Softwood Lumber

Softwood Lumber

Softwood Lumber

January 2023 Update

Lumber prices have come down off of their record highs, but the state of the lumber industry continues to impact residential construction adding costs for builders and renovators, delaying construction times and closings, and exacerbating housing affordability challenges for consumers. Strong housing demand combined with a surge in renovation and do-it-yourself activity during the pandemic drove up demand and competition for labour and input materials, particularly lumber. Lumber prices have been up and down over the past two years, showing record volatility. While the housing sector overall had been rebounding well, CHBA’s Housing Market Index (HMI) shows rising interest rates have dramatically impacted builder confidence which will see a slow in starts in coming quarters, while ongoing lumber price volatility is still impacting residential construction activity. This will likely lead to reducing the sector’s contribution to economic activity and undermine Canada’s recovery.

66% of CHBA members said that their lumber costs went up by more than $20,000 (down 13 percentage points since Q3 2022) and 31% of respondents indicated that their costs increased by more than $40,000. National average construction costs for lumber for a 2,400 sq ft home are up $29,616, down 21 percentage points since Q3 2022. This is the first major decline in lumber costs since we started this survey in Q1 2021. The highest average cost increase was found to be in New Brunswick (at $44,311) and in Nova Scotia (at $33,662).

On average, supply chain issues caused an average of 10 weeks in delays in home completions for builders across Canada. Overall, the panelists outlined several key challenges due to supply chain issues with garage doors being the most impacted in Q4 2022.

Price escalation has been made even worse in the U.S. thanks to their tariffs on Canadian lumber, which NAHB continues to fight. CHBA remains engaged with government and stakeholders (including the NAHB) to get the latest information on any further impacts to pricing and supply while at the same time putting forward recommendations to political parties on ways to support affordability and supply for lumber and other construction materials.

Price Escalation Clause for Members

With the ongoing challenges of price escalation on lumber and other materials, in early 2021 CHBA provided a draft price escalation clause document that members could have reviewed/edited by their legal counsel and include in their contracts as they see fit. It is based on a clause that was developed by the U.S. National Association of Home Builders (NAHB) and its legal team.

Webinar: What's the Story with Lumber? (January 28, 2021)

(watch in full screen by hitting play and then clicking on the YouTube icon)

CHBA Actions to Date

CHBA has been actively engaged on this issue since it began to surface in 2020, engaging with the wood industry and bringing it to the attention of government officials in various meetings and discussions (staff, Ministers, and members of the opposition) and through the House of Commons Standing Committee on Natural Resources. For more information, please refer to CHBA’s latest formal submission.

CHBA remains engaged with its counterparts in the lumber industry to access up to date information, urge action on supply and price, and continues to engage government to do all it can to support the lumber supply chain. CHBA hosted a webinar on January 28, 2021 (see replay above) with representatives across the lumber industry to help members get a better sense of the challenges that have caused the lumber issue and a look ahead at what to expect.

While there is little the federal government can do to directly lower lumber prices or increase supply, CHBA has been engaging regularly to ensure the government uses everything it does have at its disposal to help address the issue as best it can. To that end, CHBA has been advocating for the following:

- Support for the lumber supply chain to maximize supply output and delivery (including through essential service designations, the wage subsidy, back to work incentives and training).

- Avoidance and timely resolution to trade disputes.

- Work with domestic lumber producers to ramp up production by working with other levels of government to ensure more responsive and certain access to raw material.

- Collaborate with FPAC, the Western Lumber Retailers Association and others on key issues of securing certainty of sustainable, domestic supply of fibre and addressing persistent transportation issues.

- Help offset escalating construction costs for housing to sustain activity and affordability through other measures.

CHBA continues to keep the challenge of lumber prices front and centre in the media, both to encourage action by politicians, and to inform consumers what to expect when it comes to pricing and timelines for their new home or renovation.

Next Steps

CHBA will continue to monitor the impact of lumber prices and shortages on the sector and will continue to engage with the federal government on possible avenues to address the effects of the issue. CHBA will also continue to engage with the lumber industry and other affected stakeholders to ensure members and the association have up to date information. CHBA is also ensuring all players are focused on ensuring that if there are further operational constraints put in place due to further waves of COVID, that the lumber industry (and the full residential construction materials and products supply chain) and related transportation industry remain safe and fully functional—while residential construction is an essential service, it cannot function if the supply chain is severely disrupted or prices are too high.

KEY FACTS AND ADDITIONAL INFORMATION

Housing industry outlook

Residential construction began its recovery at a decent pace, returning many jobs to the economy with both starts and building permits up nationally, and renovation returning to normal volume.

Residential construction is recovering at a decent pace, returning many jobs to the economy with both starts and building permits up nationally, and renovation returning to normal volume.

- December 2021 seasonally adjusted starts: 236,000, compared to 230,000 at the same time last year. The low was 165K in April 2020. (Statistics Canada and CMHC, 2022).

- Total value of residential building permits in December 2021 edged down 13% to $6.8 billion. (Statistics Canada, 2022) after posting an all-time record in June 2021 at $8.8 billion. Before the pandemic, the previous record for residential building permits was in May 2018.

Lumber industry outlook

The current shortage, and subsequent price increases are a result of:

- Early 2020 forecasts for low demand which led to production curtailment before the pandemic.

- Efficiency and capacity limitations brought on by COVID-19.

- Slow ramp up of economic activity due to labour shortages.

- Transportation issues with mostly with rail, and increasingly with trucking, which is more expensive and less efficient. CN, who transports the majority of the lumber that moves across the country, experienced disruptions beginning prior to the pandemic.

- Much stronger spring and summer demand, including from the DIY market, than anticipated.

- Ongoing trade disruptions, disputes, and tariffs, creating price volatility and uncertainty around supply.

- Shortages of wood fibre in some areas due to mountain pine beetle infestations and wildfires.

- Strong housing demand through the fall of 2020 and into 2021

Lumber mills in most parts of the country were closed for as much as 6 weeks during the initial wave of the pandemic, in response to public health measures. Based on discussions with the lumber industry, it is our understanding that lumber mills in Canada have mostly now operating at 100 percent capacity since September. The same is not true in the US, which was slower to ramp up, contributing to supply shortages across the entire North American market. In Canada, mills are running about three months behind on orders, particularly on oriented strand board (OSB) and plywood, and with ongoing challenges securing raw materials and labour, it may be some time before they can effectively meet demand.

Lumber Price Trends (As of March 20, 2025)

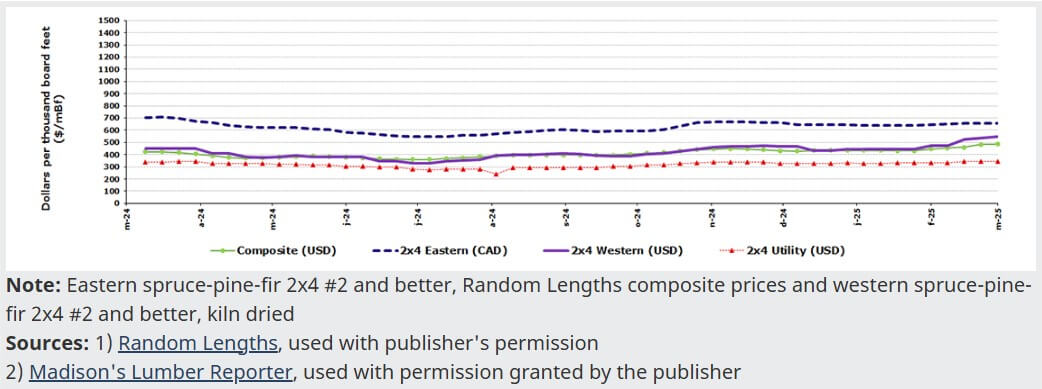

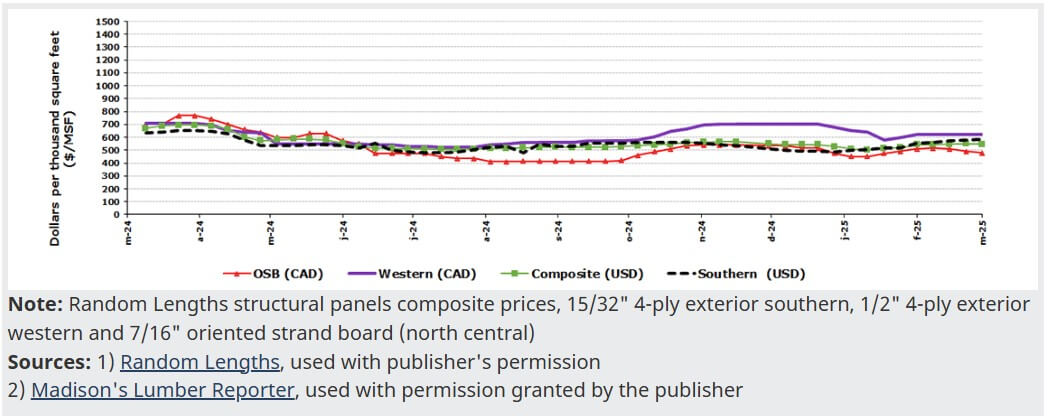

The two charts from Natural Resources Canada below show the trends in lumber products for the past year for softwood and panels.

For context, Eastern spruce-pine-fir 2x4s, which are commonly used for framing, was at $500 CAD/mBf in April 2020. OSB, commonly used for sheathing, was at $350 CAD/MSF in April 2020.

Figure 1: Weekly lumber prices in North America

Figure 2: Weekly panel prices in North America

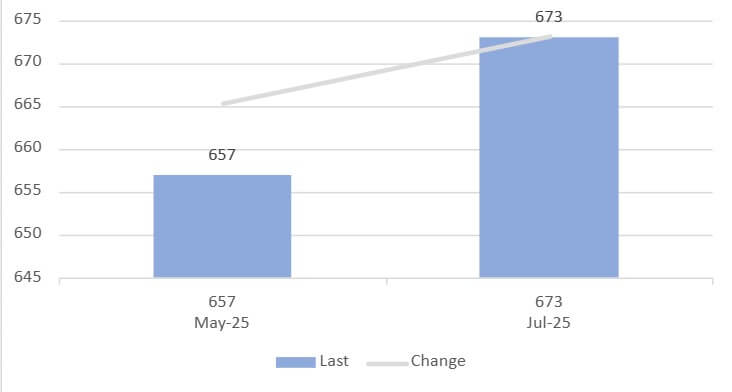

Lumber Futures - Quotes (As of March 20, 2025)

This chart show the trends in lumber futures for the upcoming months according to the CME Group. Click here for more information.

World Trade Organization Ruling – Softwood Lumber Agreement

On August 24, 2020, the World Trade Organization ruled in Canada’s favour on the long-standing dispute with the US over softwood lumber, declaring that the U.S. Department of Commerce and the U.S. International Trade Commission were wrong in 2017 when they imposed countervailing duties on Canadian softwood lumber exports, having concluded that Canada's regulated forestry industry amounts to an unfair subsidy for Canadian producers. CHBA welcomed the ruling, but it has only driven up demand for Canadian lumber.

Past CHBA Actions

In December 2017 the U.S. finalized tariffs on Canadian lumber that it believed was dumped into the American market at artificially low prices, due to it being sourced from crown lands. Most Canadian producers then paid a combined countervailing and anti-dumping rate of 20.83 per cent, down from 26.75 per cent in preliminary determination from July 2017.

CHBA facilitated talks between the National Association of Home Builders (NAHB) in the U.S. and the Parliamentary Secretary to the Minister of Foreign Affairs (Canada-U.S. Relations) on this issue, with the ultimate goal of accelerating a resolution of the dispute, and in so doing bringing down lumber prices for industry and increasing affordability for consumers on both sides of the border.

CHBA strongly advocates that trade disputes regarding construction materials in the integrated Canada-U.S. market are detrimental to both countries and should be avoided, or at least resolved quickly when they arise.