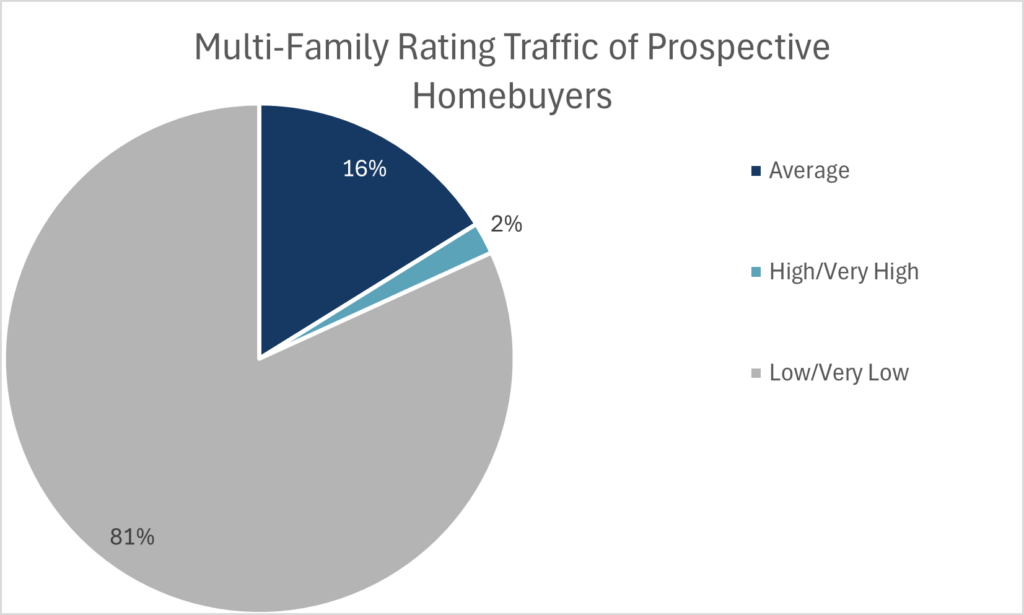

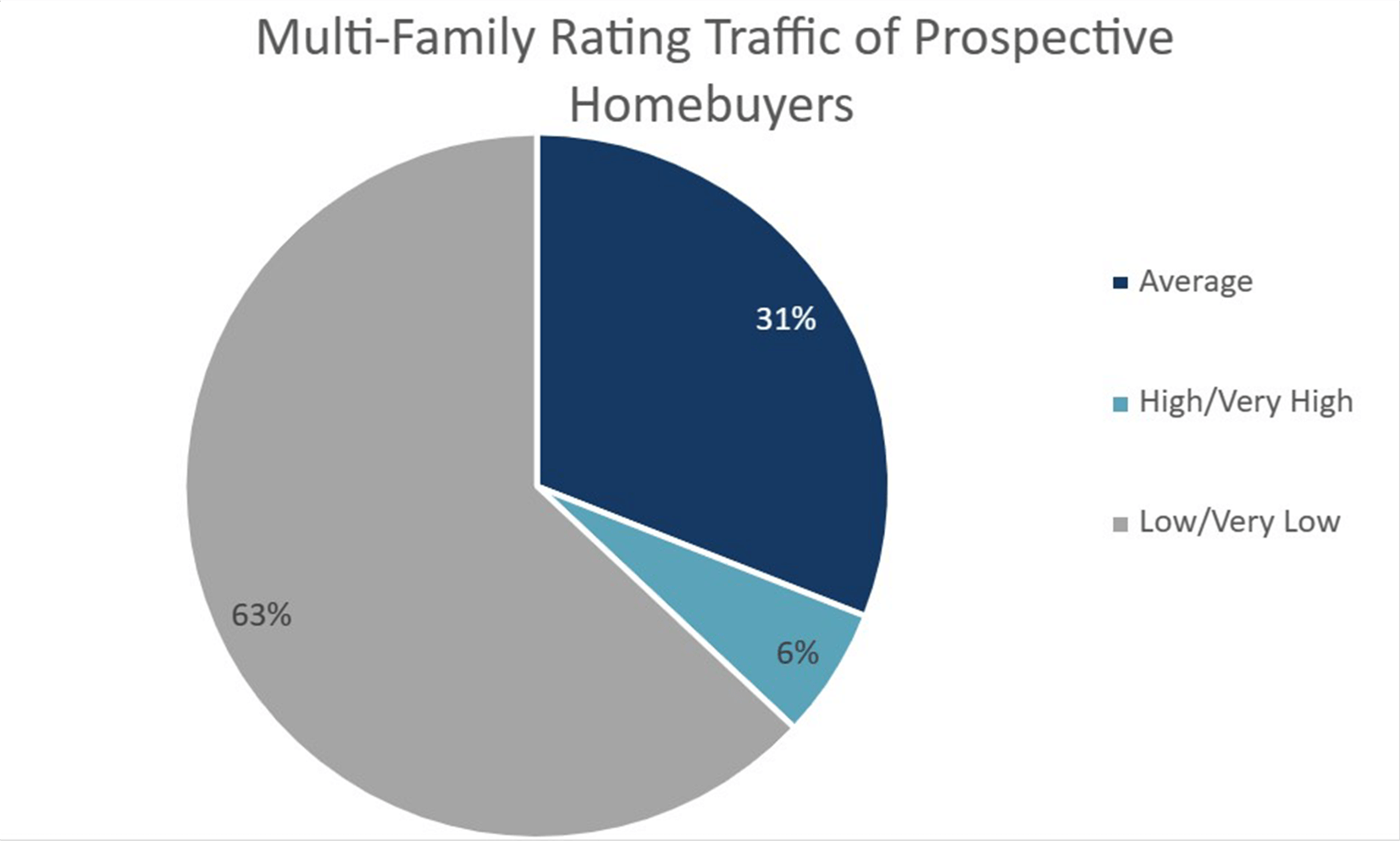

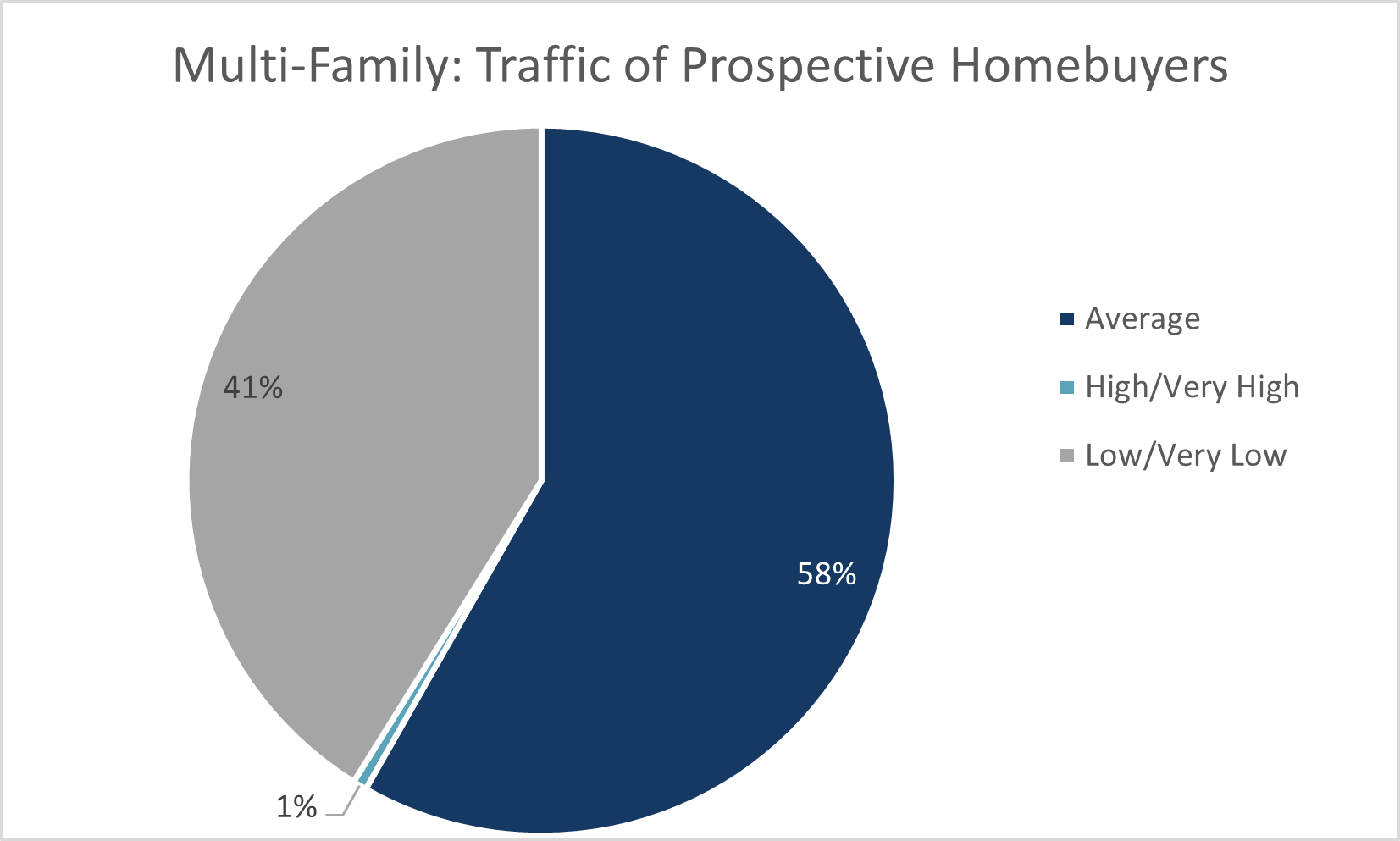

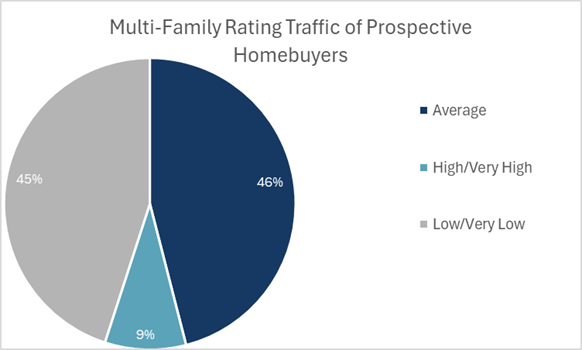

- While the sales office traffic and inquiries sub-index improved from the previous quarter, there are no areas in the country where builders are rating this as High or Very High. The overall sub index remained weak during the important spring selling season.

- Regional trends generally held from previous quarters. Builder confidence in Ontario was 7.4, continuing to highlight the dire market conditions—particularly in the Toronto CMA. Confidence in British Columbia was 27.4, which has led to HMI scores under 30 for a full year. With a score of 47.3, sales conditions in the Prairie provinces are on a concerning downtrend since reaching a strong score of 73.2 in Q2 of last year.

.png)

.png)

.png)

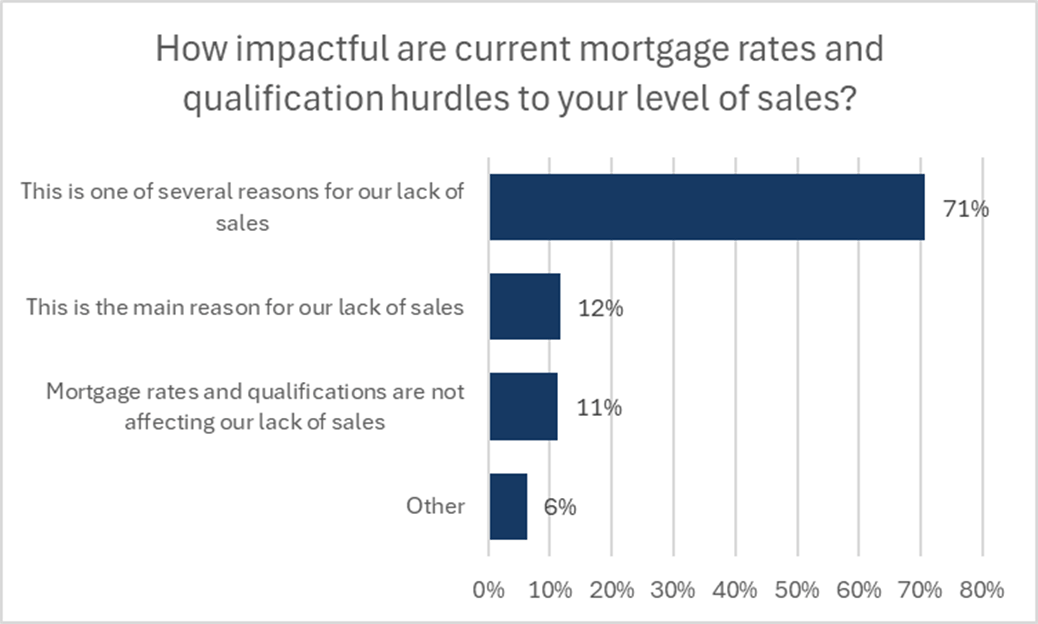

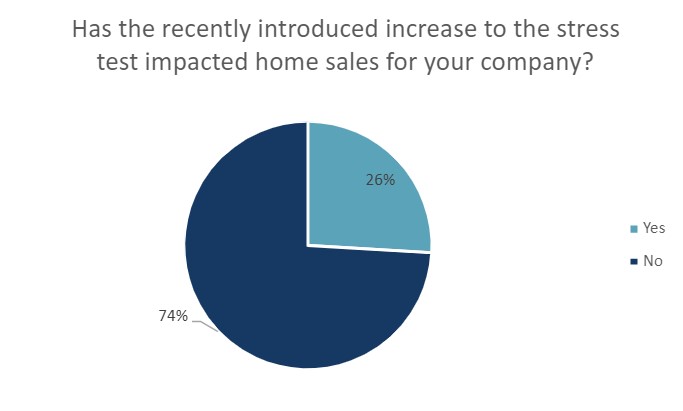

- Builders were asked about the impact prevailing mortgage rates and the minimum qualifying rate stress test are having on their level of sales. 83% of respondents stated these factors are affecting sales. 12% stated this was the main reason for lack of sales, while 71% stated they are among many reasons sales are slow, indicating the need for policy change in these and many other areas to reverse the tide.

- 87% of builders stated that they have a level of concern about the well-being of their business over the next 12 months, with over 1 in 5 saying they are extremely concerned

- Builders were again asked about worker layoffs within their firm and the subs they use. 35% said that they have and have no current plans to rehire. Of concern, this response rate is up sharply from the 21% of builders that stated this in the second quarter last year. While builders and contractors have reported holding onto their workers in hope of a market turn around, this may no longer be feasible.

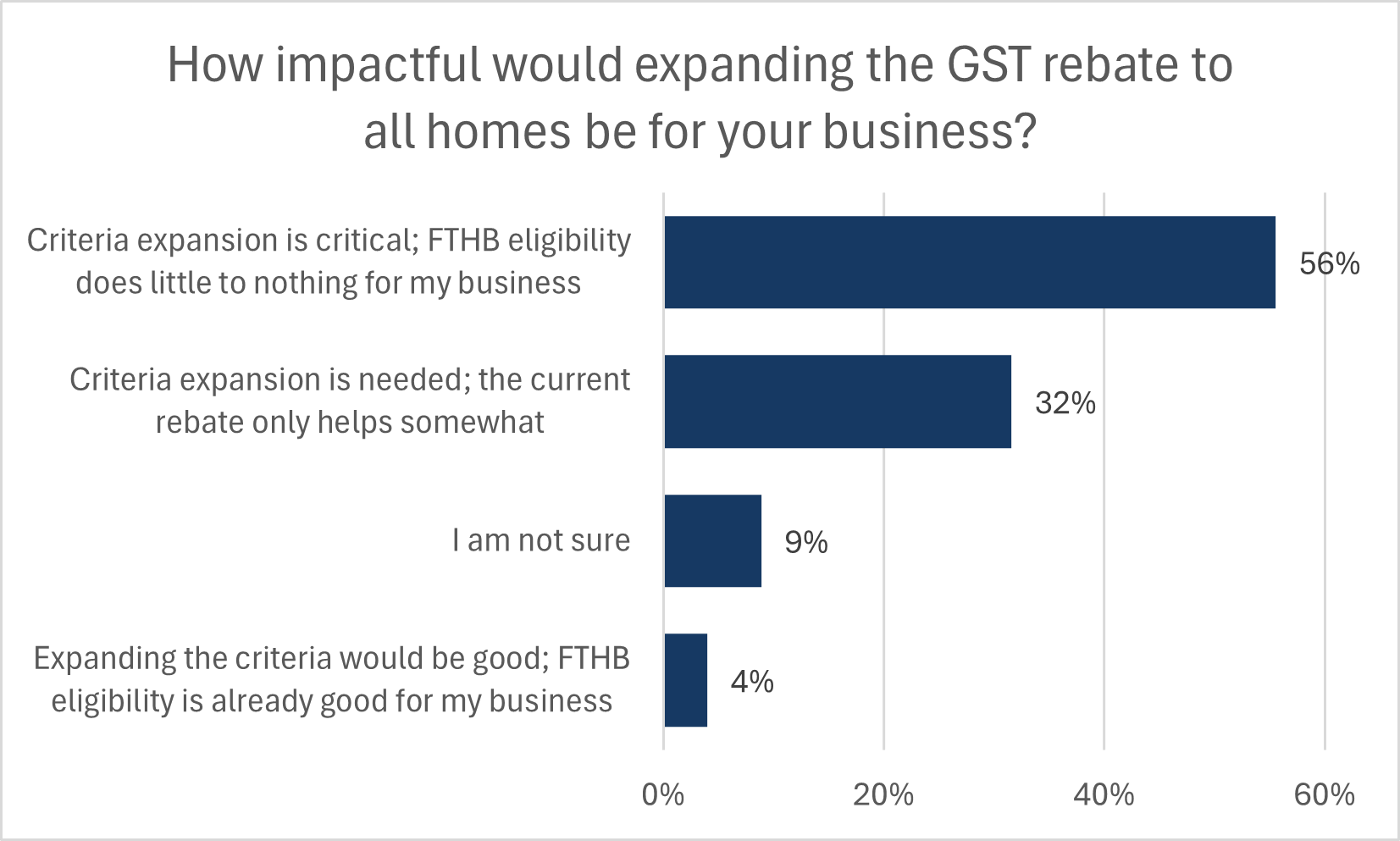

- 56% of builders felt that expanding the HST/GST rebate from first-time buyers to all buyers on homes under $1 million, declining up to $1.5 million, is critical for the policy to unlock additional sales and housing starts. A third of builders felt that the GST waiver will provide modest help in its current form but still felt that eligibility for all buyers is needed to help turn the market around.

- Over the past year, several policy changes have been introduced to support additional new home sales. To gauge the polices’ collective effect of helping sales conditions rebound, builders were asked if their expectations for sales if there was no trade war with the US. While 36% felt that their sales would indeed improve, 45% still felt like these policies are not enough to turn the market around from its current state.

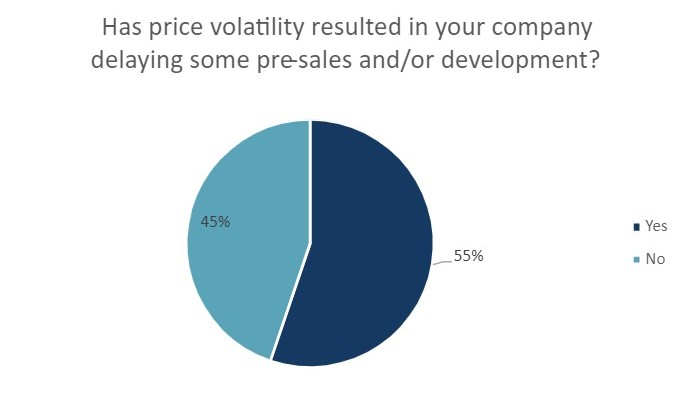

- 62% of builders stated that it has become significantly more difficult to price their homes with the high level of tariff uncertainty relative to 28% that said it has not. This difficulty stems from both the tariffs in place that have had varying degrees of effect on retail prices of building materials and the tariffs that could be enacted in the near future.

- Builders were asked to estimate the percentage increase they have seen so far to building materials. The majority reported cost increases under 10%. However, there is a wide distribution of estimates, reenforcing the fact that supply chains are very different from region to region, with varying degrees of construction material integration with the US.

- Builders were asked to comment on the impact of tariffs that have been implemented by Canada so far. Cost concerns were concentrated with glass products, steel products, and HVAC equipment. Due to the regional nature of both supply chains and home sales conditions, many builders noted they have not yet noticed a tariff impact on their construction materials.

- Providing some assurance, the majority of builders noted they have not felt a price impact on foreign building materials that are first imported into the US before being distributed to Canadian material suppliers.

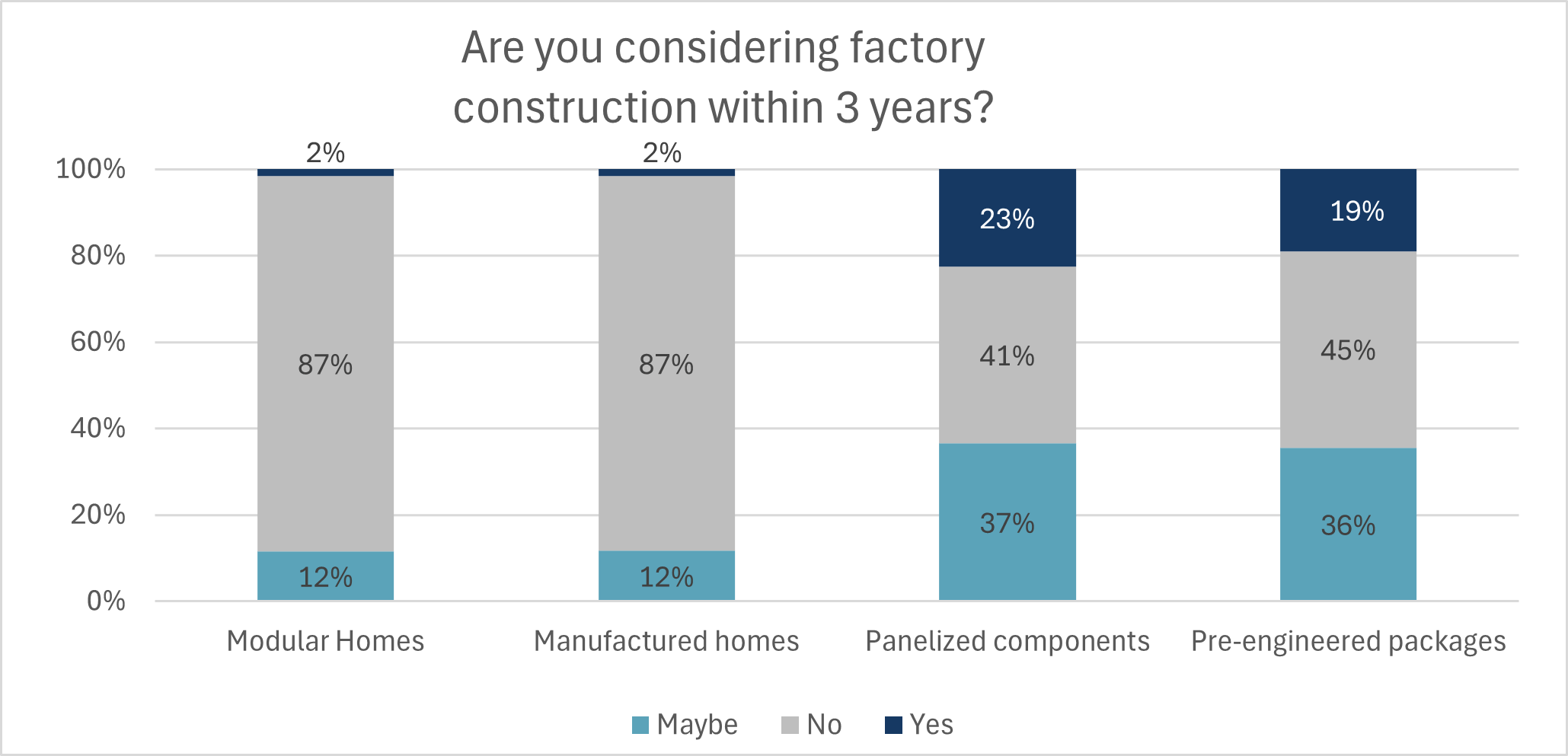

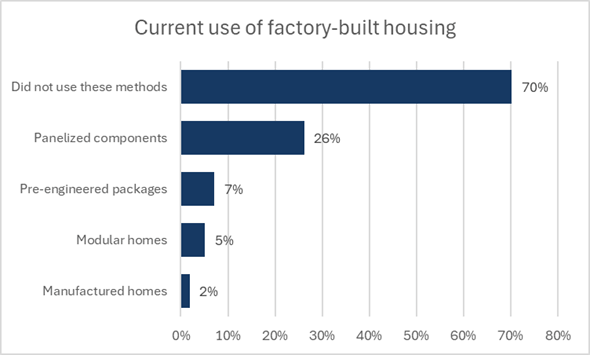

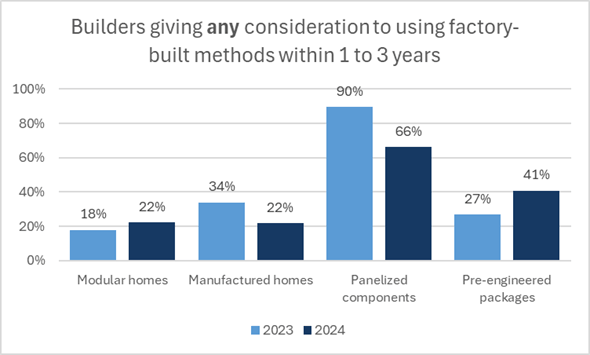

- Approximately one third of the respondents stated that they utilize one or more kind of factory-built construction technique. This is very similar to the utilization seen in the previous two years this question was asked. Use of panelized components continues to be the most prevalent—at 26% of all builders surveyed. While the panel of builders surveyed was not calibrated to ensure specific coverage of factory construction builders, 7% stated they utilize modular construction and 5% utilize pre-engineered packages. Out of the subset of builders that do take advantage of factory-built construction, 72% have partnered with suppliers, rather than done in-house.

- Among the subset of builders that do not currently utilize factory construction, there is also a stark difference between the kinds of techniques they would consider over the next 3 years. 59% of these builders are giving some level of consideration to using panelized components, 55% are considering pre-engineered packages and 13% to either modular or manufactured homes. This group would also strongly tend towards partnering with an existing factory over in house operations.

- While the impact of tariffs has more so affected economic certainty, the cost of construction continues to climb. Builders were asked to update their estimate of increases to the cost of non-lumber construction materials over the past year. Based on these estimates, non-lumber materials cost $69,650 more to build a 2,400 square foot home than it did at the beginning of 2020—prior to an era of the rapid cost growth. In combination with rising lumber costs, the material cost increase on a 2,400 square foot home since 2020 has risen by over $96,000.

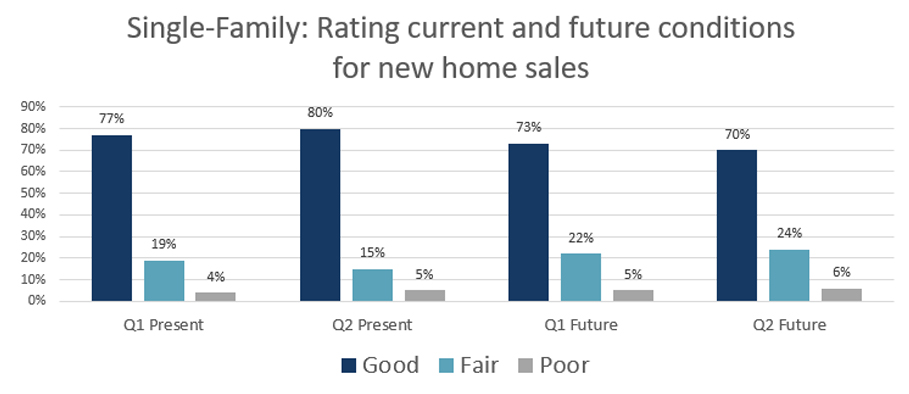

- Single-family builder confidence was 26.4 in the first three months of 2025. This is a small increase of 1.3 points over Q4 2024, but a decline of 8.5 points from the same quarter in 2024 and represents sentiment still within touching distance of the index’s all time low of 24.6 points recorded in Q4 2023—before the Bank of Canada started to lower rates.

- 56% of builders rated present selling conditions as Poor. The majority of single-family builders have given a rating of Poor in five of the past six quarters.

- Likely related to the tariff situation, 53% expected future sales to be Poor. Since the start of 2023, builders have been hopeful that sales would improve to more normal conditions, however, this is no longer the case.

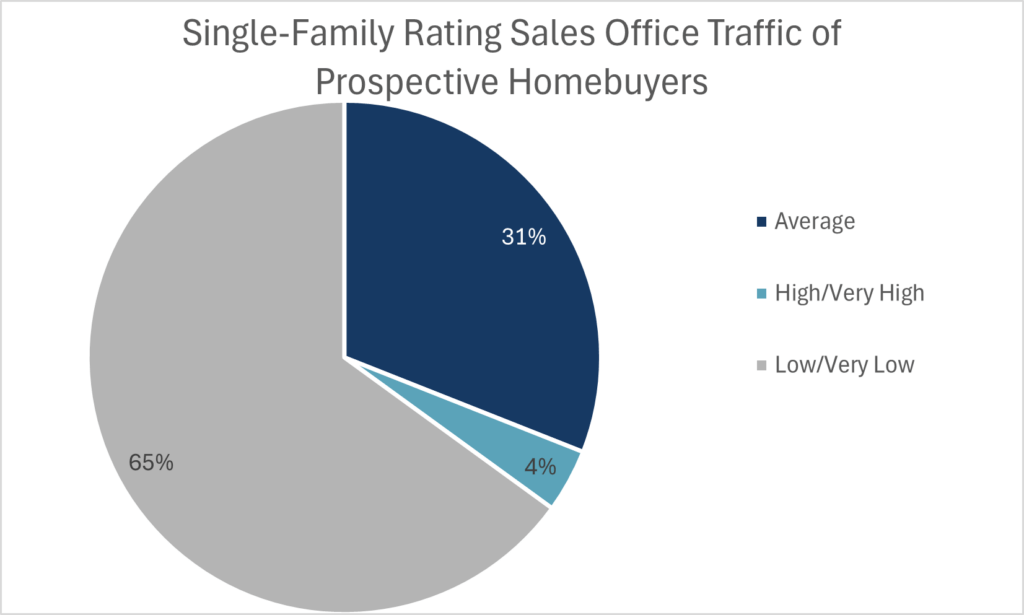

- Sales office traffic or general sales inquiries showed no signs of improvement, and 65% of builders rated conditions as Low or Very Low. The proportion of builders that rated traffic as High or Very High has remained in single digits since the third quarter of 2023.

- Regional trends showing Ontario and British Columbia faring much worse than builders in Prairies and Atlantic provinces continued this quarter. Builder confidence in Ontario fell to a record low of 7.4—recording single digits for the first time. Sentiment in British Columbia increased somewhat over last quarter but was still an abysmal 17.2. Sentiment in the Prairie Provinces was 49.0, remaining close to a neutral score for the past three quarters. Atlantic Canada was the sole bright spot for single family construction, rising 21.4 points over the previous quarter to 66.3—suggesting a strong start to the spring selling season.

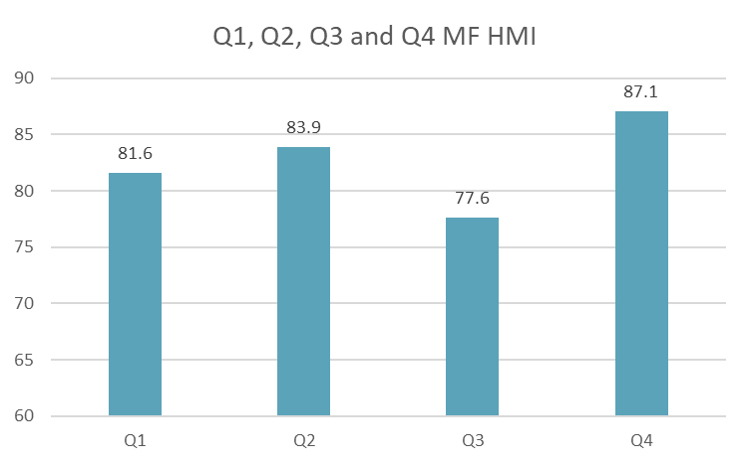

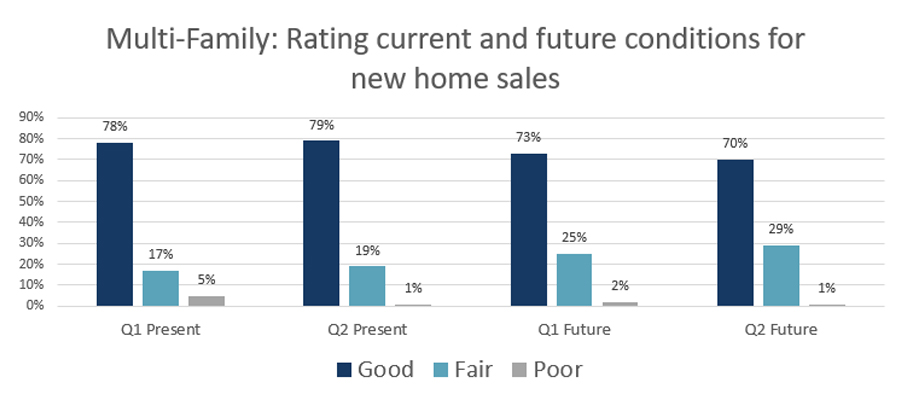

- The multi-family Housing Market Index was 22.3 in the first quarter of 2025, essentially unchanged from the record low of 22.0 recorded in the previous quarter. However, it is 15.6 points below the score recorded a year ago, suggesting that this year there is no seasonal boost from the start of the spring selling season.

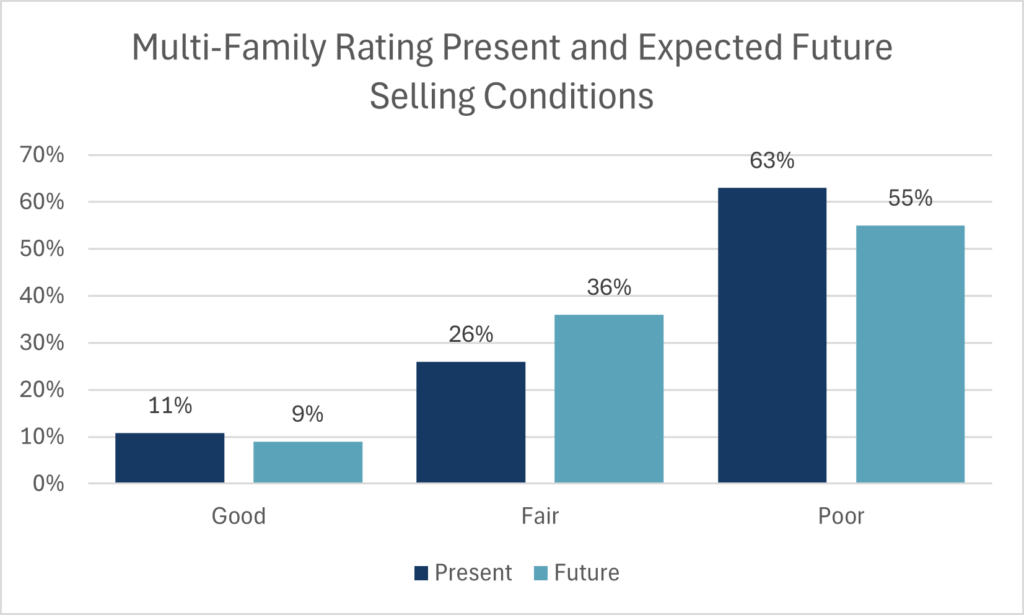

- Particularly concerning was the 63% of builders who rated current selling conditions as Poor. This was a record high in terms of the breadth of negative opinions. Only 11% rated sales as Good.

- Like the single-family HMI, in the past, multi-family builders have tended to expect improvement to average selling conditions in the near future. Bucking that trend, a record high 55% of builders rated their expectation for future selling conditions as Poor. Prolonged weakness in the market and the threat of tariffs have reduced this optimism.

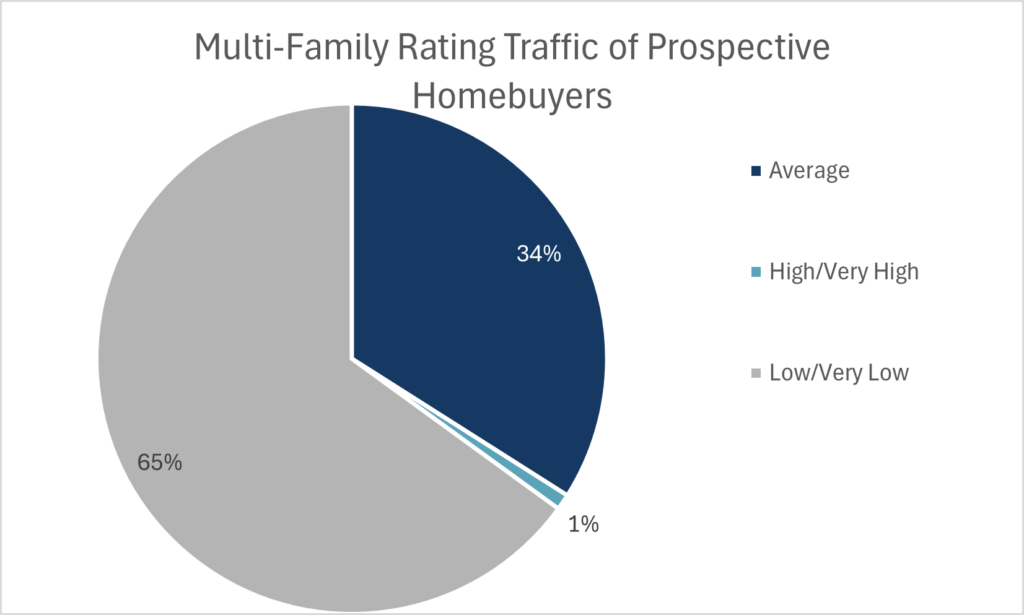

- Sales office traffic remained weak, as 65% of builders rated conditions as Low or Very Low. Surprisingly, this improved over the 81% that gave this rating the previous quarter, which could be related to seasonal factors. This improvement helped the overall multi-family HMI avoid setting another record low in builder confidence.

- Regional trends re-enforce how dire markets conditions are in Ontario, with an HMI of 2.9, falling from a score of 6.2 in the previous quarter. British Columbia remained pessimistic with a score of 24.8, down 18 points from a year ago. The Prairie Provinces maintained their position as the sole bright spot, with a score of 61.3, rising 6.8 points from a year ago.

.png)

.png)

.png)

Each quarter, CHBA asks a set of topical questions to understand the HMI results better as well as other industry issues. This quarter, the questions were largely focused on the threat of tariffs. While Canada’s phase II list of counter tariffed products was not implemented on April 2nd, it has not been officially removed as policy consideration, pending what the U.S. does moving forward.

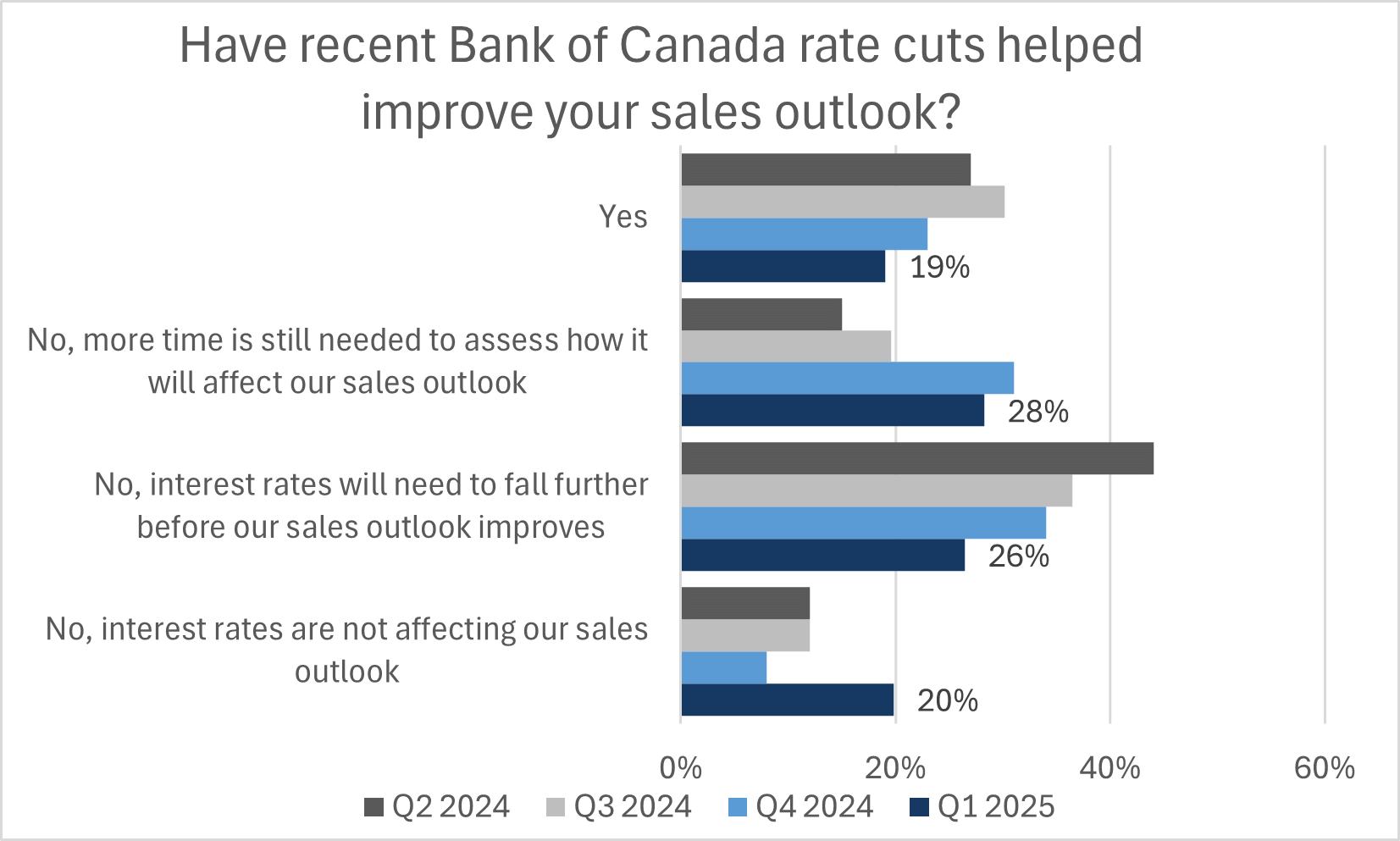

- Builders were asked if the Bank of Canada’s 25 basis point cuts in January and March helped improve their expectations for sales over the next six months. Just 19% stated that it did, notably lower than the three previous quarters. The biggest change from past quarter was in the 20% of builders saying that interest rates are not affecting their sales outlook, up from 8% last quarter and 12% in Q2 2024. This is reflective of the trade war, but also mortgage rates not lowering in tandem with the Bank of Canada rate.

- Builders were asked if they had already received a notification from a supplier about a cost increase in 2025—regardless of the reason. 71% of builders said they had, while 24% said they have not. The threat of tariffs threatens to increase the prices of a broad range of goods and likely includes items that are not listed under Canada’s counter tariffs.

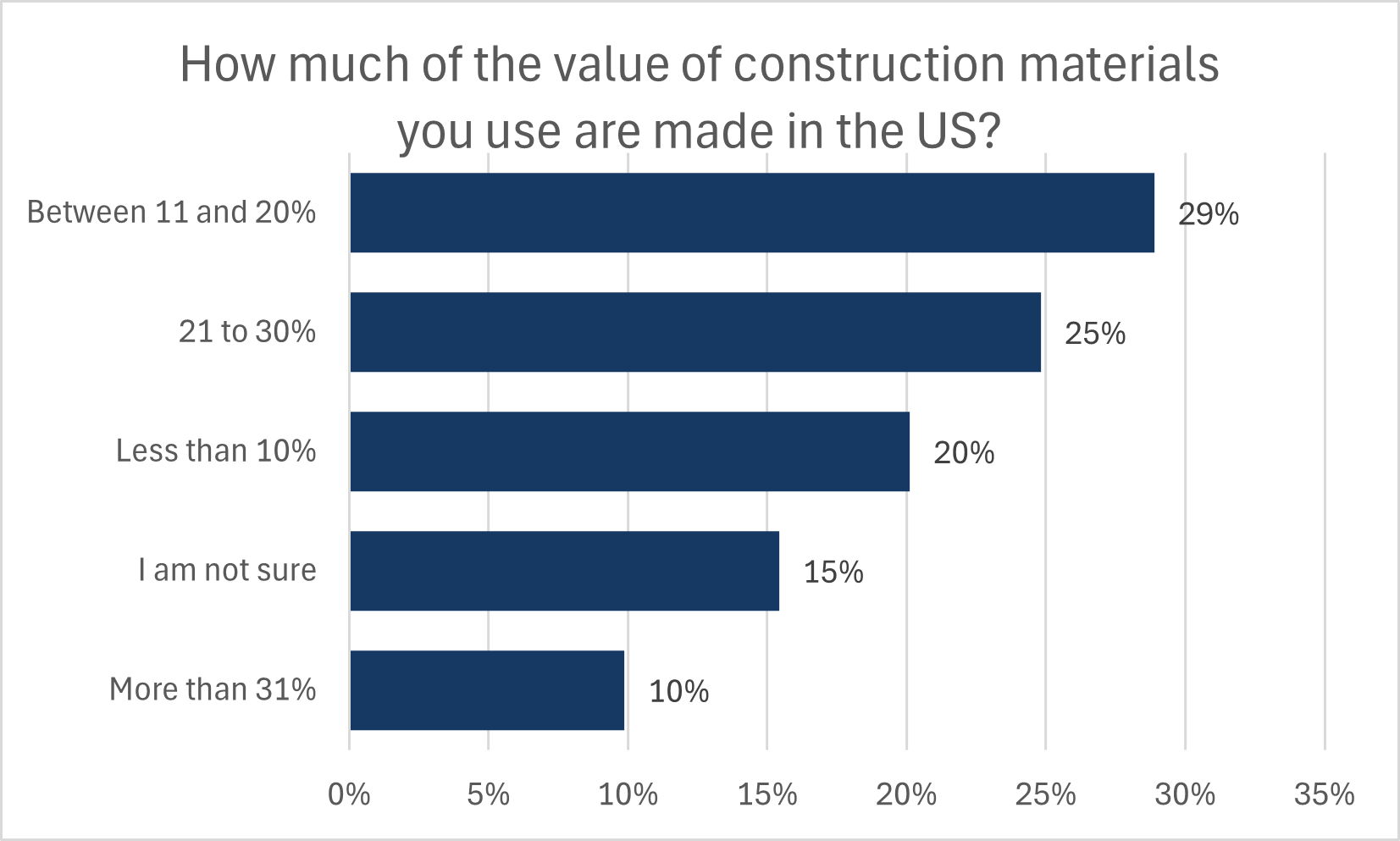

- To help judge the impact of tariffs on building construction, builders were asked to provide an estimate of the proportion of the value of total building materials that is made in the US. 29% of builders said that between 11 and 20 percent of the value of materials is made in the US, which was the most common answer. Just 10% said that more than 31% of the value of materials comes from the U.S. In general, most products can be sourced domestically or imported from non-U.S. trading partners. However, this is not a certainty, as country of origin has been less of a factor under free trade.

- Canada has implemented tariffs on $30 billion worth of U.S. product imports, including most large kitchen and/or laundry appliances. 75% of builders state that they supply these appliances in their purchase agreements, however a large portion of builders were not sure if these appliances simply came from the U.S. or were a product made in the U.S. After removing the builders who were unsure, on average, 53% of the large appliances supplied by these builders are believed to be subject to tariffs on U.S. products

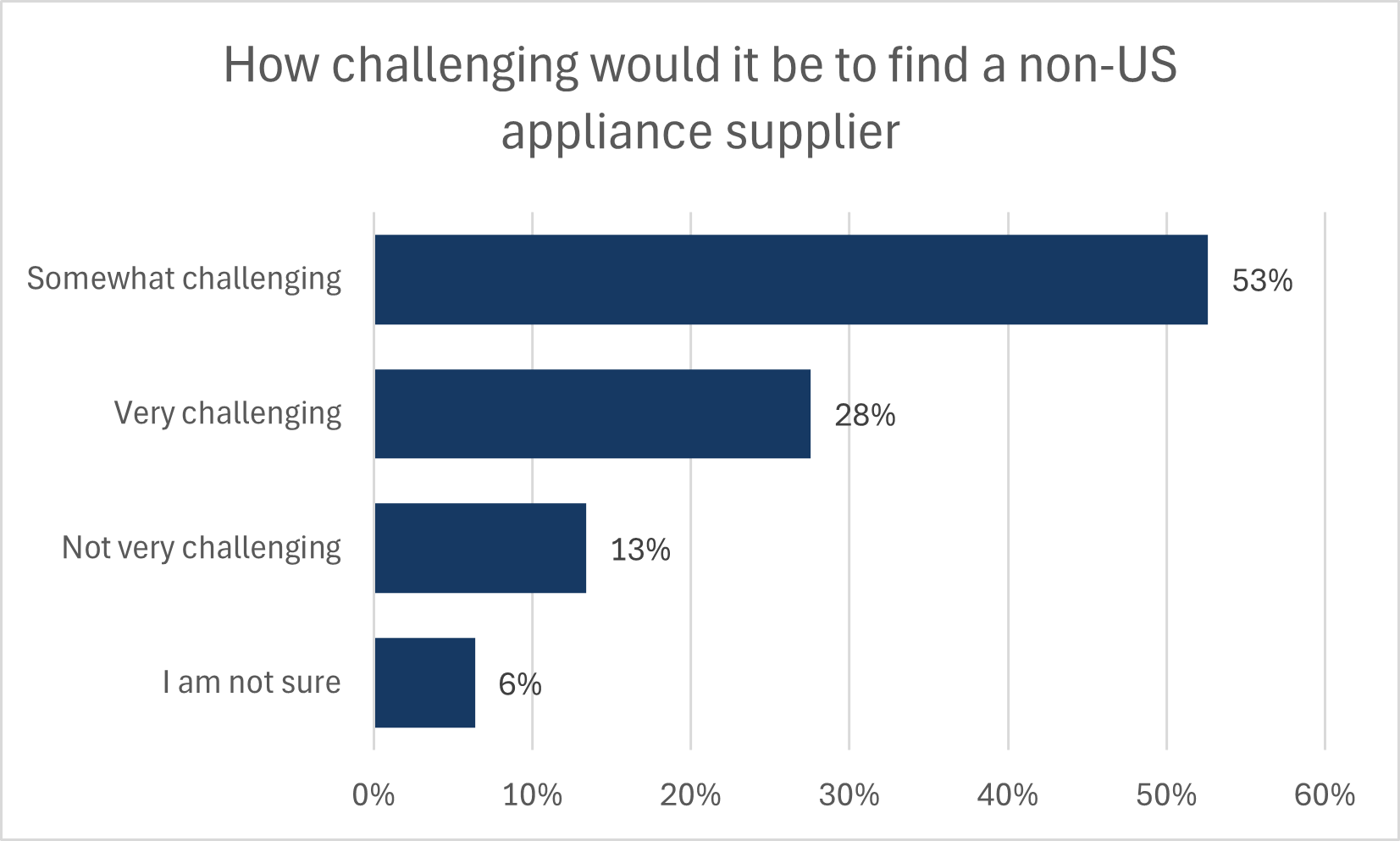

- 53% of builders believed finding non-U.S. appliance suppliers will be somewhat challenging and a further 28% believe it will be very challenging. CHBA has advised government officials that additional overseas production is often geared towards smaller standards of Europe and Asia, making additional sourcing problematic.

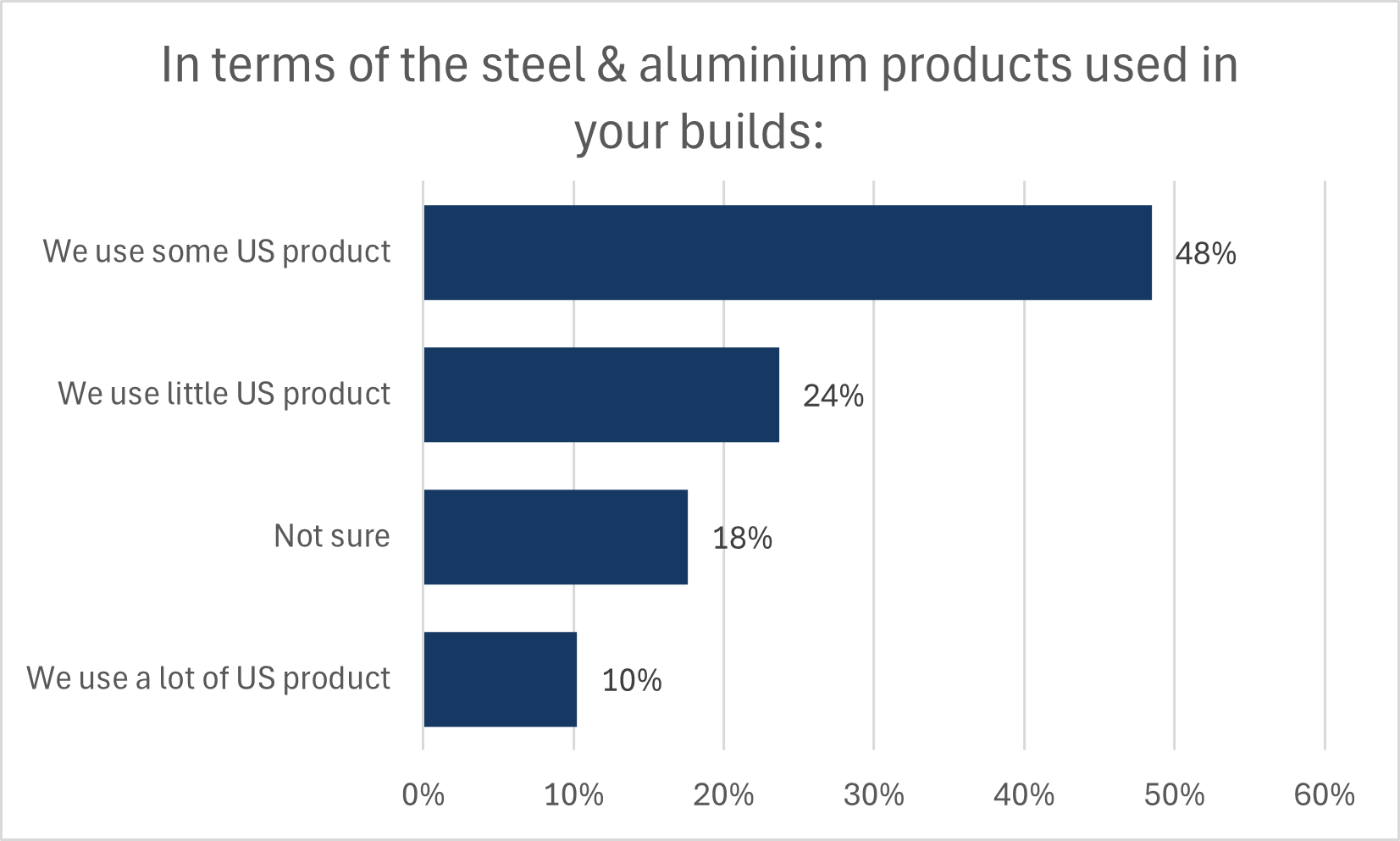

- In response to the U.S.’s global tariffs on steel and aluminium as well as products made of these materials, Canada has implemented counter tariffs on these goods in return. Understanding the difficulty in estimating the level of U.S. product, builders were asked to subjectively judge how much U.S. steel and aluminium they use in construction. 48% of builders stated that they use some U.S. product and 24% said they use a small amount of U.S. product.

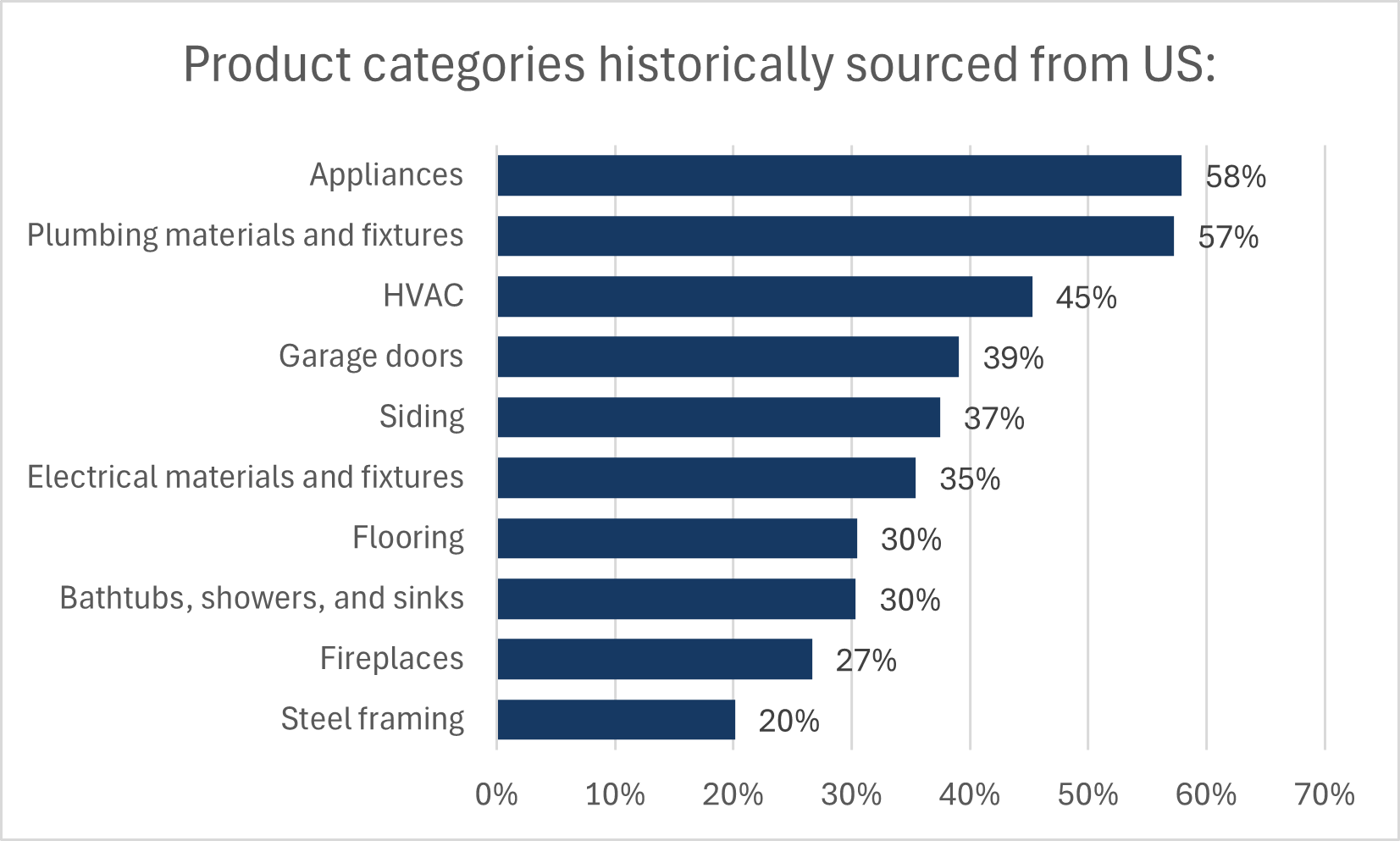

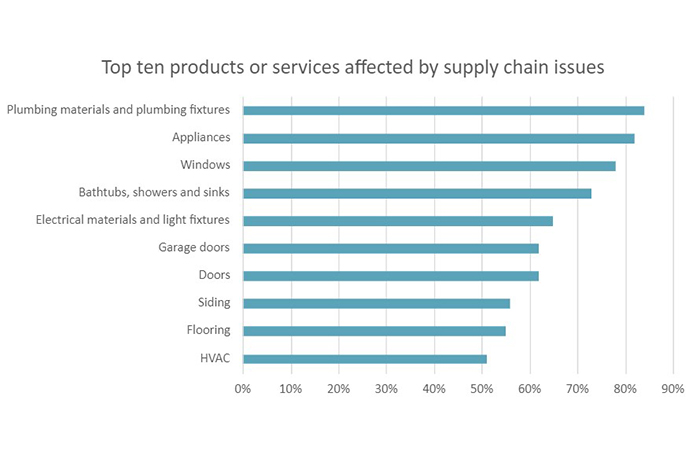

- Many other building materials are contained within the $125 billion Phase II list of counter tariffed goods, which could still be implemented, depending on U.S. tariff announcements going forward. Builders were asked to identify any broad building material categories that they have historically sourced from the U.S. Among the most exposed product categories to U.S. imports, according to builders, were appliances and plumbing products at 58% and 57% respectively.

- CHBA remains concerned about the risk that the global trade shock will lower economic growth in Canada and weaken new home buying demand further. While builders prioritized keeping staff through the period of high interest rates, Q1 shows signs that a lack of sales has begun to necessitate layoffs. While 43% have still not laid off workers, 34% have, with no immediate plans to rehire, a proportion that is 11 percentage points higher than the response rate from a year ago.

- The rapid and compounding rise in building costs have also worked against affordability, which will be exacerbated by tariffs directly on building materials. Builders were again asked to estimate the increase in cost of non-lumber construction materials over the past year. Based on this, the average non-lumber material cost to build a 2,400 square foot home has risen over $70,000 since the start of the pandemic in 2020. When including cumulative lumber cost increases, total material costs have risen by nearly $98,000 to construct a 2,400 square foot reference home relative to early 2020.

- Single-family builder confidence was 25.1 in the fourth quarter of 2024. This is a decline of 2.3 points from the previous quarter and is just 0.5 of a point above the index’s all-time low of 24.6 recorded a year ago.

- 56% of single-family builders rated current selling conditions as Poor. The majority have given this rating in four of the past five quarters.

- With respect to expectations for sales over the next six months, builders maintain some optimism for improvement with 52% rating their expectations for conditions to be Fair. 32% still expect conditions to be Poor over the near future.

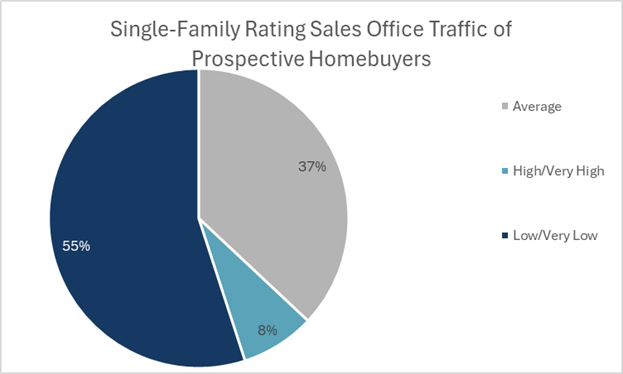

- Ratings of sales office traffic and potential buyer inquiries remains weak. 70% rate their level of traffic as Low or Very Low. Only 2% of the survey respondents rated traffic as High or Very High.

- Comparatively, the NAHB/Wells Fargo HMI for US single-family builders recorded an average score of 45 in the fourth quarter. While still pessimistic, the balance of builder views is far closer to neutral than in Canada.

- Regional differences persist in the four regions tracked by the survey. Builder sentiment in Ontario reaching an abysmal 11.3, reflecting near universal current sales pessimism in the province. However, this quarter was marked by British Columbia’s sharp decline in sentiment for single-family sales, falling below that of Ontario for the first time since 2021, by reaching a score of 10.5. In contrast, builder sentiment in the Prairie Provinces was 48.2, which is 18.8 points higher than recorded a year ago. Sentiment in Atlantic provinces fell for a third consecutive quarter and recorded a neutral reading of 44.9.

- The multi-family Housing Market Index result was 22.0 in the fourth quarter of 2024, falling 6.5 points from the previous quarter and 7.1 points from Q4 2023. Unfortunately, this quarter was a new record low, surpassing Q4 2022’s score of 26.0.

- A record-high 60% of builders rated current multi-family selling conditions as Poor, a 7-percentage point jump over the fourth quarter of 2023.

- 50% of builders reported their expectations for sales over the near future to be Fair, while 39% expect conditions to be Poor.

- The drop to a record low in the multi-family HMI this past quarter was the result of responses to sales office traffic and sales inquiries. 81% of respondents rated traffic and inquiries as Low or Very Low and lowered the traffic sub-index to unprecedented weakness.

- The Ontario multi-family HMI was 6.2, a new all-time low, down from 21.3 at this time last year and from an all-time high of 90.7 in Q4 2021. No builders in Ontario gave a rating of Good or High/Very High. British Columbia recorded a score of 25, progressively lowering from 42.9 in Q1 2024. The Prairies Provinces recorded a score of 53.7, notably falling from scores of 73.2 in Q2 2024 and 64.3 in Q3 2024.

.png)

.png)

.png)

The results from these questions allow CHBA to better understand what is driving change in builder sentiment as well as monitor current industry issues.

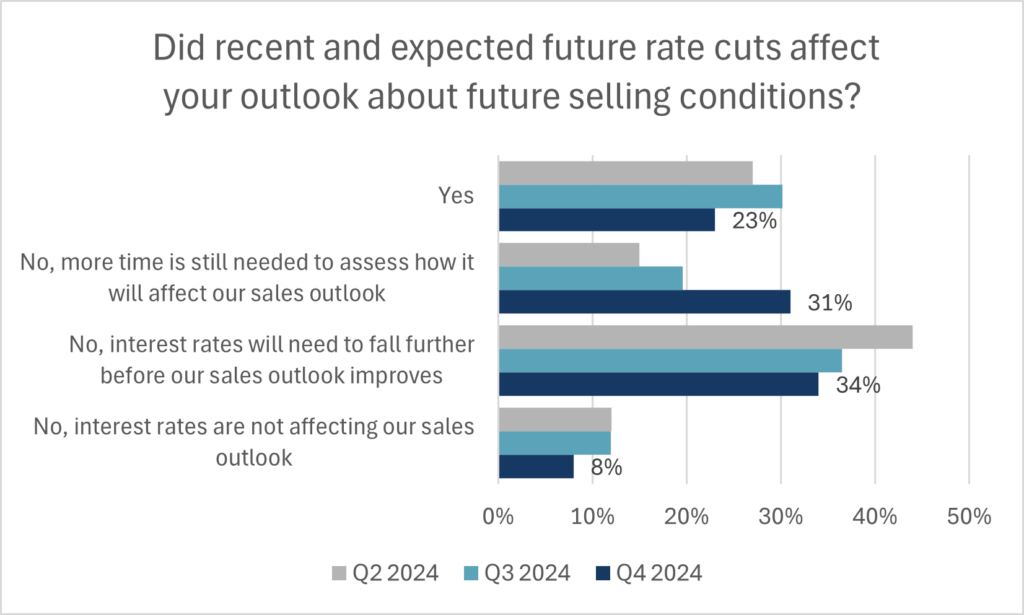

- The Bank of Canada delivered a fifth consecutive rate reduction in December, while the survey was in field, totalling 1.75 percentage points of reductions to short term interest rates since June. Builders were again asked if the BoC’s reductions influenced their expectations about future sales. 34% stated that rates need to fall further before they would it would give them reason to raise their outlook. While there was an initial drop in fixed mortgage rates in Q4 2023, average fixed mortgage rates fell about 0.8 percentage points over the second half of 2024 and kept the mortgage stress test above the default 5.25% Minimum Qualifying Rate. 31% of builders said they would need more time to assess how this impacts their outlook, as the mortgage offerings adjust with the longer-term bond yields. 23% of builders said Yes, it did improve their sales outlook, but this proportion was down from the previous two quarters.

- While national sales conditions remain weak, regional difference highlighted in builder sales sentiment will also extend to construction activity. Most builders state that the interest rates and general economic conditions are still restricting their starts to some degree. Responses from builders stating that interest rates are not restricting their construction came primarily from Prairie and Atlantic province builders, where pre-existing affordability was and continues to be more conducive to sales.

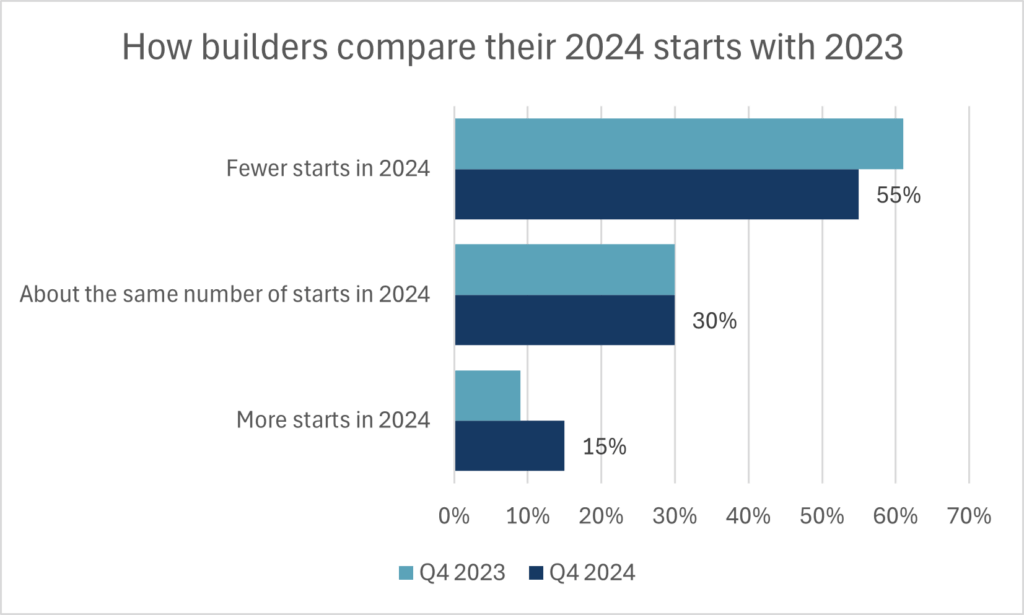

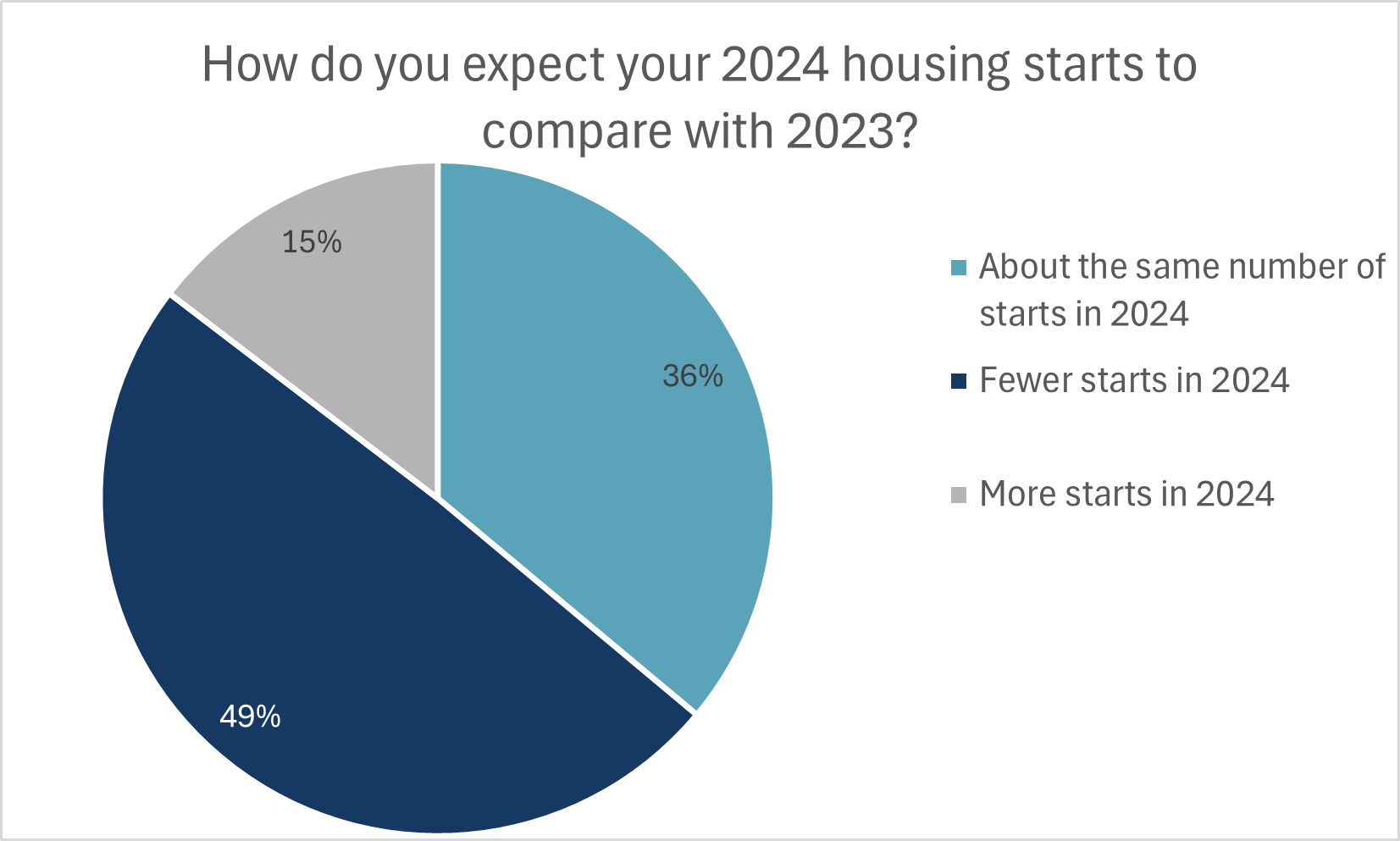

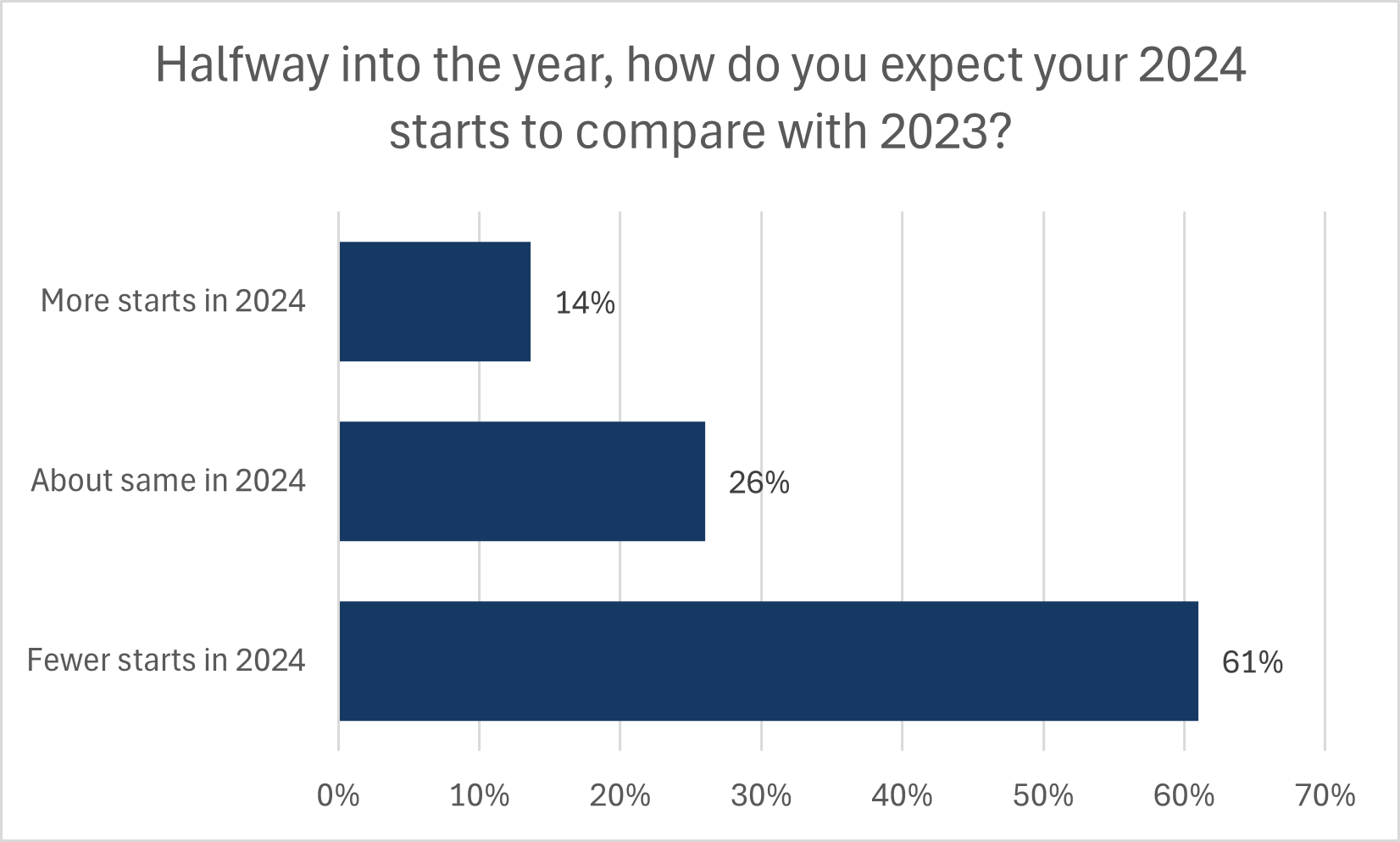

- The majority of respondents stated that they had fewer housing starts in 2024 than they did in 2023. On average these builders stated they reduced their starts by 50% relative to 2023. Note that this does not account for the magnitude of change in starts. Out of the builders that stated they had more starts in 2024, the majority were based in the Prairie Provinces.

- -To continue monitoring the escalation of construction costs, builders were asked about their non-lumber material costs relative to a year ago based on the most typical home they build. Based on the average of responses, the price increases of materials excluding lumber have added $36,000 to the cost of constructing a 2,400 square foot home, relative to the end of 2023.

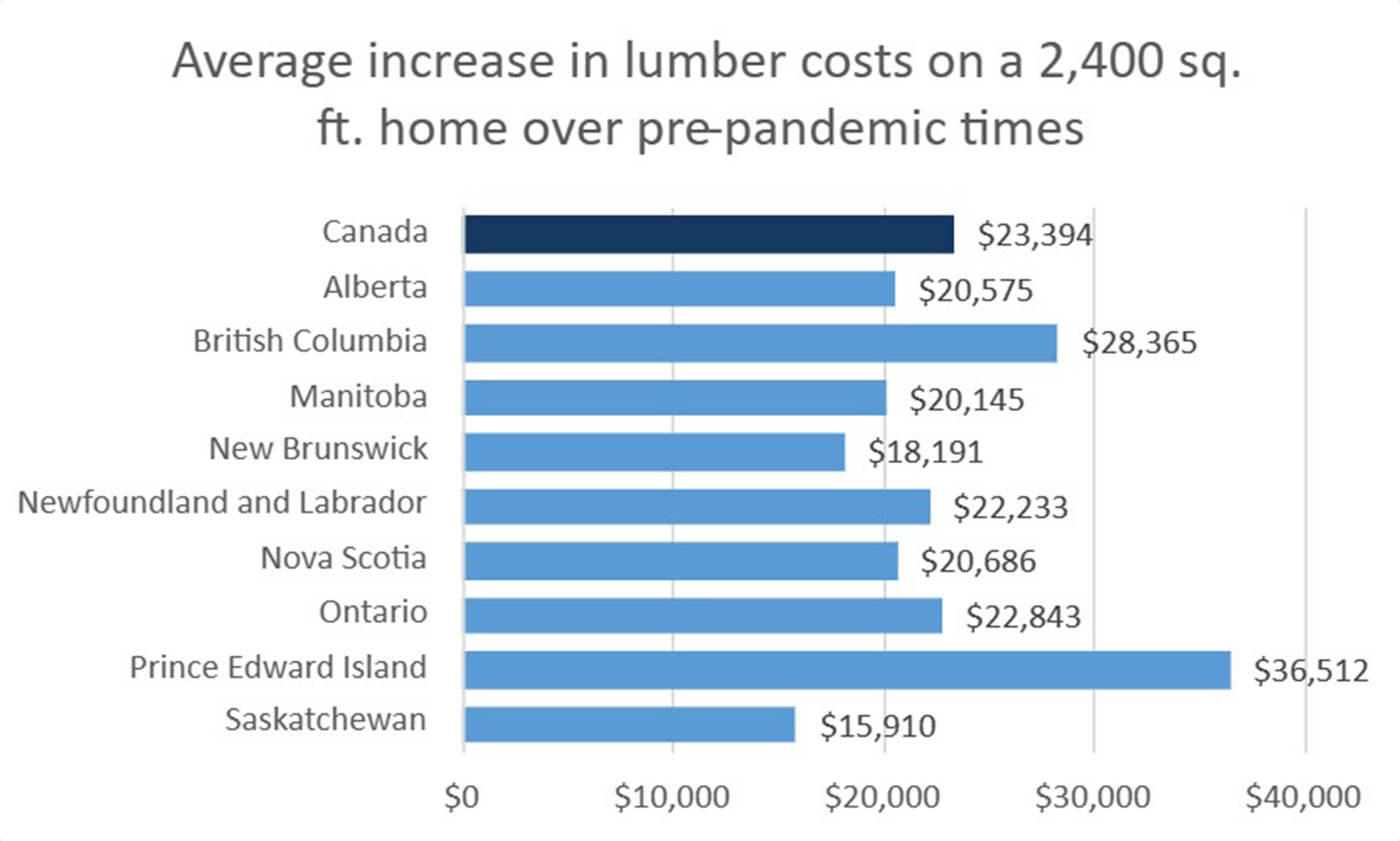

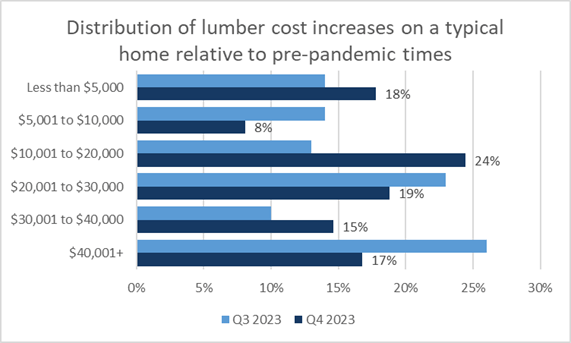

- Softwood lumber prices spiked in Q4, increasing lumber material costs by over $4,200 relative to a year ago and $30,000 since the start of 2020 to the construction cost of a 2,400 square foot home. CHBA remains engaged in policy discourse over the effect of compounding broad based tariffs on lumber and the possibility of additional lumber curtailment.

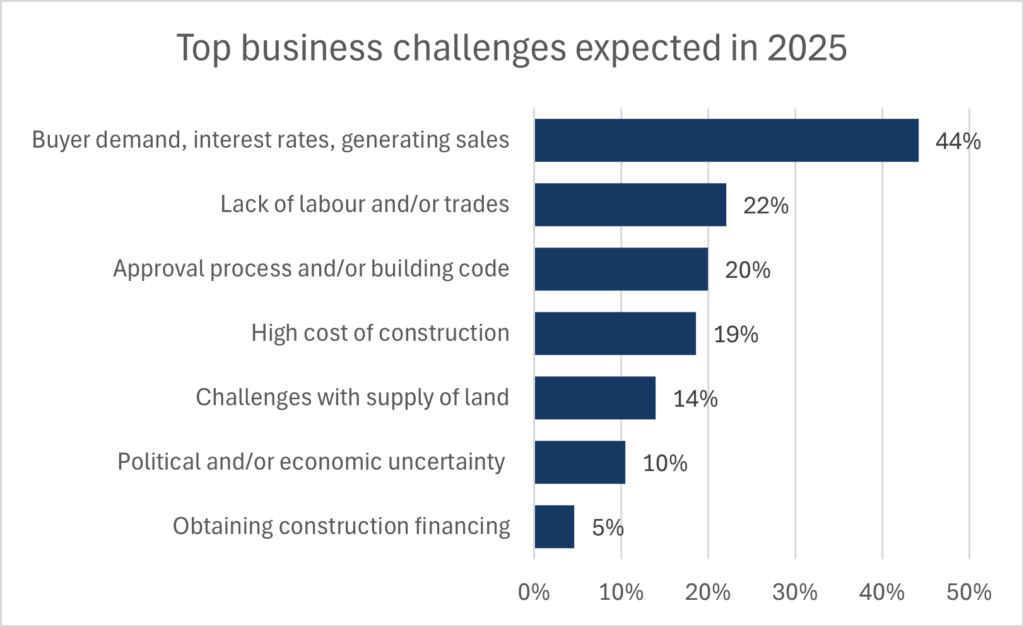

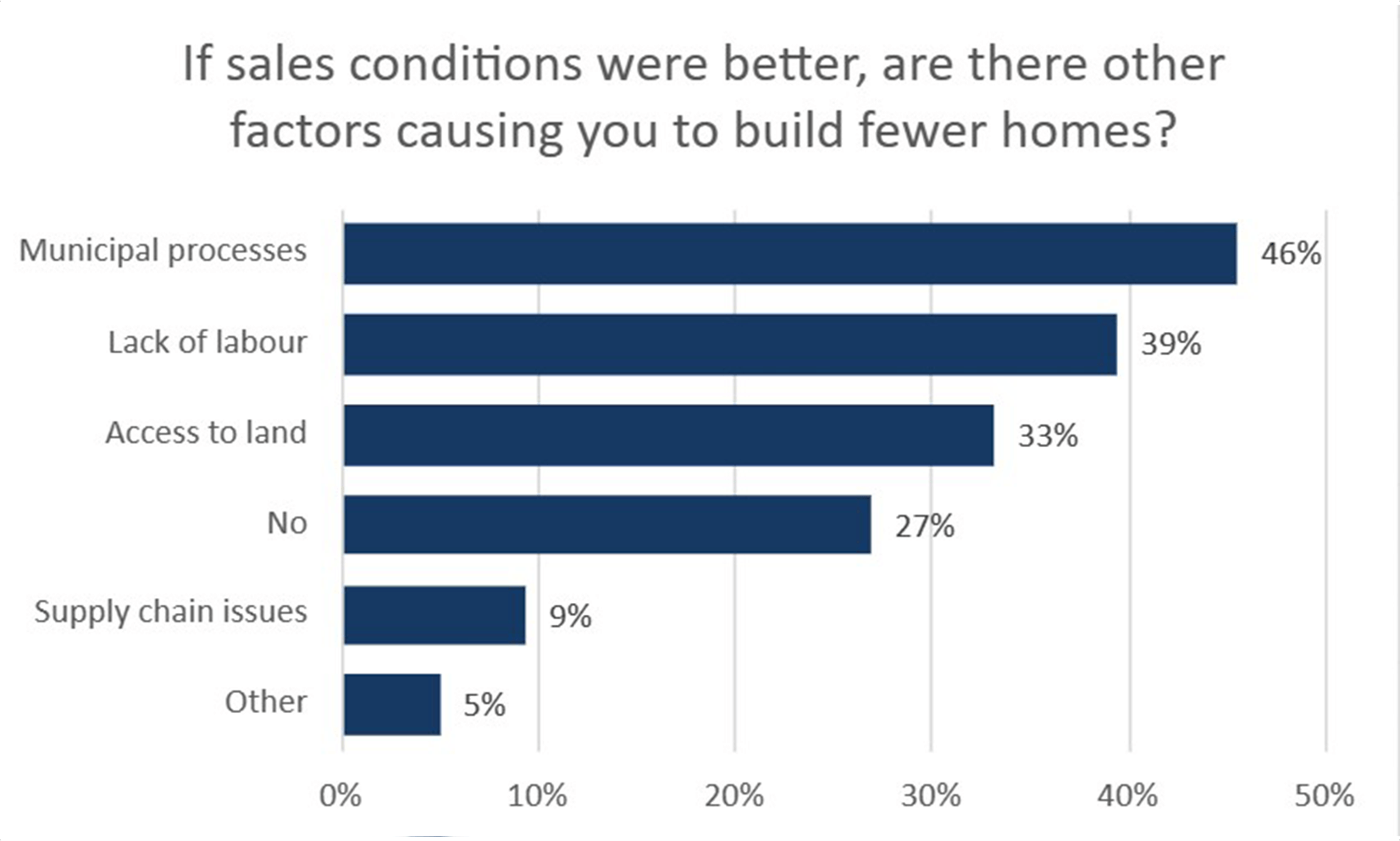

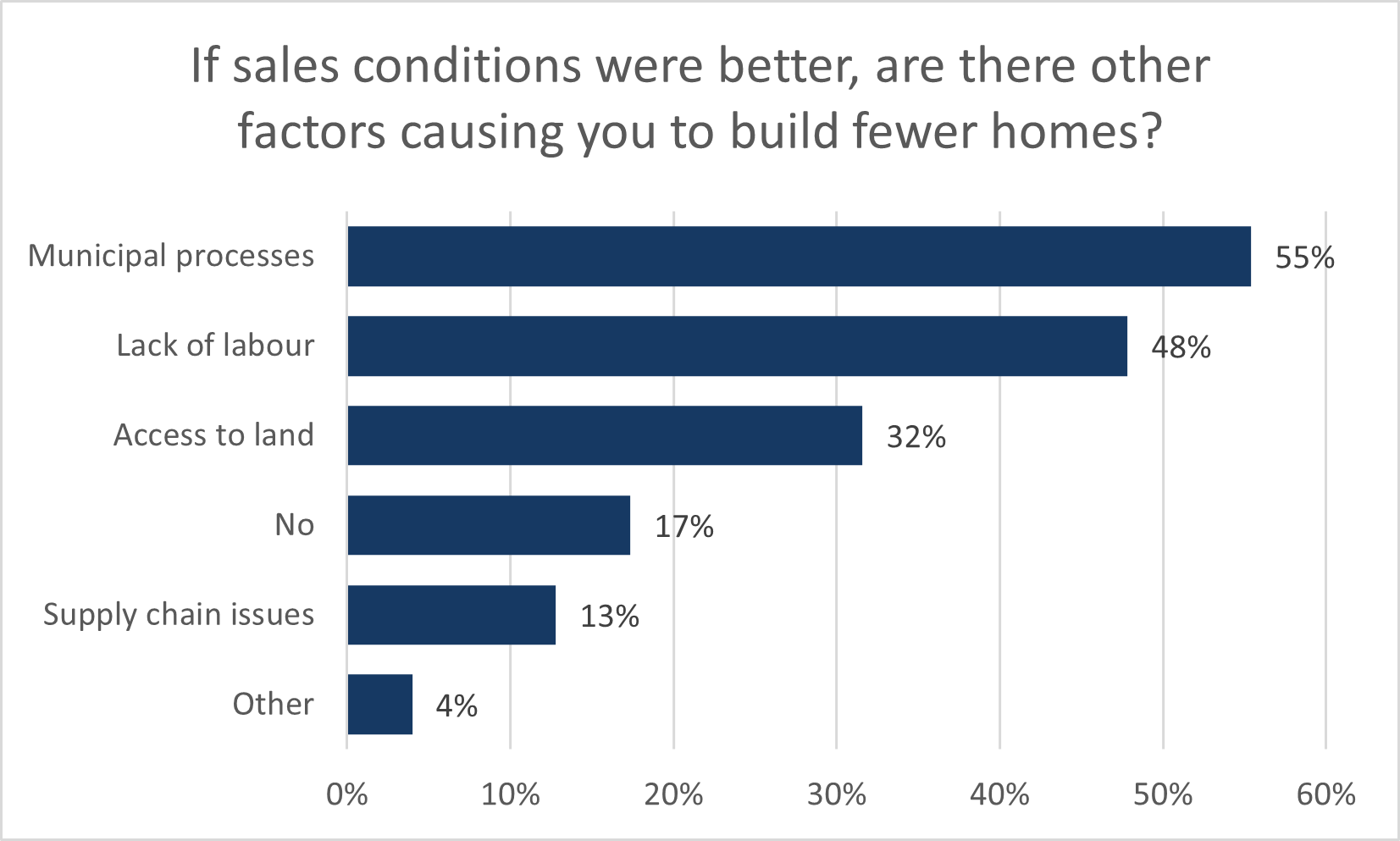

- Builders were asked, without a list to choose, what they expect the top challenge for their business will be in 2025. Comments were categorized into 7 main categories. 44% of builders stated getting their regular flow of sales back will be their top challenge. After this, there was a near-equal proportion of builders mentioning challenges of finding qualified trades, issues with the building approval process or codes changes, and their high construction costs specifically that make sales challenging. 14% of builders stated that issues with obtaining enough suitable lots or obtaining land at a viable price will be a top challenge. For reference, when asked in Q4 2023 about what the most acute issues would be if buyer demand was better, they were: municipal processes (46%), lack of labour (39%), and access to land (33%). Note: The first two issues stated were counted in cases where multiple issues were stated. Since issues related to a lack of sales remain the top issue for 2025, answers regarding the cost of construction being why they continue to expect low sales were recorded separately.

- The single-family Housing Market Index recorded 27.4 in the third quarter of 2024. This is 2.5 points lower than the previous quarter and 6.5 points lower than in Q3 of 2023. The single-family HMI has retrenched to just 1.2 points above its record low of 26.2 recorded in Q4 2022.

- Over 55% of single-family builders rated current selling conditions as Poor. This majority pushed down the present selling conditions sub-index to just 1.1 points above its all-time low recorded in Q4 2024.

- 58% of builders believe that selling conditions over the next six months will be Fair, while 25% still feel conditions will be Poor.

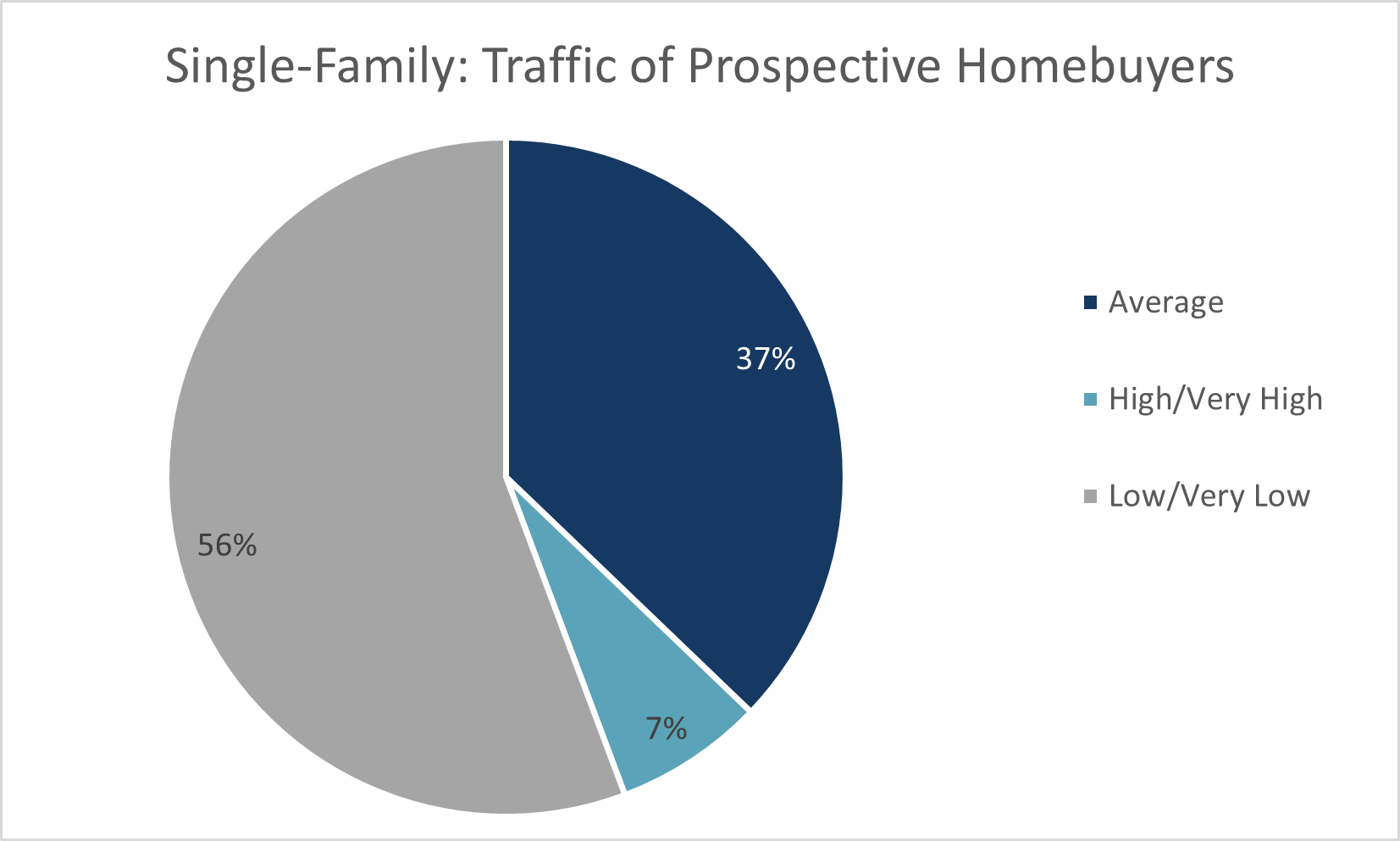

- 65% of single-family builders rated traffic through sales offices and general inquiries were Low or Very low. Furthermore, only one builder in the entire sample rated traffic conditions as High or Very High.

- The US NAHB Single-Family HMI for the third quarter averaged 40. The sentiment score in both Canada and the US has trended down by about 8 points since the first quarter of 2024. Yet Canadian builders have maintained a more pessimistic view going back to mid-2022.

- Regionally, single-family HMI in British Columbia edged down from 17.8 in Q2 2024 to 17.1, reaching a new record low for the second consecutive quarter. The HMI for Ontario builders remains terrible at 14.3 (up marginally from its its record low of 11.6 in Q2 2024) —still indicating abysmal sentiment on sales conditions. Meanwhile, sentiment in the Prairie and Atlantic provinces fell from their marginally optimistic readings to marginally pessimistic readings in the mid-40s.

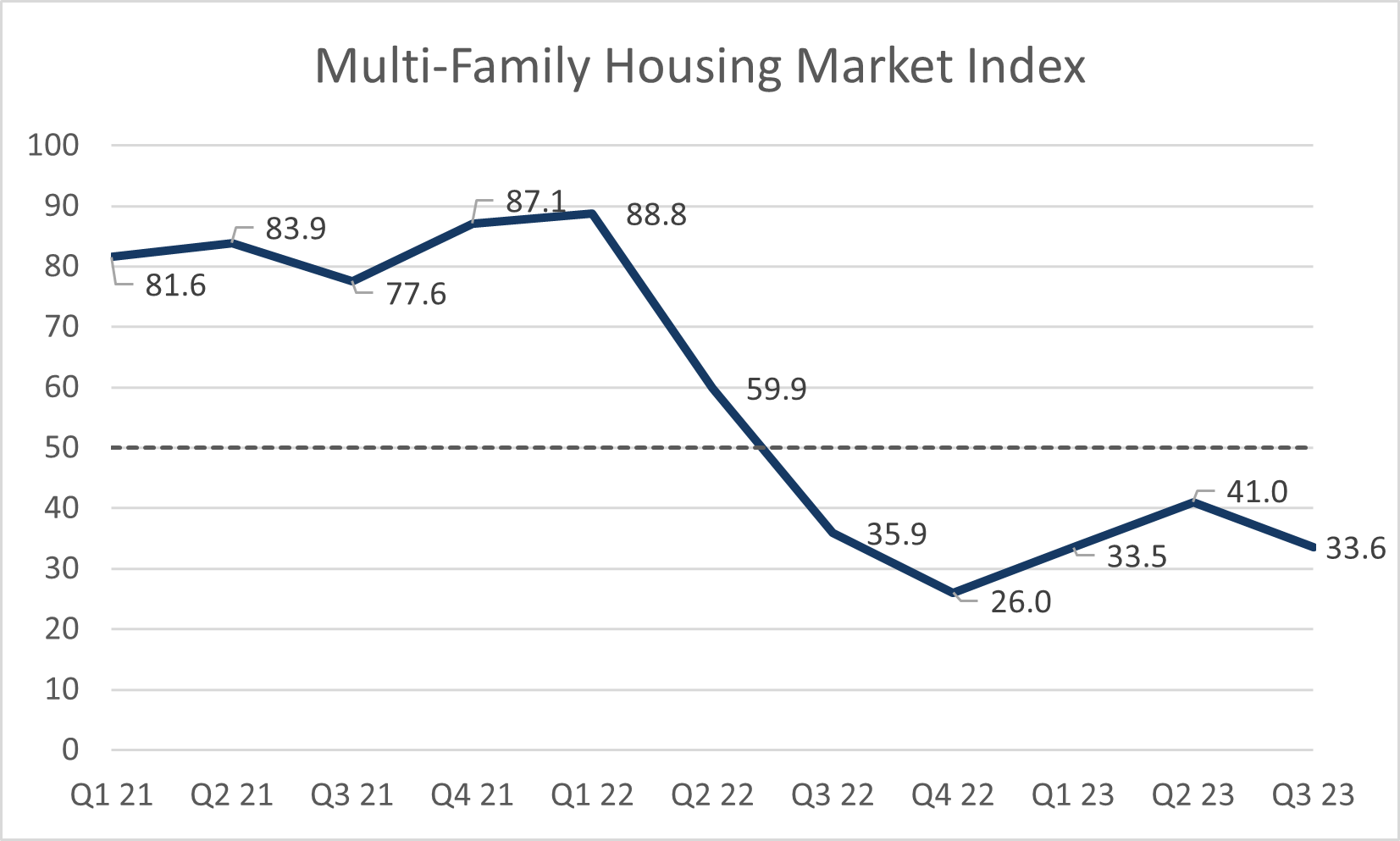

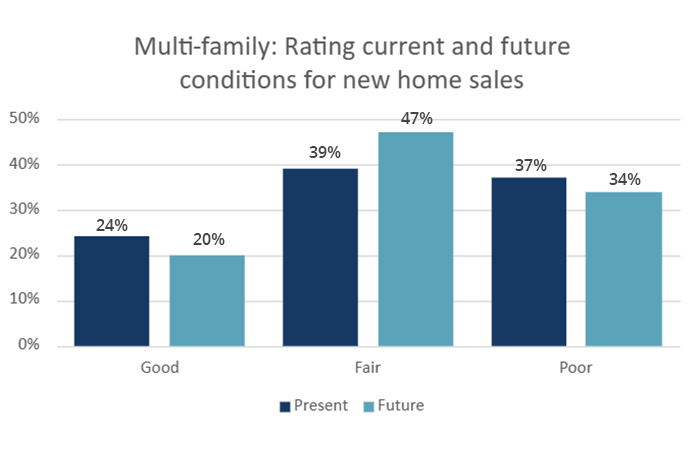

- The multi-family Housing Market Index recorded 28.5 in the third quarter of 2024. The index declined 4 points from Q2 2024 and 5.1 points from this quarter last year. This is the second lowest multi-family HMI reading on record, after it reached 26 in Q4 2022.

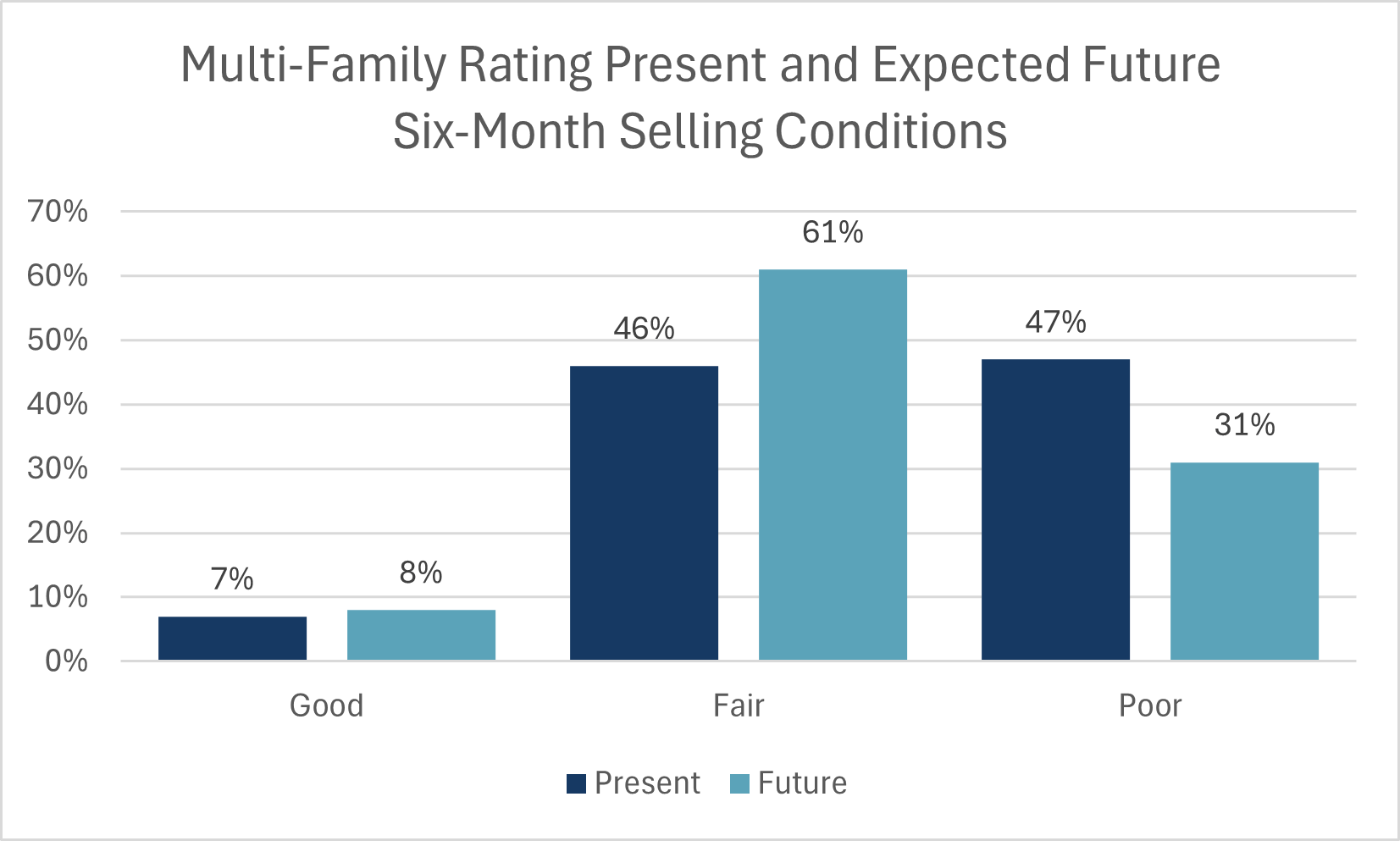

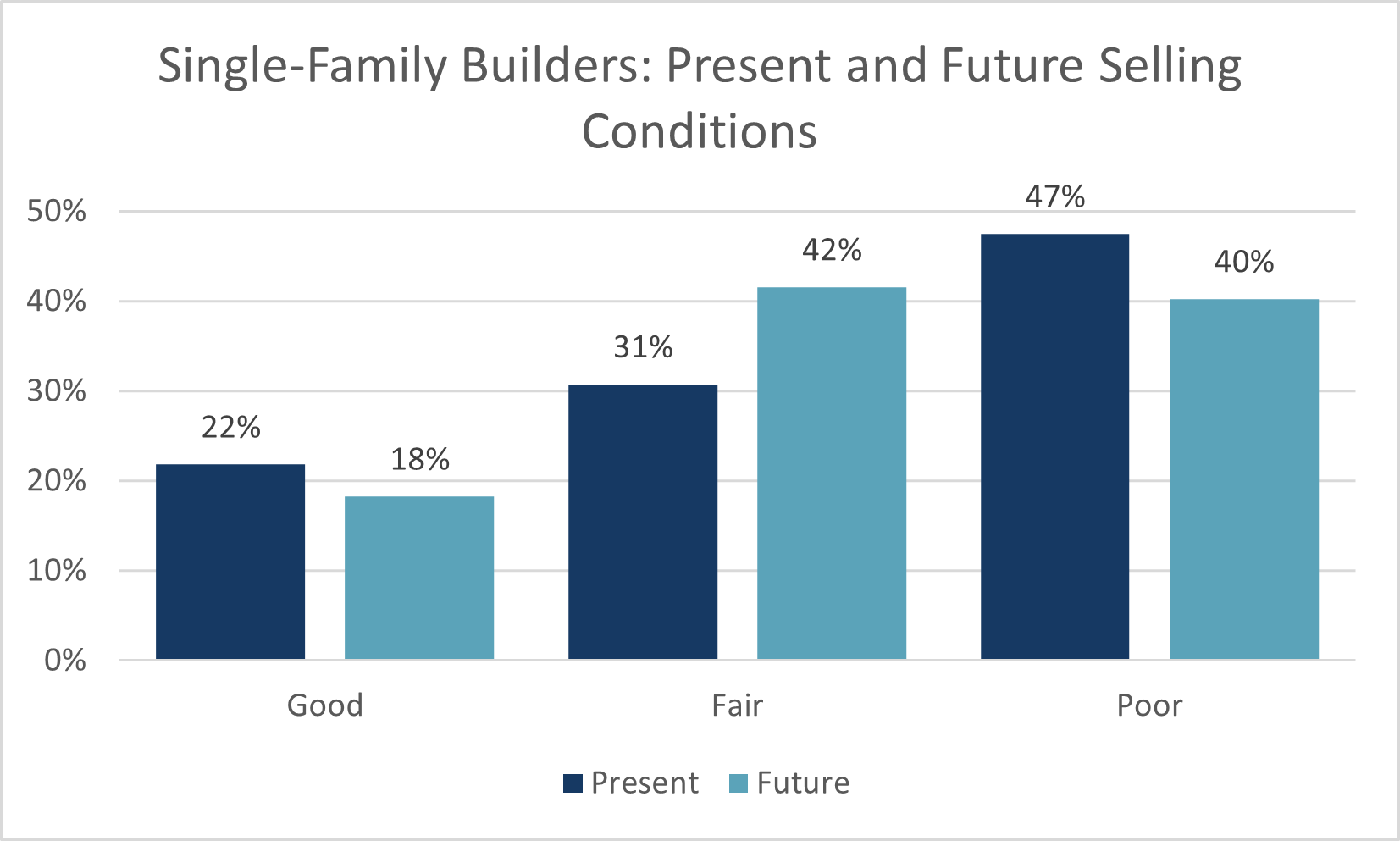

- 47% of multi-family builders rated current selling conditions as Poor and 46% rated conditions as Fair. For the first time, the proportion of builders rating conditions as Good was in the single digits

- 61% of builders rated their expectations for selling conditions over the next six months as Fair. Concerningly, this sub-index has softened in the last two quarters.

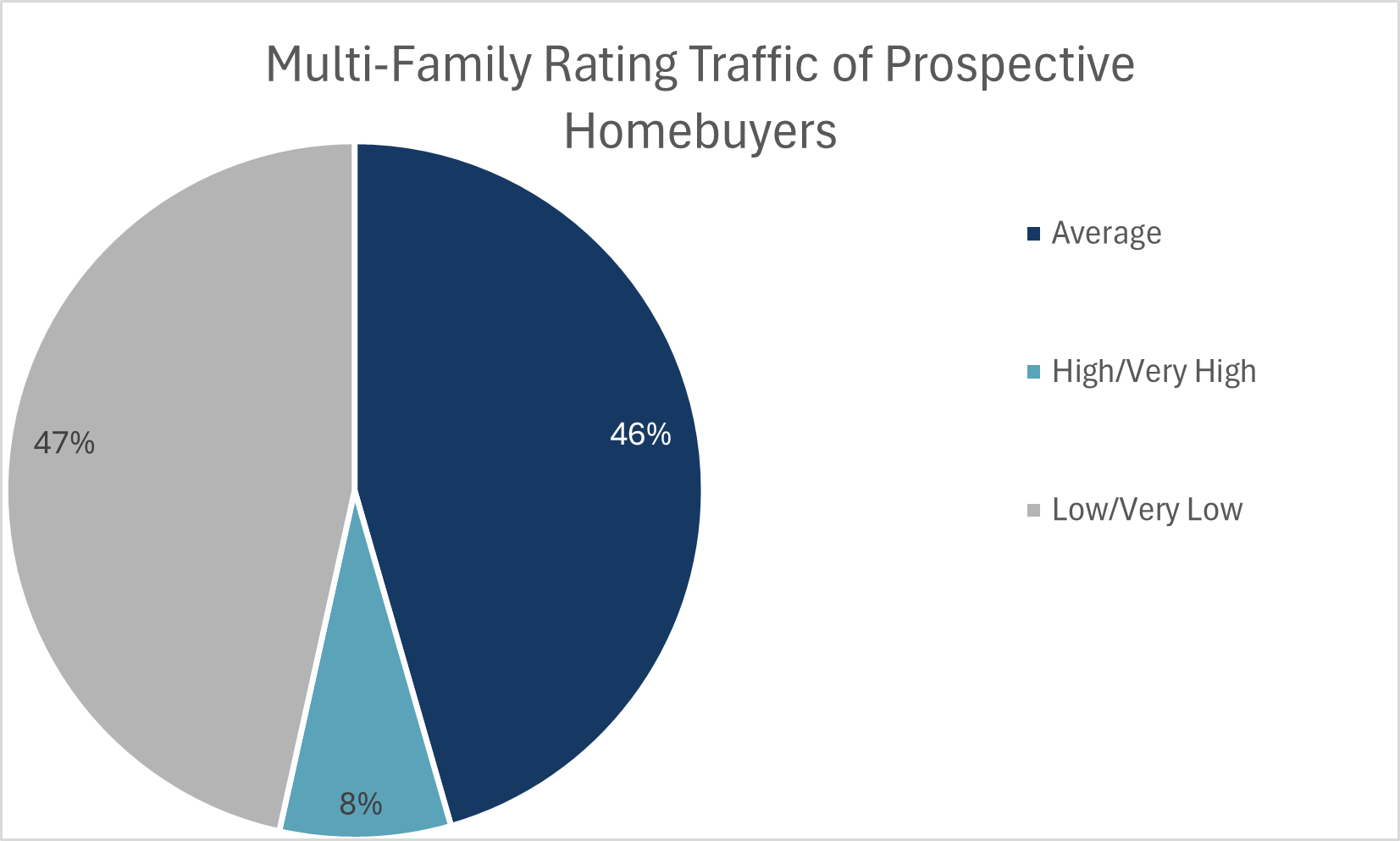

- 57% of builders noted that sales office traffic and inquiries were Low or Very Low. Similar to the single-family HMI, just one builder across the country rated traffic as High or Very High.

- Ontario continued to report lowest sentiment out of the four regions CHBA tracks, with a regional HMI of 12.5, nearly as bad as the record low of 11.6 recorded in the previous quarter. The Multi-family HMI in British Columbia was 29.3, a new record low for the province. Meanwhile, the multi-family HMI in the Prairie provinces was 64.3 in the third quarter, it is down from a score of 73.2 in the previous quarter.

.png)

The results from these questions allow CHBA to better understand what is driving change in builder sentiment as well as monitor current industry issues.

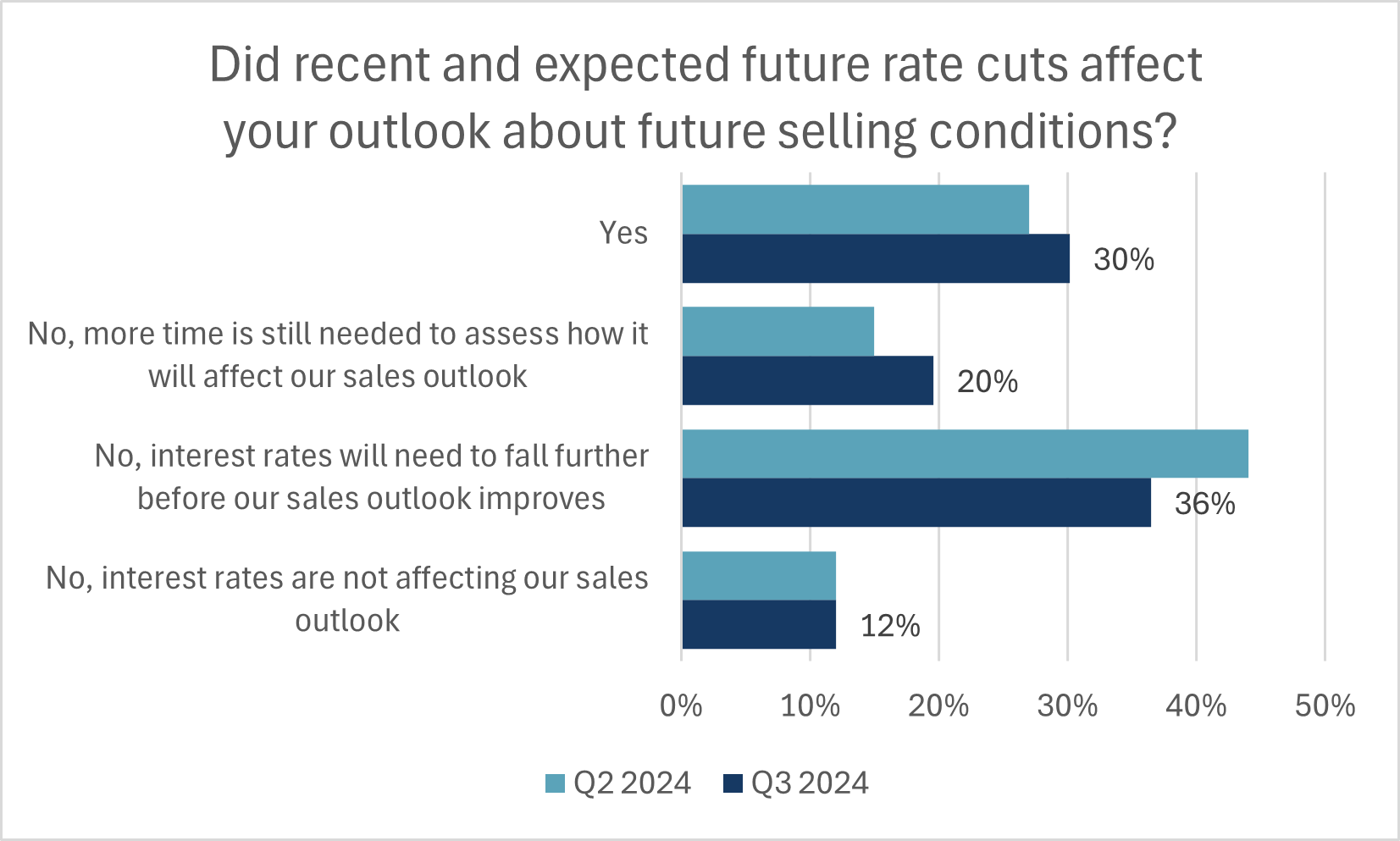

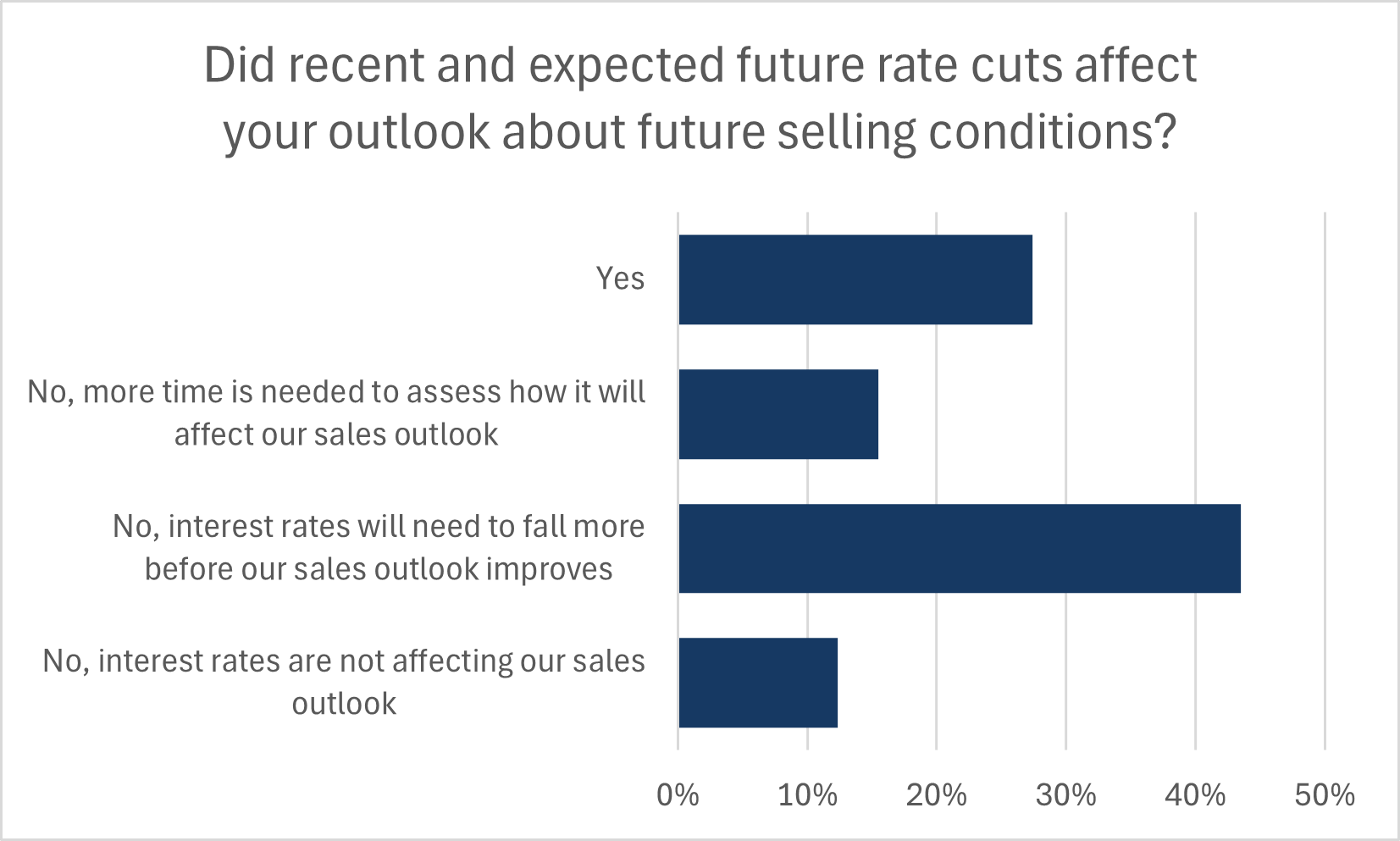

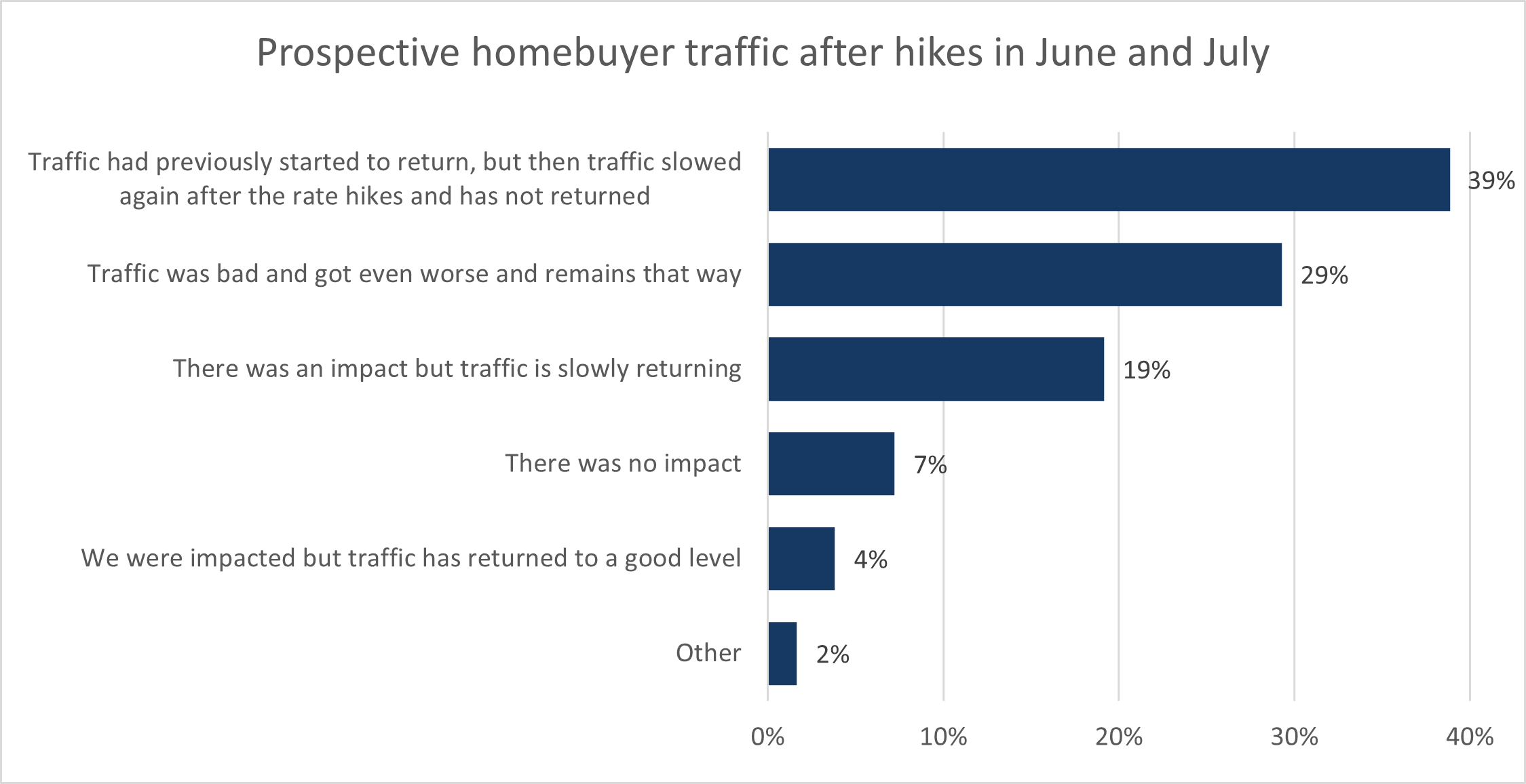

- The Bank of Canada cut its policy rate two additional times in the third quarter. Builders were again asked if these cuts, along with expectations for future rate cuts, materially influenced their view on future sales conditions. 30 percent said it did. But as with the previous quarter, the largest share of builders, at 36%, stated that it did not and that rate will need to fall further, with another 20 percent saying more time is needed to assess impactds on their outlook. Given that most mortgage originations remain fixed-rate, which are slower to adjust, and that mortgage rates still face issues with the stress test, it is not surprising that the marjority of builders remain dubious.

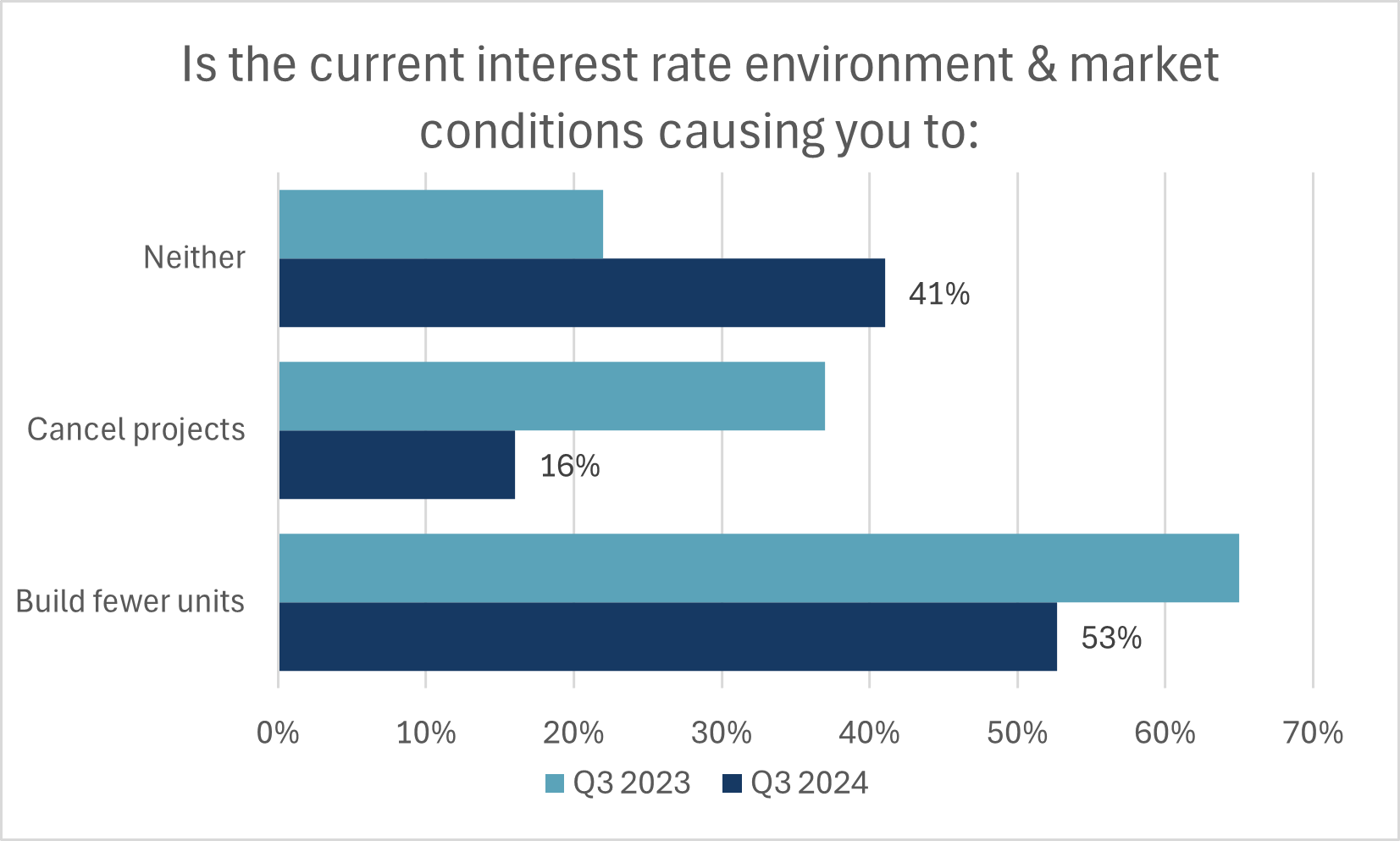

- While sales conditions across the country remains weak, regional variations in sales strength have emerged. This has reduced the proportion of builders reporting that the current interest rate environment is hampering their operations relative to a year ago, but is regional – regions with better affordability are seeing a greater impact of lower interest rates, while more expensive markets are finding slightly lower interest rates are insufficient to create a turnaround. Overall, the majority of builders continue to state that the rates for builders and homebuyers are reducing their quantity of starts. Note that this question does not measure the magnitude of the interest rate impact on starts.

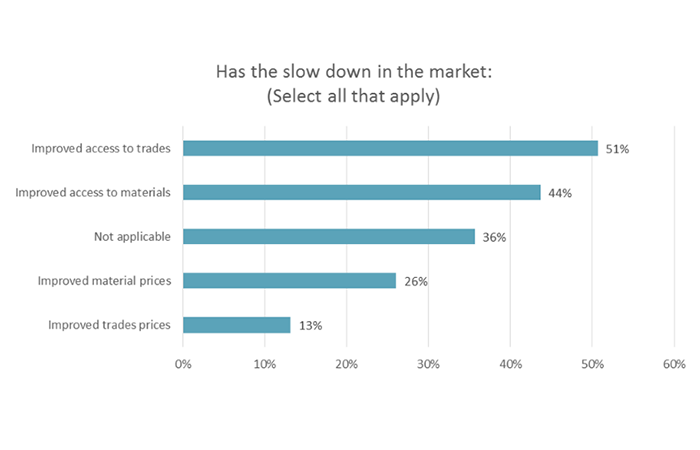

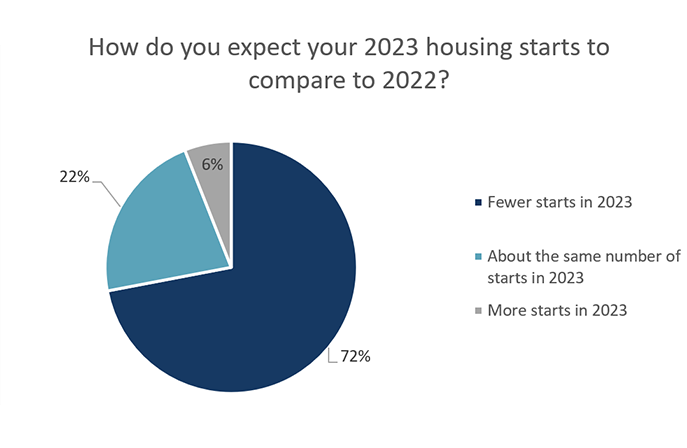

- Half of builders continue to expect to have fewer starts this year compared to 2023. Of particular concern is that this group contains many small and medium sized builders who report they will have far fewer starts this year. On average this group expects to have 52% fewer starts relative to 2023. 36% of builders expect starts to be about the same, while on 15% expect higher starts. Some builders did comment that they are hopeful for a better 2025 spring selling season, which will lead to starts in late 2025 or the following year.

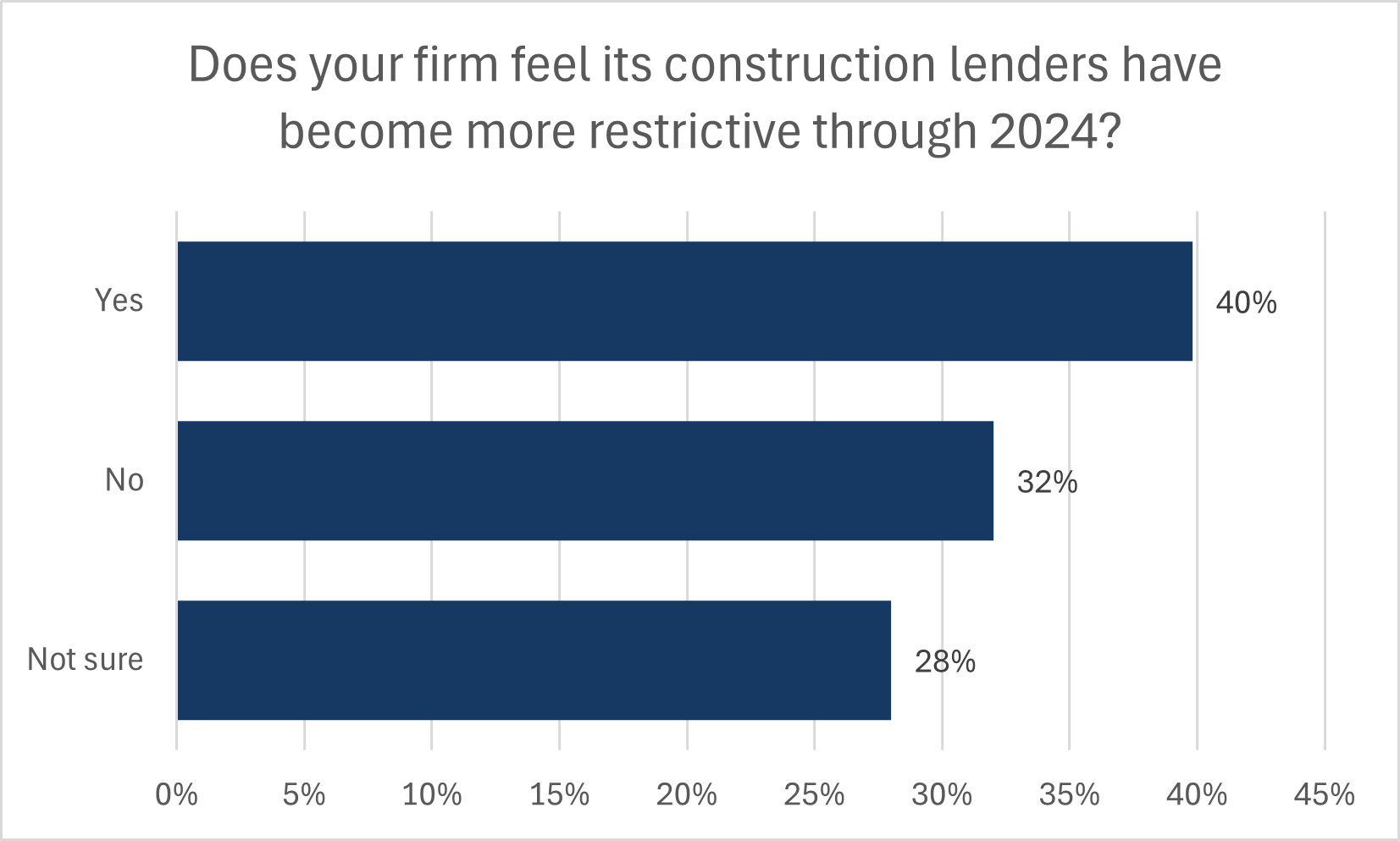

- While credit conditions have broadly eased with policy rate cuts, it is less clear for builders accessing loans for construction. 40% said it is more difficult to work with lenders in 2024, a function of other tightening in lending practice. This is attributable to difficulties in meeting lenders’ pre-construction sales requirements, changes to CHMC multi-family insurance offerings, and appraisers more closely monitoring values of the project. Several builders that were not sure about credit access conditions stated because they have not needed funding this year.

- The extended period of weak sales, along with year-old enhanced rental GST rebate incentive, builders were asked if they are or are considering pivoting to constructing rental units. 22% of builders said that the state of new home sales has led them to develop or actively consider developing rental units. A further 16% stated that this is informally under consideration. CHBA will monitor this trend in future HMI surveys.

- While past surveys have illustrated that trades access and prices have stabilized relative to their challenges in recent years, the underlying labour shortage in residential construction remains. 42% of builders state they have not laid off workers, partly due to the difficulty in finding a replacement at a time when local market conditions improve. The results of this question were in line with findings from the third quarter survey in 2023.

- The average increase of non-lumber materials cost relative to this time last year, as reported by surveyed builders, added an additional $35,270 to the cost of a square foot detached home. Factory gate softwood lumber prices have declined over 2% from a year ago, but this still leaves the lumber cost for the same 2,400 square foot home at over $26,000 more than it was pre-pandemic. Normal rates of inflation for building materials continues to compound the accelerated cost increases from the years prior, further eroding affordability.

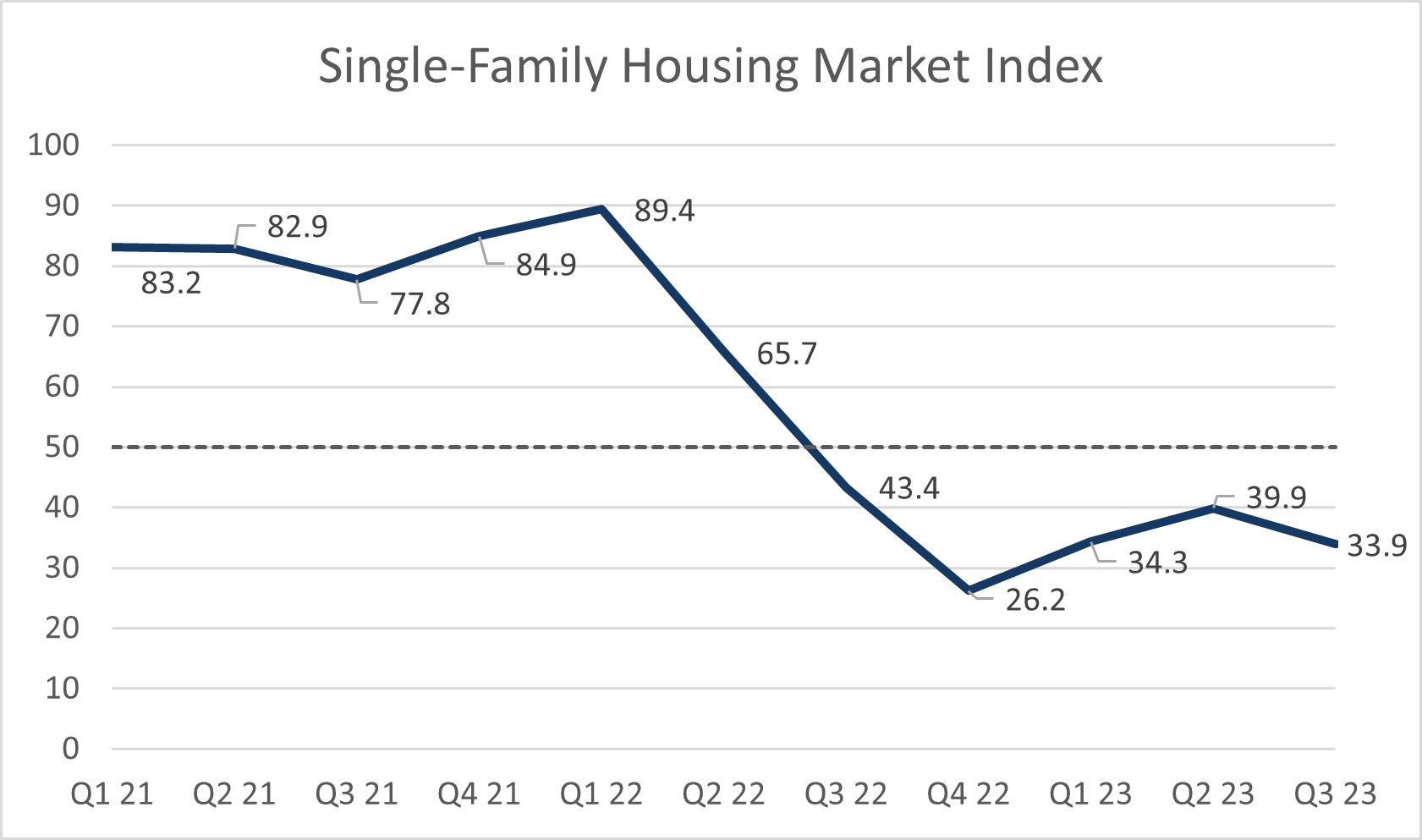

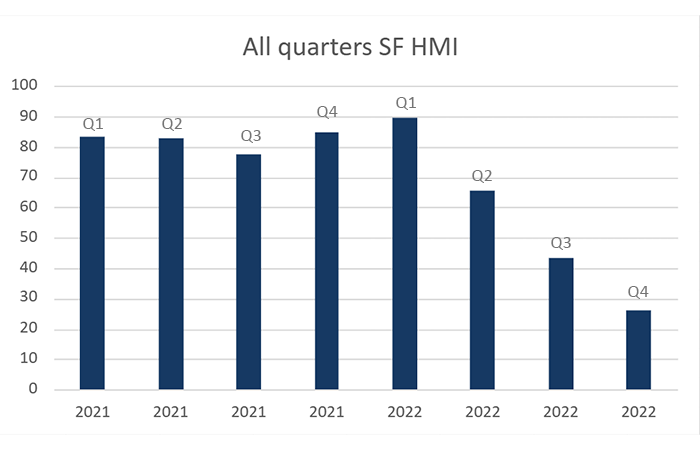

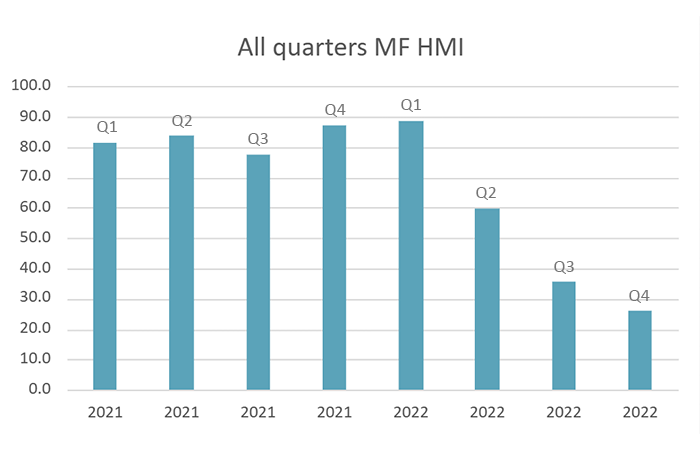

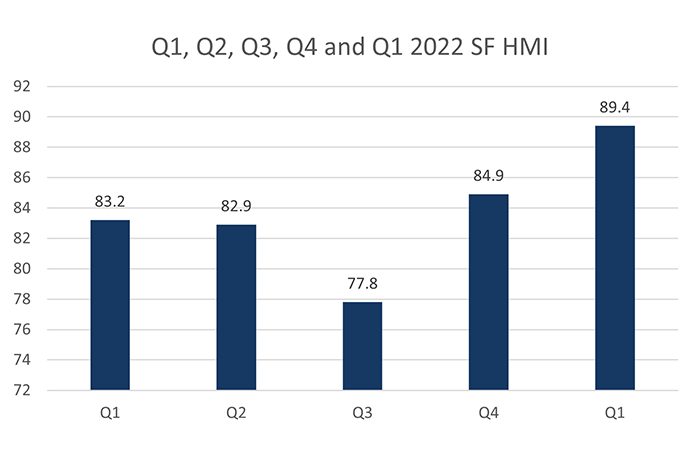

- The CHBA Single-Family Housing Market Index (HMI) continued to reflect builders’ broadly pessimistic views on new home selling conditions, registering a score of 29.9 in the second quarter of 2024. This score is 5 points lower than in the first quarter of 2024 and 10 points lower than in same quarter of 2023. This latest reading is close to the record low of 24.6, in the fourth quarter of 2023. By comparison, the record high was at 89.4 in Q1 2022, when interest rates were still extremely low and before the rate hikes began.

- Since the final quarter of 2022, there are different regional trends in selling conditions sentiment that have emerged. Sentiment held by Ontario and BC have continued their downward trajectory and the single-family HMI in both provinces hit their lowest level ever in Q2 2024 (11.6 in Ontario and 17.8 in BC).

- Over the same 18-month period, sentiment across the aggregated prairie provinces has trended up and breached the neutral sentiment mark of 50 for the first time since Q2 2022. Meanwhile, builder sentiment in the Atlantic provinces has held steady and is modestly positive.

- In the US, the NAHB/Well Fargo single family HMI averaged a score of 46.3 in the second quarter. This sentiment was also down from both a quarter ago and a year ago, albeit not as much as the declines seen in Canada. This is reflected in healthier housing starts in the US versus Canada.

- The present-sales sub-index fell once again, as the majority of builders rated conditions as Poor. With costs continuing to pressure selling prices, the builders experienced another challenging spring sales season. In Ontario, there were no builders that characterized current sales as Good.

- Builders continue to hope for more normal conditions in the future, based on the expected future selling conditions sub-index. 48% of builders rated future selling conditions as Fair. This proportion has roughly held steady over the past year, and points to expectations of falling interest rates and hope that policy changes will come into effect to help conditions.

- Single-family sales traffic remained the weakest sub-index, with 60% of builders rating traffic sales and/or inquiries Low or Very Low. This suggests builders experienced an even slower important spring season relative to the same time last year.

- The second quarter multi-family housing market index was 32.5 – firmly downbeat selling conditions. The index fell 5.4 points relative to the previous quarter and 8.5 points relative to the same quarter a year ago.

- Regional results were similar to the findings of the single-family index. Overall sentiment is at survey record lows in Ontario (11.6) and British Columbia (32.5), with the overall index lifted by sentiment in the prairie provinces, which has remained above 50 for five consecutive quarters.

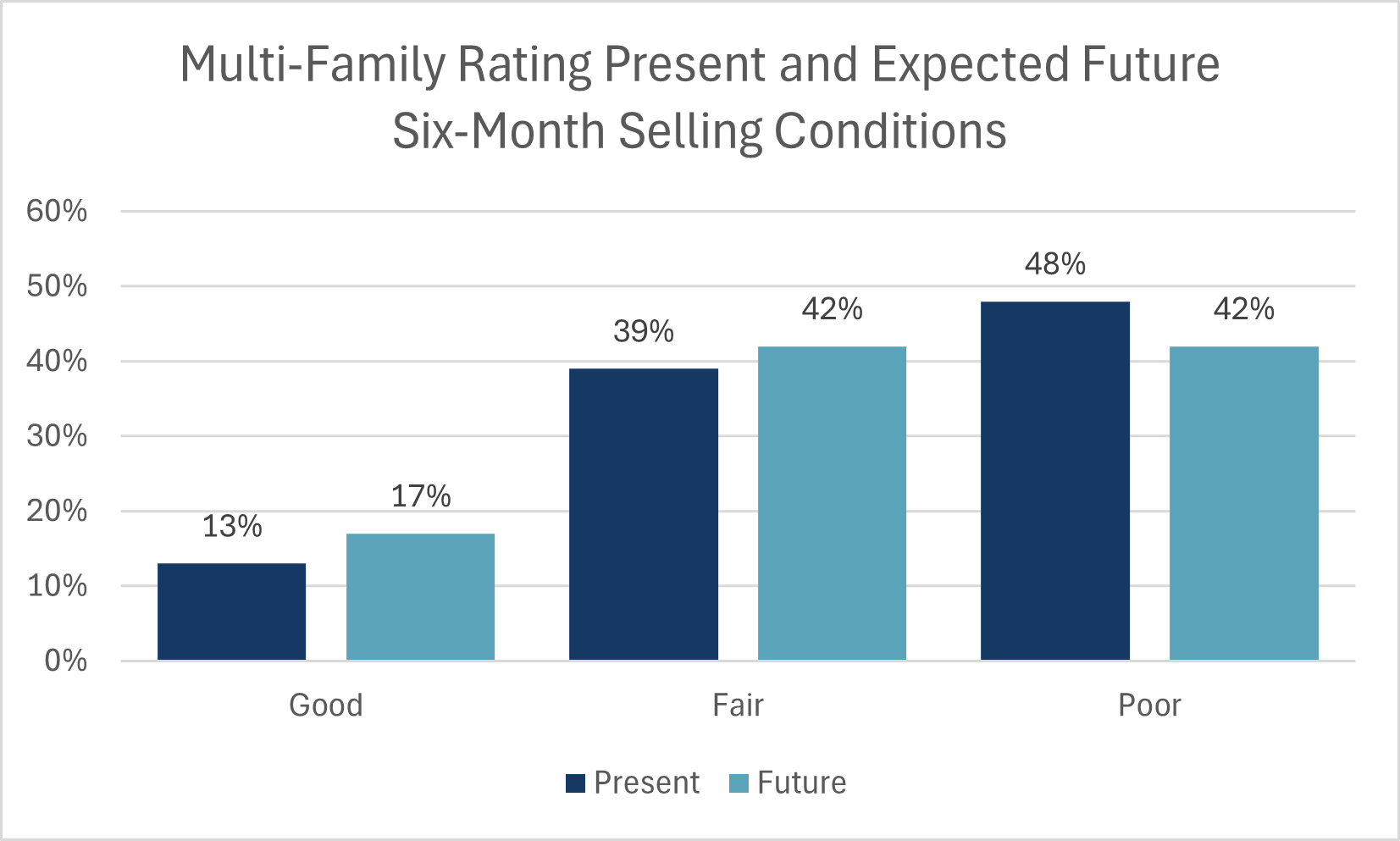

- The present sales sub-index remained pessimistic, with 48% of builders rating it as Poor. This proportion was a 10-percentage-point increase over both the last quarter and the result from the Q2 2023 survey, underscoring the slow sales conditions. Only 13% of builders gave present conditions a rating of Good, and this small proportion has held steady for four consecutive quarters.

- The expectations for future sales sub-index showed that 42% of builders expect Fair conditions, and an equal proportion rated their outlook as Poor. Notably, the proportion rating a poor outlook rose by 24 percentage points over the previous quarter.

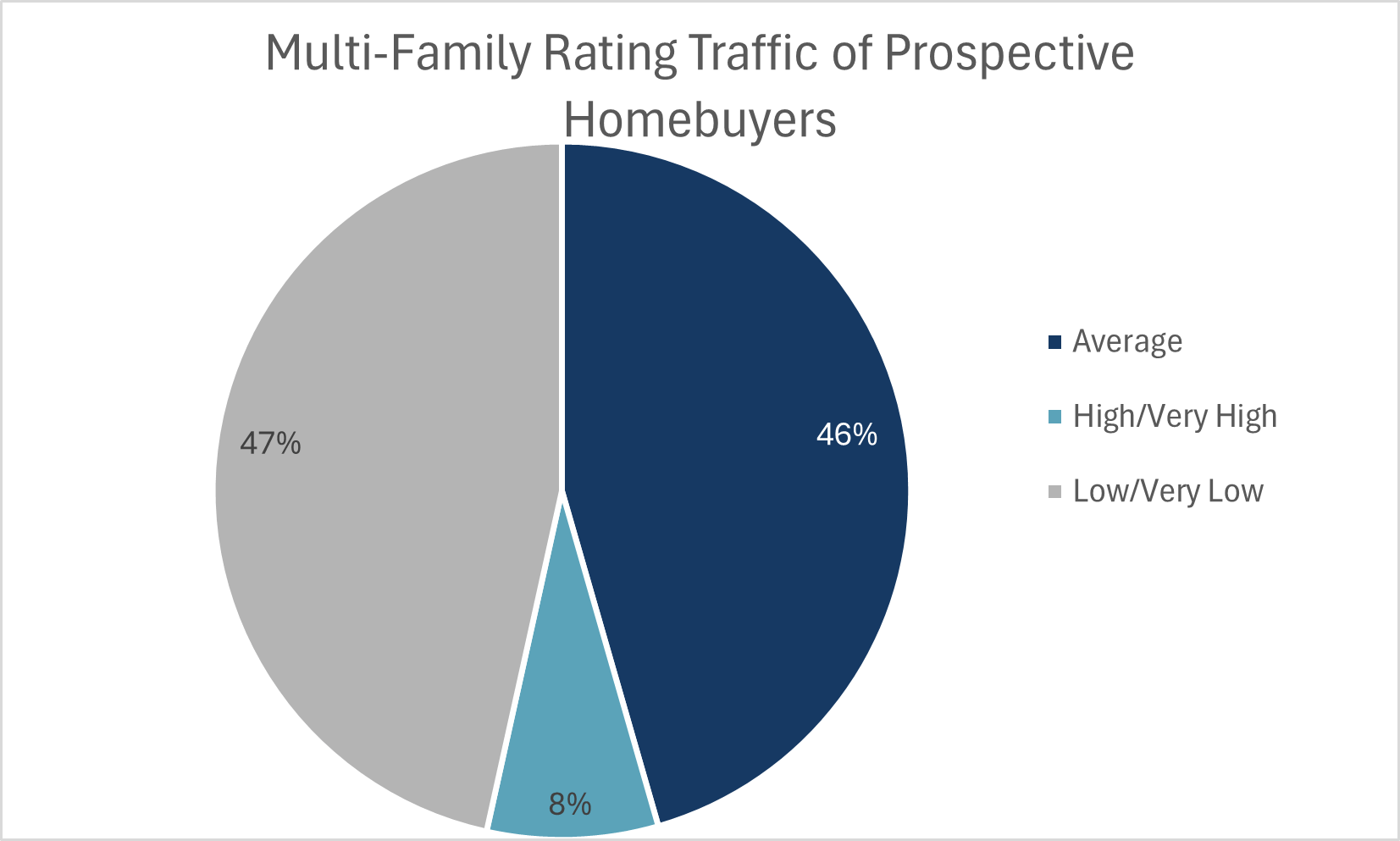

- The sales office traffic sub-index was the lowest of the three. Only single-digit proportions of builders reported traffic levels of High or Very High, which has remained consistent over the past year.

The results from these questions allow CHBA to better understand what is driving change in builder sentiment as well as monitor current industry issues.

- Builders were asked if June’s 25-basis point lowering of the Bank of Canada’s policy rate affected their answer regarding their outlook on future sales over the next six months. 44% of builders said that rates will need to fall further before they adjust how they rate their outlook on sales conditions over the next six months. 27% stated that the cut did affect their outlook, likely related to how it increased confidence if there are additional rate reductions in the months ahead.

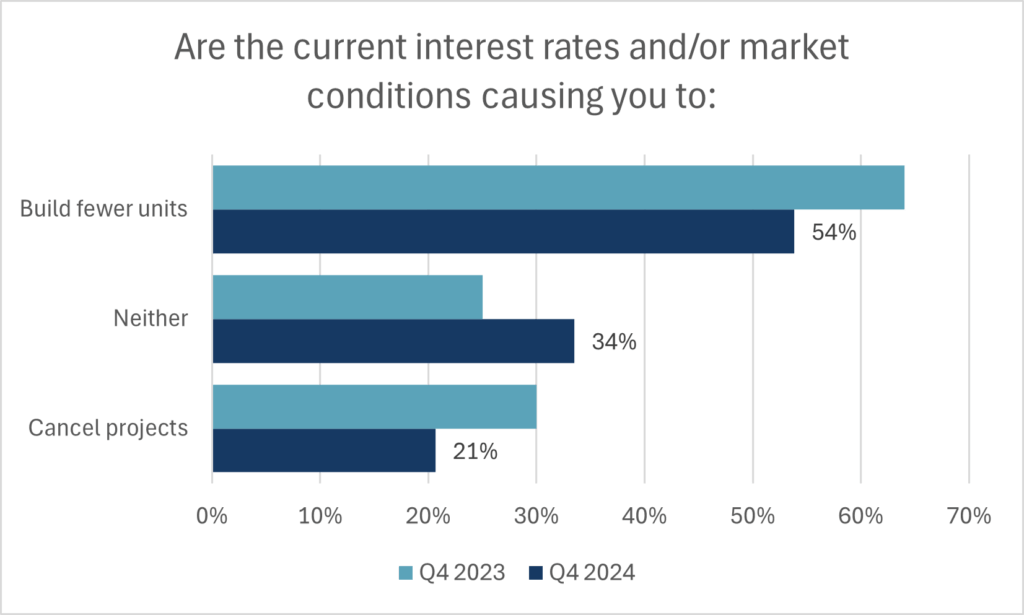

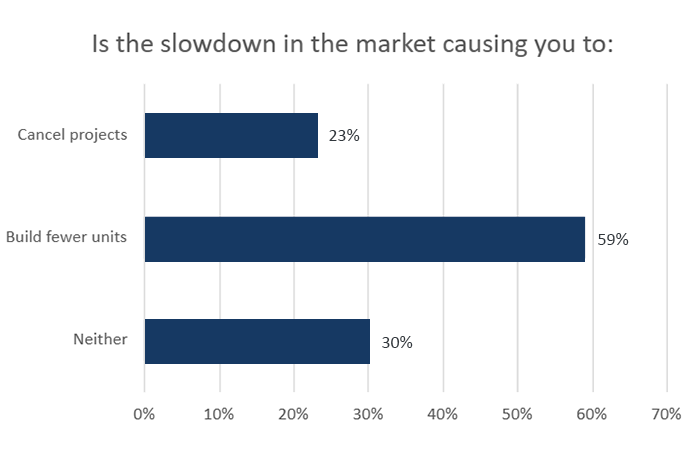

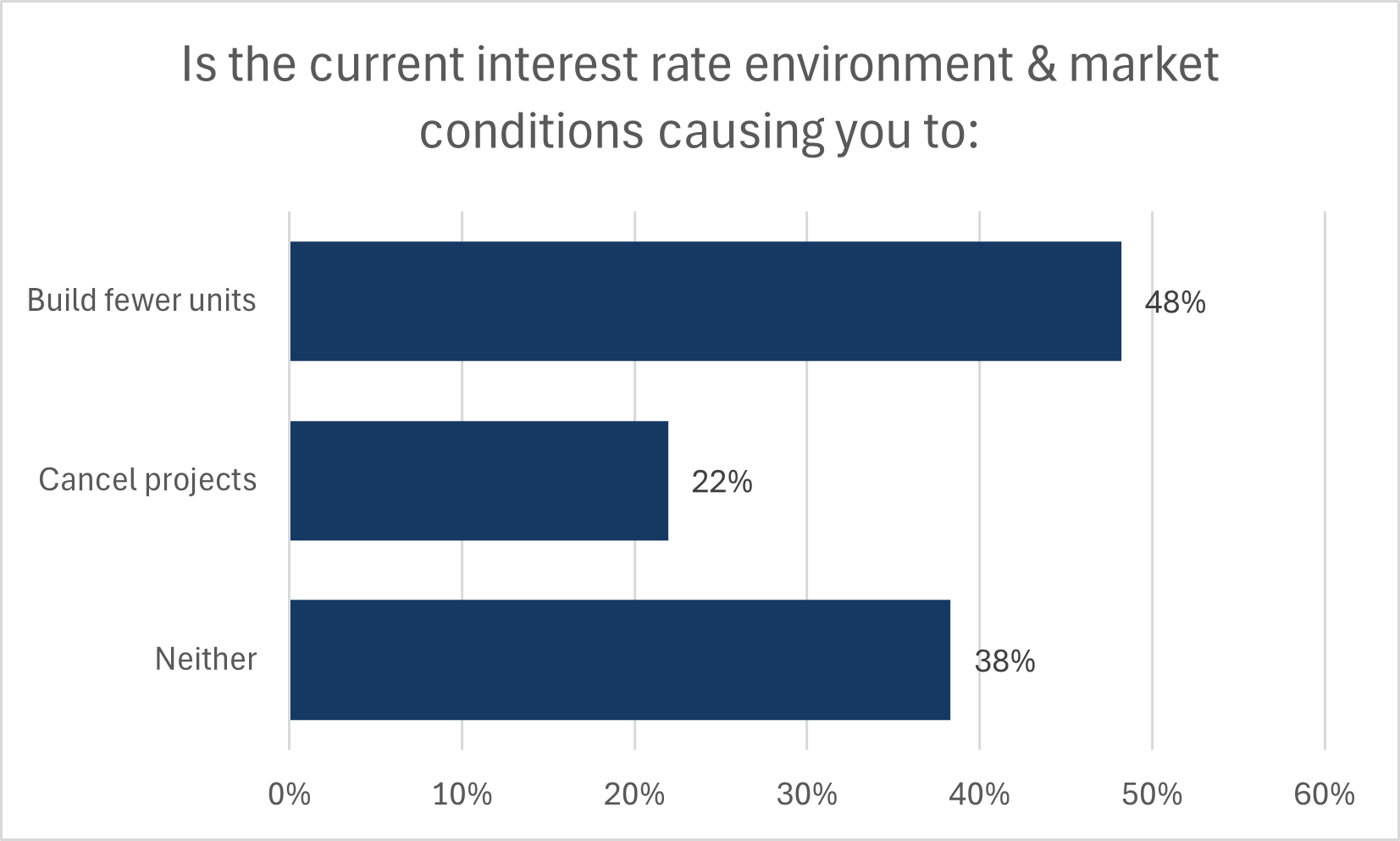

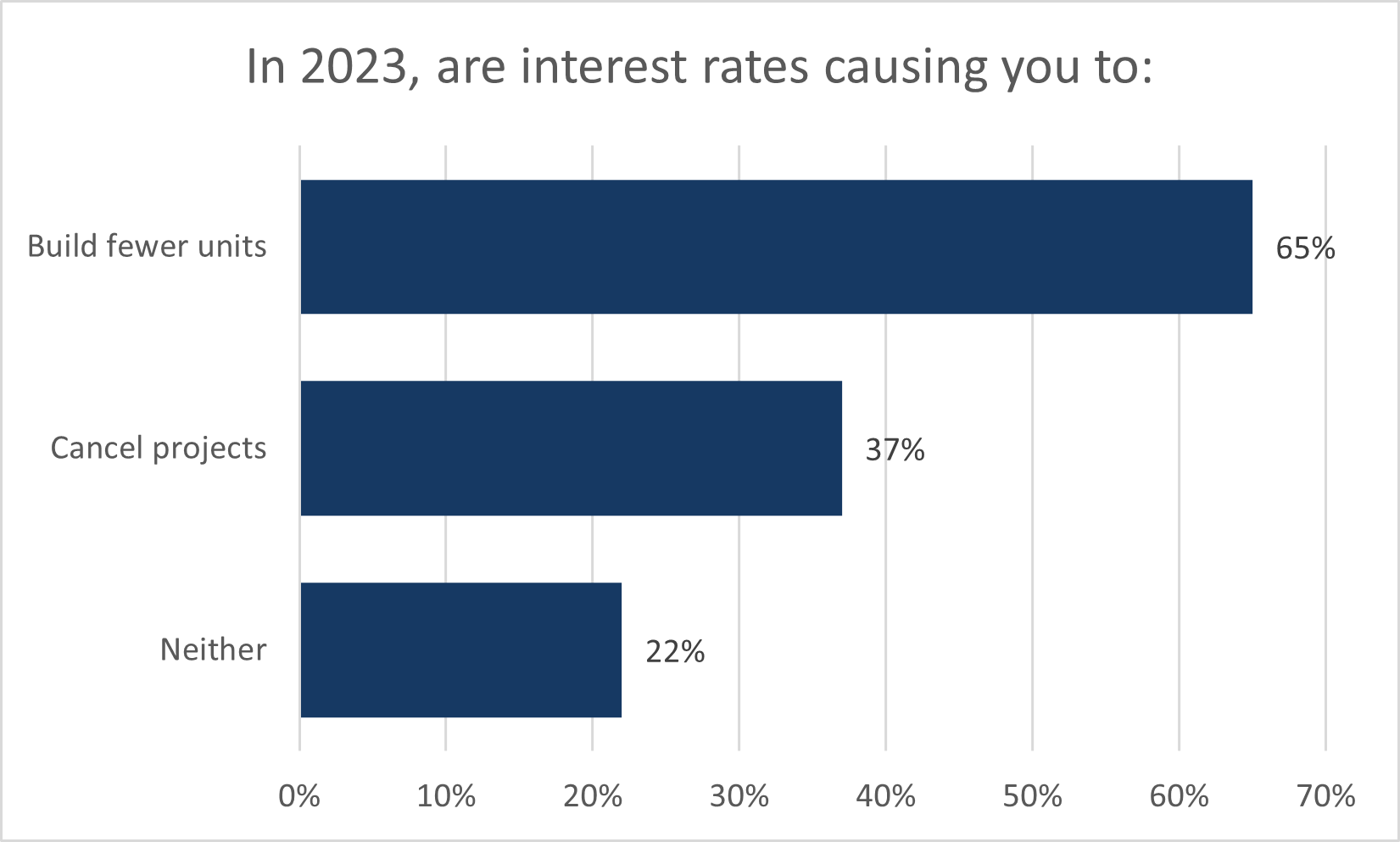

- With the majority of builders believing that further rate reductions and/or more time is needed to normalize the level of well qualified demand, builders also reported that their construction activity continues to be hampered. 48% stated that they are building fewer units than they otherwise would have as a result of demand reduction attributable to challenges with mortgage qualification. 22% have stated that the lack of sales have led to the cancellation of projects.

- Builders were again asked how they expect 2024 housing starts will compare against their starts in 2023. 61% of respondents expect to have fewer starts. This group of builders on average believed that their number of starts will fall 50% relative to 2023. Several small- and medium-sized builders in BC and Ontario believe that their starts will fall by 80 percent or more. Only 26% of builders felt they would maintain a similar level of starts as last year.

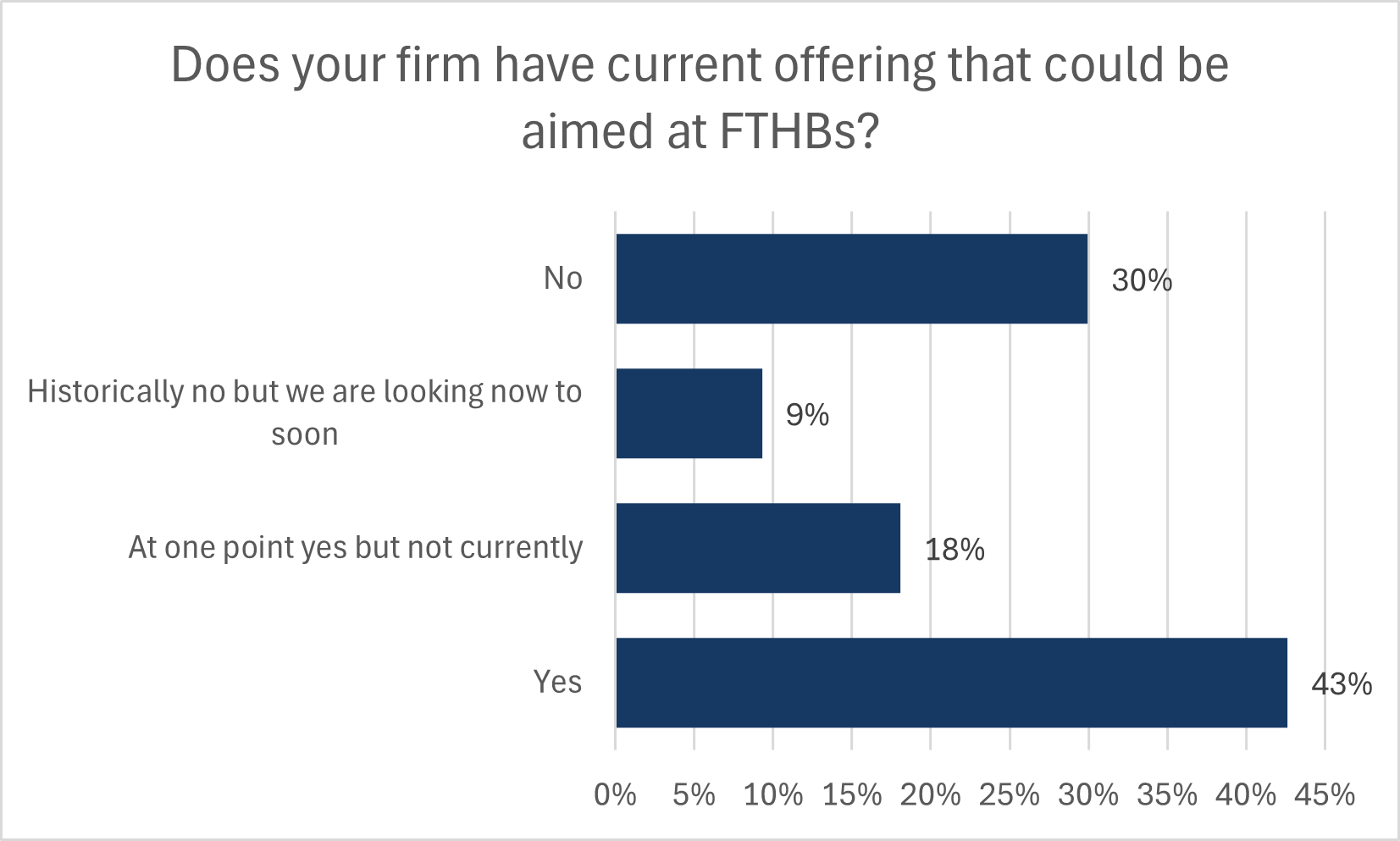

- The Canada Housing Plan, within the Federal Budget 2024, announced a lengthening of insured mortgage maximum amortizations from 25- to 30-years for new homes purchased by first-time home buyers (FTHB)—beginning August 1st. This move aims to support the creation of new supply at the entry-level segment of the market. 43% of builders state that they produce homes that could be aimed at first-time buyers. Given affordability and the cost of construction, 30% stated they do not operate in this segment and 18% stated they used to but currently do not.

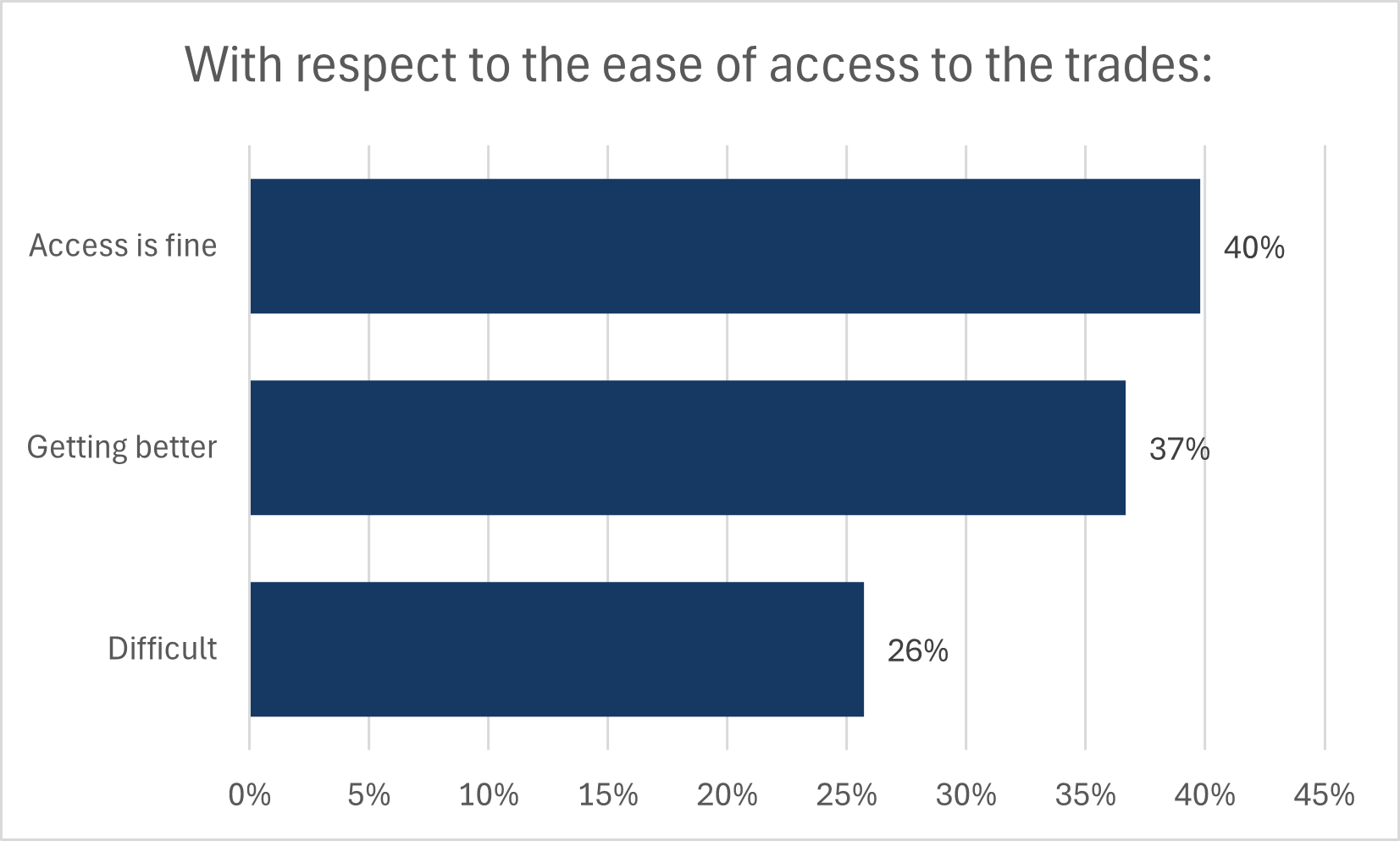

- Based on the extended period of poor sales, pressure on trades access has lowered. 40% of builders characterized trades access as Fine and a further 37% said that access was getting better. The 26% of builders that felt trades access was difficult was down from the 39% that gave this rating a year ago. It is important to note that the underlying shortage in Canada’s construction labour force has not changed and is only muted because of the slowdown in construction; this issue still requires comprehensive policy reform to increase capacity to build once the market begins to turn around.

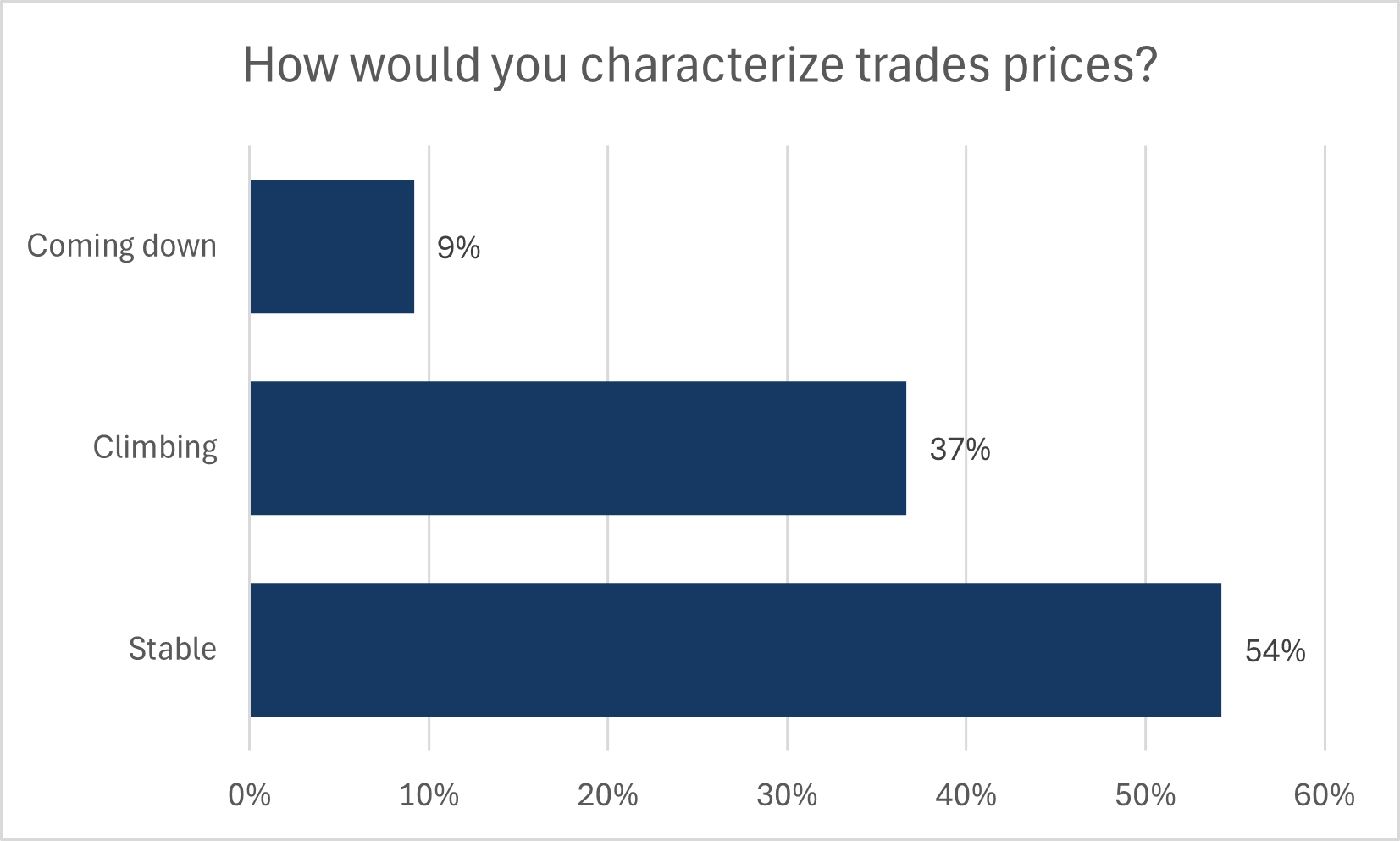

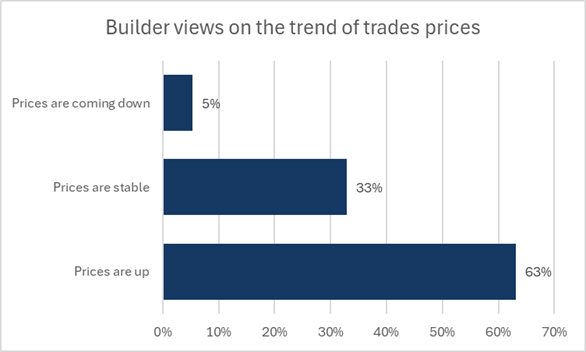

- While trades access is easing, the price of trades is continuing to rise. 37% stated that trades prices are climbing while just 9% felt they have come down. This comes after a period of rapid increase in prices, which have now settled as the new normal. While the majority believed prices are stable, these new high prices are a major source of the higher construction costs builders face.

- While it may seem that trades conditions are easing under poor sales conditions, builders and the subcontractors they work with prioritize holding onto their employees. 47% reporting they have not laid off employees, reflecting the desire to retain workers even in this slow period, given the challenges of replacing them when conditions improve. The results of this question are broadly like the results of the Q2 2023 survey. In addition, average year-to-date monthly payroll employment in residential construction is largely unchanged between 2023 and 2024.

- Construction material costs also continue to mount. On average, builders estimate that their non-lumber material costs for a 2,400 square foot home have risen by just under $28,000, relative to the prices paid over the first half of 2023. Since the start of 2020, non-lumber material costs for said home will have risen by $70,000. When combined with the costs of lumber, which are also rising, inflation of material prices has added $94,000 to the cost of construction to a 2,400 square foot home compared to 4.5 years ago.

- The Q1 2024 single-family housing market index value is 34.9, 10.3 points above the record low of 24.6 in Q4 2023. This quarter’s index value is also in line with the level recorded a year ago.

- Despite the increase, it comes on the heels of a 3-year low in sentiment from the previous quarter. This means that negative sentiment, below a value of 50, has prevailed for seven consecutive quarters.

- In comparison to US single-family builders, the NAHB/Wells Fargo HMI averaged 48. This was also an improvement over sentiment in Q4 2023, and is an indication of U.S. home sales improving faster than in Canada.

- Regionally, single-family home builders in Ontario held the most downbeat views on sales once again.

- Open-ended comments from single-family builders were also in line with the responses to the HMI, with many noting extreme drops in sales.

- In a highly interest-rate-dependent market, expectations around summertime rate cut played a role in lifting sub-indices for present selling conditions, expected future selling conditions and sales office traffic levels. The rise in the current sales conditions index is likely related to well-qualified buyers forgoing some interest rate relief over the mortgage term in favour of entering the market ahead of anticipated sale price increases.

- 45% of builders rated current selling conditions as poor and contributed the most to the overall HMI remaining below 50.

- Half of builders rated their expected future selling conditions over the next six months as Fair. Again, this improvement is related to builder expectations that some additional well-qualified buyers will come off the sidelines.

- The sales office traffic subindex was the weakest of the three HMI subindices, as 55% of builders still rated their sales office traffic as Low/Very Low and a further 38% rated traffic volumes as Average.

-

-

- The multi-family housing market index recorded a value of 37.9 in Q1 2024, up 8.8 points from a value of 29.1 in the previous quarter. This is modestly above the value of 33.5 recorded in Q1 2023.

- The multi-family HMI has also remained deep in pessimistic territory for seven consecutive quarters.

- Regionally, the most downbeat views continued to stem from multi-family builders in Ontario.

- 47% of multi-family builders rated current selling conditions as Fair, a material increase from the previous quarter. Yet, just 15% of respondents characterized selling conditions as good. This led to the sub-index of present selling conditions remaining well below a score of 50.

- 62% of respondents believed future selling conditions will be average. The lower cost and larger existing inventory of multi-family units relative to ground-oriented builds could help them improve sales if and when conditions improve.

- The assessment of sales office traffic was split, at roughly 45%, between rating conditions as Average volume and Low/Very Low volume.

- Despite the intense rotation towards multi-family housing starts through 2023, the survey shows that sales office traffic is still historically weak.

- Unlike the single-family builders, open-ended comments from multi-family builders were unanimously negative, largely attributed weak sales and traffic flows to buyers remaining in a wait and see mode.

-

- These questions allow CHBA to better understand what is driving change in builder sentiment and gain insights into current industry issues. The following are some of the findings from the special questions in the Q1 2024 survey:

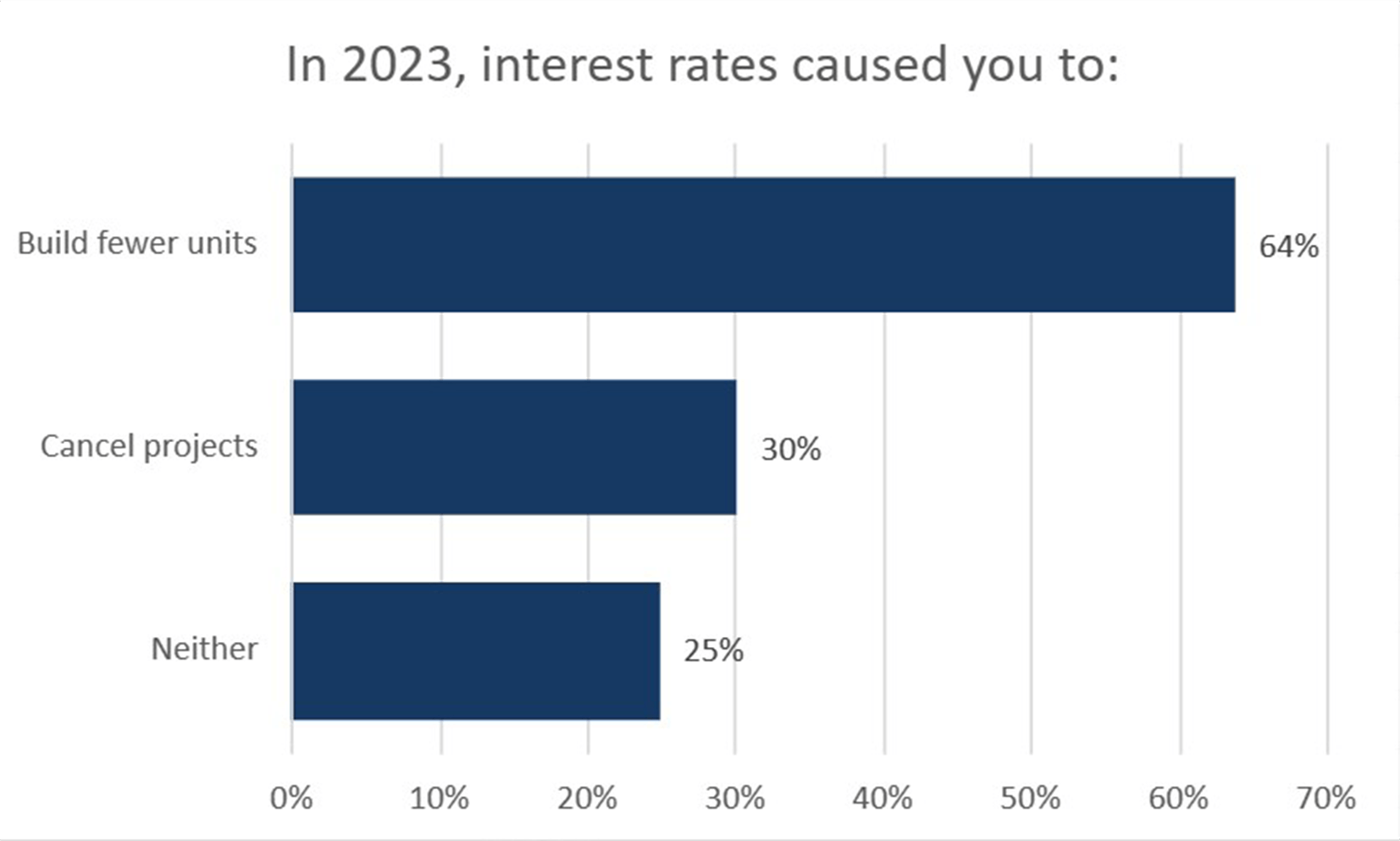

- As the Bank of Canada’s 5.0% policy rate continues to progressively weigh on home construction activity and the broader economy, 65% of builders said that the level of interest rates have directly caused them to build fewer units than they would have otherwise, and 31% stated they have cancelled projects. These proportions are up 6 and 8 percentage points respectively from the first quarter of 2023, when the Bank’s policy rate was lifted to 4.5%.

- With the weakness in sales conditions, particularly over the second half of 2023, 54% stated that they expect their housing starts in 2024 to be below their level of starts in 2023. On average, these builders expect a decline in their starts of 41%. Just 15% of all respondents expect to have more starts in 2024.

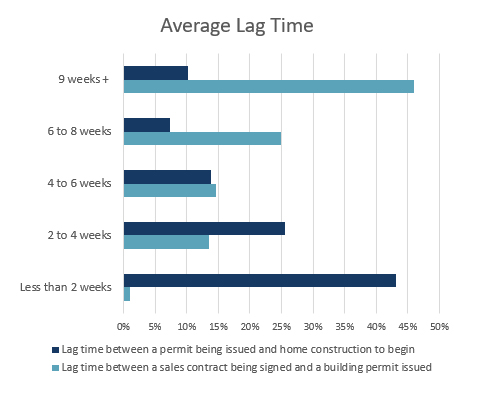

- Builders were asked to estimate the average time between the application for a building permit and its issuance. The most common average range was 2 to 4 weeks—31% of builders. However, the second most common answer was over 10 weeks, at 22%. Out of this subset of builders, half said their average wait time can extend to six months and beyond.

- The distribution of average wait times was similar to responses in the Q2 2022 survey, with a modest reduction in the proportion of builders that are waiting more than 10 weeks. The forthcoming update to CHBA’s Municipal Benchmarking Study will provide a more robust assessment of the progress made on improving municipal processes since 2022.

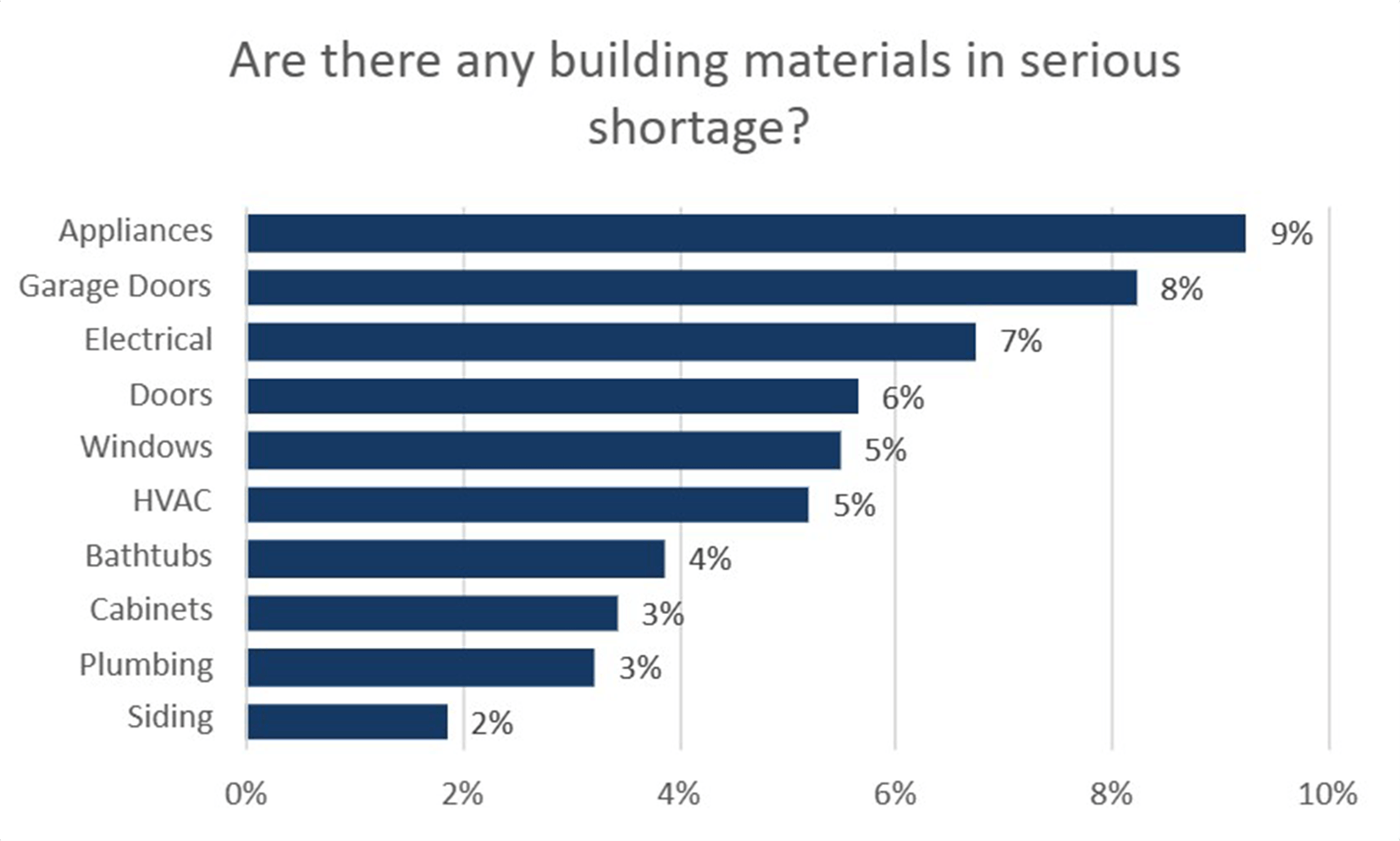

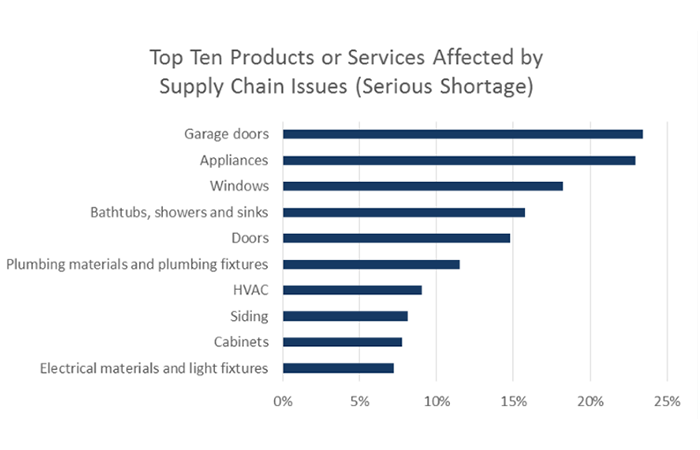

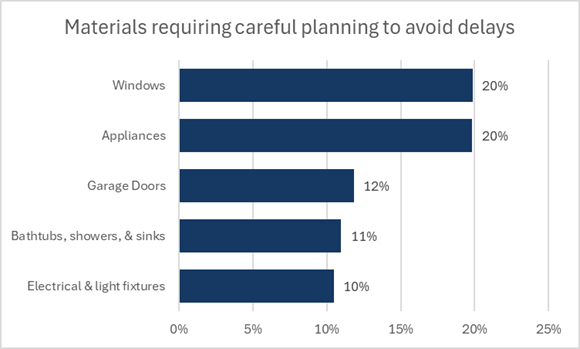

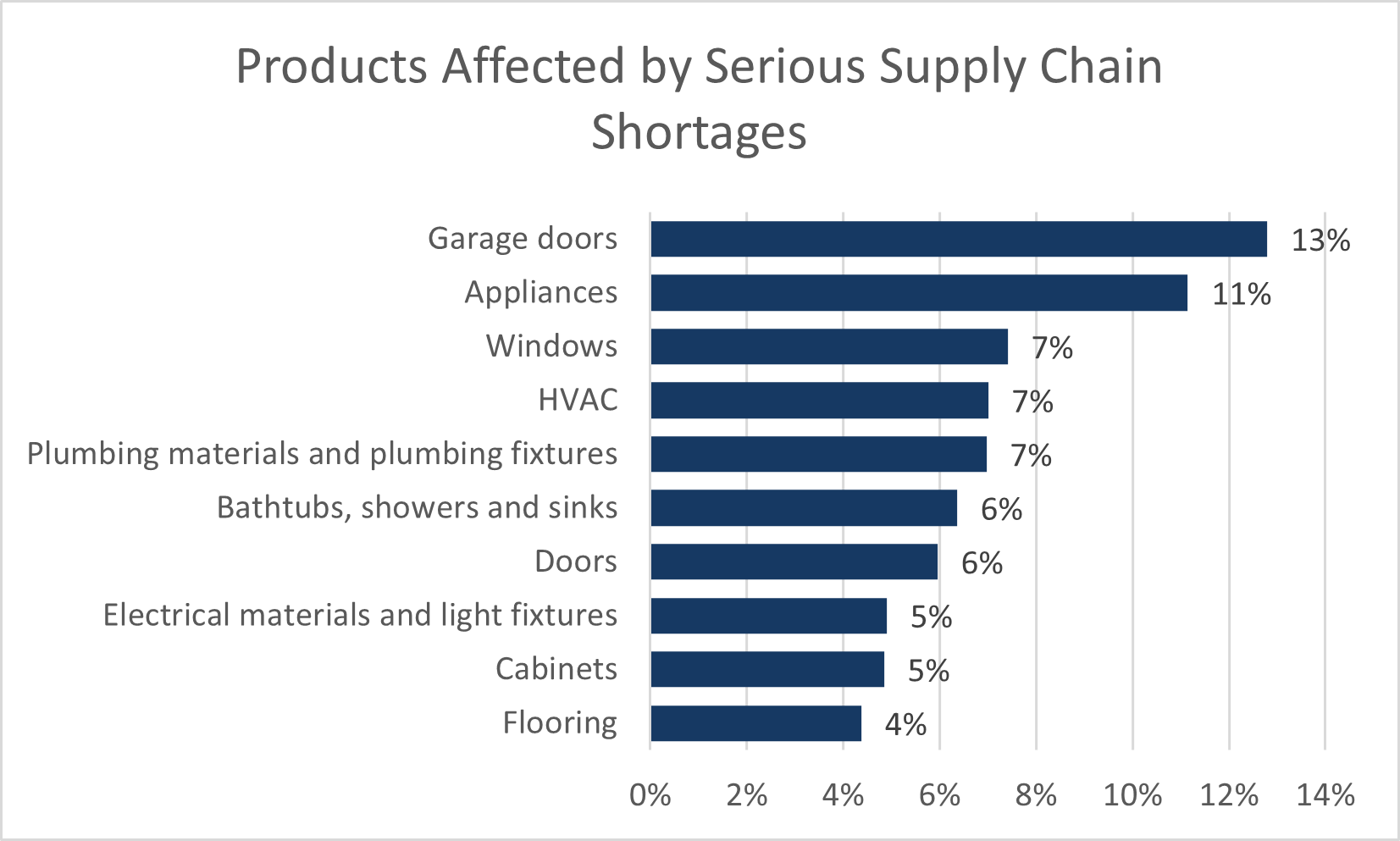

- Respondents were asked about any building materials that need more careful planning to avoid construction delays, recognizing that supply chains are back to normal. Windows and appliances were the most common answer—given by 20% of respondents each. To a lesser extent, garage doors were also an issue, dropping from the top issue as they had been for several quarters. Encouragingly, 49% stated that they are not concerned about the availability of any specific building material.

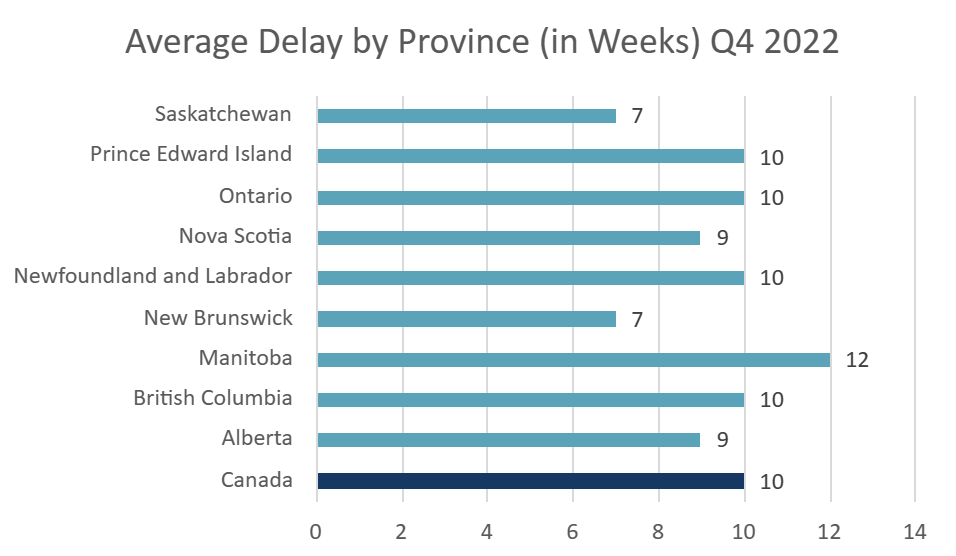

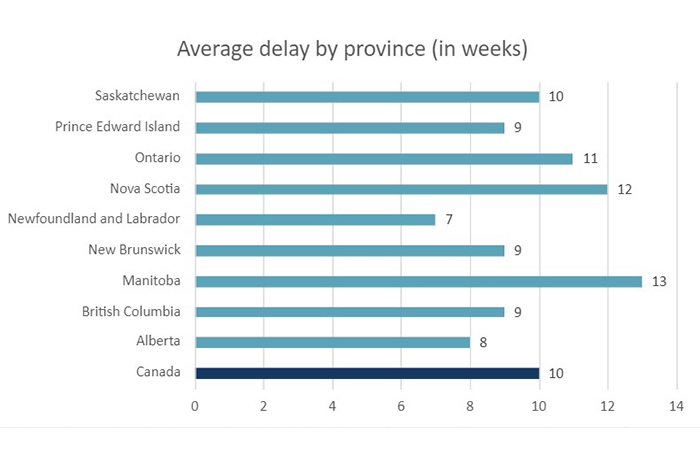

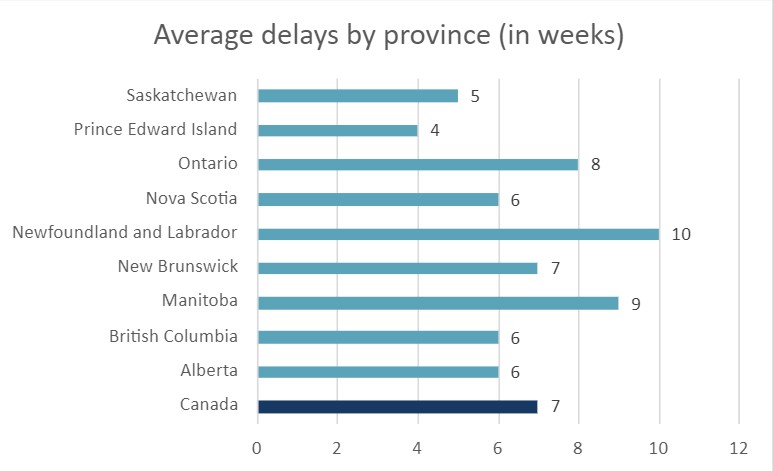

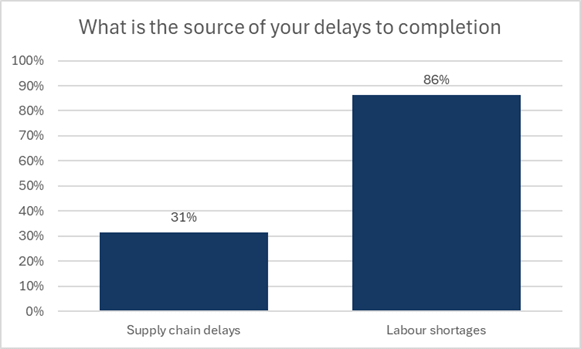

- A third of respondents said that they have difficulty meeting closing dates as a result of either building materials or labour issues. This group of builders reported a delay length of 10.6 weeks on average, a significant hinderance to rates of completion. In total, 30% of all builders are having trouble with meeting closing dates because of labour availability, and building material availability is affecting 10% of builders.

- The survey asked to characterize the labour market conditions and wage trends for trades. In terms of ease of access, the range of views were evenly represented across respondents. This suggests that acute labour challenges have been lessened by extended poor sales conditions as well as differences in access to specific types of trades. In terms of characterizing trades prices, 63% of builders stated that price of trades is up and 33% said they are stable.

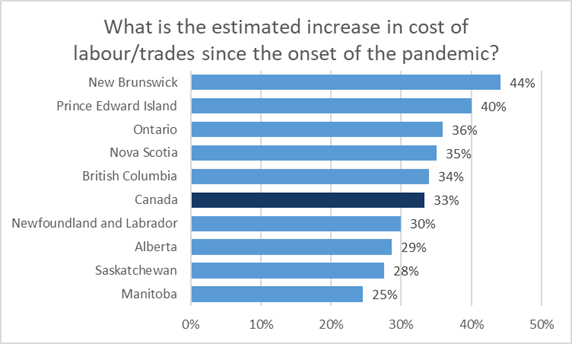

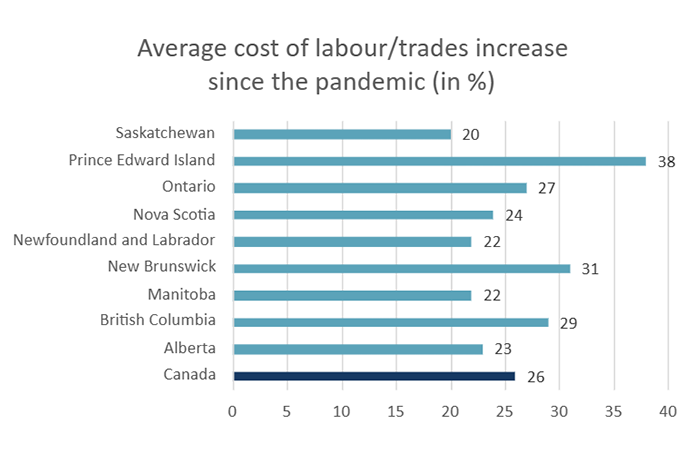

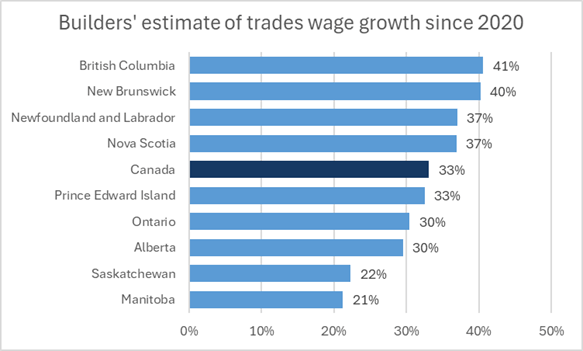

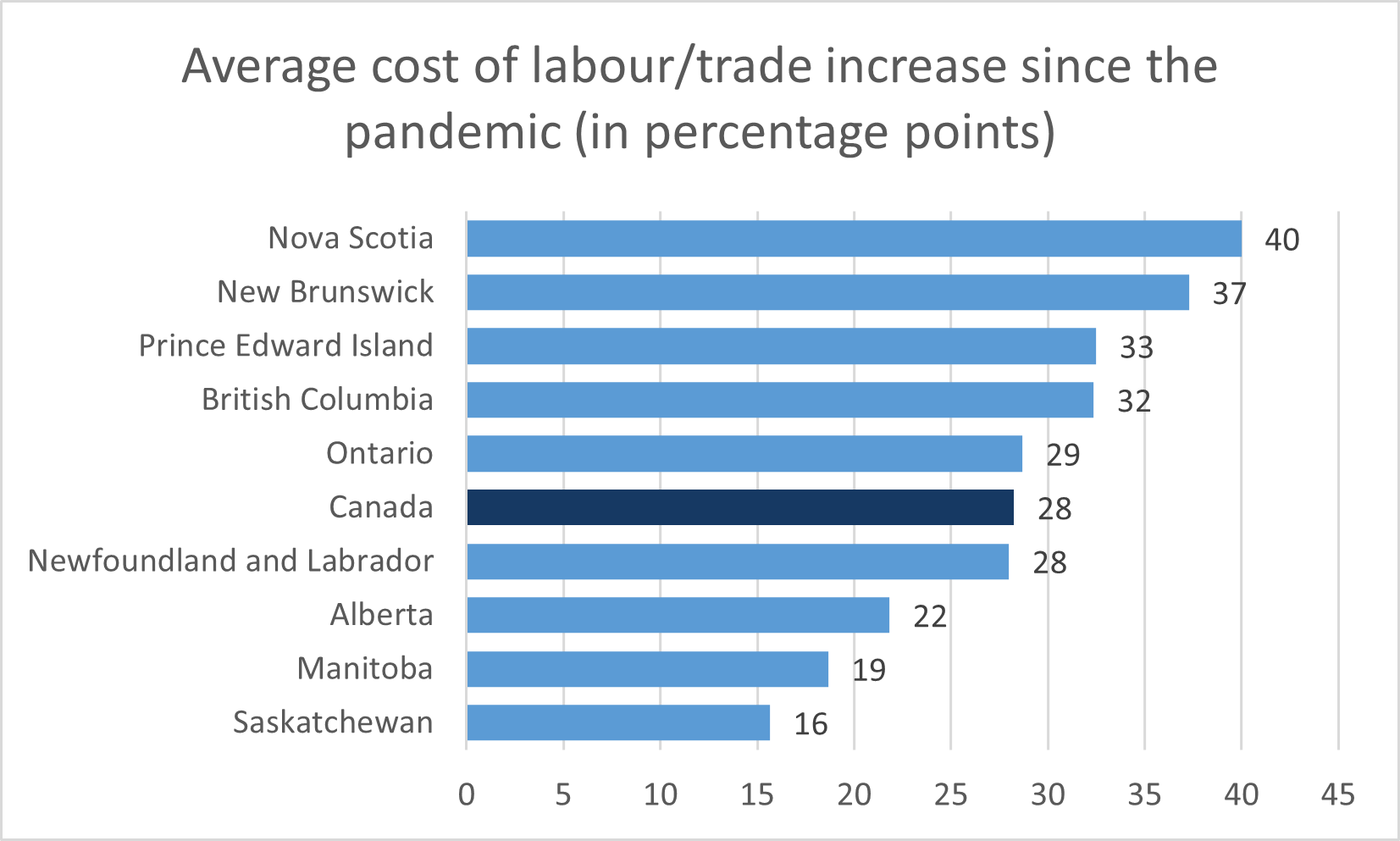

- The average of builders’ estimated trades wage growth since the onset of the pandemic in 2020 was 33%, up from a reported 26% average in Q1 2023. In combination with the results of the previous question, trades wage growth is normalizing, but this growth is occurring on top of the large increases seen in years prior.

- When asked about recent layoffs, 40% stated they have not laid off workers. This is a smaller proportion than in recent surveys. Meanwhile, the 13% that stated that there are plans to rehire those who were laid off in the very near future was slightly higher than past quarters. This could be related to some hope that interest rate changes will help bolster headcounts.

- Statistics Canada data shows that industrial prices for framing lumber rose noticeably in early 2024. Since the beginning of 2020, the estimated average cost of lumber on a 2,400 square foot home incurred by a builder stands at $24,470.

- CHBA continued to ask builders about the rise in non-lumber material prices experienced since the start of 2020. Builders estimated that these costs have risen by $43,270 on a 2,400 square foot build. 55% of builders reported their non-lumber material costs have rise above $40,000, up from 47% of builders this time last year. Similar to consumer goods, closer-to-normal material price growth is being applied to the pandemic-era run up in prices and suggests that this is the ‘new normal’ in terms of costs of construction.

- This brings the total costs of construction material increases (lumber and non-lumber) to $67,740 compared to prior to the pandemic.

Special Question Results on Factory Built Construction

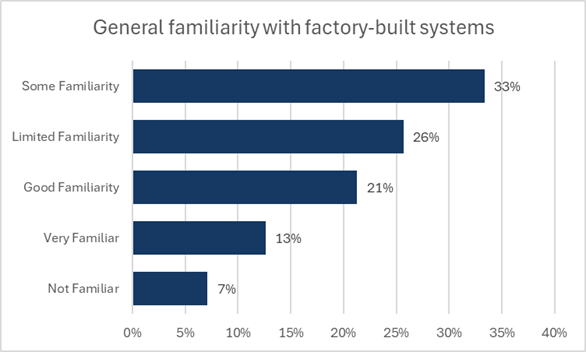

Following up from the questions surrounding factory-built construction methods first asked during 2023’s Q1 HMI survey, builders were asked if their business currently makes use of modular housing, manufactured homes, panelized components, or pre-engineered packages. Relative to 2023, panelized components remained the most prevalent factory construction method among builders at 26%. The 2% that reported using modular construction and 3% that used pre-engineered package methods in 2023 rose to 5% and 7% with the sample, respectively.

- Given the changes occurring in the industry, and in particular the labour shortage, builders were asked how seriously they are considering using various factory-built methods within their business over the next 1 to 3 years. 66% of builders said that they are considering panelized construction—which includes builders that are currently utilizing this method. Although the most prominent method, panelized construction was down from 90% in the 2023 survey. Part of this could be related to differences in survey sample or a legitimate decline in interest given market conditions. That said, using a subset of repeat respondents between 2023 and 2024, we found that 72% of those that had originally stated they were firmly interested in implementing panelized construction methods remained interested a year later, while 19% who originally said they may be considering panelized construction now are no longer considering it a year later. That said, 38% of the builders who originally said they were not considering factory-built options are now giving it some thought. Therefore, despite the total sample decline, there is evidence that panelized adoption will increase over the next few years.

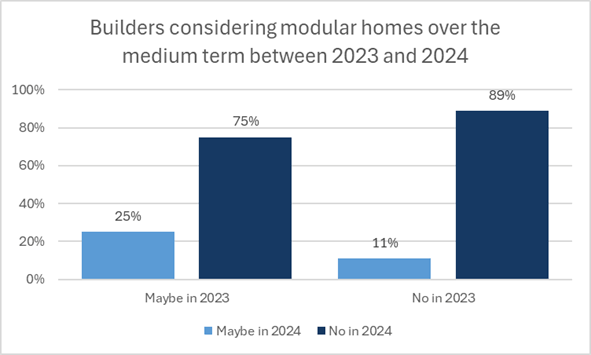

- Both the use and medium-term consideration for modular housing improved relative to 2023, but total uptake remains low. 5% stated they have produced a modular home over the past year, up from 2% in 2023, and a total of 10% said they are firmly considering modular over the next 1 to 3 years—relative to 4% last year. With increased government focus on derisking this technology, adoption could accelerate over the years ahead.

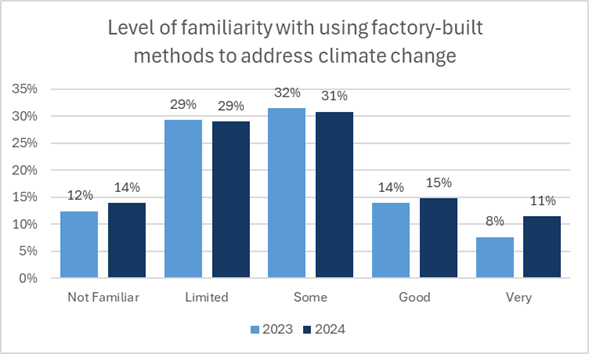

- Builders were asked to characterize their familiarity with factory-built methods in a broad sense as well as its separate benefits related to improving business productivity and addressing climate change factors (i.e. emission reductions and improved resiliencies). About two thirds have familiarity with factory-built methods and the productivity benefits, and 57% are familiar with the benefits for addressing climate change factors.

- The CHBA Single-Family Housing Market Index fell to a historical low of 24.6 in Q4 2023, the most negative quarterly sentiment reading in the three years CHBA has been conducting the survey. The index fell 9.3 points from a reading of 33.9 in Q3 2023 and is 1.6 points below the previous record low of 26.2 recorded in Q4 2022.

- The record low sentiment readings represent a continued decline in serious and qualified buyers looking to purchase a new home. In addition, builders commented that some buyers are waiting on the sidelines with the belief of lower mortgage rate offerings in 2024.

- For an approximate comparison, the US NAHB’s single-family HMI averaged 37 in the fourth quarter of 2023, down from an average reading of 45 in Q3 2023, but still better than the Canadian numbers.

- The Q4 2023 single-family sub-indices for present selling conditions, expectations for future selling conditions, and sales office traffic fell to levels that were all lower than the previous quarter and the previous record low seen in Q4 2022.

- As with previous quarters, the proportion of builders holding pessimistic views were broadest in Ontario. However, single-family sentiment deteriorated in all regions of the country over Q3 2023.

- 57% of single-family builders rated current selling conditions as Poor, worsening nearly 10 percentage points from the previous quarter. Regionally, except for the Atlantic region, most builders characterized current selling conditions as Poor.

- Influenced by several factors, views about future selling conditions were closely split between Poor (45%) and Fair (43%). However, the proportion of builders that were optimistic about conditions in the next six months fell six percentage points from Q3 2023 to 12%. Rating future conditions as Fair was most common in all regions outside of Ontario, where the most common rating was poor.

- The collective view on sales office traffic was the most pessimistic of the sub-indices, with 73% giving a Low or Very Low rating. Several builders commented that traffic was especially slow even when considering that it is a seasonally slow time of the year for inquiries from prospective buyers. Just 2% of builders surveyed rated sales traffic conditions as High or Very High.

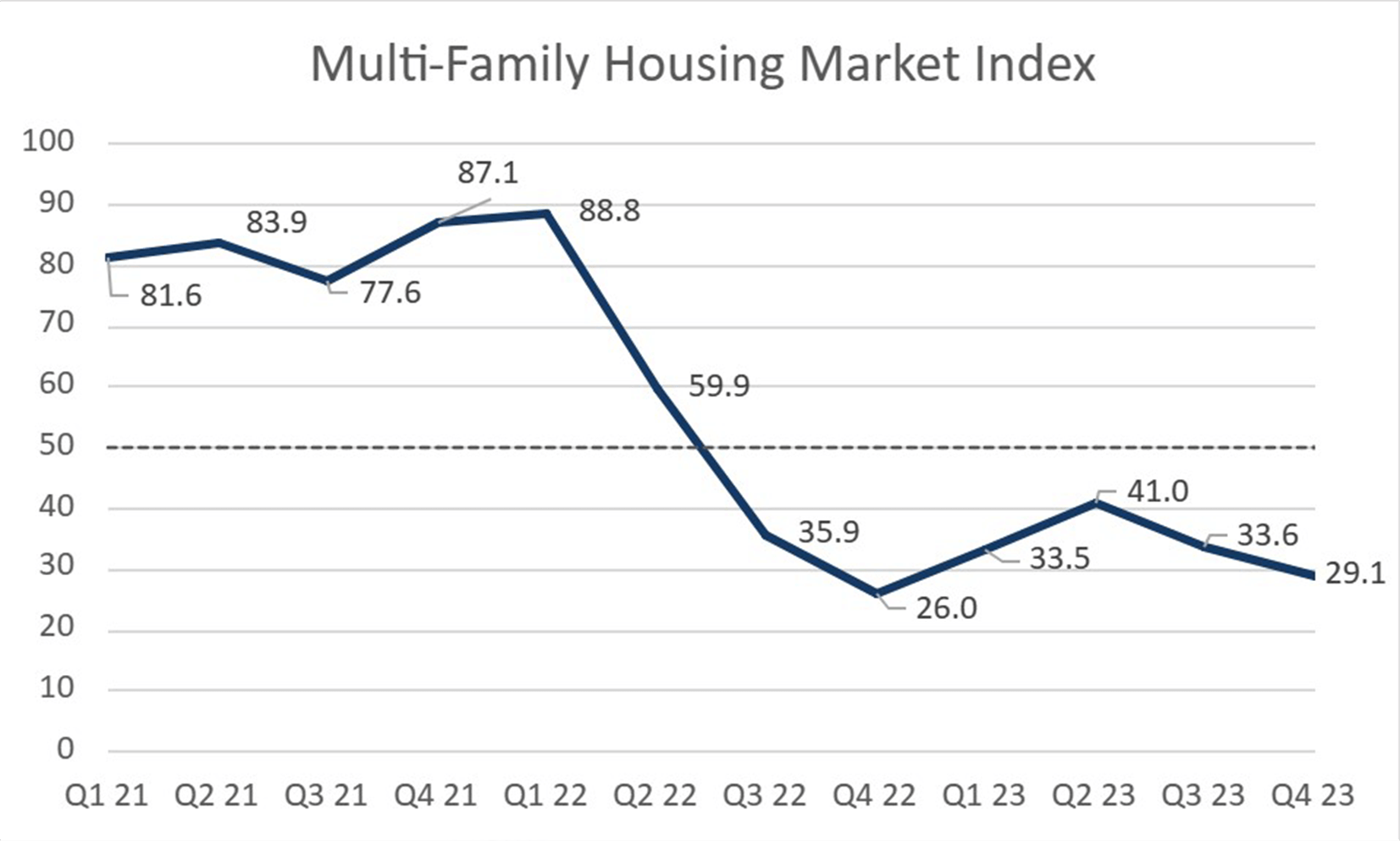

- The CHBA HMI for multi-family builders was down to 29.1 in Q4 2023. The index fell 4.5 points from a value of 33.6 in Q3 2023. The declines seen in the second half of 2023 leaves sentiment marginally above its 3-year low of 26.0 recorded in Q4 2022.

- Regionally, downbeat views from multi-family builders were most broadly held in Ontario as well as British Columbia. This is despite strong annual growth in multi-unit starts in both Toronto and Vancouver in 2023, reflecting projects that were approved before the climb in interest rates. Meanwhile, the balance of sentiment was neutral among builders responding from Prairie provinces.

- The majority of multi-family respondents, at 53%, rated current selling conditions as Poor. The increase in the proportion of those giving a Poor rating over last quarter came from a decline in the proportion of respondents that gave a Fair rating. Builders that gave current selling conditions a Good rating held steady from Q3 2023 at only 13%.

- Expectations about future selling conditions were balanced, with 47% of builders giving a Fair rating. This was higher than the 32% of multi-family builders that gave a Poor rating. Only 21% expect future conditions to be good.

- 63% of multi-family builders rated traffic of prospective homebuyers to be Low or Very Low, up a substantial 22 percentage points from the previous quarter. This came from a large drop in the proportion of builders that said sales traffic was average, which now stands at 31%.

- Relative to Q4 2022, multi-family builder views on current selling conditions and sales traffic levels were quite similar in Q4 2023 survey.

These questions allow CHBA to better understand what is driving change in builder sentiment and gain insights into current industry issues. The following are some of the findings from the special questions in the Q4 2023 survey:

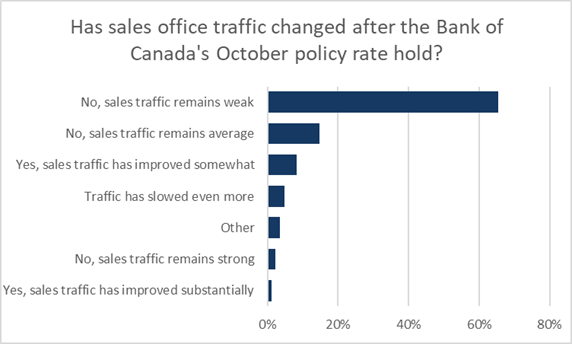

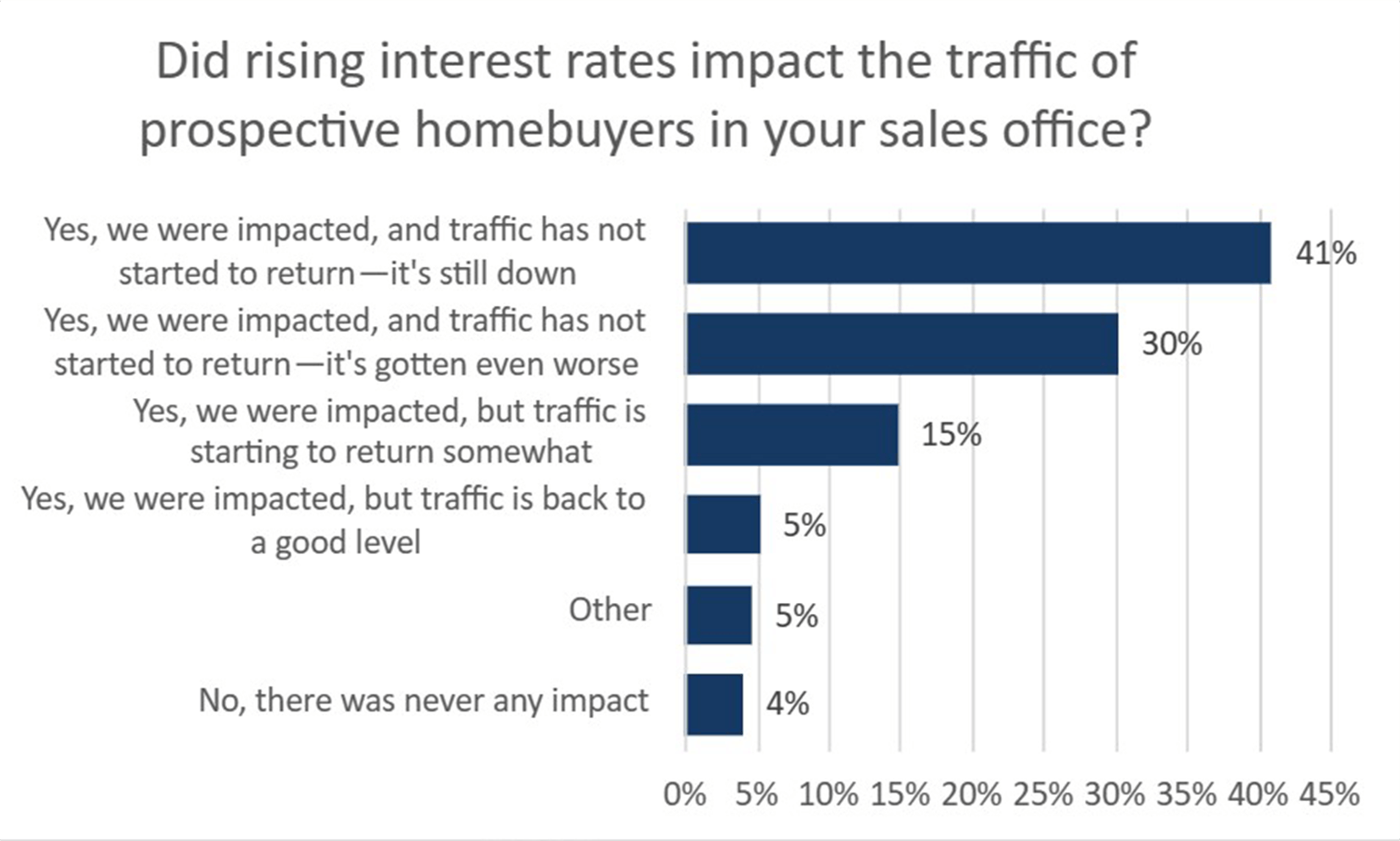

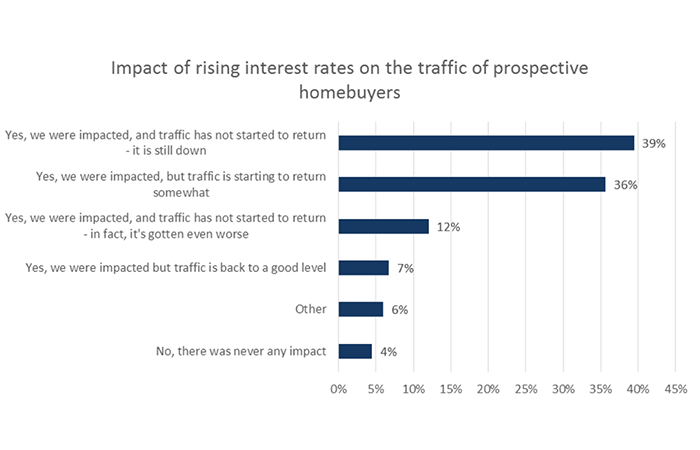

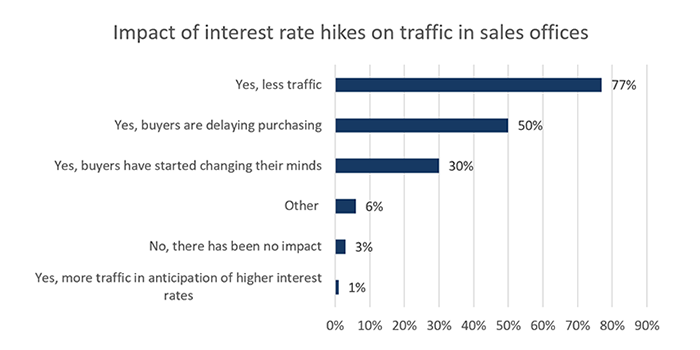

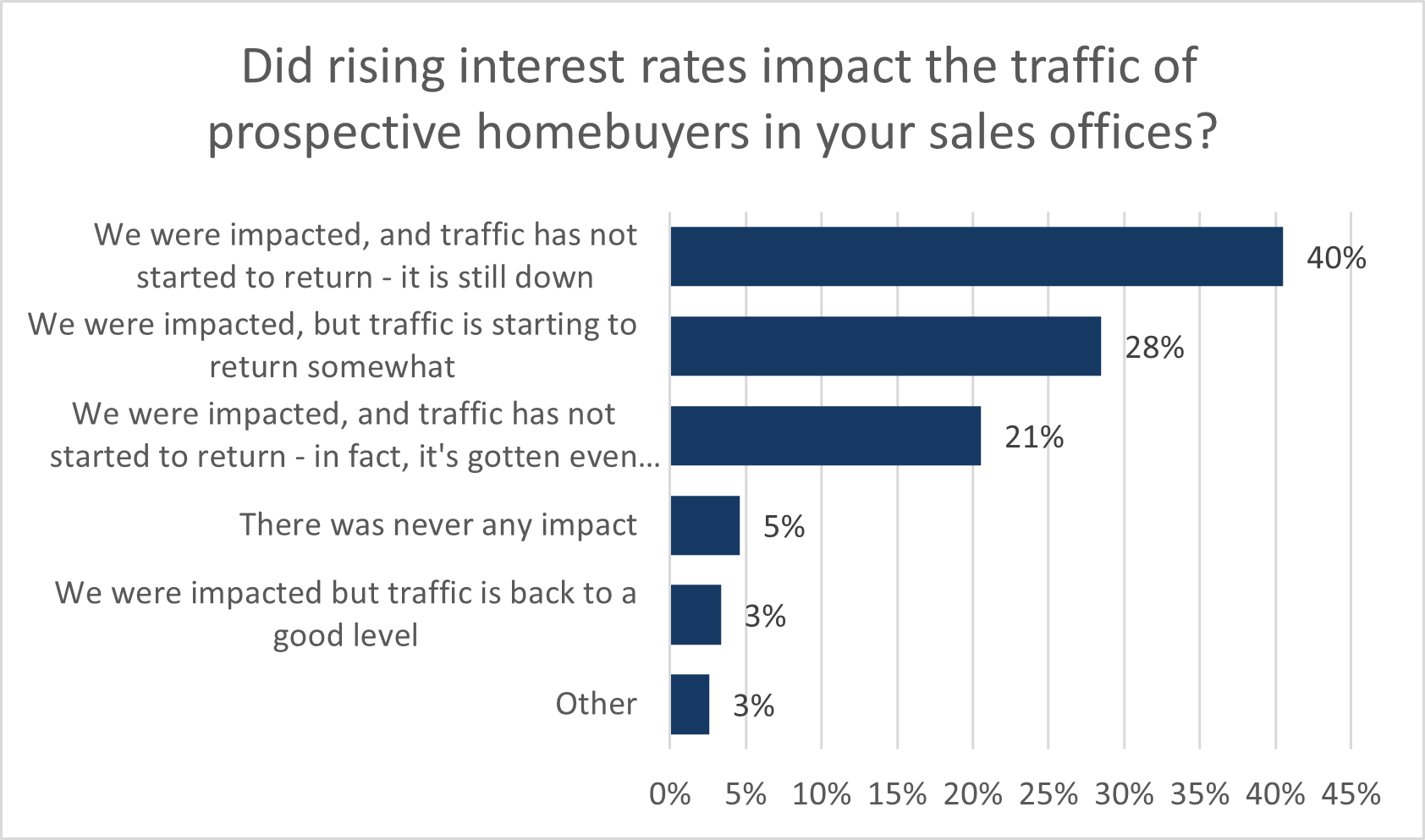

- Assessing the cumulative impact of interest rate hikes on their sales office traffic, 41% of builders stated that their sales traffic is down and they have not yet seen a recovery in traffic flow. A further 30% of builders noted that not only has prospective buyer traffic not seen a recovery, but it has also worsened as of late.

- Builders were asked a follow up question about prospective buyer traffic after the Bank’s rate hold announced in late October. In the first half of 2023, a four-month pause in interest rate hikes corresponded to a modest improvement in both HMI readings. However, this was the case in Q4. 65% of builders reported that sales traffic remains weak, and another 5% reported that traffic has slowed even more.

- Builders were asked if they have had to scale back their operations as a result of the interest rate environment in 2023 and the results were somewhat consistent with the prior quarter. 64% stated that it has caused them to build fewer units and 30% of builders stated that they canceled projects as a result.

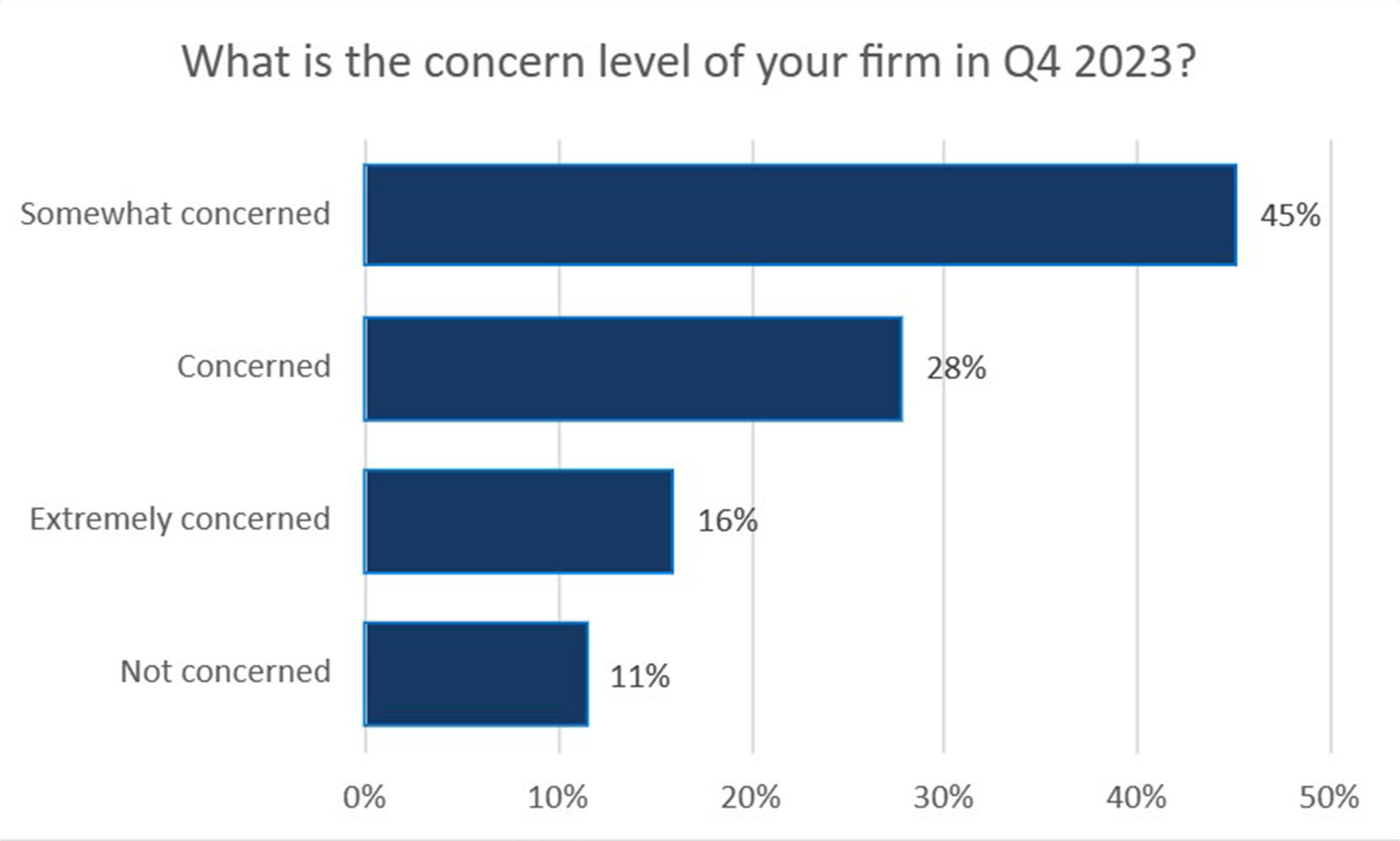

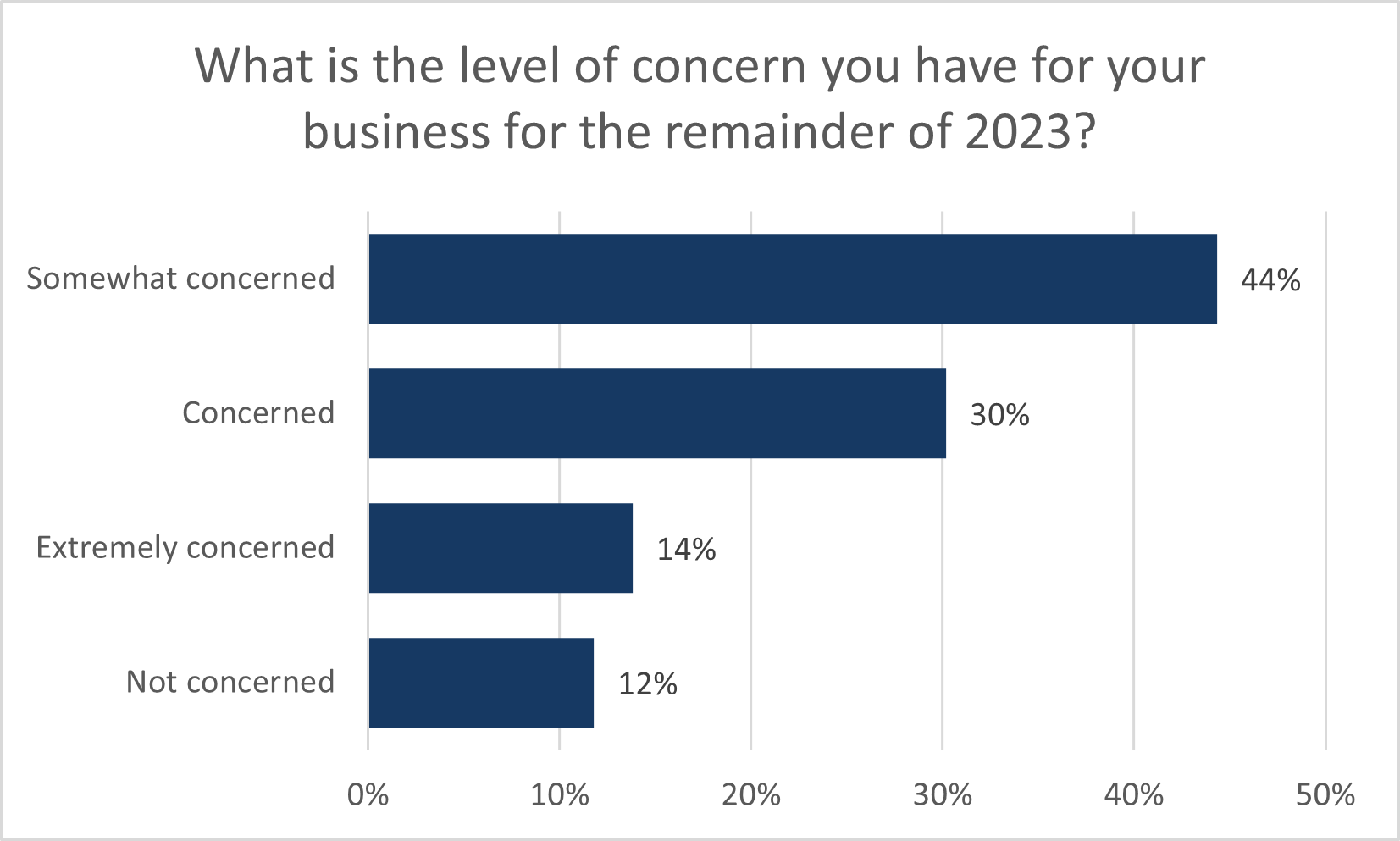

- With respect to the concern they currently have about the future of their business, 45% of builders stated that they are somewhat concerned and 28% said they are concerned. 11% stated they did not have any concern.

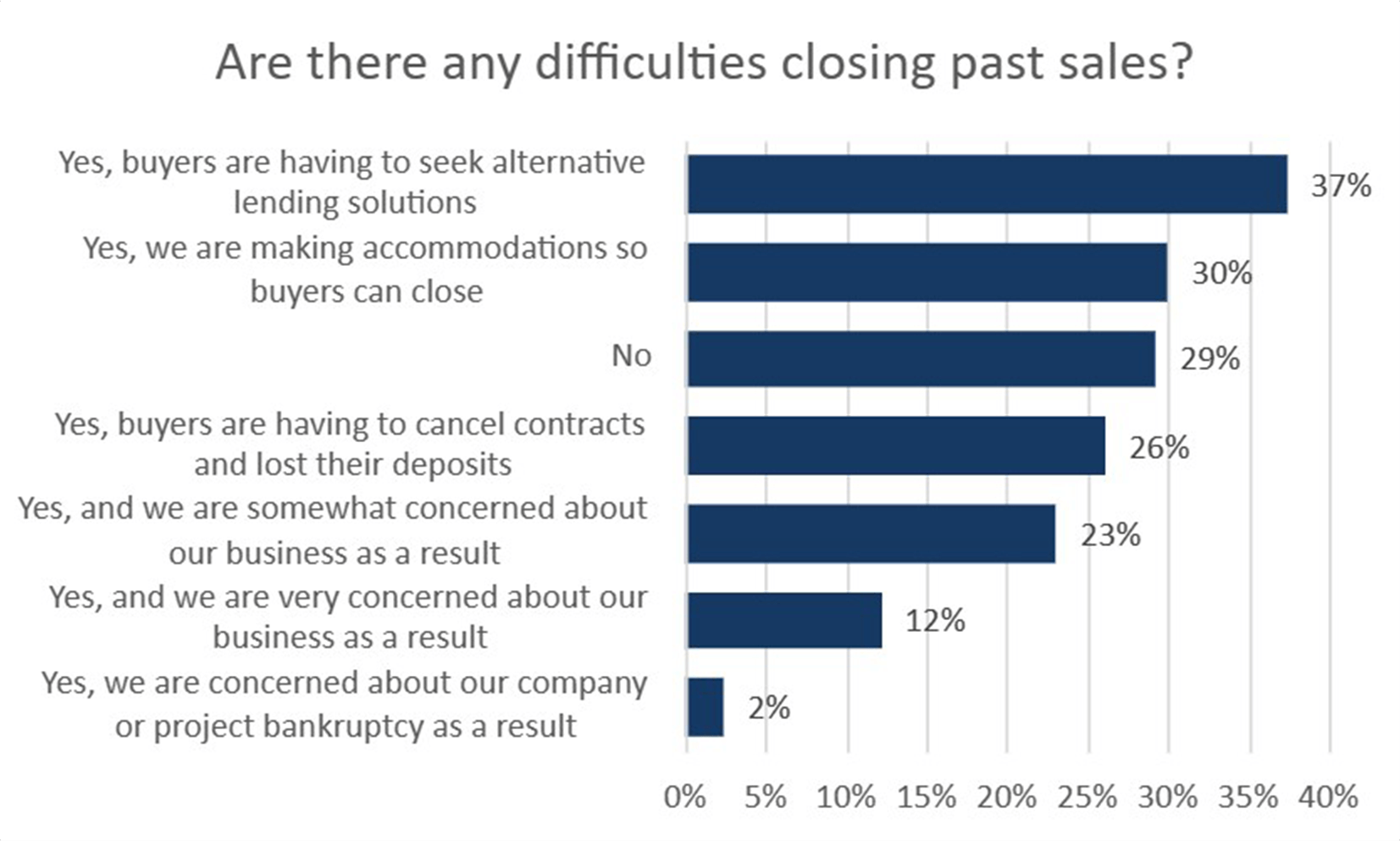

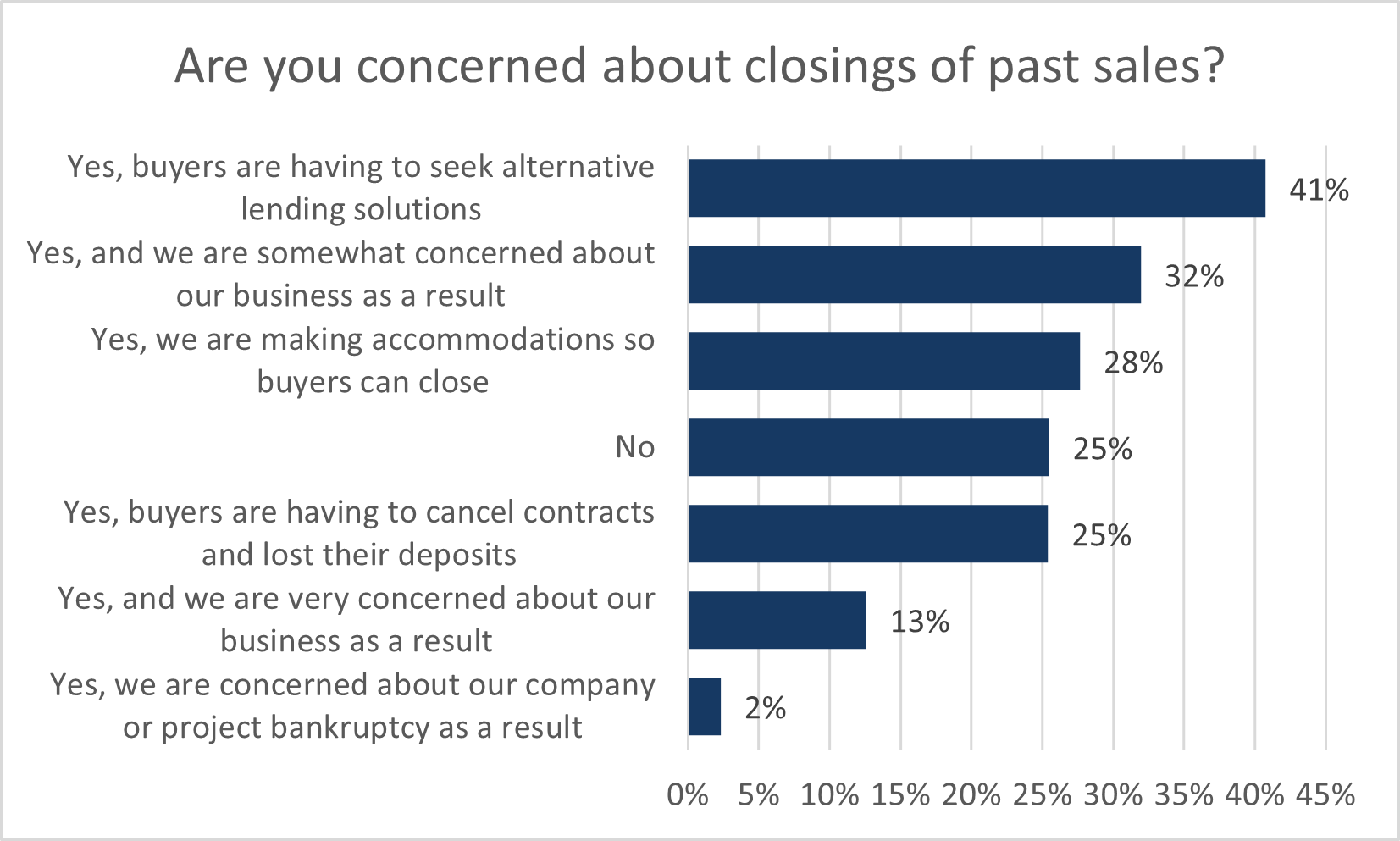

- Builders continue to face difficulties with closing past sales. 37% of respondents stated that buyers have sought alternative lending solutions and 30% said that they’ve made accommodations so that buyers can close.

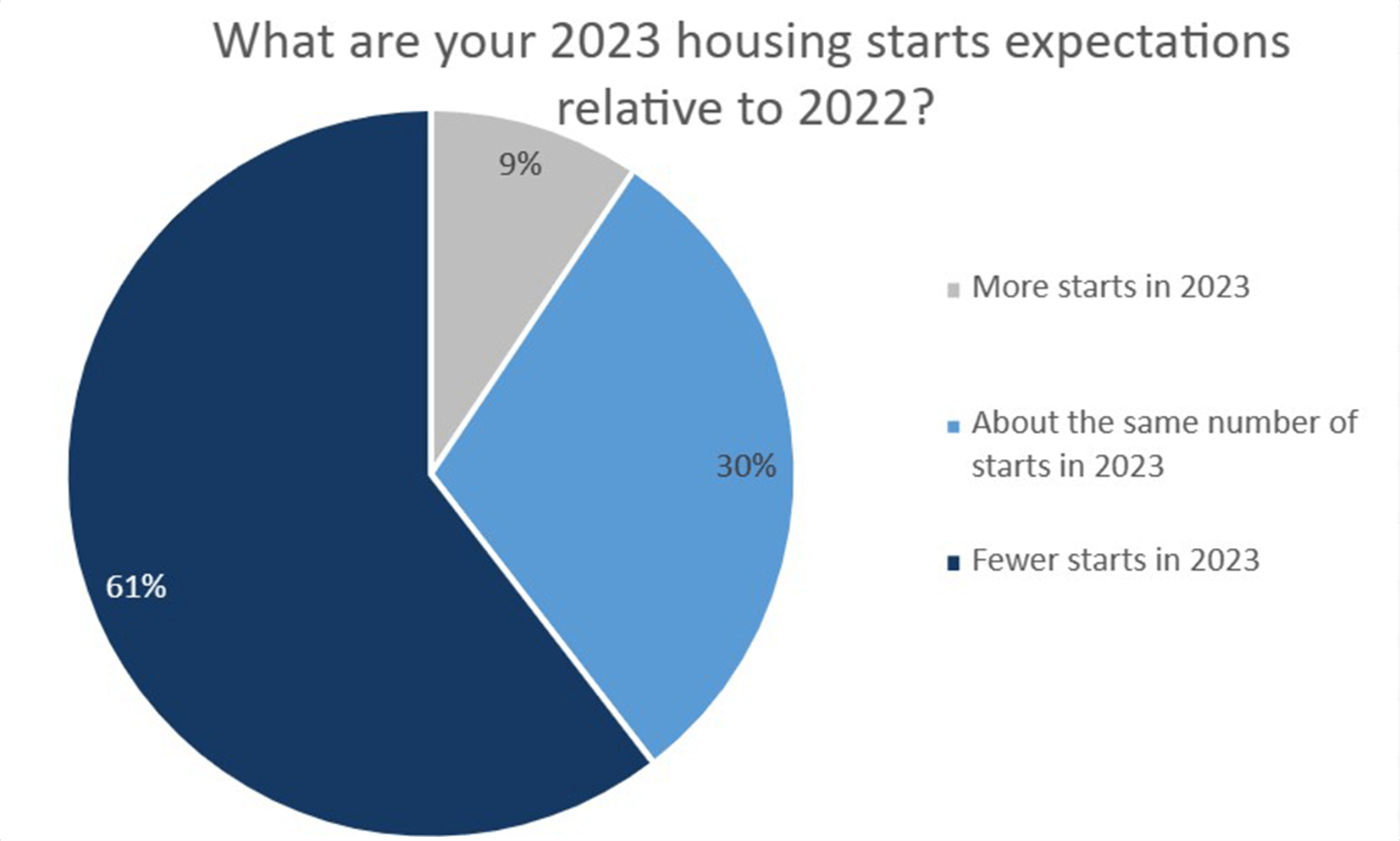

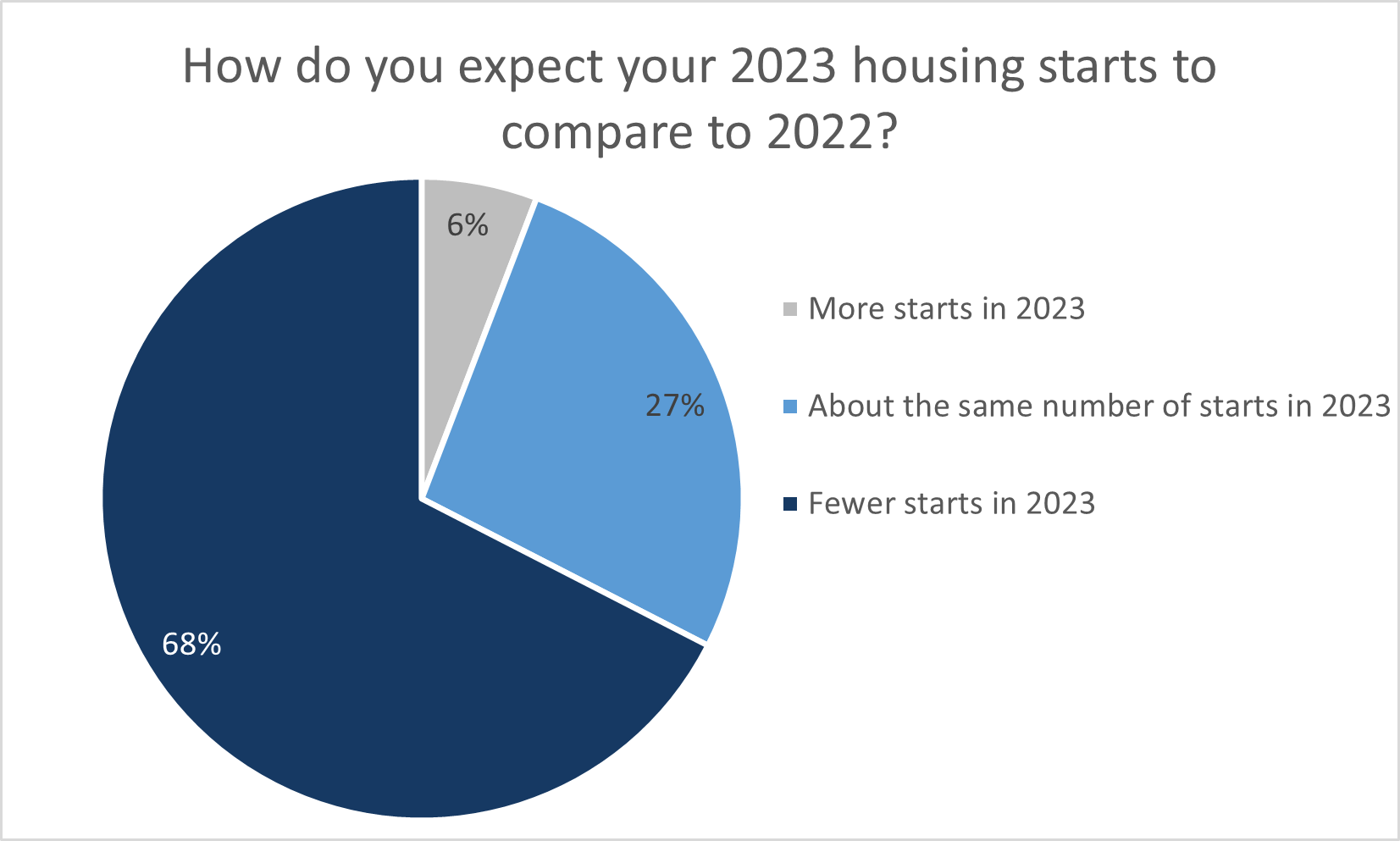

- With the majority of the year complete, builders were asked to report how their annual housing starts compare to the number of starts in 2022. 61% of builders surveyed stated that they expect to have started fewer builds in 2023 relative to 2022, while just 9% said they expect their starts to have increased.

- Out of the builders that said they expect to build fewer units in 2023, they expect to have reduced their starts on average by 47%. The average expected percentage decrease in 2023 starts was higher among small and medium builders.

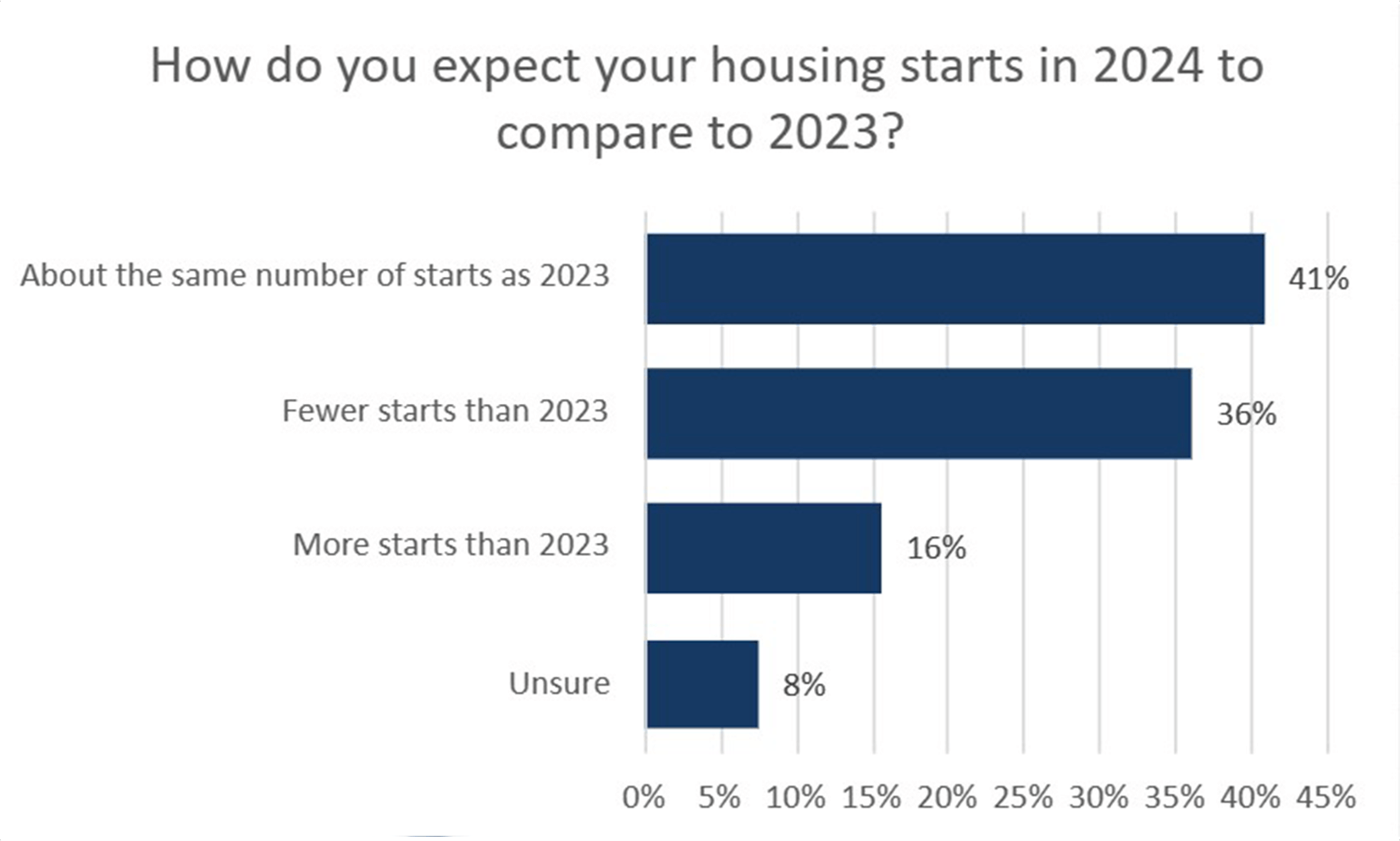

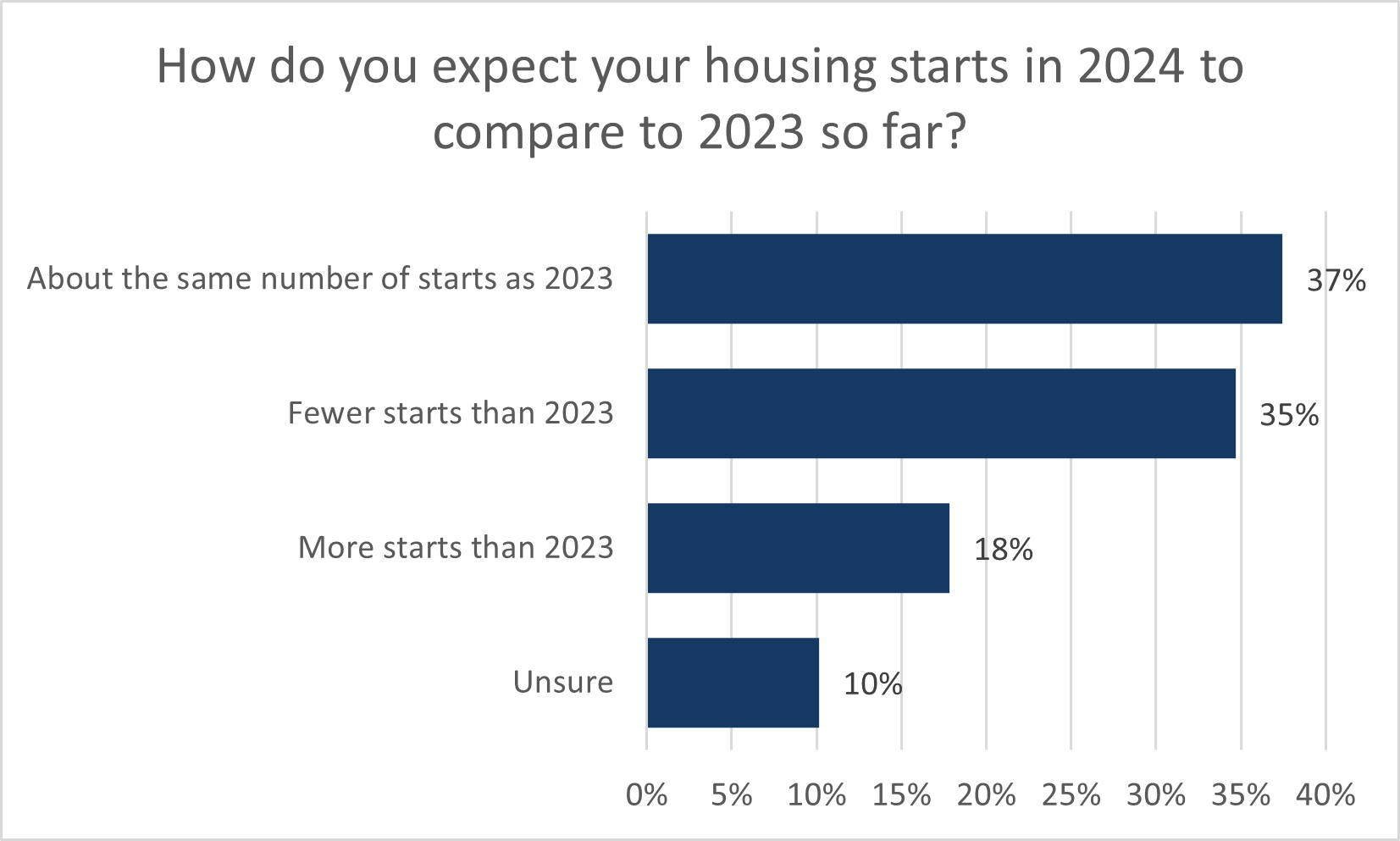

- We asked about builder expectations for their number of starts in 2024, based on demand conditions over the previous 12 months. 41% of builders stated they expect to build about the same number as they will in 2023. Closely behind, 36% reported that they expect to start fewer homes next year.

- Builders were also asked to provide any other comment about their starts expectations for 2024 and while focused on interest rates, builder rationale varied. Several builders stated their belief around maintaining their number of starts as 2023 was due to the expectation of rate cuts. Other comments stated that 2024 will certainly be lower, as 2023 was used to catch up on delayed projects from 2022.

- Beyond interest rates, builders were asked to identify other pertinent factors that are also constraining their housing starts. As with Q3, municipal processes was the most widely reported pain point lowering a builder’s number of starts—at 47% of builders. 30% of builders noted a lack of adequate labour remains an issue, while 28% stated that access to land is difficult.

- When asked the same question but under a hypothetical situation where market conditions were better, the proportion of builders stating that a lack of labour would hold them back increased to 39%. The proportions of other stated factors were similar to the answers from the original question.

- With the lowering of sentiment and weak sales conditions, 33% of builders reported laying off workers - 9% expect to rehire but 24% do not.

- Builders were asked about the cost and the availability of trades. 51% of builders stated that the cost of trades is up. Some builders commented that access has improved because of the weak local market conditions and that delays due to trades access will return when those conditions improve.

- On average builders estimate that their trades costs have increased 33% since the onset of the pandemic. So as more normal wage growth resumes, this is on top of large increases in the recent past, which is also the case for many other costs incurred by builders.

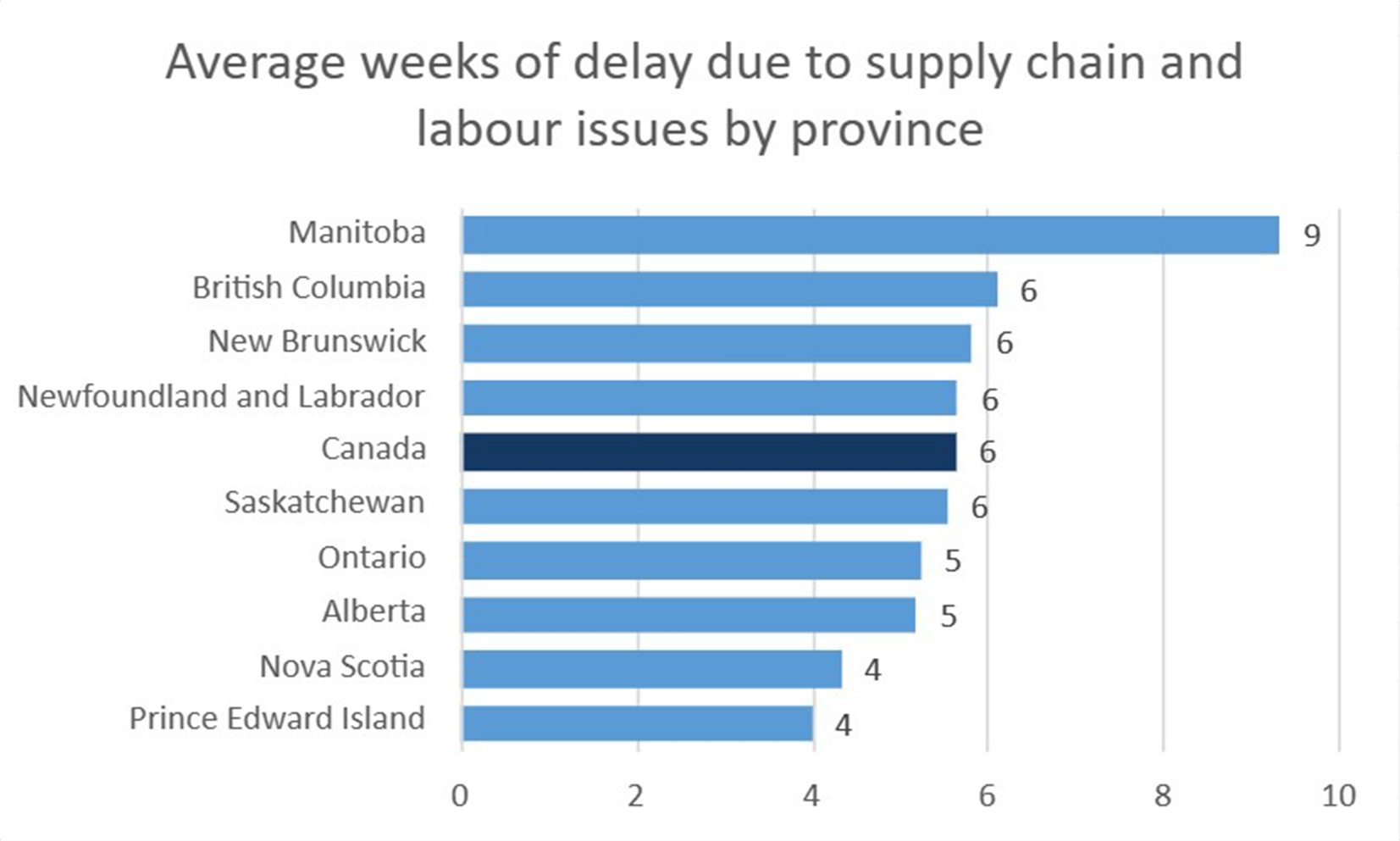

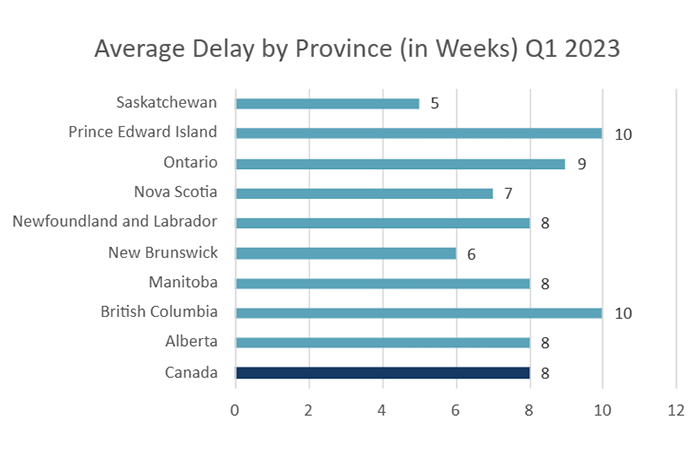

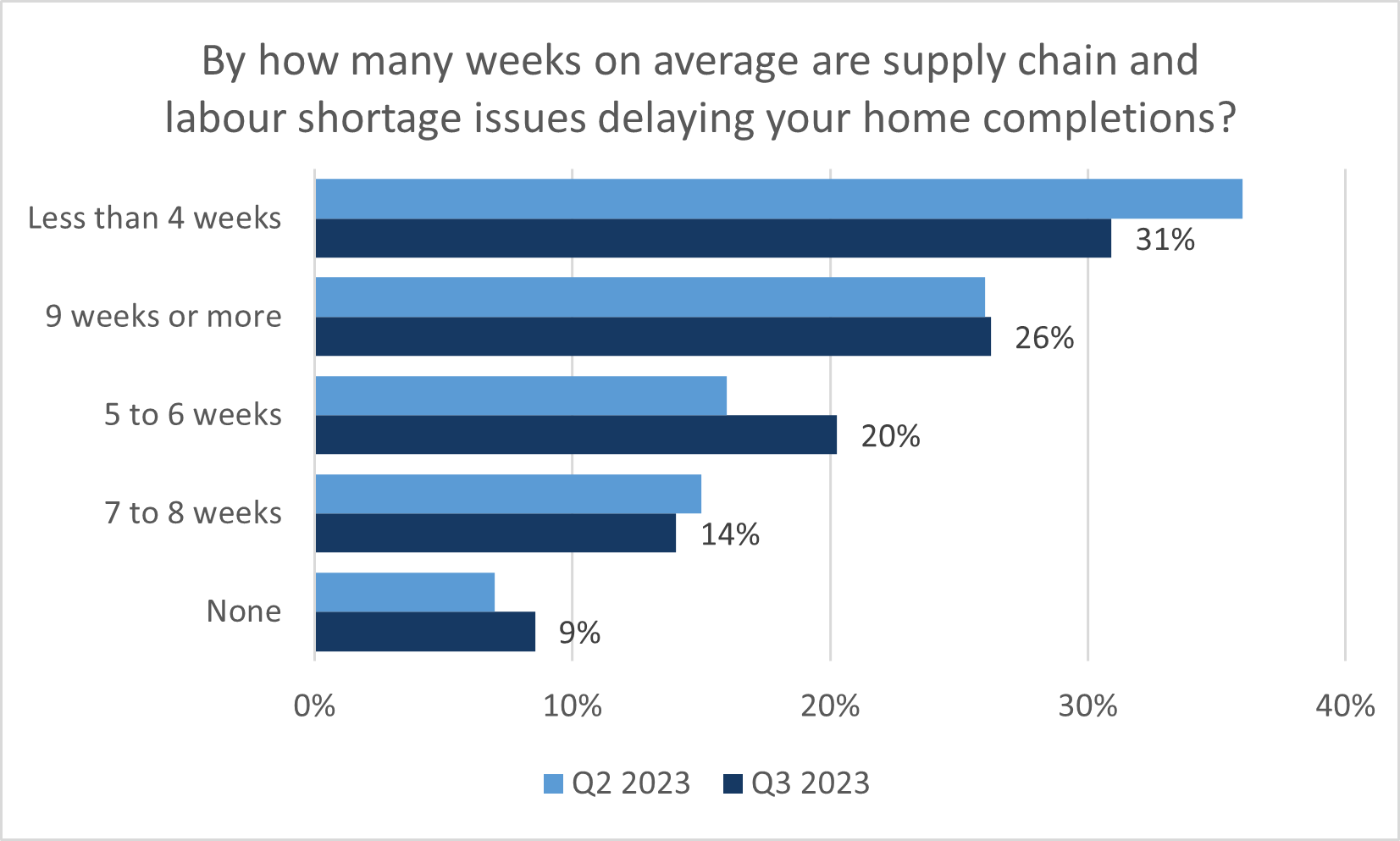

- Supply of inputs, especially building materials, have improved over the course of 2023 as demand for new homes weakened and supply chains normalized. The nationwide average construction delay as a result of a lack of materials or labour trend downwards towards normal, but is still at 6 weeks delay compared to normal. This is down from an average of 7 weeks over the previous two quarters and down from 10 weeks in Q4 2022.

- As with previous quarters, appliances and garage doors were the two building material categories with the highest incidence of being in serious shortage at 9% and 8%, respectively. 21% of builders stated they did not experience noteworthy material shortages this quarter, which would be good if it weren’t coupled with the slowdown in construction activity overall.

- Although lumber prices and sharp market price swings have normalized, survey respondents reported that lumber has increased the cost of construction from the onset of the pandemic on a 2,400 square foot home by a national average of $23,400. This average has remained fairly consistent over 2023.

- We also continued to ask about the increase in construction costs from non-lumber building materials. 77% of respondents said that their costs have gone up by more than $20,000 since the start of the pandemic. The national average construction cost increase for a 2,400 square foot home is $42,216. This average has remained well above $40,000 throughout 2023 and is unlikely to see a broad or material decrease in the near future.

- This puts the total cost of materials for construction (lumber and other materials) compared to prior to the pandemic up over $65,500 for a 2,400 square foot home.

- The CHBA HMI for single-family builders fell to 33.9 in Q3 2023, 6 points lower from 39.9 recorded in Q2 2023. This is its second lowest reading on record, with data going back to 2021, and is slightly below 34.3 that was recorded in Q1 of 2023. Furthermore, the single-family HMI has reflected downbeat sentiment—below a value of 50—in five consecutive quarters. All three subindices for present selling conditions, expectations for selling conditions in the next six months, and sales traffic of prospective homebuyers deteriorated and contributed to the decline in the single-family HMI between the second and third quarter.

- Regionally, home builders in Ontario were most pessimistic. That said, the third quarter single family HMI readings in British Columbia and the Prairie Provinces also declined.

- The open-ended comments received from builders also follow similarly to sentiment readings. Given the difficulty in gaining mortgage approvals, sales office traffic remains low. Some builders noted that of the few well qualified buyers, there is buyer interest in existing inventory only.

- 47% of single-family HMI respondents rated the current selling conditions as Poor, which is 15 percentage points worse than Q2 2023. Relative to the previous quarter, the proportion of respondents that gave current selling conditions a Fair rating fell by over 17 percentage points to 30.7%.

- Compared to the national average of 48%, Ontario respondents were most likely to rate current conditions as Poor, at 70%.

- Only 7% of single-family builders rated sales office traffic of prospective homebuyers to be High or Very High. The proportion of builders selecting this rating has now remained in single digits for five consecutive quarters. 55% of respondents rated prospective traffic volume as Low or Very Low, which is an increase of 11 percentage points over the previous quarter but still below the 72% that gave this rating in Q4 2022—when the single-family HMI recorded its all-time low.

- Both the Prairie Provinces and the Atlantic Region were most likely to select an Average rating. Meanwhile, 79% of builders from Ontario rated traffic conditions as Low or Very Low.